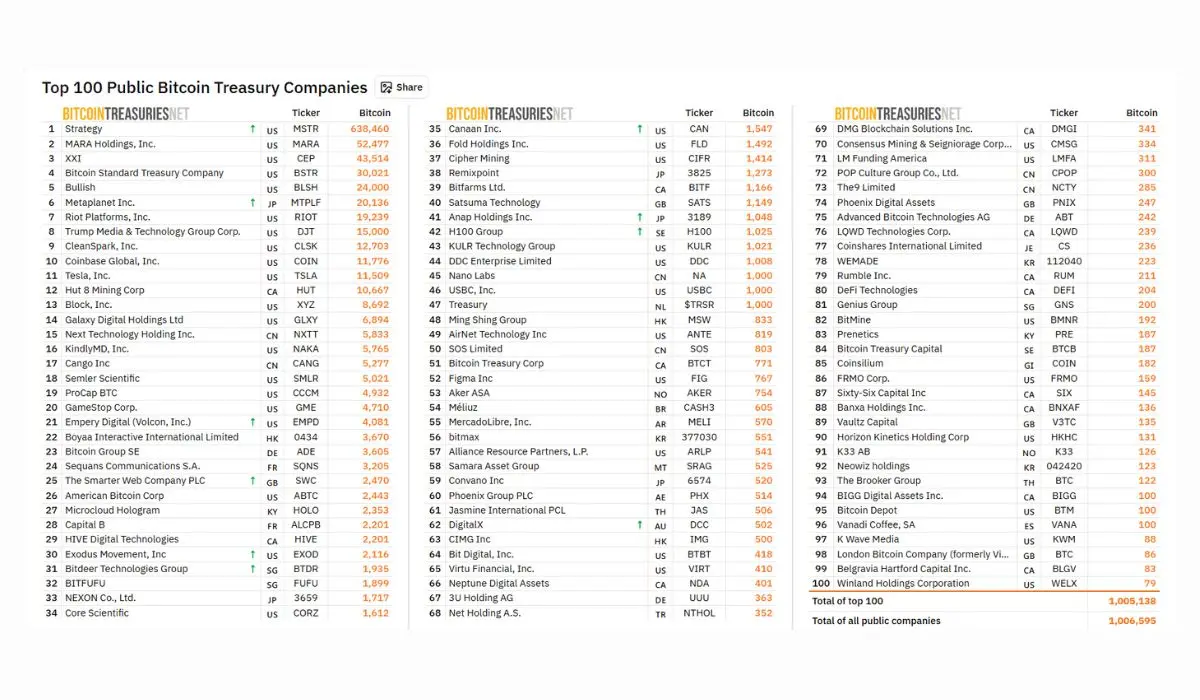

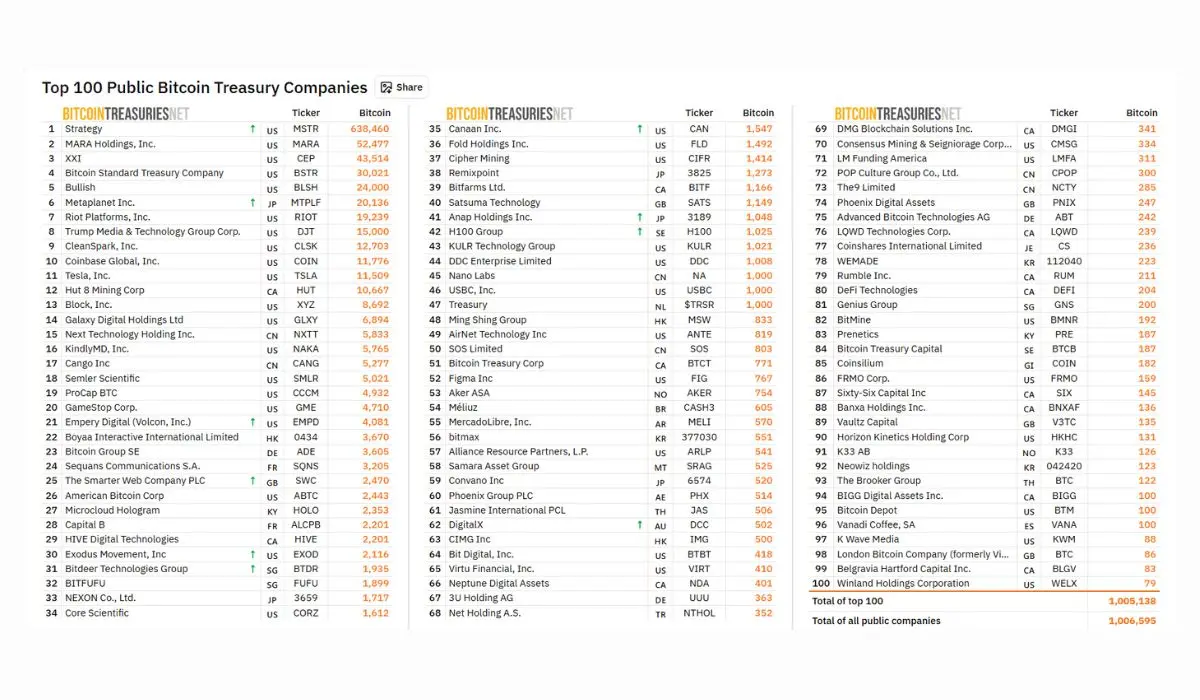

The company cryptocurrency treasury motion has entered a brand new section. What as soon as appeared like an “straightforward cash” technique—elevating capital to purchase Bitcoin and driving a shortage premium—is now turning into a ruthless “participant versus participant” competitors. In accordance with new evaluation from Coinbase Analysis, greater than $215 billion in digital belongings at the moment are managed throughout 213 company treasuries, with over 1 million Bitcoin—value round $110 billion—held by public corporations.

