In my earlier article, I defined the speculation behind XAU Sentinel: a trend-following EA designed to filter out the noise utilizing a “Market Regime Engine” (MRE).

Principle is nice, however Stay Outcomes are higher.

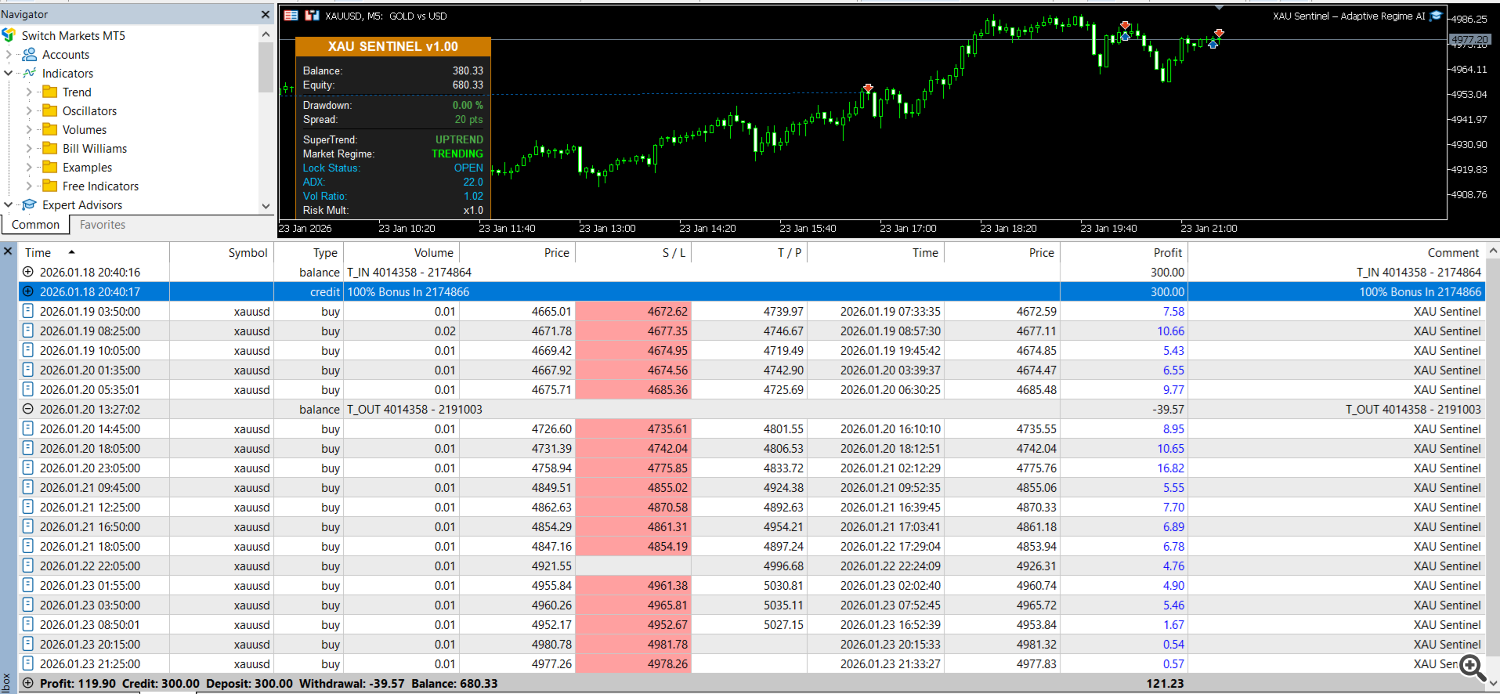

We simply concluded the primary week of reside testing on XAUUSD (M5 timeframe), and the outcomes completely illustrate why static methods fail and why adaptive methods survive.

Right here is the breakdown of how the algorithm dealt with this week’s Gold rally, producing a 100% Win Charge on this sequence.

The Proof: Adaptive Logic in Motion

Wanting on the chart above, you see a pleasant fairness curve. However look nearer on the Dashboard metrics within the prime left nook. That is the place the engineering stands out.

1. Detecting the “TRENDING” State The Dashboard confirms the Market Regime is TRENDING (Inexperienced). Beneath the hood, the EA analyzed the ADX and Volatility Ratio utilizing the parameters outlined within the inputs ( MRE_ADX_Threshold) . As soon as the situations had been met, it switched to Regime 1, activating aggressive targets and enabling the Trailing Cease.

2. The “Adaptive” Half (The Secret Sauce) That is essentially the most important technical element on this screenshot.

-

The Rule: By default, XAU Sentinel requires an ADX > 25.0 to enter a pattern .

-

The Actuality: Within the screenshot, the ADX is studying 22.0.

Why is the EA nonetheless buying and selling? Commonplace bots would have seen ADX drop under 25, panicked, and switched to “Ranging” mode—seemingly reducing your winners early or taking small losses through the pullback.

XAU Sentinel makes use of an adaptive logic referred to as Hysteresis ( MRE_ADX_Exit) . As soon as a pattern is established, the exit threshold mechanically drops to 20.0 .

The Logic: It’s more durable to begin a pattern than to remain in a single.

As a result of 22.0 continues to be above the adaptive exit degree of 20.0, the EA “knew” the pattern was nonetheless legitimate. It ignored the dip in pattern power and allowed us to seize the complete revenue of the transfer ($121.23).

3. The Outcomes (Week 1) As a result of the EA efficiently filtered out the “chop” earlier within the week and solely engaged when the Regime was confirmed:

Conclusion : Buying and selling Gold is not about guessing the path; it is about figuring out the Regime. This week proved that the “Adaptive Regime AI” is not only a advertising time period—it’s a security mechanism that retains you within the commerce when others exit too quickly.

I’m operating this sign reside. You may observe the efficiency or obtain the demo to backtest this particular week your self.

🔗 Sources: