Hey merchants,

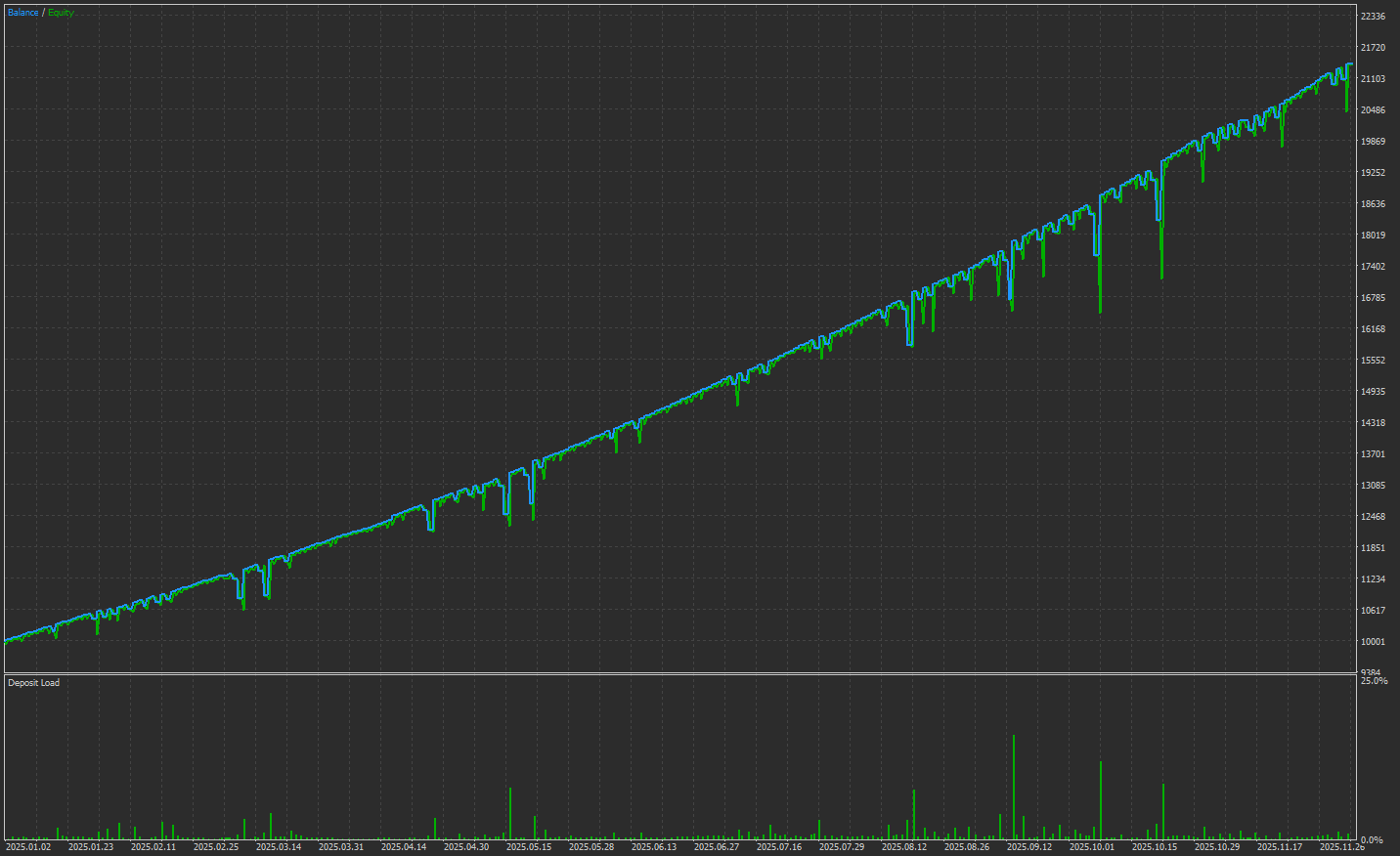

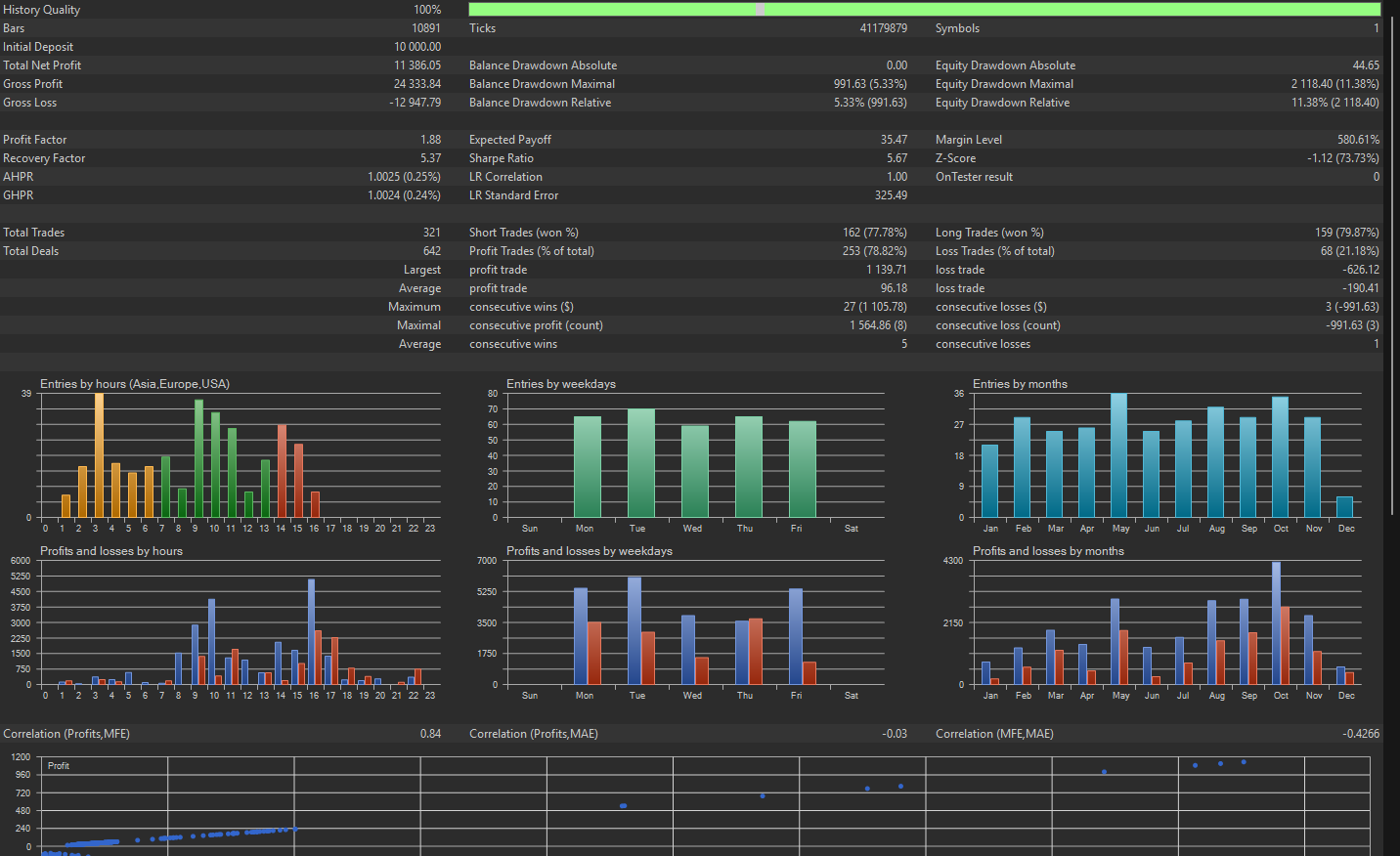

On this weblog put up i current you a completely automated technique for ACRON Provide Demand EA. It’s optimized to commerce particularly NASDAQ Indice in M30 timeframe. In simply 11 months managed to attain +113% revenue with solely 11% drawdown. This technique combines buying and selling in prime quality provide and demand zones with correct threat administration. It was designed for merchants looking for constant, secure and long-term earnings. Backtesting contains 321 trades, which is a sufficiently massive pattern dimension to make sure statistically dependable and reliable outcomes.

This technique has been optimized particularly for NAS100 (M30) pair to make sure its greatest efficiency. Utilizing it on different pairs could not yield the identical outcomes. For any query don’t hesitate to contact us.

🔹Backtesting Technique Particulars

ACRON Provide Demand EA Hyperlink: https://www.mql5.com/en/market/product/150278

Pair: NAS100

Backtesting Interval: 1/1/2025 – 5/12/2025

Timeframe: M30

Beginning Capital: $10,000

Cash Administration : Share Danger

Share Danger per Commerce: 1.0%

Account Leverage: 500:1

Examined Dealer: Vantage Markets, Uncooked Unfold Account [ If you use a different broker, the strategy may not perform the same ]

💡 Tip for Conservative Merchants:

You’ll be able to change to Fastened Danger Cash Administration and set a customized Fastened Danger Quantity per commerce in keeping with your account stability for decrease publicity.

🔹Outcomes Abstract

Complete Web Revenue : $11,386

Revenue Development: + 113%

Backtest Period: 11 months

The EA maintained a clean fairness curve with low drawdown, exhibiting robust adaptability to the NAS100 market construction all through 2025.

Relative Fairness Drawdown: 11.38%

🔹Visible Outcomes

Under are the screenshots from the MT5 Technique Tester exhibiting the fairness graph and detailed statistical report:

![[+113% Profits in 11 Months] 100% Automated NAS100 Technique ‘ACRON Provide Demand EA’ – Buying and selling Methods – 5 December 2025 [+113% Profits in 11 Months] 100% Automated NAS100 Technique ‘ACRON Provide Demand EA’ – Buying and selling Methods – 5 December 2025](https://i0.wp.com/c.mql5.com/i/og/mql5-blogs.png?w=696&resize=696,0&ssl=1)