XRP is on the middle of the institutional flows, main the crypto market in streaks of capital inflows whilst its worth is locked round $2. Latest knowledge reveals that cash continues to be coming into into Spot XRP ETF merchandise, however regardless of this regular demand and a transparent shift towards bullish sentiment throughout social platforms, XRP’s spot worth has struggled to interrupt greater, and this raises questions as to why inflows and worth motion seem out of sync.

Spot XRP ETFs Are Seeing Relentless Institutional Demand

Institutional urge for food for XRP has been particularly seen by means of Spot XRP exchange-traded funds. These merchandise have now logged 19 days of uninterrupted inflows, with a recent capital of $20.17 million added once more on Friday.

Associated Studying

The latest figures from SoSoValue present that these inflows pushed cumulative inflows to $990.91 million, near the $1 billion mark. Property underneath administration have additionally continued to rise, now sitting effectively above the $1 billion threshold at $1.18 billion. To place this into perspective, Spot Ethereum ETFs ended final week with $19.41 million of outflows

This sample factors to deliberate and sustained accumulation of XRP. Establishments seem snug constructing publicity to XRP progressively, profiting from its deep liquidity and controlled entry by means of ETF constructions.

Bullish Social Sentiment Has Not But Translated To Worth

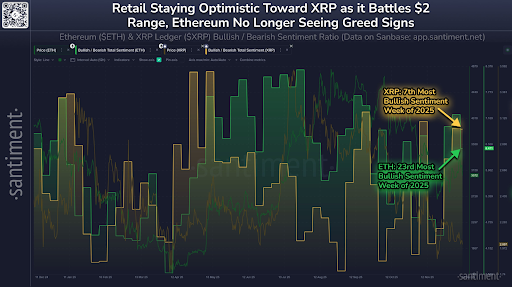

One other notable development with XRP is that sentiment amongst retail individuals has turned more and more optimistic up to now few days. Information from market intelligence agency Santiment, which screens discussions throughout platforms together with X, Telegram, Reddit, and Discord, factors to a noticeable enhance in optimistic commentary surrounding the altcoin over the previous week.

Associated Studying

Santiment knowledge reveals that XRP has ranked among the many most positively mentioned property of the yr, a lot greater than Ethereum. This enhance in optimistic sentiment has been characterised by merchants expressing confidence as the worth continues to carry above $2. Significantly, Santiment knowledge reveals that final week was the seventh most bullish sentiment week of 2025 for XRP.

Retail Staying Optimistic Towards XRP. Supply: Santiment

Beneath regular situations, this mixture of robust inflows and bettering sentiment would sometimes recommend a bullish setup. Nonetheless, sentiment alone doesn’t transfer markets, and XRP has been range-bound round $2.

Crucial factor is the distinction between shopping for and promoting stress. The shortage of bullish worth motion signifies that persistent sell-side exercise from present holders has been adequate to soak up incoming demand, and this has stored XRP’s worth constrained whilst accumulation quietly builds.

The identical dynamic applies to ETF flows. Though Spot XRP ETFs have posted inflows for 19 consecutive days, the every day figures are comparatively modest. Inflows would wish to increase into the tons of of thousands and thousands of {dollars} on a constant foundation for these merchandise to replicate within the XRP worth. The strongest sign of bettering sentiment proper now’s XRP’s means to carry above $2 within the subsequent few buying and selling classes, slightly than any decisive breakout to the upside.

Featured picture created with Dall.E, chart from Tradingview.com