However whereas the headline figures look spectacular, rising rates of interest, tighter rules, and market maturity are exposing basic weaknesses in these enterprise fashions. Buyers at the moment are asking: is that this evolution a threat or a possibility?

MicroStrategy Paved the Method, however the Sport Has Modified

The shift traces again to 2020, when Michael Saylor’s MicroStrategy—now rebranded as Technique Inc. pioneered the Bitcoin treasury mannequin. By tapping convertible bonds and fairness raises, the corporate constructed the most important company Bitcoin place on this planet.

At the moment, Technique holds a staggering 638,460 BTC, reporting $14.05 billion in unrealized positive aspects in Q2 2025. Impressed by its success, different companies jumped in:

- MARA Holdings now controls 52,477 BTC.

- Jack Mallers’ XXI amassed 43,514 BTC.

- Japan’s Metaplanet has set a daring goal of 210,000 BTC by 2027, doubling its holdings each 60 days.

The early movers loved a big “shortage premium.” Their shares traded effectively above internet asset worth as traders rewarded their aggressive Bitcoin positioning. However with dozens of imitators flooding in, that premium has compressed, forcing corporations to distinguish or threat fading into irrelevance.

Rising Charges Expose Structural Weaknesses

A significant concern for analysts is that company Bitcoin treasuries haven’t any pure yield. In contrast to actual property, which produces rental earnings, Bitcoin merely sits on stability sheets. Many companies have borrowed closely in fiat to purchase BTC, making a negative-carry commerce.

For instance, Technique has financed its accumulation with $3.7 billion in low-coupon convertible bonds and $5.5 billion in perpetual most popular shares. Metaplanet is taking over comparable leverage, issuing ¥270.36 billion in zero-interest bonds and elevating $1.45 billion via inventory gross sales for Bitcoin purchases.

This strategy labored throughout an period of ultra-low rates of interest, however with borrowing prices climbing, the technique appears more and more dangerous. If Bitcoin stagnates for 2 to 3 years, dilution and solvency issues may weigh closely on shareholder worth.

Regulatory and Market Headwinds Intensify

The aggressive atmosphere is just not solely formed by monetary realities but in addition by regulatory scrutiny. The Nasdaq now requires shareholder approval for sure digital asset transactions, tightening oversight of company treasuries.

Even market leaders should not immune. Regardless of assembly technical standards, Technique was denied inclusion within the S&P 500, with the index committee citing the dangers of Bitcoin-centric enterprise fashions.

In the meantime, Glassnode analyst James Examine and different market observers warning that the straightforward positive aspects are over. New entrants should now show they’ll add worth past easy Bitcoin hoarding.

This skepticism is amplified by critics like Ran Neuner, who argues that many treasury companies act extra like exit automobiles for insiders than real long-term market patrons. In some circumstances, insiders contribute crypto in trade for shares, solely to money out at premiums whereas retail traders are left holding inflated positions.

A Rising however Dangerous Ecosystem

Regardless of these challenges, the motion is increasing. In 2025 alone, 154 U.S.-listed corporations raised $98.4 billion to fund crypto purchases—up from simply $33.6 billion by 10 companies in prior years.

Notably:

- Ahead Industries raised $1.65 billion for Solana-based treasuries backed by Galaxy Digital and Bounce Crypto.

- Company Ethereum holdings climbed to $28 billion throughout a number of entities.

This diversification means that Bitcoin is not the one sport on the town, although BTC stays the dominant company asset.

Investor Takeaway: Dangers and Alternatives

For traders, the transition from “straightforward cash” to “participant vs participant” competitors cuts each methods. On one hand, rising charges, regulatory boundaries, and market saturation improve the chance of failures, notably amongst overleveraged companies. Fairness dilution, class-action lawsuits, and risky mark-to-market swings could additional erode confidence.

Then again, elevated competitors may additionally push corporations to undertake smarter, extra strategic capital allocation strategies. This might in the end create extra sustained shopping for stress on Bitcoin and different digital belongings, benefiting long-term traders.

The period of easy premiums is over—however for these keen to abdomen volatility, the company crypto treasury battle should still show rewarding.

Associated: Worth Predictions: BTC Hovers Round $114K and ETH Heading In direction of Document Ranges

Conclusion

Company Bitcoin treasuries are not a easy guess on shortage. The mannequin has developed right into a high-stakes sport the place execution, regulation, and macroeconomic situations will resolve winners and losers.

Whereas early adopters like Technique nonetheless dominate, newer entrants face an uphill climb in an more and more crowded and scrutinized area. For traders, this implies fastidiously distinguishing between companies with sustainable methods and people merely replicating the playbook of the previous.

The “straightforward cash” section could also be gone—however the subsequent chapter might be much more consequential.