Extremely Charts: Full Person Information

Introduction

Extremely Charts is a robust Skilled Advisor that transforms your MetaTrader 5 platform by enabling a number of different chart varieties past the usual candlestick, bar, and line charts. This device offers merchants entry to Second Charts, Tick Charts, Renko, Vary, Line Break, and Heiken Ashi charts—all inside the acquainted MT5 atmosphere.

This information will stroll you thru every chart sort, clarify the settings, talk about efficiency concerns, and present you use the management panel successfully.

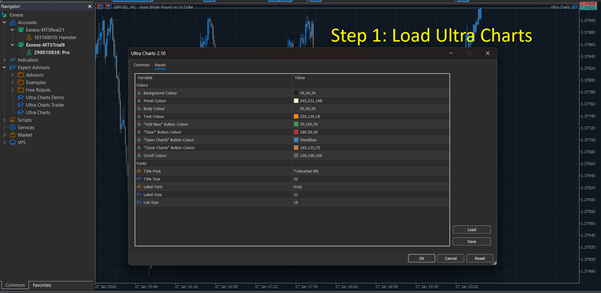

Getting Began with MT5 Extremely Charts

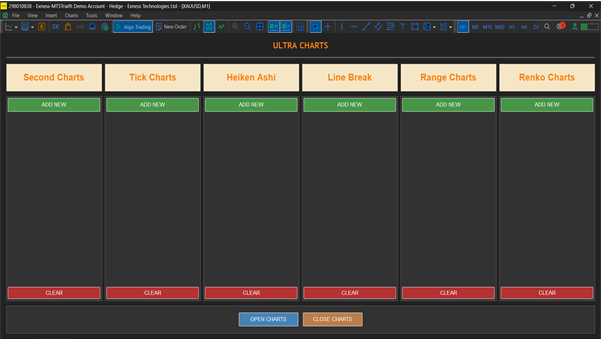

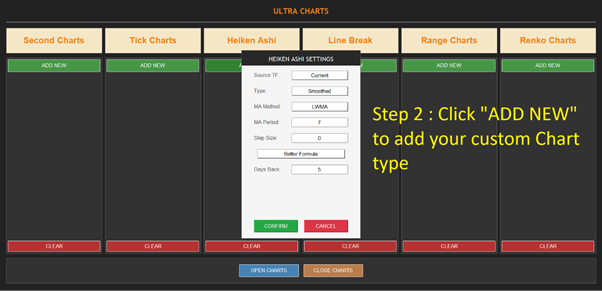

The Management Panel Overview

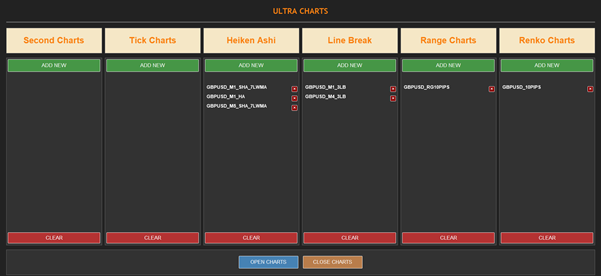

As soon as activated, MT5 Extremely Charts shows a user-friendly management panel with six foremost buttons:

- Add New: Creates a brand new customized chart based mostly in your chosen parameters

- Clear: Closes & removes all at the moment displayed customized charts for the chart sort

- Scroll Up: Navigates upward by means of your checklist of charts

- Scroll Down: Navigates downward by means of your checklist of charts

- Open Charts: Opens chosen charts in new home windows

- Shut Charts: Closes & eliminated all at the moment opened charts

Chart Varieties and Settings

1. Second Charts

What Are Second Charts?

Second Charts create new candles based mostly on time intervals measured in seconds relatively than minutes or hours. This gives ultra-short-term value motion visibility.

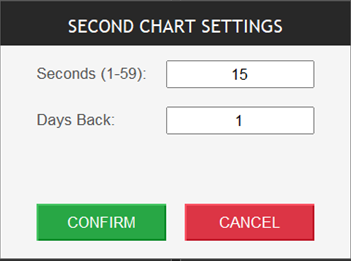

Key Settings:

- Interval: Variety of seconds per candle, with an higher restrict of seconds

- Days Again: What number of days again price of information we need to use to create customized bars

Efficiency with Smaller Ranges:

When utilizing very small second intervals (5-15 seconds), count on:

- Excessive CPU utilization throughout energetic market hours

- Giant information storage necessities

- Wonderful granularity for scalping methods

- Extra noise in value motion

- Sooner sign era

Finest Use Instances:

- Scalping methods

- Order circulate evaluation

- Entry timing refinement

- Excessive-frequency buying and selling setups

2. Tick Charts

What Are Tick Charts?

Tick Charts create a brand new candle after a specified variety of value modifications (ticks) happen, no matter time. This volume-based method filters out low-activity intervals.

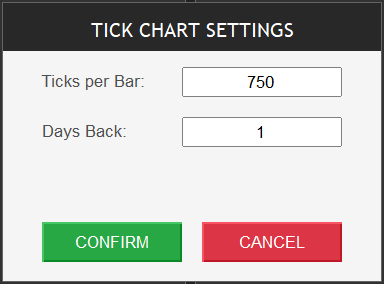

Key Settings:

- Ticks Per Bar: Variety of ticks earlier than a brand new candle varieties (e.g., 50, 100, 500)

- Days Again: What number of days again price of information we need to use to create customized bars

Efficiency with Smaller Ranges:

Utilizing decrease tick counts (10-50 ticks per bar) ends in:

- Extraordinarily quick candle formation throughout risky intervals

- Slower candle formation throughout quiet markets

- Higher filtering of time-based noise

- Larger processing calls for

- Extra aware of precise buying and selling exercise

Finest Use Instances:

- Quantity-based buying and selling methods

- Market volatility evaluation

- Filtering consolidation intervals

- Order guide evaluation

3. Renko Charts

What Are Renko Charts?

Renko charts show value actions utilizing bricks of fastened sizes, filtering out minor value fluctuations and time totally. A brand new brick solely varieties when value strikes a predetermined quantity.

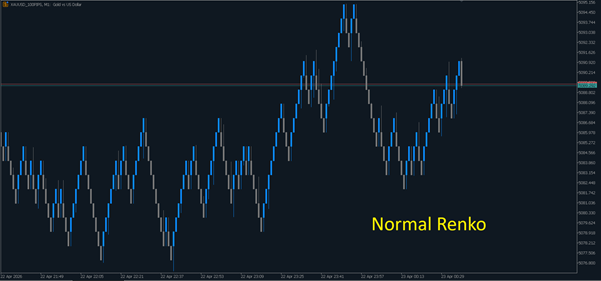

Regular Renko

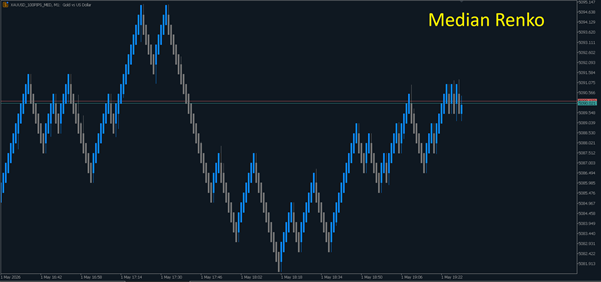

Median Renko

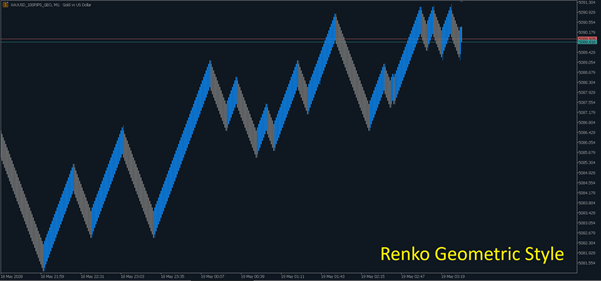

Geometric Renko

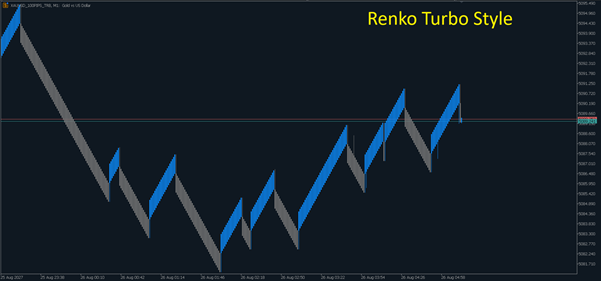

Turbo Renko

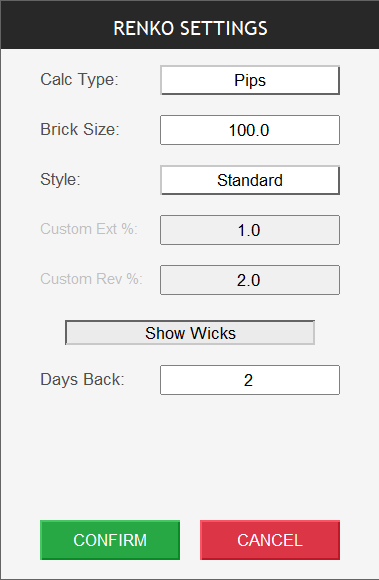

Key Settings:

- Brick Measurement: The pip/level worth for every brick (e.g., 5, 10, 20 pips)

- Calc Kind: To make use of pips/factors within the calculation

- Chart Kind: Regular, Median, Geometric or Turbo

- Present Wicks: To indicate wicks on Renko Bars or not

- Days Again: What number of days again price of information we need to use to create customized bars

- Customized Extension and Reversal : Value motion in share for customized Renko bars

Efficiency with Smaller Ranges:

When utilizing smaller brick sizes (2-5 pips):

- Extra bricks type, displaying finer value element

- Elevated sensitivity to minor value actions

- Larger useful resource consumption

- Higher for decrease timeframe evaluation

- Extra false indicators in ranging markets

Finest Use Instances:

- Pattern identification

- Help/resistance ranges

- Breakout methods

- Noise discount in evaluation

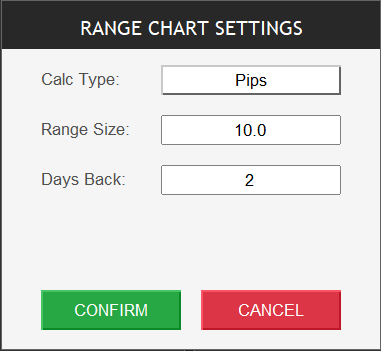

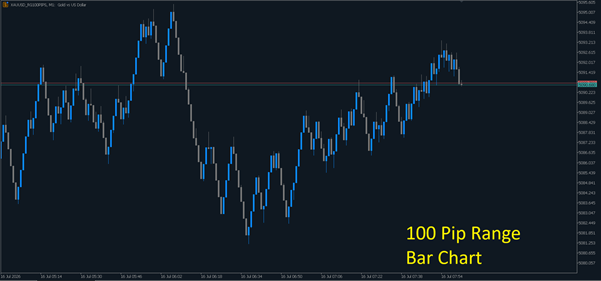

4. Vary Charts

What Are Vary Charts?

Vary Charts create a brand new bar when the worth strikes a specified vary from the opening value of the present bar. Every bar represents the identical value vary motion.

Key Settings:

- Vary Measurement: The worth vary in pips/factors (e.g., 10, 20, 50)

- Calc Kind: To make use of pips/factors within the calculation

- Days Again: What number of days again price of information we need to use to create customized bars

Efficiency with Smaller Ranges:

With smaller vary values (5-15 pips):

- Extra frequent bar creation

- Higher visibility of micro value actions

- Elevated computational load

- Helpful for exact entry/exit factors

- Can generate extreme bars in risky situations

Finest Use Instances:

- Constant value motion monitoring

- Volatility normalization

- Sample recognition

- Vary-bound market buying and selling

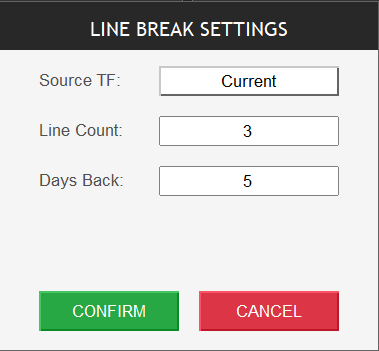

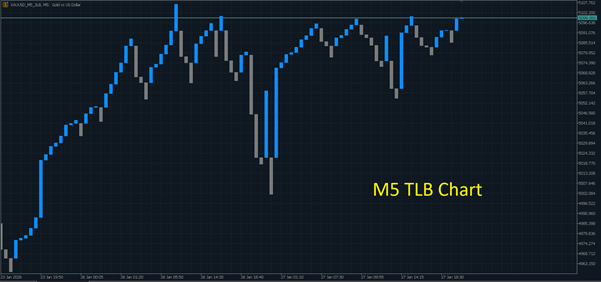

5. Line Break Charts

What Are Line Break Charts?

Line Break charts show a collection of vertical strains based mostly on value actions. A brand new line in the identical route varieties when value exceeds the earlier excessive/low. A reversal requires breaking a number of earlier strains.

Key Settings:

- Variety of Strains: What number of strains should break for reversal (usually 3)

- Supply TF : Supply Timeframe

- Days Again: What number of days again price of information we need to use to create customized bars

Efficiency with Smaller Ranges:

When configured for greater sensitivity:

- Extra frequent line formations

- Earlier development change indicators

- Higher short-term development capturing

- Elevated false reversal indicators

- Extra processing necessities

Finest Use Instances:

- Pattern continuation/reversal identification

- Breakout affirmation

- Filter for range-bound markets

- Japanese candlestick alternate options

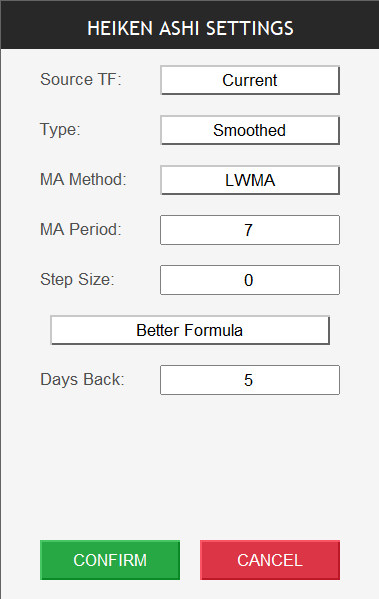

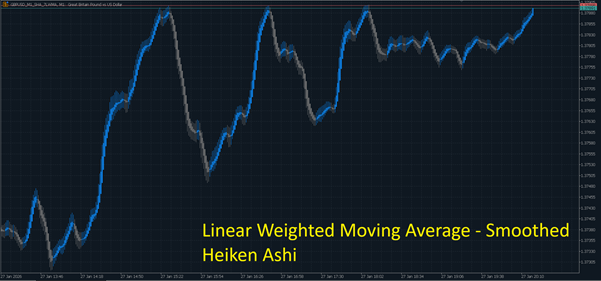

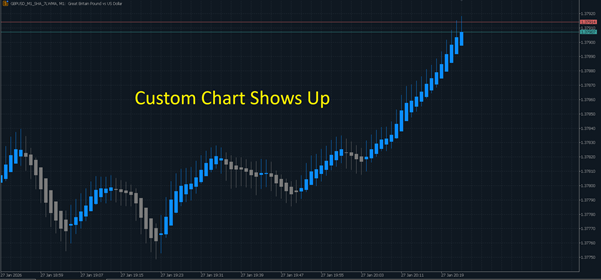

6. Heiken Ashi Charts

What Are Heiken Ashi Charts?

Heiken Ashi charts use modified candlestick calculations that common value information, creating smoother candles that higher spotlight traits and scale back market noise.

Key Settings:

- Timeframe: Base timeframe for calculations (M1, M5, H1, and many others.)

- Smoothing Interval: Further shifting common smoothing (optionally available)

- Kind: Customary or Smoothed Heiken Ashi

- MA Interval : The interval to make use of for Smoothed Heiken Ashi

- Step Measurement : The step measurement for step Heiken Ashi

- Higher Components : Toggle to make use of higher components Heiken Ashi or not

- Days Again: What number of days again price of information we need to use to create customized bars

Efficiency with Smaller Ranges:

On decrease timeframes (M1, M5):

- Smoother value motion even on small timeframes

- Delayed indicators because of averaging

- Diminished whipsaw trades

- Reasonable useful resource utilization

- Higher development visibility

Finest Use Instances:

