The Bitcoin market has suffered by means of a disappointing efficiency over the previous few weeks, resulting in a value retest of the $100,000 assist zone. Nonetheless, an thrilling on-chain analysis predicts a optimistic value motion within the close to future.

Bitcoin Value Under Common Value — Particulars

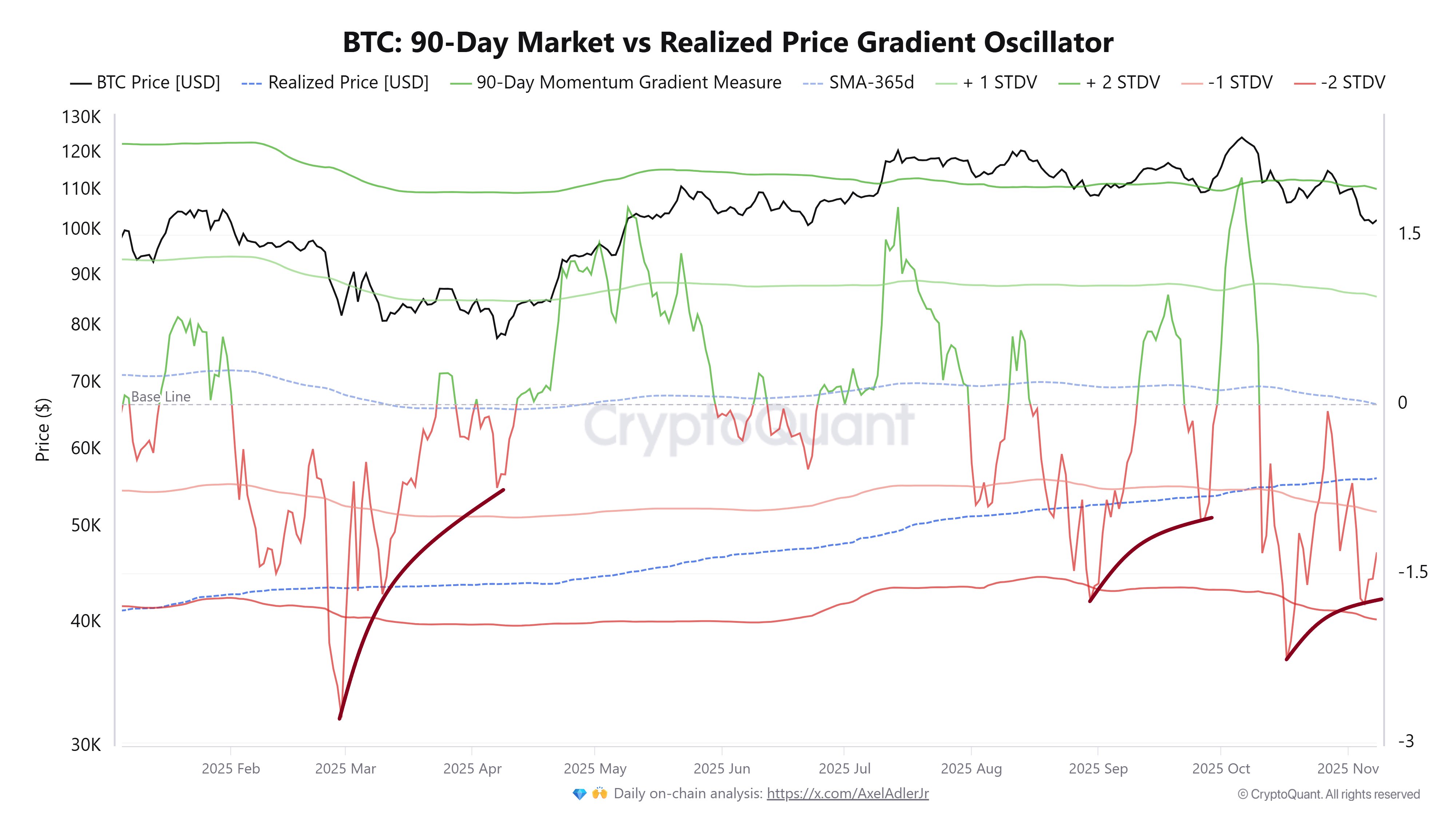

On November 8, well-liked market analyst Burak Kesmeci shared on X the underlying causes behind his expectations of a bullish reversal. Kesmeci’s submit principally will depend on the Bitcoin: 90-Day Market Value vs Realized Value Gradient Oscillator. Primarily, this indicator features as a method of monitoring the space of Bitcoin’s market value deviation from its realized value over the previous 90 days.

A optimistic studying from the metric signifies a sooner rising market value of Bitcoin, in comparison with its common value foundation (realized value), thereby exhibiting rising bullish momentum. A adverse studying, then again, connotes a major decline of market value beneath realized value, an indication of bearish momentum, which may lengthen right into a ‘cooling’ part.

Within the submit on X, Kesmeci reveals that the metric’s studying has fallen to a worth of -1.27 STDV (Commonplace Deviations). As beforehand defined, this means that the Bitcoin value has vastly fallen beneath its historic value foundation, a improvement that would level out that the flagship cryptocurrency’s value momentum has reached a state of ‘excessive cooldown.’

Expressed extra merely, Bitcoin traders are paying a lot lower than the quantity its current patrons did on common to accumulate Bitcoin. If extra traders had been to buy Bitcoin round its present value, there could possibly be a complete or vital absorption of what already seems to be exhausted bearish stress.

Notably, Kemesci additionally referenced previous occurrences to buttress his prediction of an imminent value rebound. In keeping with the analyst, durations the place this metric fell beneath -1 STDV have typically preceded the ends of downtrends and the beginnings of value expansions. We see this prevalence twice in current months: first, in April, the place Bitcoin noticed an increase from about $82,000 to $100,000; and second, the place the worth noticed a development from $108,000 in July to succeed in $124,000. Thus, if historic information is dependable, the Bitcoin value may quickly put in a brand new value backside, after which vital motion to the upside would possible comply with.

Bitcoin Value Overview

As of this writing, Bitcoin stands at a valuation of roughly $102,023, reflecting a slight lack of about 0.94% for the reason that final day.