Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a video evaluation printed immediately, crypto market commentator CryptoInsightUK argues that XRP is poised to front-run the following leg greater throughout crypto property, citing a transparent structural divergence in liquidity profiles versus Bitcoin and Ethereum on lower-timeframe charts and confirming indicators on the XRP/BTC cross.

Why XRP Might Outperform BTC And ETH

The core of his case is a comparative liquidity mapping throughout BTC, ETH, and XRP. On Bitcoin, he notes that draw back swimming pools round “about 106K” have been a persistent magnet on intraday timeframes, however the each day heatmap nonetheless exhibits heavier clusters above spot. “Now we’re down at these ranges, it’s extra doubtless than not that we do proceed to take this liquidity right here for Bitcoin,” he says.

The analyst provides that on the each day timeframe “to the upside there could possibly be a push into this liquidity about $126K–$128K after which we’re beginning to see orange liquidity now at $141,000.” He frames any reversal as quick and reflexive: “After we get this transfer again to the upside… it’s going to be fairly aggressive and individuals are going to be caught on the mistaken facet of the commerce.”

Associated Studying

Ethereum’s setup, in contrast, is described as tactically softer after already tapping important overhead liquidity throughout its prior pop. On his hourly mapping, the denser swimming pools sit under current lows, implying a non-trivial threat of imply reversion. “We even have come again to this form of space as nicely and we are able to see this extra dense liquidity once more under us sitting at round $4,050ish… the dense liquidity sits about $4,000 to $4,450,” he explains, characterizing ETH as “a bit fingers off” for now—whereas additionally flagging that immediately’s US market closure for a public vacation can distort intraday reads.

The crux of the bullish divergence is on XRP. On the hourly foundation, he exhibits that XRP has already swept and “taken the purple liquidity under,” leaving the “essential liquidity… above,” a configuration he views as conducive to an upside reversal if bid momentum emerges.

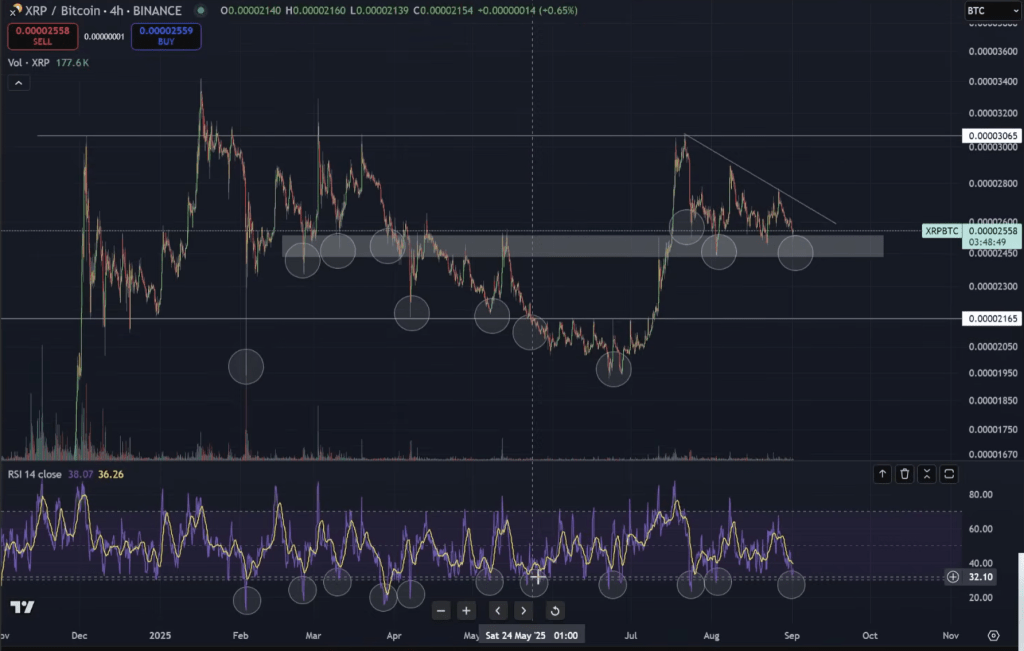

“Is XRP front-running right here? Is it going to front-run altcoins?” he asks, pointing to the token’s completely different placement on the liquidity map relative to BTC and ETH. Extending the lens to relative efficiency, he highlights the XRP/BTC pair on the four-hour chart, the place a previous resistance field has been flipped to help and momentum has repeatedly depraved into oversold territory with constructive reactions.

Associated Studying

“After we’re at this degree, we need to flip this resistance into help. Presently, we’re holding that help,” he says, including that whereas such oversold prints don’t completely name bottoms, “as a rule, they’ve had a good response, particularly once we’re in an space of help like this.”

On greater timeframes, he reiterates that XRP’s heavier liquidity sits overhead—deciphering that as dry powder for continuation if spot can reclaim momentum—whereas BTC nonetheless has a sexy path to hoover higher swimming pools as soon as fast draw back pockets are cleaned. Ethereum, having already consumed a lot of its near-term upside liquidity, may underperform tactically till its decrease clusters are examined or rebalanced. The analyst ties the mosaic along with a cycle view that continues to be incomplete: “That’s one of many causes I actually don’t suppose the highest is in but for crypto.”

He stresses that the work is descriptive, not prescriptive. “This doesn’t imply that that is my opinion particularly. I’m simply exhibiting you charts right here,” he says, earlier than reiterating the cycle-long thesis: “I’ve mentioned for the entire cycle, I feel XRP is main.” The approaching weeks, he provides, ought to make clear whether or not the structural divergence he outlines interprets into XRP management on the tape as broader market euphoria returns and sidelined merchants chase.

At press time, XRP traded at $2.77.

Featured picture created with DALL.E, chart from TradingView.com