Key Takeaways

- $1.97 billion in leveraged positions have been liquidated throughout the crypto market in 24 hours, as Bitcoin (BTC) dropped under $82,000 and Ethereum (ETH) fell underneath $2,900 for the primary time in practically 6 months. The whole crypto market cap has dipped under $3 trillion.

- Leveraged longs represented $1.78 billion, whereas shorts accounted for $129.3 million of the liquidations, which resulted in practically 400,000 merchants closing their positions. $960 million in BTC, $52.27million in ETH, and $98.18 million in SOL are at a loss.

- Analysts recommend that the first driver of at present’s losses comes from leveraged whale positioning. The crypto market has misplaced $1.3 trillion in total worth since final month, however there have been little to no bearish fundamentals.

- Although the Crypto Concern and Greed Index lies within the “Excessive Concern” zone, bullish catalysts like the top of the Fed’s QT cycle, spending resumption by the usgovernment, and the potential $2,000 tariff dividend by the Trump administration are but to be at play.

The continued rout throughout the cryptocurrency market continued on Friday, as practically $2 billion was liquidated over the previous 24 hours. This has resulted within the complete crypto market capitalization dropping under $3 trillion for the primary time since June 2025.

The decline was triggered by Bitcoin (BTC) – the alpha cryptocurrency – shedding practically 10% of its worth in 24 hours to an intraday low of $81,868, which additional amplified the month-to-month downtrend.

Crypto Market Cap Falls to $2.9 Trillion as $1.97 Billion in Leveraged Positions have been Liquidated in Underneath 24 hours

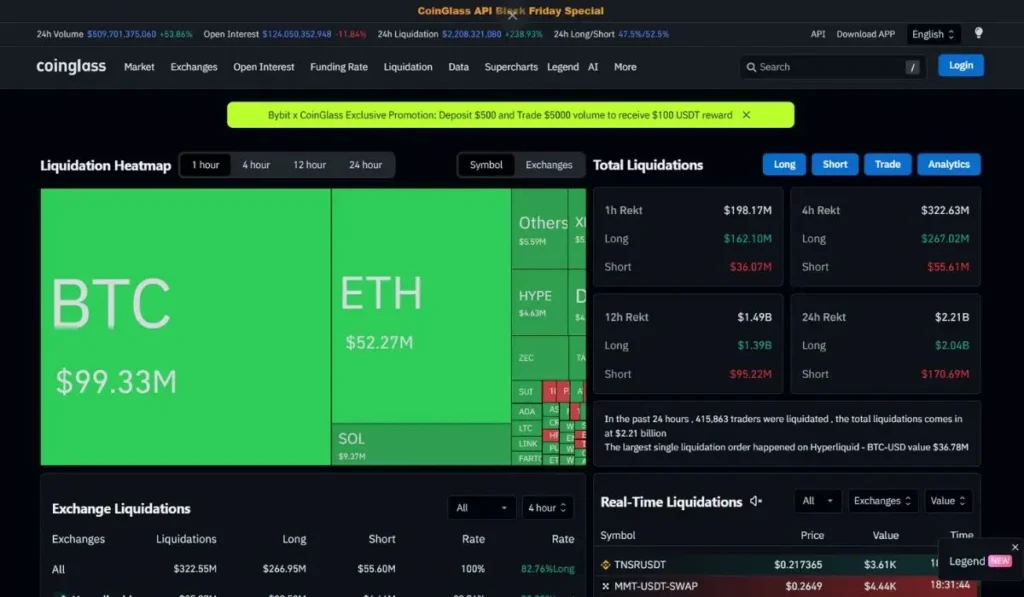

In response to knowledge from CoinGlass, complete crypto liquidations hit $1.98 billion over the previous 24 hours, with 391,164 merchants pressured to exit their leveraged market positions. The highest 10 cryptocurrencies by market cap, bar stablecoins, have posted double-digit losses throughout that point.

BTC led the liquidation chart at $990 million, with $929 million of that complete stemming from lengthy positions. Ethereum (ETH), the second-largest crypto by market cap, adopted with $52.27 million, with leveraged longs accounting for $183 million of the losses. $98.18 million was liquidated in Solana (SOL), with longs contributing $56 million.

Leveraged longs represented $1.78 billion of complete liquidations, whereas shorts accounted for simply $129.3 million. The only-largest liquidation occasion occurred on the decentralized perpetual alternate Hyperliquid, the place a BTC-USD place price $36.78 million was closed.

Whereas the broader bearish market sentiment stems from macroeconomic and geopolitical uncertainties, at present’s drop is extra localized, doubtlessly pushed by leveraged whale positioning available in the market.

One whale investor has suffered $37 million in unrealized losses on his BTC and ETH lengthy positions. The dealer’s income dropped from $63 million on November 10 to simply $4 million as of Friday, a 93% decline in 10 days.

Leveraged Whale Place Exits Piled Downward Strain on Crypto Costs

Blockchain analytics platform PeckShieldAlert reported in an X thread that a number of main whales have been liquidated after ETH fell under $2,900, with particular person losses within the crypto starting from $2.9 million to $6.52 million.

In the meantime, Lookonchain reported that high-profile crypto dealer, Jeff “Machi” Huang, who has deposited $6.96 million in USDC on Hyperliquid because the October 11 market crash to lengthy ETH and XRP, has suffered a complete lack of $20.23 million, along with his account now right down to a steadiness of solely $15,538.

He had deposited $115,000 in USDC to assist his lengthy place solely hours earlier. In late September, Huang’s complete income stood at $44.8 million. He has suffered practically $650,000 in losses over the previous 24 hours.

Andrew Tate, who had opened two BTC longs at present, was liquidated in underneath an hour. The millionaire social media influencer has been liquidated 84 occasions in complete on Hyperliquid.

This huge sell-off occasion comes as the entire crypto market cap dipped over 6% prior to now day to $2.9 trillion. Market analytics platform The Kobeissi Letter emphasised that the sector has misplaced $1.2 trillion in worth since early October, claiming that that is “one of many fastest-moving crypto bear markets ever.”

The Kobeissi Letter means that the “mechanical bear market” was attributable to heavy leverage and sporadic liquidations, as merchants have been pressured to promote with costs dropping quick, which created a suggestions loop of downward stress.

Nonetheless, the analysts famous that all through the course of the 45-day bear market, there have been little to no bearish basic developments.

“The market is environment friendly; it should iron itself out,” the X publish learn.

Crypto Market May Reverse Losses as Key Liquidity Catalysts are But To Play Out

The Crypto Concern and Greed Index stays at “Excessive Concern” ranges, however Derek Lim, head of analysis at Caladan, instructed crypto media outlet Decrypt that the present market exercise doesn’t align with key financial indicators.

He argued that market liquidity boosting catalysts, comparable to the top of quantitative tightening by the Federal Reserve, the top of the U.S. authorities shutdown and resumption of its spending, and a possible $2,000 stimulus bundle introduced by President Trump, are nonetheless at play.

The analyst famous that these elements will take time to affect market sentiment, making a situation the place the market has but to catch as much as what consultants view as robust financial fundamentals.