When you’ve ever stared at a chart coated in indicators and thought, “There must be an easier manner,” Rob Smith’s STRAT might be what you had been searching for the entire time.

And if you happen to’re utilizing our MQL5 STRAT Value Motion Scanner indicator, this weblog is right here to attach the dots

What’s The STRAT?

The STRAT is a price-action buying and selling technique created by Rob Smith. As a substitute of counting on shifting averages, oscillators, or a pile of indicators, it focuses nearly fully on what every candle did relative to the earlier one, plus:

At its core, The STRAT reduces the complete market into simply three candle varieties and the patterns they kind. When you perceive these constructing blocks, every part else turns into sample recognition and context.

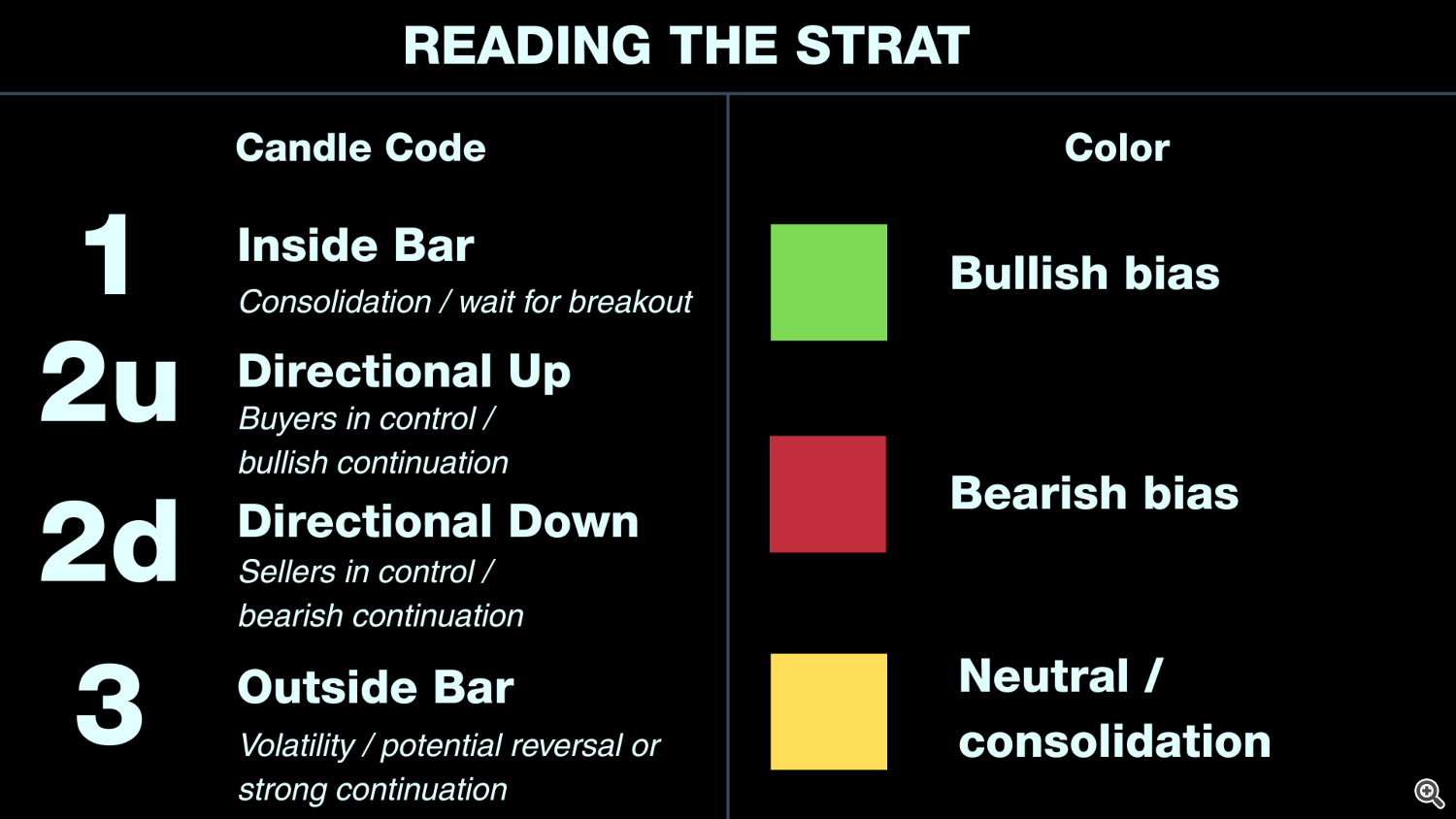

The Three STRAT Situations: 1, 2, and three

Each candle in The STRAT will get certainly one of three labels:

1 – Inside Bar

-

The present candle’s excessive and low are contained in the earlier candle’s vary.

-

It represents consolidation and a second of steadiness.

-

STRAT merchants deal with it as a coiled spring: whichever manner it breaks, that’s your info.

2 – Directional Bar (2U or 2D)

A directional bar takes out one facet of the earlier candle:

-

2U (Directional Up) – The present candle trades above the earlier excessive, however doesn’t take out the low.

-

2D (Directional Down) – The present candle trades beneath the earlier low, however doesn’t take out the excessive.

That is the engine of development: it exhibits continuation in a single course.

3 – Exterior Bar

-

The present candle takes out each the excessive and low of the earlier candle.

-

It exhibits growth and volatility – value “broadens out”, sweeping each side.

From Single Bars to STRAT Combos

On their very own, 1/2/3 are simply candles. The magic occurs whenever you hyperlink them:

-

2-1-2 Reversal

-

