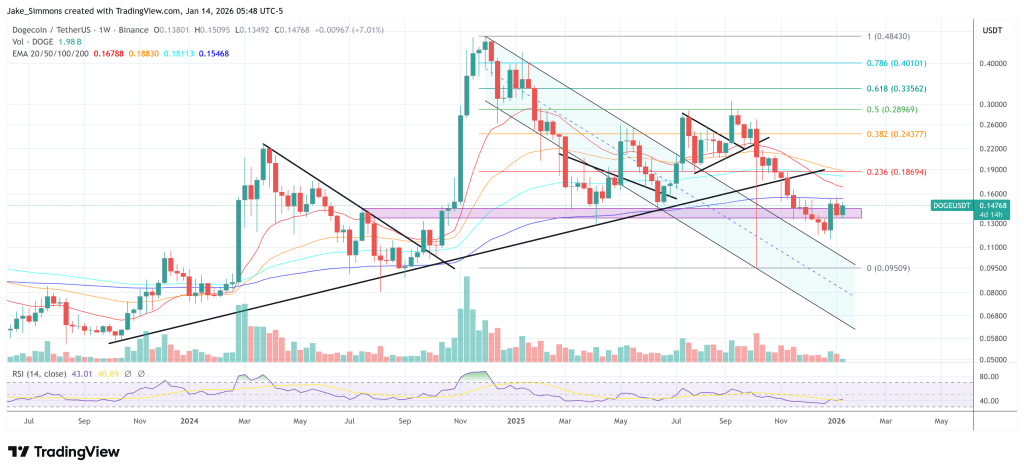

Dogecoin (DOGE) is urgent right into a technically vital choice space after a pointy bounce, however a number of chart reads from a number of revered crypto analysts converge on the identical level: the rally solely graduates from “aid” to “reversal” if DOGE can clear the mid-$0.15s and put in a contemporary native excessive.

Dogecoin Rallies, However The Actual Check Is $0.157

The framing by Kevin (Kev_Capital_TA) is specific about what affirmation seems like. “Dogecoin like BTC and lots of different Altcoins got here again and efficiently examined its key 4HR MA’s after breaking out of them in an try to finish its main corrective section. A profitable retest adopted by a brand new native excessive shall be additional proof the corrective section ended within the actual zone we stated it might. A brand new excessive could be a break of .157 cents.”

On Kevin’s 4-hour view, DOGE spent months trending decrease whereas repeatedly failing at declining moving-average bands, the chart marks a number of prior rejections. The latest push larger is notable as a result of value reclaimed these averages after which pulled again into them, holding the retest reasonably than rolling straight over. That habits is according to a regime trying to rotate from “sell-the-rip” to “buy-the-dip,” however the chart makes clear the market continues to be buying and selling beneath a broader downtrend construction until it could actually drive a better excessive.

Associated Studying

Cantonese Cat’s day by day snapshot captures the place that friction is exhibiting up in actual time. The most recent candle closes at $0.1486 after printing $0.1508 on the day, successfully tagging into the identical space the place sellers have leaned in earlier than.

He writes: “DOGE is placing in one other bullish day by day candle that engulfs the final 5 bearish candles.” Whereas that is an bullish sign a short-term impulsive transfer, a brand new larger excessive nonetheless must be completed by the Dogecoin bulls.

Associated Studying

@BigCheds’ day by day panel underscores why the mid-$0.15s matter: DOGE stays below heavier development measures, with the 34-day EMA at $0.1828 and the 200-day SMA at $0.2212 nonetheless properly overhead.

Bollinger Bands present DOGE rebounding out of low-end compression, with the decrease band round $0.11, the idea close to $0.135, and the higher band near $0.16. Value first bounced off the decrease band, pushed by the idea and tagged the higher band, then retraced to the idea, held the retest, and is now rotating again towards the higher envelope.

The setup is evident: holding above the reclaimed short-term averages and clearing $0.157 would full the “retest, then larger excessive” sequence Kevin is watching, whereas additionally forcing value by the day by day provide zone Massive Cheds has boxed out. A renewed push into the higher Bollinger Band would add affirmation that momentum is increasing within the course of the transfer.

Failure to clear that zone, adopted by a slip again below the reclaimed MA space, would shift consideration to $0.1319 first, then $0.1208, with $0.1068 because the deeper line within the sand proven on the chart.

At press time, DOGE traded at $0.14768.

Featured picture created with DALL.E, chart from TradingView.com