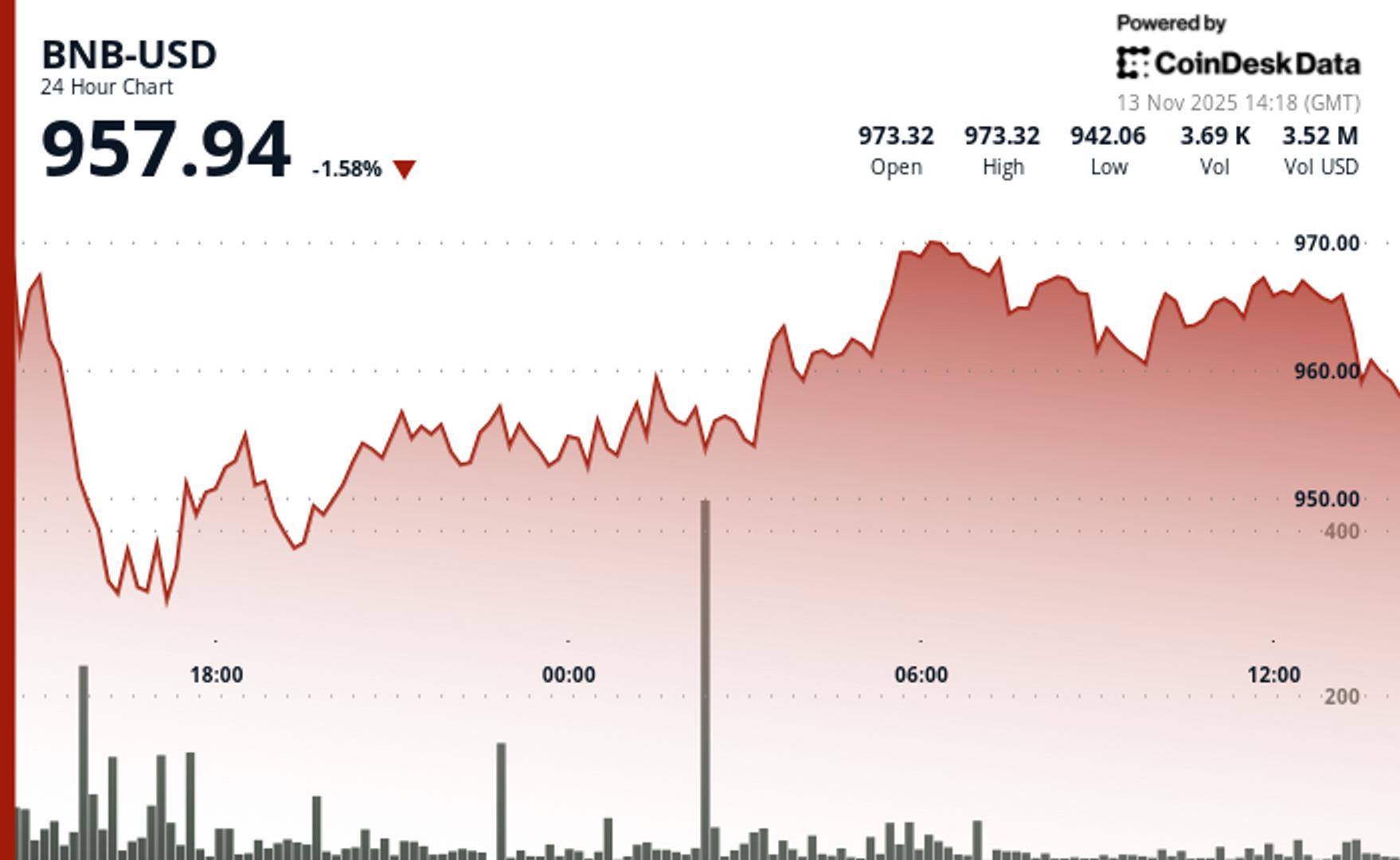

The native token of the BNB Chain, BNB , slipped under $960 within the final 24 hours, giving up beneficial properties after working into resistance simply above $970.

The token’s value briefly climbed to a excessive of $970.03 dropping again. Quantity jumped sharply throughout the reversal, suggesting large-scale promote orders triggered a cascade of liquidations, in line with CoinDesk Analysis’s technical evaluation information mannequin. The worth fell to a session low of $942.06 earlier than recovering.

The shift in momentum left the token rangebound, with patrons making an attempt to stabilize BNB across the $950–$960 zone. The token held close to the decrease finish of its intraday vary, signaling continued warning amongst merchants.

“BNB’s break under $970 will not be a lot about its volatility, however extra a couple of shift in order-flow dynamics,” Alex Boruski, co-founder of BNB-linked undertaking iMe AI, instructed CoinDesk in an emailed assertion. “With liquidity pockets sitting under $950, the trail of least resistance stays to the draw back.”

BNB is caught between a transparent resistance degree close to $970 and short-term assist close to $942. Boruski highlighted the formation of a head-and-shoulders sample on shorter timeframes, a setup typically seen as an indication of potential draw back forward.

Different analysts on social media pointed to comparable patterns, conveying short-term bearish strain affecting the cryptocurrency.

Whether or not BNB can reclaim floor above $970 or breaks decrease towards assist ranges round $900 could form its subsequent main transfer. For now, the decline is consistent with the broader crypto market. The CoinDesk 20 (CD20) index fell 1.6% over the interval.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.