The MT5 divergence indicator solves this drawback. It mechanically scans charts for these price-momentum discrepancies, highlighting potential reversal factors earlier than they change into apparent. No extra squinting at oscillators or second-guessing what you’re seeing. The alerts seem straight on the chart, giving merchants an edge in timing entries and exits.

Understanding Divergence in Technical Evaluation

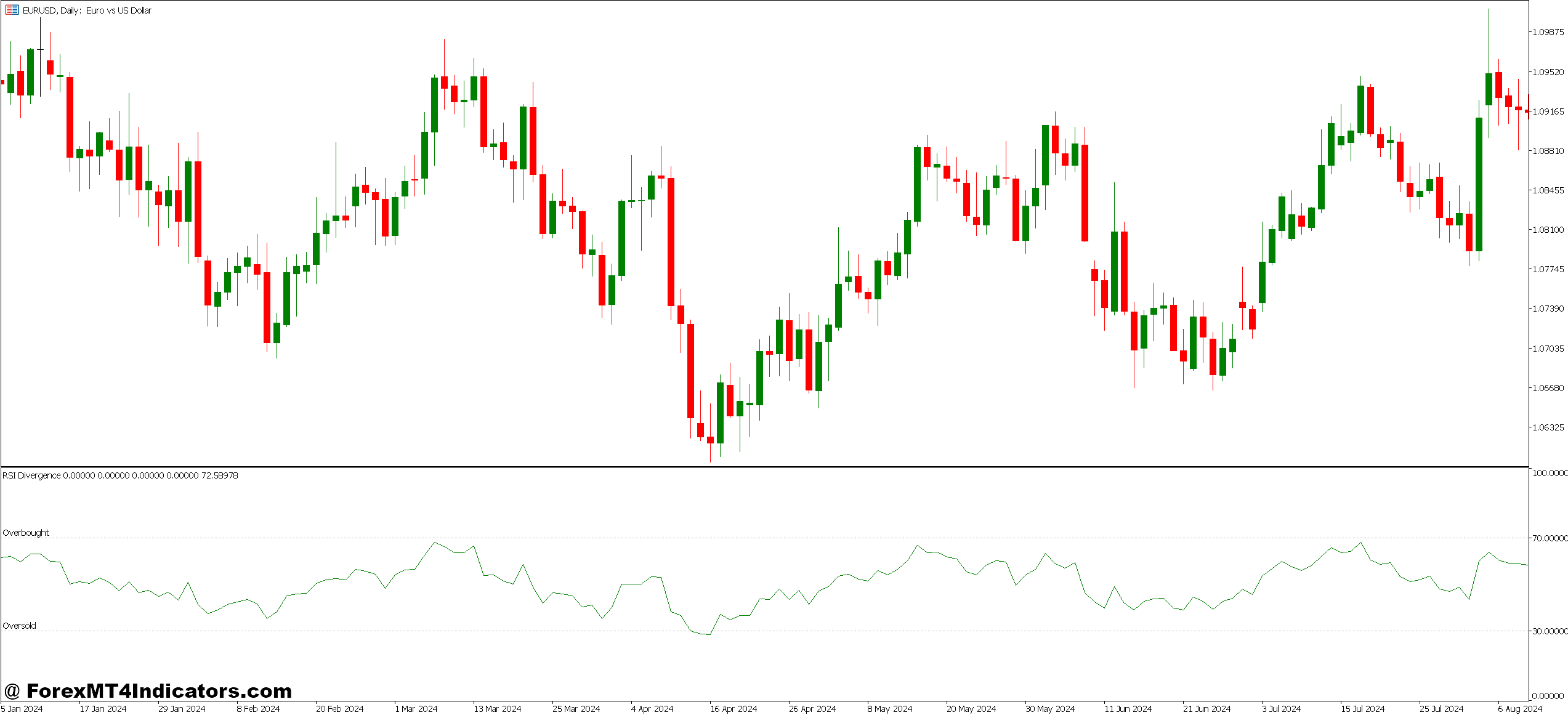

Divergence happens when worth motion and a momentum oscillator transfer in reverse instructions. The MT5 divergence indicator sometimes works with fashionable oscillators like RSI, MACD, or Stochastic to establish these mismatches. When EUR/USD hits the next excessive however the RSI makes a decrease excessive, that’s bearish divergence—momentum is weakening regardless of worth pushing greater.

The logic is simple. Value displays what’s occurring. Momentum indicators present the energy behind these strikes. After they disagree, one thing’s obtained to present. Normally, it’s worth that adjusts to match momentum.

Right here’s the factor: Not all divergences are created equal. Common divergence alerts potential reversals. Hidden divergence signifies development continuation after pullbacks. The MT5 indicator will be configured to identify each sorts, although most merchants deal with common divergence for reversal trades.

The calculation methodology relies on which oscillator the indicator pairs with. For RSI-based divergence, the software compares swing highs and lows within the 14-period RSI towards corresponding worth pivots. It attracts connecting traces mechanically when it detects misalignment. Some variations embody alert features that notify merchants the second divergence types.

Actual-World Utility: Buying and selling the Alerts

Testing this indicator on USD/JPY through the March 2024 volatility spike revealed its sensible worth. On the every day chart, the worth made a decrease low at 147.20, however the MACD histogram printed the next low. Basic bullish divergence. Merchants who entered lengthy at that sign caught a 200-pip rally over the following week.

However context issues. That very same setup would’ve failed in a robust downtrend with out extra affirmation. Good merchants mix divergence with help/resistance ranges. When bullish divergence seems at a serious help zone, the likelihood improves dramatically. The indicator identifies the sign; the dealer evaluates whether or not the market construction helps the commerce.

Timeframe choice adjustments all the pieces. On the 15-minute chart, divergence alerts fireplace continuously—most end in minor pullbacks or fail. The 4-hour and every day charts produce fewer however higher-quality alerts. A divergence that develops over a number of days carries extra weight than one which types in just a few hours.

One sensible strategy: Use divergence on greater timeframes for route, then drop to decrease timeframes for exact entries. When the every day chart reveals bearish divergence on AUD/USD, look forward to a 1-hour bearish engulfing candle to enter quick. This layered technique reduces false entries.

Customizing Settings for Totally different Markets

Most MT5 divergence indicators permit parameter changes. The pivot sensitivity controls how simply the indicator identifies swing factors. Decrease settings (3-5) mark each minor wiggle as a pivot, creating noise. Larger settings (10-15) solely flag important swings, decreasing false alerts however probably lacking legitimate divergences.

The oscillator interval impacts sign technology, too. A 14-period RSI is normal, however shorter intervals like 9 create sooner, extra responsive alerts. That works for scalping risky pairs like GBP/JPY throughout London session hours. Longer intervals like 21 or 25, easy out noise, higher fitted to swing buying and selling main pairs like EUR/USD.

Alert customization issues for merchants monitoring a number of charts. Set the indicator to set off push notifications when divergence types on particular timeframes. This prevents lacking setups whereas specializing in different duties. Some superior variations embody filters that solely alert when divergence seems close to key worth ranges.

Colour coding helps distinguish sign high quality. Many indicators use totally different colours for normal versus hidden divergence, or for robust versus weak alerts primarily based on the divergence angle. Steeper divergence angles sometimes point out stronger momentum shifts.

Strengths and Trustworthy Limitations

The MT5 divergence indicator excels at figuring out potential reversals earlier than they’re apparent on worth alone. It really works throughout all foreign money pairs and timeframes, offering constant logic no matter market circumstances. Automation saves time—no handbook comparability of oscillator peaks and worth pivots required.

That stated, divergence is a number one indicator, which suggests early alerts and false positives. Not each divergence results in a reversal. In robust trending markets, costs can stay “diverged” for prolonged intervals, creating losses for counter-trend merchants. The 2023 USD rally offered numerous bearish divergence alerts that failed because the greenback saved climbing.

Whipsaws occur, particularly on decrease timeframes. The indicator would possibly sign divergence, worth reverses briefly, then continues the unique route. Cease losses get hit earlier than the precise reversal happens. This frustrates merchants who don’t perceive that divergence alerts likelihood, not certainty.

Not like some indicators that can be utilized in isolation, divergence requires context. A divergence sign close to no important help or resistance stage, with no development exhaustion indicators, carries minimal worth. Merchants must combine worth motion evaluation, market construction, and typically extra indicators for affirmation.

Buying and selling foreign exchange carries substantial danger. No indicator ensures earnings. The MT5 divergence indicator identifies potential setups, however danger administration, place sizing, and market understanding decide long-term success. Relying solely on divergence alerts with out a correct technique results in inconsistent outcomes.

How Divergence Compares to Different Reversal Indicators

Candlestick patterns like engulfing candles or capturing stars additionally sign reversals, however they’re reactive—exhibiting what occurred after the reversal begins. Divergence provides warning, giving merchants higher entry factors. The trade-off? Extra false alerts because of that main nature.

Transferring common crossovers lag considerably. By the point two MAs cross, a lot of the reversal transfer has already occurred. Divergence can spot exhaustion whereas the development continues to be energetic, permitting entries nearer to the turning level with tighter stops.

In comparison with the Relative Energy Index alone, the divergence indicator gives visible readability. Uncooked RSI requires merchants to manually evaluate peaks and worth motion. The automated drawing of divergence traces and alert features make sample recognition easy, particularly for much less skilled merchants.

