Wolf Pack Fury EA

Introduction

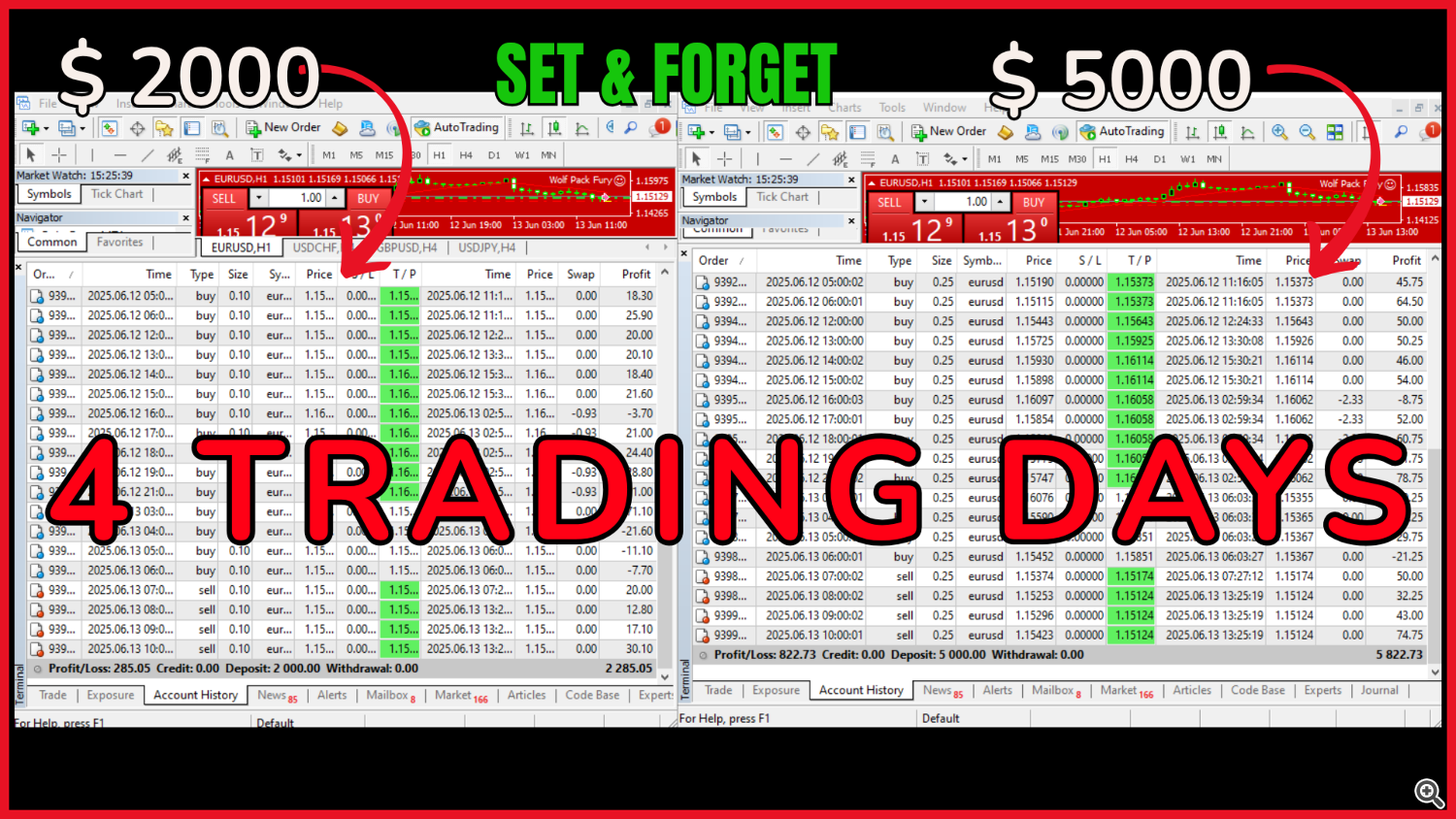

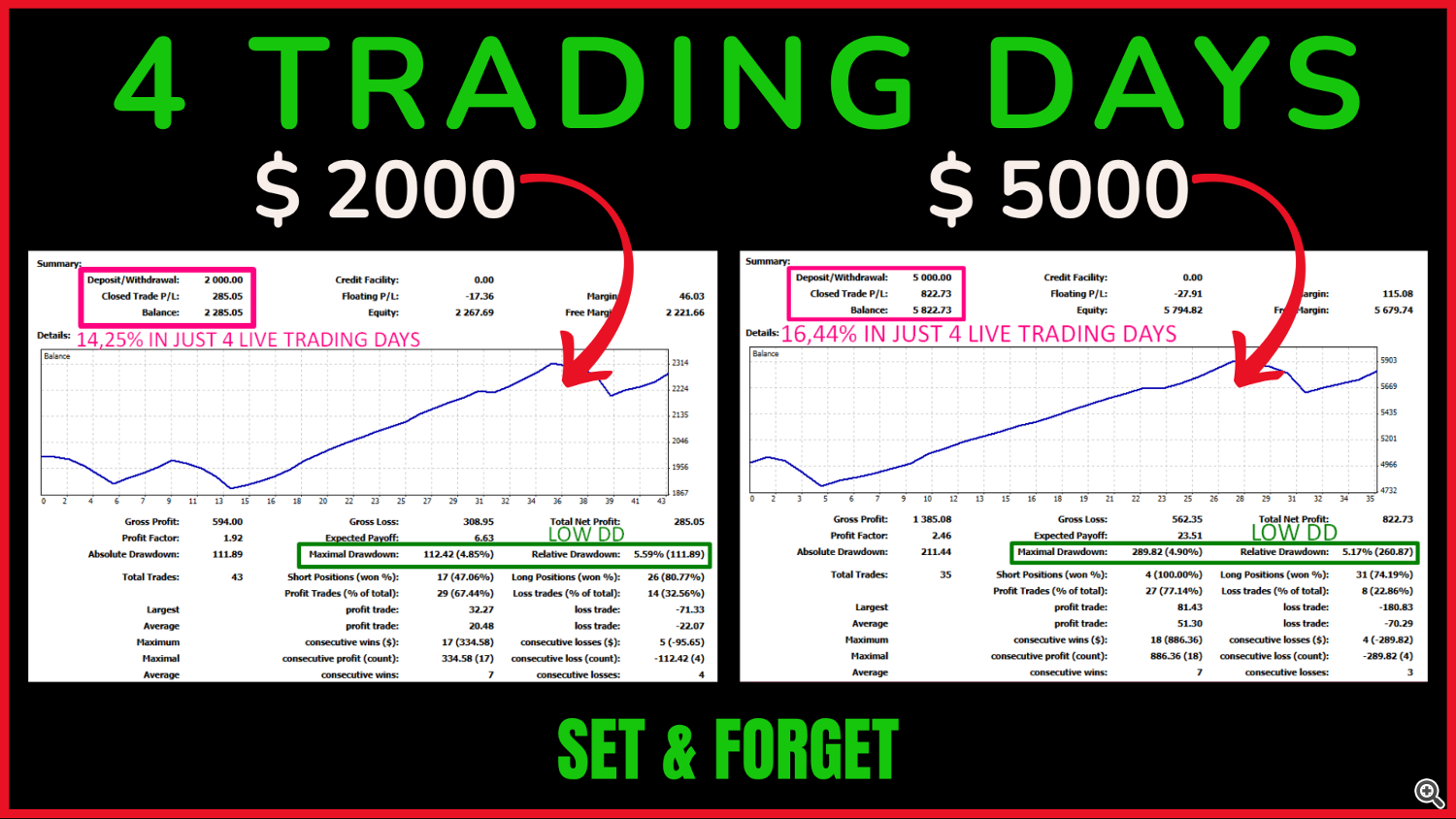

Wolf Pack Fury EA is designed for merchants who worth consistency and prudent capital administration. It doesn’t promise in a single day miracles; as a substitute, it goals to offer regular month-to-month returns whereas preserving full management over your account stability. The EA operates 24/5, utilizing volatility-based algorithms to adapt to various market environments.

