A governance vote at World Liberty Monetary (WLFI), a DeFi venture marketed across the Trump model, is drawing allegations of “gradual” worth extraction after a outstanding dealer claimed affiliated wallets pushed by means of a proposal whereas many public holders remained unable to entry or vote with their tokens.

DeFi^2 (@DeFiSquared), who describes himself because the #1 ranked dealer on Bybit in 2023 and 2024, wrote on X that he was “citing an alarming governance vote by World Liberty Fi this month that seems to be the beginning of a gradual extraction of worth from WLFI holders by the group.”

World Liberty Fi Hit With ‘Rigged Vote’ Claims

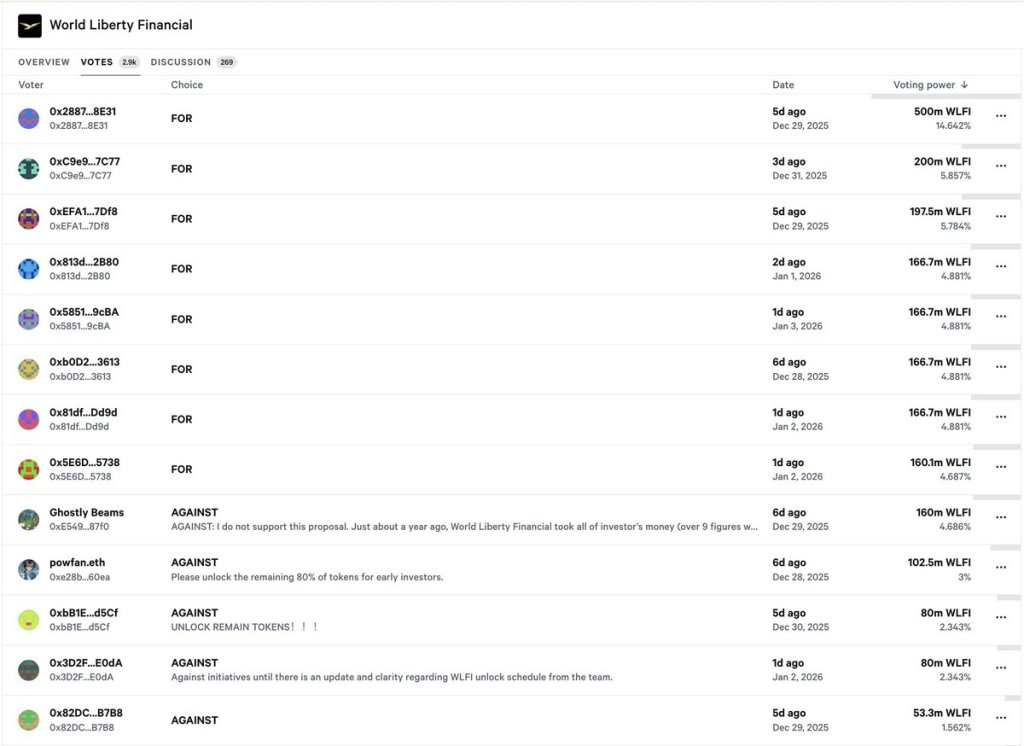

DeFiSquared wrote: “What you see above seems to be a rigged vote, the place nearly all of prime voters are indicated to be group wallets or strategic associate wallets by Bubble Maps. That is in distinction to the true voters decrease within the screenshot, who’ve all been locked from accessing their WLFI tokens since TGE, and unable to vote on an unlock till the group permits it.”

Associated Studying

The proposal on the heart of the thread is what he calls the “USD1 progress proposal.” He argues it reads as “pretty mundane” on its face, however says the governance sequencing is the inform: “why would the group exit of their solution to drive this vote by means of, as an alternative of voting on the WLFI token unlock that almost all of holders are asking for?”

His thesis hinges on WLFI economics. DeFiSquared claims WLFI holders “should not entitled to ANY protocol income in any respect,” and says the venture’s “Gold Paper” specifies income routing: “75% of protocol income goes to the Trump household, and 25% goes to the Witkoff household.” In his framing, that creates a perverse incentive: “It’s truly as loopy because it sounds: the group is forcing a vote to promote WLFI tokens on the expense of locked holders, in an effort to fund protocol income that goes solely to themselves.”

Associated Studying

He additionally alleges the vote’s final result was manufactured late within the course of. “This vote was truly failing by the point it reached quorum with a majority of votes rejecting the proposal, till the group / companions pressured the vote by means of,” he wrote, including token allocation context: “the WLFI group is allotted 33.5% of all tokens and strategic companions one other 5.85%, whereas the general public sale was allotted solely 20%.”

Put up-vote, he factors to on-chain flows as corroboration, citing “contemporary transfers corresponding to this one in all 500 million WLFI tokens to Leap Buying and selling,” whereas “investor WLFI allocations stay forcibly locked.”

DeFiSquared closes with a valuation and positioning name: “it’s troublesome to see the intrinsic worth behind a 17 billion greenback token that has no actual governance energy, no income share, and new basis promote stress occurring for their very own profit.” He provides he has shorted WLFI “on and off since pre-market costs above $0.34,” and expects continued draw back “as a result of dilution, intentional extraction,” and “different components associated to Trump’s closing time period in workplace.”

At press time, WLFI traded at $0.1608.

Featured picture created with DALL.E, chart from TradingView.com