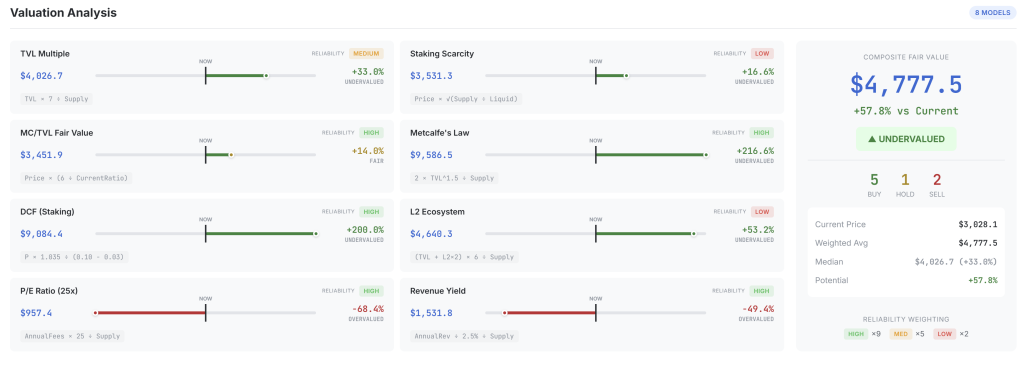

Ethereum is buying and selling far beneath its modeled “intrinsic worth,” in accordance with a reside valuation dashboard launched by Hashed CEO Simon Kim. On ETHval (ethval.com), the present snapshot exhibits Ethereum at a spot value of $3,034.0 whereas the reliability-weighted “Composite Honest Worth” stands at $4,777.5, implying +57.8% upside versus the market. The median truthful worth throughout fashions is $4,026.68, or +33.8% above spot. The dashboard labels ETH “UNDERVALUED” and aggregates its eight fashions into 5 purchase, one maintain and two promote indicators.

How The Honest Worth Of Ethereum Is Calculated

Kim launched the venture on X with the specific purpose of shifting the dialogue away from pure sentiment: “What’s ETH really price? The crypto business deserves higher than value hypothesis. I constructed a dashboard to consider ETH’s intrinsic worth with 8 fashions… Removed from good and open to suggestions.” ETHval makes these fashions and their outputs absolutely seen, together with their particular person reliability tags.

Associated Studying

The instrument’s central panel breaks out every valuation. The TVL A number of mannequin, which costs ETH off whole worth locked in DeFi utilizing a 7× TVL-to-market-cap anchor, assigns a good worth of $4,026.6, judging ETH 32.7% undervalued (reliability: medium). A extra conservative MC/TVL Honest Worth mean-reversion mannequin, handled as excessive reliability, lands at $3,453.1, solely 13.8% above spot and labeled as “truthful.”

Fashions that embed stronger network-effect or cash-flow claims are way more aggressive. The DCF (Staking) framework, which reductions an implied perpetual stream of staking rewards, values ETH at $9,101.9, indicating it’s 200.0% undervalued. A high-reliability Metcalfe’s Legislation implementation, which scales worth with TVL to the facility of 1.5, is much more bullish at $9,585.9, or 216.8% above the present value.

The Ethereum L2 ecosystem mannequin, which provides twice the TVL of main rollups to Ethereum mainnet TVL earlier than making use of a a number of, generates a good worth of $4,640.0, implying 52.9% undervaluation, though ETHval marks this mannequin’s reliability as low. A Staking Shortage mannequin, additionally low reliability and based mostly on liquid-supply contraction, costs ETH at $3,538.2, or 16.6% undervalued.

Associated Studying

Two income-style fashions push in the other way and nonetheless obtain excessive reliability scores. The P/E Ratio (25×) mannequin treats annualized protocol charges as “earnings,” applies a 25× a number of and arrives at a good worth of solely $957.4, studying ETH as 68.4% overvalued. The Income Yield mannequin reverse-engineers value from a goal protocol yield of two.5%; at present income ranges it outputs $1,531.8, implying 49.5% overvaluation.

To synthesize these conflicting indicators, ETHval applies a disclosed weighting scheme: high-reliability fashions are multiplied by 9, medium by 5 and low by 2 when computing the $4,780.7 composite. That weighting, mixed with the acute upside implied by the DCF and Metcalfe fashions, is what drives the general conclusion that Ethereum is strongly undervalued regardless of two revered frameworks pointing to draw back.

The dashboard itself stops in need of making funding suggestions. Beneath the numbers, ETHval reiterates that the outputs are for reference solely and that every mannequin rests on express, debatable assumptions.

However by fixing the present ETH value at $3,034.0 towards a reside fair-value band stretching from $957.4 on the bearish finish to $9,585.9 on essentially the most bullish, Kim’s web site quantifies a debate that normally performs out in anecdotes and narratives—and, for now, that quantified view leans clearly towards Ethereum being undervalued.

At press time, ETH traded at $3,029.

Featured picture created with DALL.E, chart from TradingView.com