In keeping with reviews, Bitcoin’s outlook for 2026 is sharply divided as merchants shut the 12 months. The coin was buying and selling at $87,520 on the time of publication and is down 8% since Jan. 1, 12 months to this point. Market temper has been weak. The Crypto Worry & Greed Index hit 20 on Dec. 26, marking a stretch of two weeks labeled “excessive worry.”

Associated Studying

Analysts Cut up On Market Route

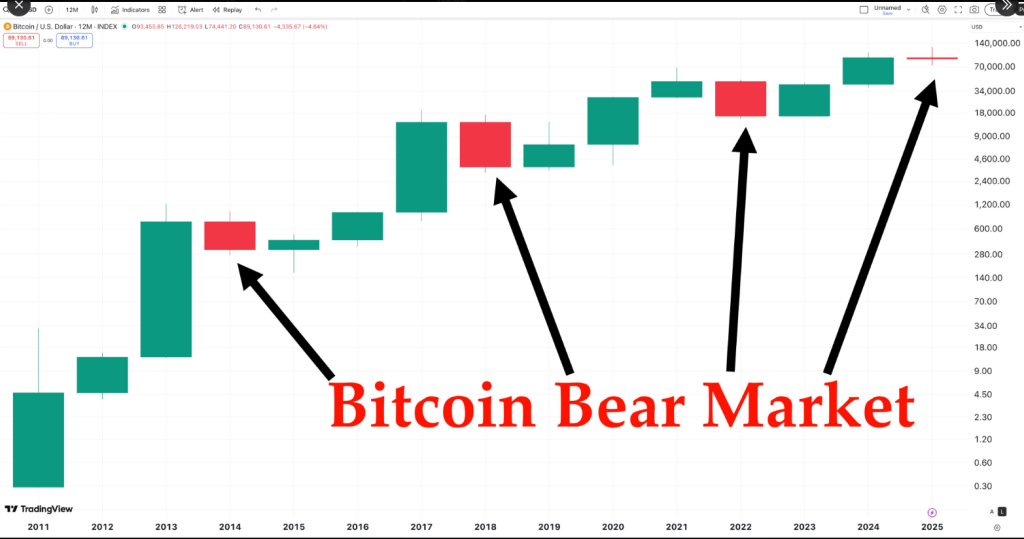

In keeping with posts on X, Jan3 founder Samson Mow contend that 2025 was the bear market and that Bitcoin might be coming into a bull run that lasts into 2035.

PlanC, one other well-known analyst, posted that Bitcoin has by no means had two crimson yearly candles in a row and instructed that surviving 2025 meant surviving the bear section. These feedback have been picked up throughout trade pages and sparked contemporary debate.

2025 was the bear market. https://t.co/1ganX0YSbI

— Samson Mow (@Excellion) December 26, 2025

Some Huge Value Calls Stay Bullish

A number of outstanding voices nonetheless count on sharp beneficial properties. Geoff Kendrick at Normal Chartered and Gautam Chhugani at Bernstein every forecast $150,000 for Bitcoin in 2026.

Charles Hoskinson, founding father of Cardano, predicted $250,000 by 2026, pointing to constrained provide and rising institutional demand as the principle drivers.

Arthur Hayes and Tom Lee additionally pushed massive targets as just lately as October, with $250,000 talked about as a attainable final result by year-end.

Sentiment And Market Knowledge

Based mostly on reviews, sentiment readings haven’t helped bullish momentum. The worry index that reached 20 on Dec. 26 stayed in “excessive worry” territory for a number of days.

On the identical time, Bitcoin’s value sits under many earlier projections. Market watchers word the coin is underneath strain regardless that a number of forecasts stay optimistic.

Bears Put Ahead Sharp Draw back Situations

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, expects a decline of roughly 60% from the historic peak above $126,000 by 2026.

Jurrien Timmer of Constancy warned that 2026 might be a “12 months off,” with costs probably falling towards $65,000. These views rely closely on historic drawdowns and macro headwinds.

They carry weight as a result of giant drops have occurred earlier than, although previous conduct doesn’t assure future motion.

The place The Numbers Diverge

The unfold of projections is vast. Some corporations counsel about $150,000, which might signify roughly 74% upside from a cited $86,000 degree.

Others level to $250,000, whereas draw back eventualities attain $65,000 or worse when measured from the $126,000 peak.

That hole reveals how totally different assumptions about provide, demand from establishments, and macro situations result in very totally different value targets.

Associated Studying

Merchants and asset managers will probably be watching flows into regulated merchandise, company treasury strikes, and adjustments in on-chain demand. Headlines and massive calls make for discuss, however precise flows usually determine short-term strikes.

Volatility is prone to stay, and the wide selection of forecasts means that each sharp rallies and sudden drops are attainable in 2026.

Featured picture from Pexels, chart from TradingView