Crypto analyst Will Taylor, founding father of Cryptoinsightuk, says discuss of an XRP bear market is untimely, arguing that the token’s higher-time-frame construction and liquidity profile stay bullish regardless of excessive volatility and report liquidations.

Is The XRP Bear Market Right here?

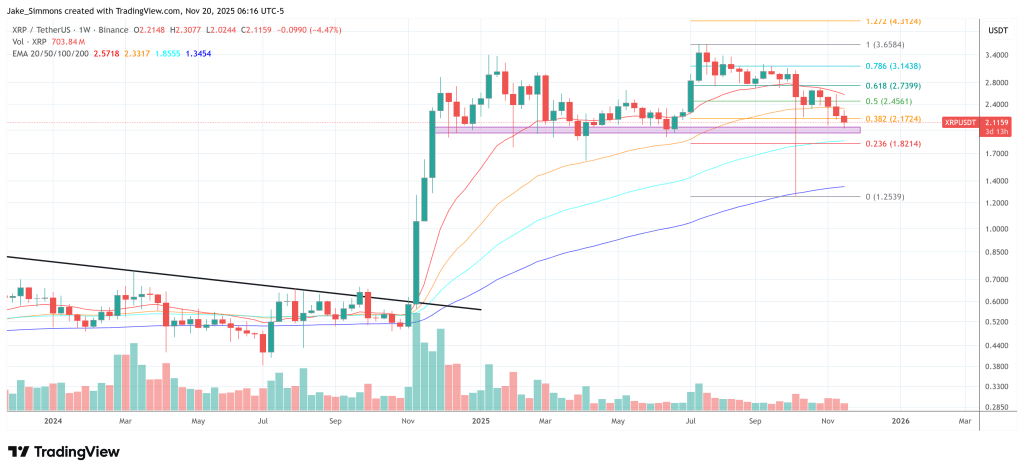

In a video revealed on 19 November, Taylor acknowledged the “doom and gloom” dominating crypto sentiment however insisted that, from a technical standpoint, “nothing’s actually modified” for XRP. His core declare is that XRP remains to be buying and selling above a reclaimed multi-year resistance degree that now acts as structural assist.

“Now we have spent over a yr above our 7-year resistance holding it as assist,” he mentioned, calling this setup “virtually unprecedented for XRP and for any asset.” So long as that zone holds, he rejects the concept that the market has rolled right into a confirmed long-term downtrend. “Till that assist is misplaced […] you possibly can’t persuade me that we’re bearish. I simply don’t imagine that.”

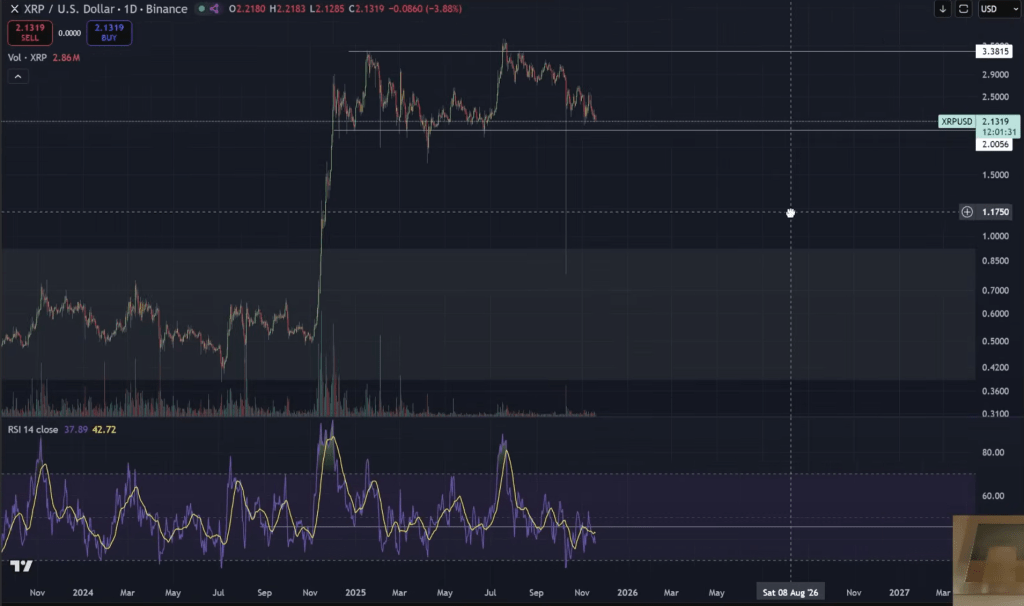

Taylor makes use of Bitcoin because the macro anchor for the XRP thesis. He described the present BTC drawdown as a regular bull-market correction, noting that value is now sitting round a 30% pullback from the highs, much like prior mid-cycle strikes. He identified that the each day RSI is oversold and that the three-day RSI is at ranges final seen close to the $25,000 lows. “If we’re referring again to when momentum has felt this unhealthy, it’s actually cycle lows,” he argued, whereas stressing that this doesn’t assure an instantaneous reversal.

Associated Studying

Towards that backdrop, he characterizes XRP as merely ranging above long-term assist. On the each day chart, he mentioned XRP is “holding its vary fairly properly,” with value close to the decrease finish of that construction. He framed the world round roughly $2 as traditionally enticing from a risk-reward perspective: “Backside of the vary is the place individuals are scared, the place sentiment’s low. These are the areas which are fairly first rate.”

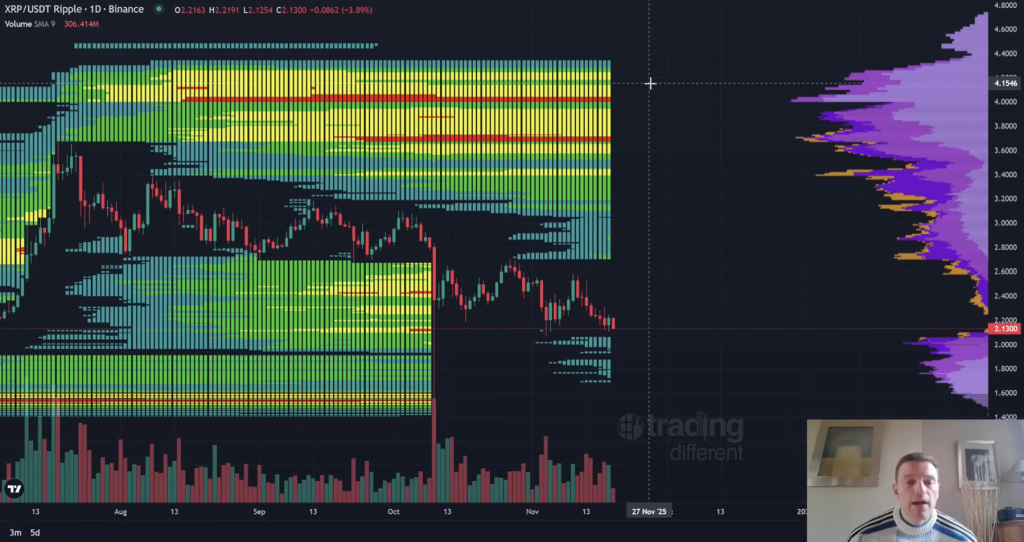

The liquidity map is central to his view. On decrease time frames, Taylor sees some liquidity beneath current lows, round $2.05–2.03, which may very well be swept with out breaking the broader vary. Nevertheless, he careworn that the overwhelming focus of resting liquidity lies far above spot. Within the each day, he claimed that for XRP “the densest space of liquidity by an absolute lengthy shot is above us […] dense all the way in which as much as $4.20, $4.30 in {dollars}.”

He argued that this distribution issues as a result of market makers and exchanges maximize income the place positions are opened and closed, not at stagnant costs. “They earn money when contracts are opened and closed. They don’t give a [expletive] whether or not the value goes up or down,” he mentioned. In his view, meaning value statistically gravitates towards probably the most crowded liquidity pockets: “You need to play the 4 out of 5 probability that it will go into the dense space of liquidity.”

Associated Studying

XRP Vs. The Relaxation Of Crypto

Taylor additionally pointed to relative-value indicators. Towards Ethereum, XRP just lately closed a weekly candle above the 0.000071 degree, which he mentioned “has trapped us down since August.” Versus Bitcoin, he highlighted that XRP has been “holding the vary lows” and has lastly logged a weekly shut above a resistance cluster that capped value since early October. XRP dominance, he added, has damaged out of a downtrend and closed again above a current cluster, though he desires “one or two extra weeks” of continuation to substantiate a bullish cross.

He underscored that this construction has held regardless of the October 10, “the most important liquidation occasion in historical past of crypto.” Whereas the FTX collapse noticed about $2 billion in leveraged positions liquidated, the October 10 transfer liquidated roughly $20 billion and nonetheless didn’t push XRP right into a sustained breakdown.The sharp wick decrease was “immediately purchased again to the upside,” and the vary was reclaimed quickly after. “Issues like XRP are wanting tremendous bullish right here,” he concluded. “I believe XRP goes to blow the doorways off folks’s expectations.”

For now, Taylor maintains that an XRP bear market would require a decisive lack of the long-term assist zone and a really totally different liquidity and dominance image. Till these situations seem, he says, “there isn’t a factual argument” for a confirmed bear market—solely predictions.

At press time, XRP traded at $2.11.

Featured picture created with DALL.E, chart from TradingView.com