- Pattern identification and following

- Decreasing market noise

- Swing buying and selling entries

- Cease loss placement steerage

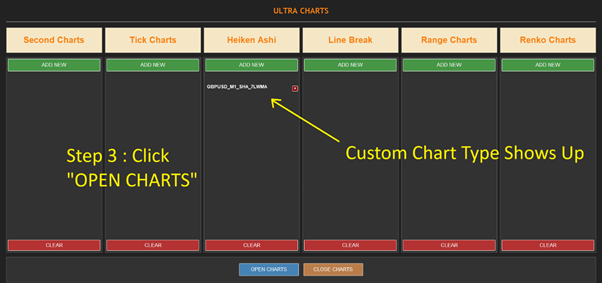

Utilizing the Management Panel Successfully

Including New Charts

- Click on the Add New button

- Choose your required chart sort from the dropdown menu

- Configure the precise settings for that chart sort

- Set your most well-liked image and timeframe

- Click on “Create” to generate the chart

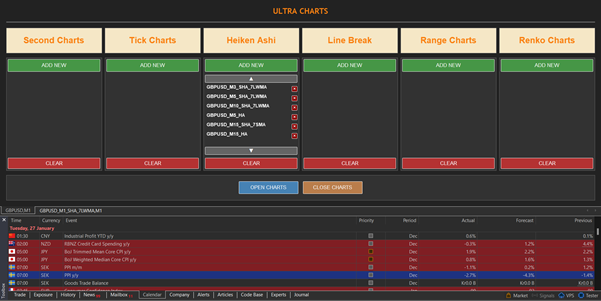

Managing A number of Charts

Scrolling Via Charts:

- Use Scroll Up and Scroll Down to navigate by means of your checklist when you’ve a number of charts created

Opening Charts in Separate Home windows:

- Choose the chart(s) you need to view

- Click on Open Charts to launch them in particular person MT5 home windows

- This permits multi-monitor setups and simultaneous viewing

Clearing Charts:

- Click on Clear to take away all customized charts and begin contemporary

- This frees up system assets

Canceling Operations:

- Use Cancel if a chart is taking too lengthy to generate

- Useful when processing giant historic datasets

- Stops the present operation instantly

Efficiency Optimization Suggestions

Basic Pointers

- Begin with average settings earlier than going extraordinarily granular

- Monitor CPU and RAM utilization when working a number of customized charts

- Restrict historic information loading for very small vary charts

- Shut unused charts to free assets

- Use on higher-spec computer systems for greatest efficiency with small ranges

Really helpful Settings by Buying and selling Type

Scalping:

- Second Charts: 15-30 seconds

- Tick Charts: 50-100 ticks

- Renko: 2-5 pip bricks

Day Buying and selling:

- Second Charts: 1-2 minutes

- Vary Charts: 10-20 pip vary

- Heiken Ashi: M5-M15 timeframe

Swing Buying and selling:

- Renko: 10-20 pip bricks

- Line Break: 3-line break on H1-H4

- Heiken Ashi: H1-D1 timeframe

Troubleshooting Frequent Points

Charts Not Loading

- Confirm ample historic information is on the market

Sluggish Efficiency

- Scale back the variety of energetic charts

- Load the Skilled on a distinct dealer image from watchlist

- Improve the vary/interval settings

- Restrict historic bars loaded

- Shut different resource-intensive functions

Lacking Knowledge

- Verify your dealer gives tick information for the image

- Test your information heart connection

- Refresh the chart or restart MT5

Conclusion

MT5 Extremely Charts unlocks highly effective different charting capabilities that may improve your technical evaluation and buying and selling methods. By understanding every chart sort’s traits and efficiency implications, you possibly can choose the proper instruments on your buying and selling fashion.

Begin with average settings, experiment with totally different chart varieties, and regularly optimize based mostly in your particular wants and system capabilities. The intuitive management panel makes managing a number of chart varieties easy and environment friendly.

Attempt the Demo Model

We have included a free demo model of MT5 Extremely Charts with this text so that you can check the performance and discover every chart sort. Please word that the demo model has the next limitations:

- Single Day Knowledge Solely: The demo works with historic information from one buying and selling day solely

- No Stay Market Updates: Actual-time value feeds and dwell market updates are disabled

- Characteristic Full: All chart varieties and management panel capabilities are absolutely operational for testing functions

This demo lets you familiarize your self with the interface, experiment with totally different settings, and perceive how every chart sort behaves earlier than upgrading to the total model. The total model gives limitless historic information entry and real-time market updates for complete buying and selling evaluation.

Obtain the demo model beneath

Comfortable buying and selling!