Bitcoin, Ethereum, and different digital belongings have witnessed a pointy retrace over the past 24 hours, which has resulted in an extended squeeze on derivatives exchanges.

Crypto Lengthy Liquidations Have Neared $600 Million Throughout The Previous Day

Based on knowledge from CoinGlass, the most recent sharp value motion within the cryptocurrency market has accompanied an enormous quantity of liquidations over on the derivatives facet of the sector.

Associated Studying

“Liquidation” right here naturally refers back to the forceful closure that any open contract has to endure after it has amassed losses of a sure diploma. For lengthy buyers, this occurs when the asset’s value drops, whereas for shorts, liquidation happens after a surge.

How a lot the cryptocurrency must transfer in a single path to liquidate a particular place comes right down to the proportion threshold outlined by the platform and the quantity of leverage that the dealer has opted for. Throughout sharp value swings, positions with excessive quantities of leverage connected are the primary to go.

Bitcoin and different belongings have confronted some notable volatility in the course of the previous day, which has as soon as once more caught out merchants on the derivatives market. Because the desk under exhibits, liquidations have crossed $650 million over the past 24 hours.

About $584 million of those liquidations concerned lengthy positions alone. That’s equal to nearly 90% of the overall, showcasing how disproportionate the worth volatility has been throughout this era.

By way of the person symbols, the most important contributor to the liquidation occasion has been Ethereum, not Bitcoin, as is commonly the case.

With over $235 million in contracts concerned, Ethereum has notably outpaced Bitcoin, which has witnessed $186 million in liquidations. ETH going through extra liquidations is probably going because of the truth that its value drawdown has been stronger in the course of the previous day.

Out of the altcoins, Solana has come out on prime with $37 million in positions flushed, forward of XRP ($16 million) and Dogecoin ($12 million). Apparently, SOL has outperformed the 2 regardless of its losses being extra restricted.

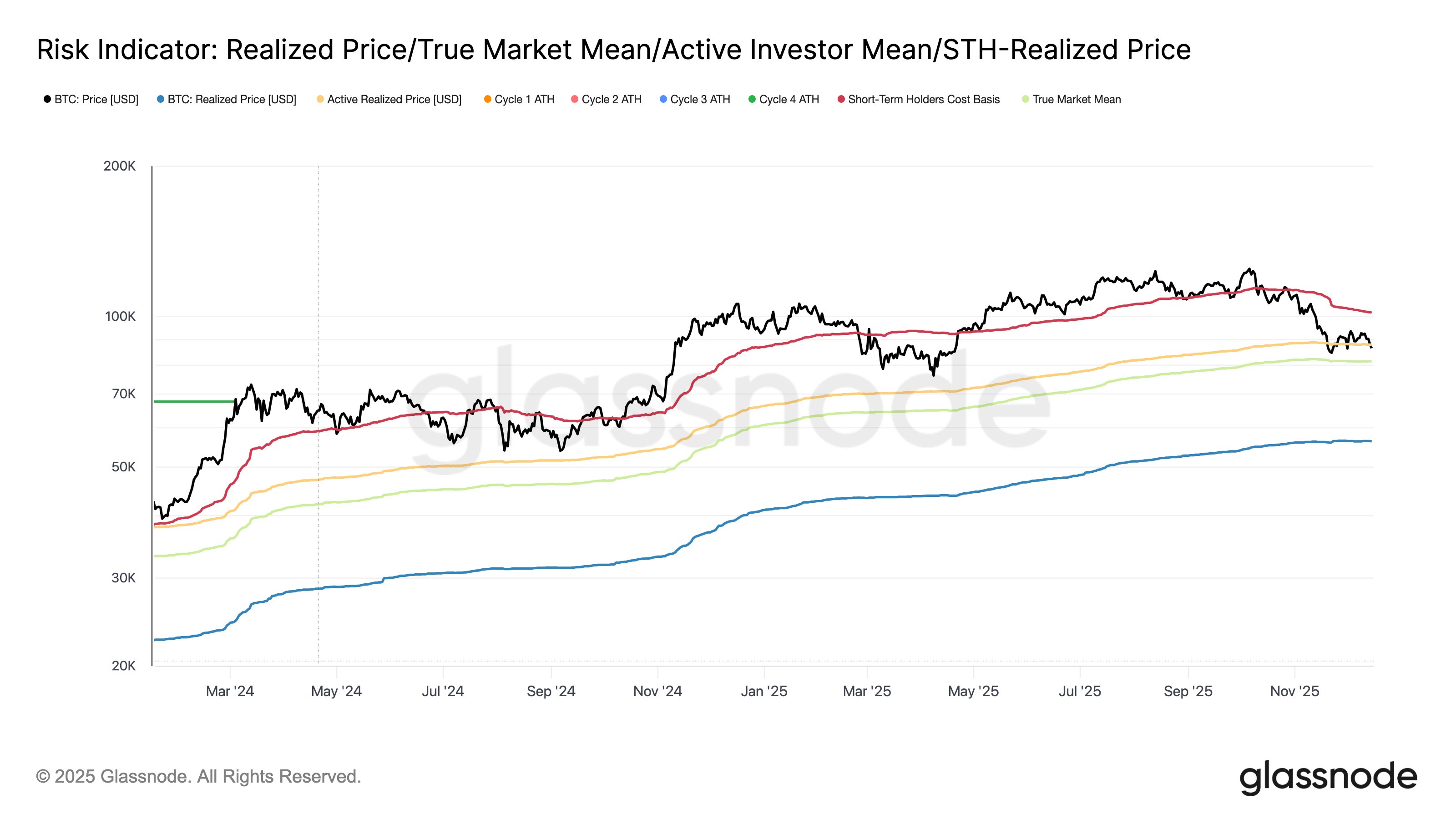

In another information, the most recent Bitcoin decline has meant that its value has fallen again underneath a key on-chain value degree, because the chart shared by analytics agency Glassnode exhibits.

The extent in query is the Lively Realized Value, similar to the associated fee foundation of the energetic individuals on the Bitcoin community. At the moment, it’s situated at $87,900, which is above the cryptocurrency’s spot value.

Associated Studying

Thus, it might seem that the most recent dip has put the energetic buyers as a complete right into a state of web unrealized loss.

Bitcoin Value

On the time of writing, Bitcoin is floating round $87,200, down greater than 3% over the past seven days.

Featured picture from Dall-E, Glassnode.com, CoinGlass.com, chart from TradingView.com