3-1-2 Reversal

There are lots of extra combos (2-2-2, 3-2-2, and so on.), however the thought is identical:

You’re studying how value went from growth → pause → growth once more, and also you commerce in step with that story.

The STRAT Value Motion Scanner indicator mechanically labels these bar varieties and combos for you, so that you don’t must manually decode 1/2/3 on each candle.

Timeframe Continuity: Tides, Waves, and Ripples

In The STRAT, timeframe continuity is only a fancy manner of claiming:

“Are all my chosen timeframes shifting in the identical course or not?”

On every timeframe (Month-to-month, Weekly, Every day, and so on.), The STRAT solely cares about one easy factor: Is value at the moment above the open of that candle (bullish) or beneath it (bearish)?

To make sense of this, it helps to think about the market just like the ocean:

-

Tides – Month-to-month, Weekly

These are the large, gradual actions. They present the total course the market is drifting. -

Waves – Every day

These transfer quicker, however they nonetheless observe the tide more often than not. -

Ripples – Intraday (H4, H1, M15, and so on.)

These are the small, noisy strikes inside the larger waves.

If the tides, waves, and ripples are all shifting in the identical course (all bullish or all bearish), you’ve got full timeframe continuity. You’re actually buying and selling with the ocean, not making an attempt to swim towards it.

-

If Month-to-month, Weekly, and Every day are all inexperienced and pushing larger, you’re going with the stream whenever you search for lengthy (purchase) STRAT setups.

-

In the event that they’re all pink and pushing decrease, you deal with quick (promote) setups.

This is the reason timeframe continuity issues: it retains you from shopping for into a robust higher-timeframe downtrend or shorting into a robust uptrend. You cease preventing the larger gamers and begin aligning with them.

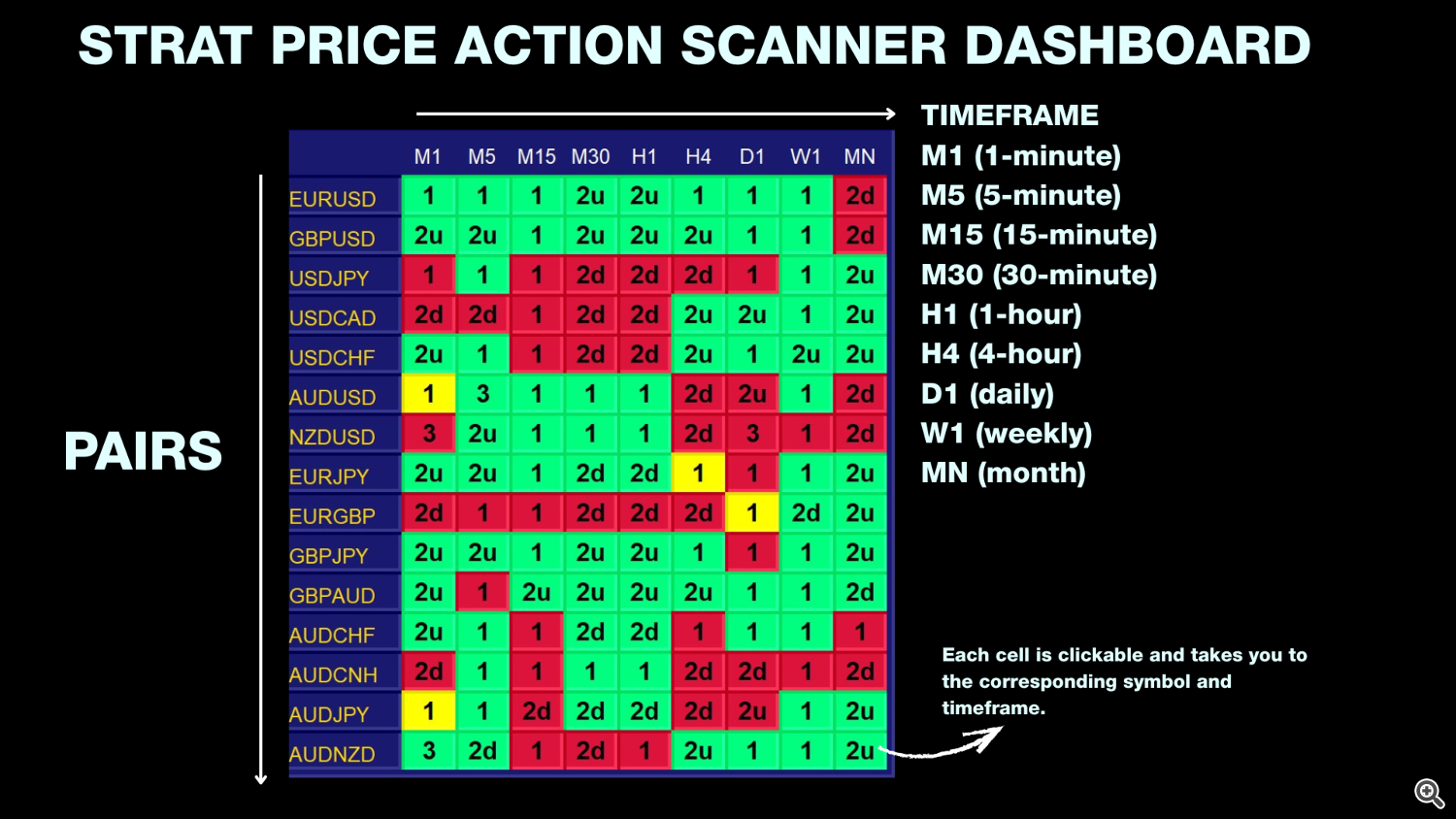

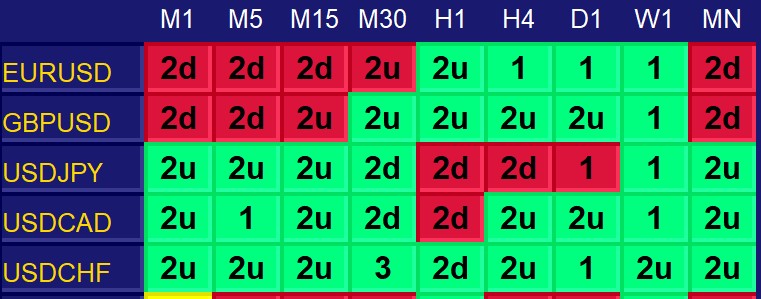

Intraday Instance: Selecting Your Battles (EURUSD vs USDCAD vs USDCHF)

Think about you’re an intraday dealer utilizing M15 or M30 as your foremost timeframe and H1/H4/D1 for course. Your dashboard seems to be like this:

-

EURUSD row

-

M1–M30: largely pink (second and 2u on pink background)

-

H1: inexperienced 2u

-

H4, D1, W1: all inexperienced (1’s)

-

MN: pink second

-

What does that say?

