Bitcoin’s bear-market flip might be traced to Oct. 10, 2025, a session broadly described as the biggest crypto derivatives liquidation occasion on report, with roughly $19 billion in futures positions forcibly unwound as costs slid sharply off their highs.

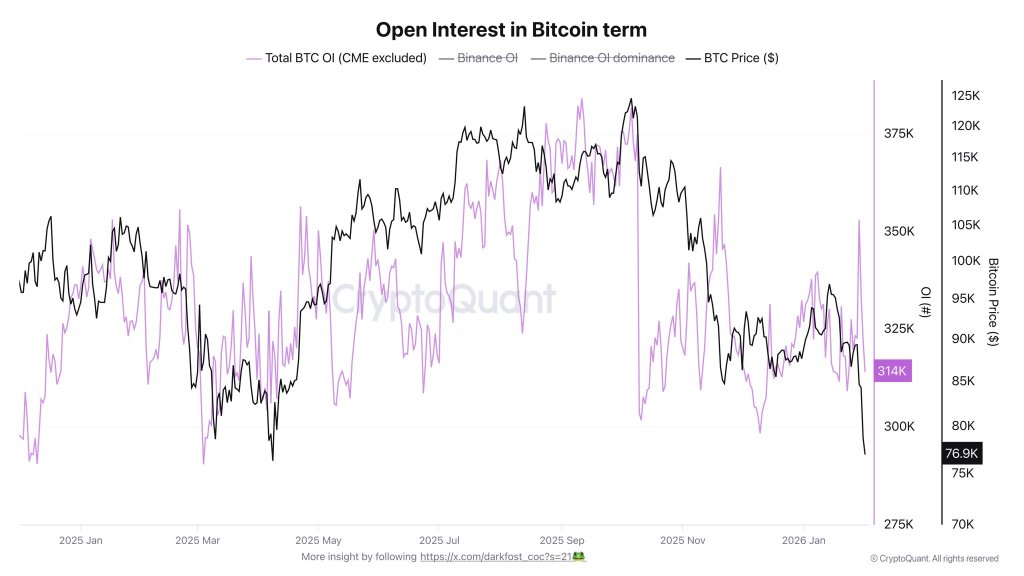

CryptoQuant contributor Darkfost argues the harm was structural as a lot as directional: open curiosity fell by about 70,000 BTC in a single day, wiping out months of leverage build-up and leaving hypothesis struggling to re-form. He claims that the Oct. 10 flush was “actually the one which pushed BTC right into a bear market” due to the velocity and magnitude of liquidity destruction in futures.

Why October 10 Was The Bitcoin Bear Market Starting

Darkfost pointed to a collapse in open curiosity measured in BTC phrases. “In a single day, round 70,000 BTC had been worn out from Open Curiosity, bringing it again to its April 2025 ranges,” he wrote. “That’s the equal of greater than six months of Open Curiosity accumulation erased in a single session. Since then, Open Curiosity has been stagnating and struggling to rebuild.”

Associated Studying

The implication is much less in regards to the particular catalyst for the selloff and extra about market construction after it. In Darkfost’s telling, the Oct. 10 occasion wasn’t only a value transfer; it was a sudden discount out there’s capability to hold leverage, which tends to compress speculative exercise throughout the advanced.

“Liquidity destruction in an already unsure crypto market surroundings isn’t conducive to a return of hypothesis, which is nonetheless a key part of the crypto market,” he added.

That view resonated with Bitcoin Capital, which replied that “nothing has been the identical after 10/10,” including that “it really looks like one thing broke.” Darkfost’s response was blunt in regards to the path again: “It must be rebuilt and it may well takes months …”

In a follow-up submit, Darkfost widened the lens past derivatives, describing an surroundings the place spot participation has additionally cooled. He stated Bitcoin is getting into a fifth consecutive month of correction, with the October 10 occasion as a significant driver because of its affect on futures liquidity, however “not the one issue at play.”

Associated Studying

He flagged broader liquidity stress through stablecoin flows and provide. Based on his figures, stablecoin outflows from exchanges have coincided with an approximate $10 billion decline in mixture stablecoin market capitalization over the identical interval, a further headwind for risk-taking, notably when leverage is already being de-risked.

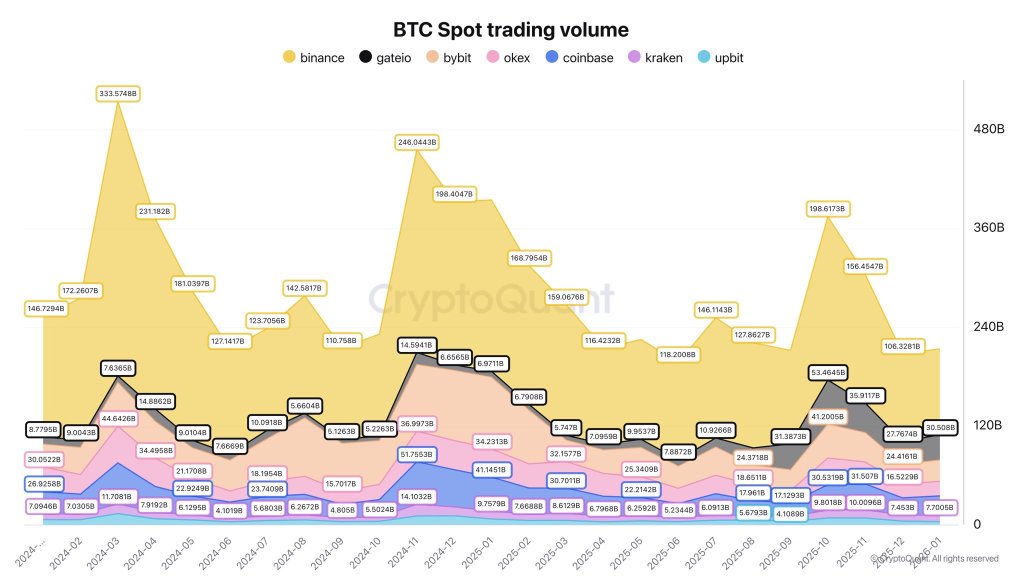

Spot volumes, he argued, inform the same story of disengagement. Since October, BTC spot volumes have been reduce roughly in half, with Binance nonetheless holding the biggest share at $104 billion. He contrasted that with October ranges when Binance quantity “had almost reached $200B,” alongside $53 billion on Gate.io and $47 billion on Bybit.

Darkfost characterised the contraction as a return to “ranges among the many lowest noticed since 2024,” and skim it as weaker demand relatively than merely a lull in exercise. The present setup, he wrote, “stays unsure and doesn’t encourage risk-taking,” arguing {that a} sturdy restoration would require monitoring liquidity circumstances and, “above all,” seeing spot buying and selling volumes return.

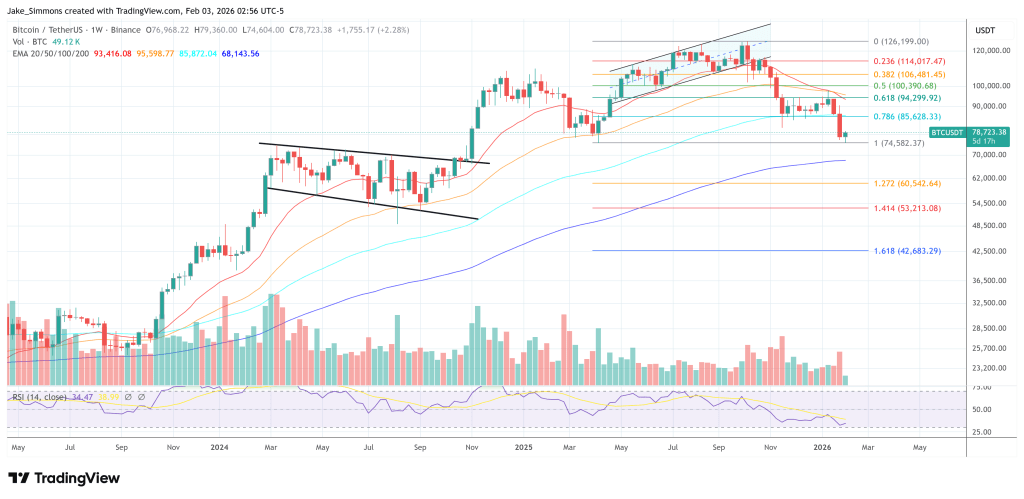

At press time, Bitcoin traded at $78,723.

Featured picture created with DALL.E, chart from TradingView.com