Pricing

- Worth will increase by $100 every time 10 models are offered

- Buy value: $1,899

Core Options

- Optimized solely for the EURUSD pair on the H1 chart, enabling exact market entries with out overtrading

- Crafted for small accounts (from $200 to $5,000) but able to scaling to bigger balances

- Sturdy danger controls restrict the whole publicity per commerce cycle, sustaining low drawdowns and account stability

- Clever entry spacing that may pause new orders throughout high-volatility candles (similar to information releases) to safeguard each commerce logic and capital

Suggest Lot Dimension Configuration

- Mounted lot-size mannequin primarily based in your account stability

- Solely parameter to set manually:

0.01 tons per $200 of stability

Sensible examples:

- $200 → 0.01 tons

- $400 → 0.02 tons

- $600 → 0.03 tons

- $800 → 0.04 tons

- $1,000 → 0.05 tons

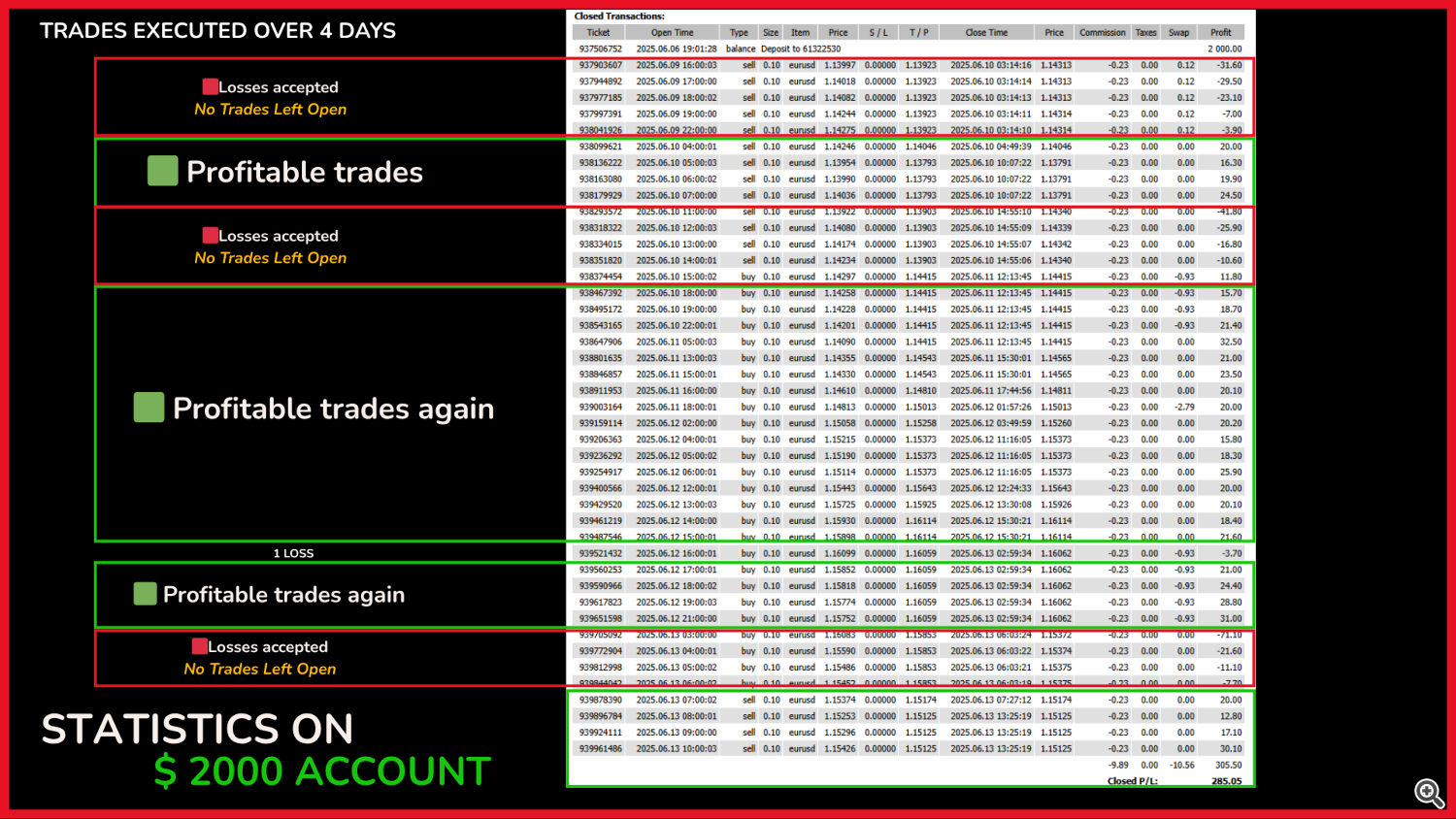

- $2,000 → 0.10 tons

- $3,000 → 0.15 tons

- $4,000 → 0.20 tons

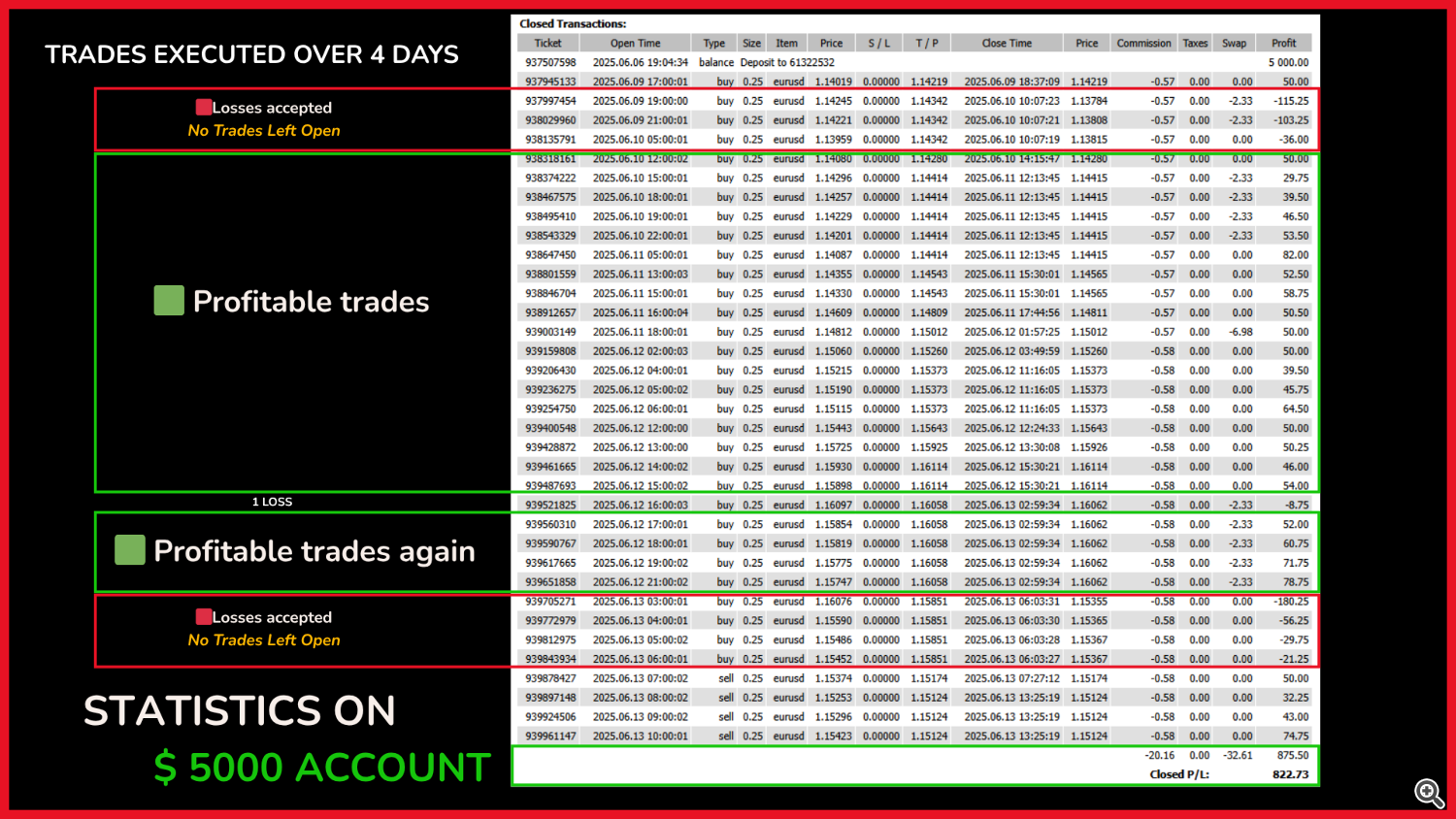

- $5,000 → 0.25 tons

In case you intend to make use of Wolf Pack Fury EA with greater than $5,000, please attain out and I’ll assist you to configure it safely.

Take Revenue (TP)

- Default TP of 200 pips, chosen for H1 as a result of it:

- Secures a considerable variety of pips

- Is practical for H1 with out being extreme

- Permits environment friendly exits with out breaching danger parameters

- Every place carries its personal TP, however the EA employs an adaptive exit mechanism that repeatedly assesses whether or not to carry or modify targets primarily based on present market context:

- Instance: When a number of positions are open with various lot sizes, the system could:

- Lock in features first on bigger tons

- Shut smaller tons with a minor loss if it advantages the general account

- Instance: When a number of positions are open with various lot sizes, the system could:

- This mechanism integrates with the Multi parameter (staged lot development system)

- Modifying the TP shouldn’t be suggested, as its default setting is calibrated to take care of a balanced danger/reward ratio

Multi Parameter (Progressive Entry Multiplier)

- Employs a layered strategy—when value strikes in opposition to the preliminary commerce, it provides new positions at successive ranges to common the entry value

- Multi determines how a lot the lot measurement will increase with every further place:

- Allows the EA to shut the mixed positions successfully as soon as value reverses, even when some didn’t hit full TP

- Repeatedly evaluates whether or not to maintain or adapt particular person TPs, probably:

- Closing bigger positions in revenue

- Exiting smaller positions at a small loss if it’s advantageous for the account

- That is a part of an adaptive volatility-based logic, not a set rule set

- Necessary: Multi works along with NextTrades, Shifting, and EquityRisk; altering it might disrupt the staggered entry logic and compromise system stability

NextTrades (Max Variety of Trades per Cycle)

- Specifies the utmost variety of positions the EA can open in a single entry sequence

- Default is 10, offering flexibility for various market circumstances:

- In apply, EquityRisk management usually limits this to 4 or 5 positions earlier than reaching the danger threshold

- Solely in uncommon circumstances—similar to utilizing 0.01 tons with a $20,000 stability—would possibly it open all 10 positions

- Following the beneficial lot sizing ensures the variety of lively trades stays inside protected limits

Shifting (Distance Between Entry Ranges)

- Defines the minimal hole between staggered positions when value strikes unfavorably

- Whereas this hole is fastened, the EA’s volatility-based logic can briefly halt or delay the following place if circumstances aren’t appropriate:

- In visible mode, you’ll discover that in high-volume candles (e.g., information spikes), the EA could chorus from opening the following commerce even when the hole is met

- Moderately than appearing mechanically, it waits for an optimum second to guard your capital

- Works hand in hand with Multi, NextTrades, and EquityRisk, forming the core of the EA’s intelligence

- Not beneficial to change, because it may upset the progressive entry logic and result in instability

EquityStop and EquityRisk (Capital Safety)

- EquityStop is enabled (TRUE) by default and mechanically closes all open trades if a crucial fairness stage is breached, preserving account security—don’t disable this function

- EquityRisk units the utmost allowed danger per commerce cycle as a share of your account stability (default 5%), calculated primarily based on the EA’s win fee, beneficial lot measurement, and Multi conduct

- Embracing managed losses is a part of sound danger administration; these safeguards guarantee Wolf Pack Fury EA:

- Retains drawdown low

- Delivers regular month-to-month efficiency

- Preserves capital throughout extended adversarial or high-volatility durations

Open Hour / Shut Hour (Each day Buying and selling Window)

- Specifies the broker-time window throughout which the EA could open new trades:

- OpenHour marks the beginning of permitted buying and selling

- CloseHour marks the top

- Lets you keep away from particular market hours or prohibit buying and selling to most well-liked classes, making certain exact management over EA exercise

Commerce on Friday / Friday Hour (Friday Buying and selling Management)

- TradeOnFriday enables you to allow or disable Friday buying and selling (TRUE by default), permitting regular operation till the desired hour

- FridayHour units the ultimate hour for Friday trades; for example, setting FridayHour = 12 means the EA stops opening new orders at midday on Fridays (dealer time), although it trades usually Monday–Thursday till CloseHour

- Gives granular management over weekend publicity with out altering core logic

Use Each day Goal / Each day Goal (Each day Revenue Objective)

- UseDailyTarget enables you to activate a each day revenue restrict (FALSE by default)

- If turned on (TRUE), the EA stops opening new positions as soon as the goal is reached

- DailyTarget is denominated in your account forex (USD, EUR, and so on.); reaching this determine pauses buying and selling till the following day

Necessary

Wolf Pack Fury EA should run on a devoted account as a result of its danger controls depend upon your complete account stability. Letting one other EA function on the identical account can disrupt danger coherence and commerce logic. All the time use a devoted account with 100% of the capital managed by Wolf Pack Fury EA.

FAQ – Continuously Requested Questions

Can I exploit Wolf Pack Fury EA on any pair or timeframe?

It’s optimized for H1, chosen for its reliability and balanced danger/management profile. It might operate on different pairs or timeframes, however handbook testing and adjustment can be required. Really helpful use: H1 as offered.

What sort of account ought to I exploit?

A low-spread, low-slippage account—ideally ECN. The kind of account is extra essential than the dealer itself.

Can I apply it to an ordinary account with low unfold?

Sure, however train warning—normal accounts usually incur hidden slippage (as much as 10 pips). With 2–3 pips of unfold added, efficiency could endure. Take a look at on a demo first if unsure.

Any beneficial dealer?

No particular brokers are endorsed—search an ECN account. Begin with a demo to guage efficiency, then change if wanted.

Does it work on small accounts?

Sure—it’s engineered for balances starting from $200 to $5,000, offered you employ the beneficial lot measurement.

Can I run it on the identical account as different EAs?

No—it should run alone. Shared account utilization can disrupt danger logic and total stability.

Does it commerce every single day?

Sure—buying and selling is almost steady, solely pausing if the market is exceptionally flat.

Do I would like a VPS?

Sure—like all EA, it should stay on-line 100% of the time. Utilizing a house PC dangers downtime; a VPS gives uninterrupted operation and peace of thoughts.

Which VPS ought to I exploit?

The dealer’s personal VPS is good—ask them immediately, because it sometimes gives ultra-low latency (2–10 ms). Generic VPS options could exhibit round 120 ms latency, whereas dwelling distant desktops can exceed 220 ms. Increased latency means slower EA reactions.

Can I contact you if I’ve questions or need assistance?

Completely—if you happen to want help with set up, VPS setup, or are not sure the place to begin, ship me a message. No query is just too fundamental; all of us begin someplace.