-

Increased intraday and swing timeframes (H4, D1, W1) are bullish – the larger image is up.

-

Very short-term intraday (M1–M30) is bearish – value is at the moment pulling again.

-

Month-to-month continues to be pink, so on the very large image EURUSD is perhaps in a bigger corrective part.

As an intraday dealer, that is messy continuity:

-

You might plan an extended, treating the pink decrease timeframes as a pullback, however you’ll most likely need:

-

It’s not the cleanest “all inexperienced” candidate in your listing, so many merchants would mark EURUSD as “wait and see” slightly than their first selection.

Now examine that with USDCAD:

-

USDCAD row

-

M1–M30: largely inexperienced (2u and 1)

-

H1: pink second

-

H4, D1, W1, MN: all inexperienced (2u or 1)

-

Right here:

For an intraday dealer, this can be a a lot cleaner bullish atmosphere:

-

You have got sturdy continuity on the large stuff (D1, W1, MN all inexperienced).

-

Most intraday timeframes are inexperienced as nicely.

-

H1 being pink would possibly merely imply you’re in the midst of a pullback, and you may watch H1/M15 for:

That is the sort of state of affairs the place you would possibly say:

“USDCAD is broadly bullish. I’ll search for a bullish STRAT setup on M15/M30 that strains up with H4/D1 and use the top of this H1 pullback as my entry alternative.”

Lastly, USDCHF:

-

USDCHF row

-

M1–M30: all inexperienced (2u, 2u, 2u, 3)

-

H1: inexperienced second (a “failed” second to the draw back)

-

H4, D1, W1, MN: all inexperienced (2u or 1)

-

That is nonetheless one of many cleanest bullish symbols on the board:

For an intraday dealer, USDCHF is a superb instance of utilizing continuity and candle behaviour collectively:

-

The upper timeframes (H4, D1, W1, MN) are clearly bullish.

-

The decrease timeframes (M1–M30) are additionally bullish.

-

H1 exhibits a failed push down (inexperienced second), which will be the beginning of a reversal again in the primary course.

Your plan is perhaps:

-

Watch H1 and M15/M30 for a clear bullish STRAT sample after that inexperienced second (e.g. a 2-1-2 up or 3-1-2 up).

-

Enter lengthy in step with the dominant uptrend as soon as that sample triggers.

-

Use our commerce assistant to set entry, SL beneath the sample low, and your most popular R:R.

USDCHF, on this situation, is precisely the kind of pair many intraday STRAT merchants will prioritise: sturdy bullish continuity throughout the board, plus a failed try and go down that may gas the following leg larger.

A Easy Workflow

Right here’s a sensible option to mix the strategy with the device.

1. Begin with Timeframe Continuity

Resolve what kind of dealer you’re for this session:

Then, on the dashboard:

-

Search for symbols the place all these timeframes are aligned up or down.

-

Mark them mentally as your “focus listing” for the session.

No continuity? No stress. Transfer on. You don’t must commerce every part.

2. Scan for Actionable STRAT Combos

When you’ve acquired continuity filtered:

3. Body the Commerce With the Commerce Assistant

If you see a setup you want:

-

Open the commerce assistant panel from the indicator.

-

Outline:

-

Your deliberate entry (e.g., simply above the within bar excessive for an extended).

-

Your cease loss (typically on the opposite facet of the sample or formation).

-

Your required risk-to-reward (e.g. 2R, 3R).

-

-

Let the panel calculate: