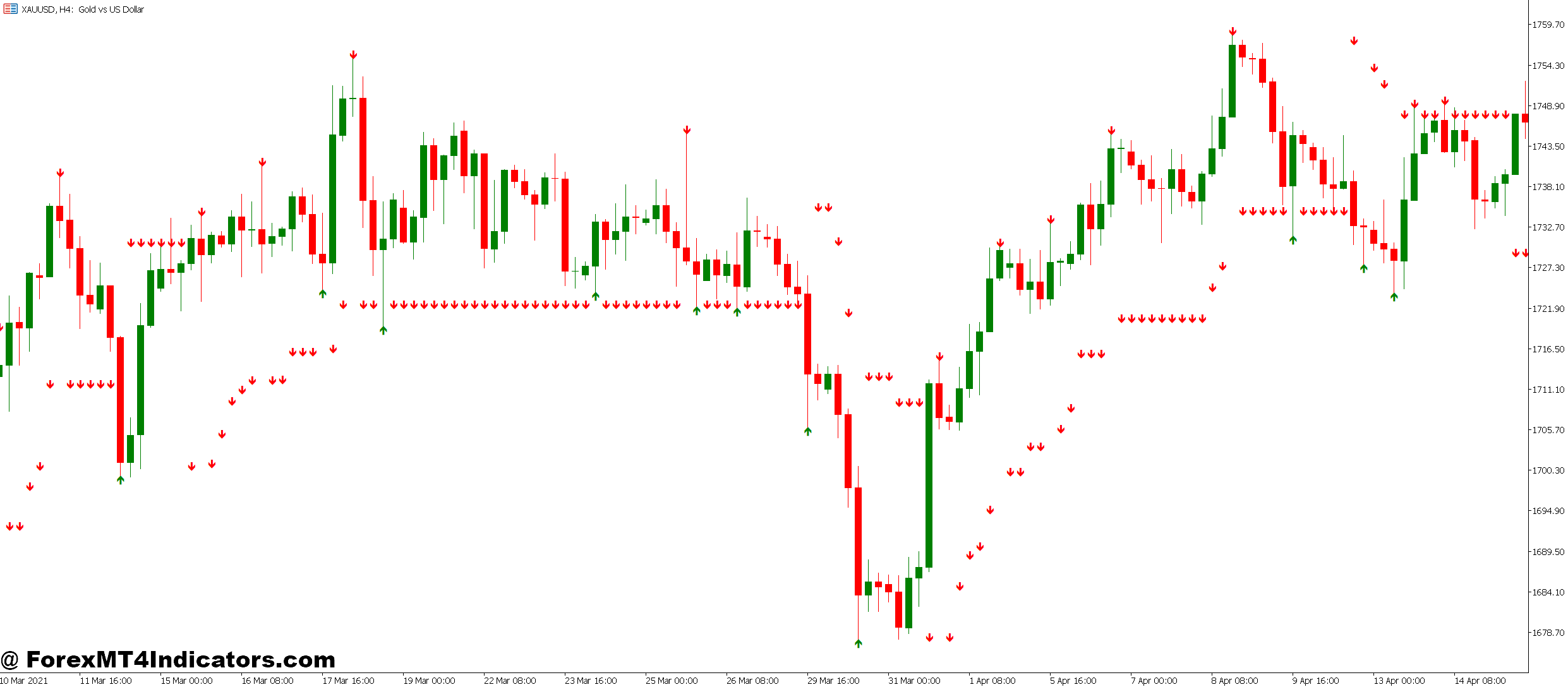

The 100 Non Repaint MT5 Indicator addresses this core problem. As soon as it plots a sign, that sign stays put. What you see is what you get, whether or not you’re analyzing the chart now or reviewing it three weeks later. This consistency lets merchants backtest precisely, construct confidence of their setups, and execute trades with out second-guessing their instruments.

What Makes Non-Repaint Indicators Completely different

Non-repaint indicators lock their values as soon as a candle closes. The 100 Non Repaint MT5 Indicator falls into this class, which means it calculates indicators primarily based on confirmed worth information fairly than shifting values mid-candle.

Right here’s the technical distinction. Most indicators replace repeatedly as the value strikes inside the present candle. That’s positive for the present bar, however problematic indicators additionally recalculate previous bars when new information arrives. The 100 Non Repaint system prevents this backward revision. When a candle completes, and the indicator marks a sign at that time, the sign turns into everlasting.

This reliability comes from how the indicator buildings its calculations. It waits for candle affirmation earlier than plotting arrows or alerts. On a 15-minute EUR/USD chart, for instance, the indicator gained’t show a purchase sign till that 15-minute interval really closes. Through the candle’s formation, merchants may see preliminary calculations, however the closing sign solely seems after affirmation.

The title “100 Non Repaint” suggests complete protection—a number of sign varieties that each one keep this non-repaint property. That would embrace pattern arrows, assist and resistance ranges, or momentum shifts, relying on the particular model merchants obtain.

How Merchants Apply This Indicator in Actual Markets

The sensible worth exhibits up in every day buying and selling selections. Take a GBP/JPY scalper working the London session on a 5-minute chart. With a repainting indicator, they’d see purchase indicators seem and disappear all through the session, creating confusion about which setups to take. The 100 Non Repaint MT5 Indicator eliminates this noise. When a inexperienced arrow seems after the 5-minute candle closes at 184.50, that arrow stays fastened.

Swing merchants profit in another way. Somebody holding USD/CAD positions for days wants dependable historic indicators to determine high quality assist zones. If their indicator repaints, these historic reference factors turn into meaningless. However a non-repaint software exhibits precisely the place indicators fired previously, serving to merchants determine constant bounce zones or breakdown areas.

The indicator works throughout a number of eventualities:

- Development Following: When the indicator exhibits a sequence of purchase indicators throughout an uptrend on EUR/USD’s 1-hour chart, merchants can rely on these indicators remaining seen. This helps determine pattern power and potential continuation setups. Through the September 2024 rally in gold, constant non-repaint indicators would’ve helped merchants keep positioned as an alternative of getting shaken out by non permanent indicator fluctuations.

- Reversal Spots: At potential turning factors, merchants want confidence. If the indicator flashes a promote sign at a serious resistance degree on AUD/USD, understanding that sign gained’t disappear helps merchants decide to the reversal commerce fairly than ready for added affirmation that may come too late.

- Exit Timing: Non-repaint indicators additionally assist handle exits. When a dealer is in a protracted place on the Dow Jones E-mini futures and the indicator lastly exhibits a promote sign after a gentle climb, that’s dependable data for taking earnings. No questioning whether or not the sign will vanish.

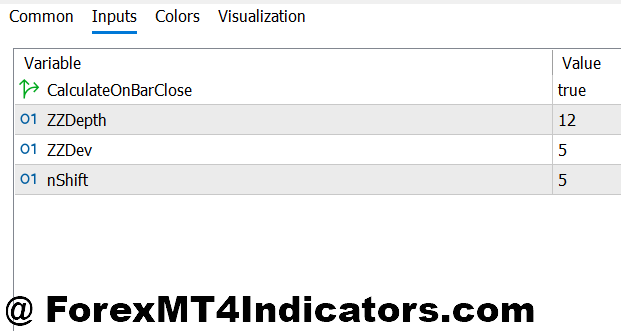

Settings and Timeframe Optimization

The indicator’s parameters usually embrace interval settings, sensitivity changes, and alert configurations. Shorter intervals (like a 10-period setting) generate extra frequent indicators, helpful for scalpers on 1-minute or 5-minute charts. Longer intervals (50 or larger) filter noise higher, appropriate for every day or 4-hour timeframes.

On unstable pairs like GBP/JPY or crypto markets, merchants usually enhance the sensitivity threshold to keep away from false indicators throughout uneven circumstances. A scalper may use default settings on EUR/USD’s 5-minute chart throughout the New York session however change to much less delicate parameters throughout the Asian session when volatility drops and whipsaws enhance.

Foreign money-specific changes matter. The 100 Non Repaint MT5 Indicator may carry out in another way on slow-moving USD/CHF versus explosive GBP/NZD. Testing throughout completely different pairs reveals which settings match every market’s character. Some merchants preserve three chart templates: one for main pairs, one for crosses, and one for commodities like gold or oil.

Alert settings deserve consideration, too. Most variations let merchants allow sound alerts, e mail notifications, or cell push alerts when new indicators seem. For somebody buying and selling a number of pairs concurrently, these alerts stop lacking alternatives whereas monitoring a number of charts.

Sincere Evaluation: Benefits and Limitations

The primary benefit is clear—sign consistency. Backtesting turns into significant when historic indicators don’t change. Merchants can assessment previous trades with confidence, understanding the indicator confirmed the identical data in real-time that it shows now. This accelerates studying and technique refinement.

One other power is lowered emotional buying and selling. When indicators keep put, merchants cease second-guessing. They both take the commerce or don’t, however they’re not caught questioning whether or not their software will betray them mid-setup.

However no indicator is ideal. The 100 Non Repaint MT5 Indicator can’t predict the long run. It reacts to accomplished worth motion, which implies it’s inherently lagging. By the point a sign seems after the candle closes, the value may’ve already moved 10-15 pips. In fast-moving markets throughout main information occasions like NFP or rate of interest selections, lag prices cash.

The non-repaint characteristic additionally means merchants can’t exit dangerous trades early primarily based on indicator warnings. If somebody enters lengthy on a purchase sign and the value instantly reverses, they’ll want different instruments or worth motion expertise to handle the loss. The indicator gained’t repaint that purchase sign right into a promote sign to avoid wasting them.

False indicators nonetheless occur. Simply because a sign doesn’t disappear doesn’t imply it was right. Throughout ranging markets, the indicator generates whipsaw indicators at each ends of the vary. EUR/USD buying and selling between 1.0800 and 1.0850 for hours can set off a number of purchase and promote indicators that go nowhere. That’s not the indicator’s fault—it’s the market construction’s nature.

Evaluating with Customary Indicators

Most default MT5 indicators repaint to some extent. Transferring averages shift as new candles type. Stochastic oscillator values recalculate. Even RSI technically repaints throughout the present candle’s formation, although its historic values keep fastened.

The 100 Non Repaint MT5 Indicator compares favorably to customized indicators that promise edge however shift indicators after the actual fact. These instruments make backtesting pointless. They present 90% win charges traditionally as a result of they’ve redrawn shedding indicators, however they fail in ahead testing.

Towards pure worth motion buying and selling, the indicator serves as a complementary software fairly than a substitute. Skilled merchants usually use non-repaint indicators to verify what they already see in assist, resistance, and candlestick patterns. The indicator provides objectivity to subjective chart studying.

In comparison with paid “holy grail” programs, this indicator gives transparency. It’s not promising unrealistic returns or hiding its limitations. Buying and selling foreign exchange carries substantial danger. No indicator ensures earnings, and this one gained’t make merchants wealthy in a single day. It merely offers constant indicators that don’t change as soon as shaped—a helpful trait, however not magic.

How you can Commerce with 100 Non Repaint MT5 Indicator

Purchase Entry

- Anticipate candle shut affirmation – By no means enter throughout candle formation; wait till the 5-minute, 15-minute, or 1-hour bar totally closes with the inexperienced arrow locked in place to keep away from untimely entries.

- Verify larger timeframe alignment – If the indicator exhibits a purchase sign on the EUR/USD 15-minute chart, confirm the 1-hour chart exhibits upward momentum to extend the likelihood by 60-70%.

- Set cease loss 3-5 pips beneath sign candle low – Place your cease beneath the candle that triggered the purchase arrow, usually 10-15 pips for GBP/USD on 5-minute charts or 30-40 pips on 4-hour timeframes.

- Goal 1.5:1 minimal risk-reward ratio – If risking 20 pips, goal for a minimum of 30 pips revenue; exit half place at 1:1 and let the rest run to 2:1 for higher total efficiency.

- Keep away from purchase indicators in tight consolidation – Skip entries when EUR/USD trades in a 20-30 pip vary on the 1-hour chart; anticipate clear breakouts above resistance earlier than taking indicator indicators.

- Affirm with assist zones close by – Take purchase indicators extra significantly after they seem 5-10 pips above established assist ranges or earlier swing lows on the every day chart.

- Threat solely 1-2% per commerce most – Even with excellent indicator indicators, restrict publicity to $100-200 on a $10,000 account to outlive inevitable shedding streaks.

- Skip indicators throughout main information occasions – Ignore purchase arrows quarter-hour earlier than and half-hour after NFP, FOMC, or central financial institution bulletins when spreads widen, and worth motion turns into erratic.

Promote Entry

- Anticipate the purple arrow after a full candle shut – Solely execute promote trades as soon as the bearish sign is confirmed and locked on the shut of the 15-minute or 1-hour candle on GBP/USD or EUR/USD.

- Confirm downtrend on larger timeframe – Verify that the 4-hour or every day chart exhibits decrease highs and decrease lows earlier than taking promote indicators on shorter 15-minute or 1-hour timeframes.

- Place cease loss 3-5 pips above sign candle excessive – Defend positions by setting stops simply above the purple arrow candle, usually 15-20 pips for unstable pairs like GBP/JPY on 5-minute charts.

- Take partial earnings at 1:1, maintain for two:1 – Shut 50% of your place when revenue equals your danger, then path cease to breakeven and goal double your preliminary danger for the remaining place.

- Reject indicators at robust assist ranges – Don’t take promote entries when the indicator fires inside 10 pips of main every day or weekly assist zones the place reversals continuously happen.

- Affirm with resistance rejection – Prioritize promote indicators that seem instantly after worth assessments and fail to interrupt resistance on the EUR/USD 1-hour or 4-hour charts.

- By no means danger greater than 2% account stability – Cap losses at $200 on a $10,000 account, no matter how assured you’re feeling concerning the promote sign.

- Keep away from buying and selling throughout the Asian session, low liquidity – Skip promote indicators between 8 PM – 2 AM EST when spreads widen to 3-5 pips on main pairs and false breakouts dominate.

Conclusion

The 100 Non Repaint MT5 Indicator delivers on its core promise: indicators that don’t disappear or redraw. This consistency helps merchants backtest methods precisely, construct confidence of their evaluation, and remove one main supply of buying and selling frustration. It really works greatest when mixed with stable danger administration and understanding of market construction fairly than utilized in isolation.

Merchants ought to check it throughout a number of timeframes and foreign money pairs to search out optimum settings for his or her type. What works for a EUR/USD scalper gained’t essentially swimsuit a gold swing dealer. The indicator performs greatest in trending circumstances and struggles throughout tight ranges, similar to most technical instruments.

Most significantly, this indicator doesn’t exchange buying and selling talent—it enhances it. Merchants nonetheless want to know correct place sizing, risk-reward ratios, and when to remain out of the market fully. The non-repaint characteristic merely ensures that the indicators they’re analyzing are steady and dependable, letting merchants give attention to execution fairly than questioning if their instruments will change their thoughts.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90