The right way to Commerce with MT5 Divergence Indicator

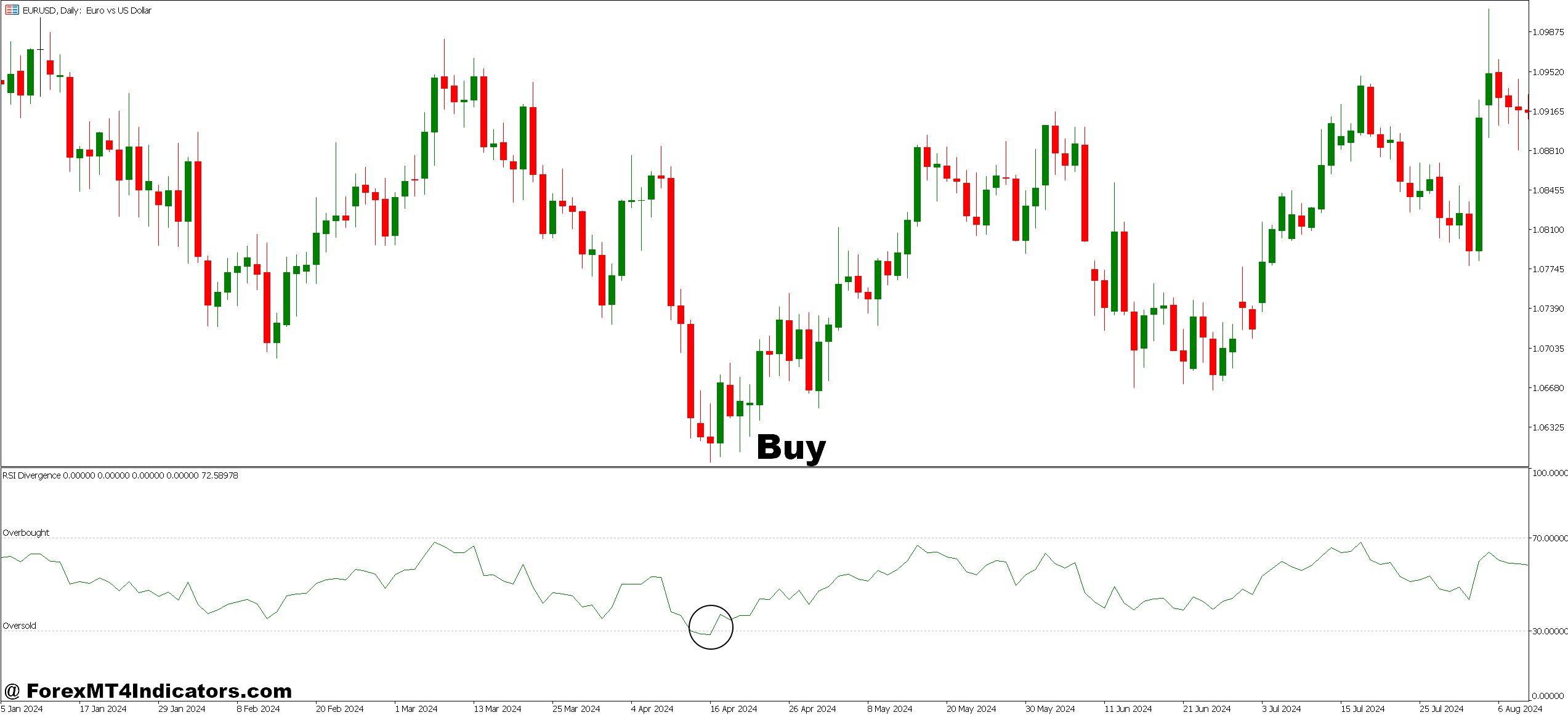

Purchase Entry

- Determine bullish divergence at help – Anticipate worth to make a decrease low close to a key help stage (like EUR/USD at 1.0500) whereas your oscillator reveals the next low on the 4-hour chart or above.

- Affirm with worth motion – Don’t enter on divergence alone; look forward to a bullish engulfing candle or pin bar to kind after the divergence sign earlier than going lengthy.

- Set stops beneath the swing low – Place your cease loss 10-20 pips beneath the worth low that created the divergence to guard towards false alerts and prolonged strikes.

- Goal 2:1 risk-reward minimal – If risking 30 pips on GBP/USD, goal for no less than 60 pips revenue to the following resistance stage to account for the 40-50% divergence failure charge.

- Keep away from in robust downtrends – Skip bullish divergence alerts when worth is beneath the 200-period transferring common on the every day chart; counter-trend trades fail extra typically in established tendencies.

- Examine greater timeframe alignment – Solely take 1-hour bullish divergence if the 4-hour or every day chart reveals no conflicting bearish divergence or robust downward momentum.

- Danger 1% most per sign – Divergence produces false alerts commonly, so by no means danger greater than 1% of your account on a single setup, no matter how “excellent” it seems to be.

- Use hidden divergence for pullback entries – When EUR/USD is in an uptrend and makes the next low with the oscillator exhibiting a decrease low, enter lengthy as this alerts development continuation, not reversal.

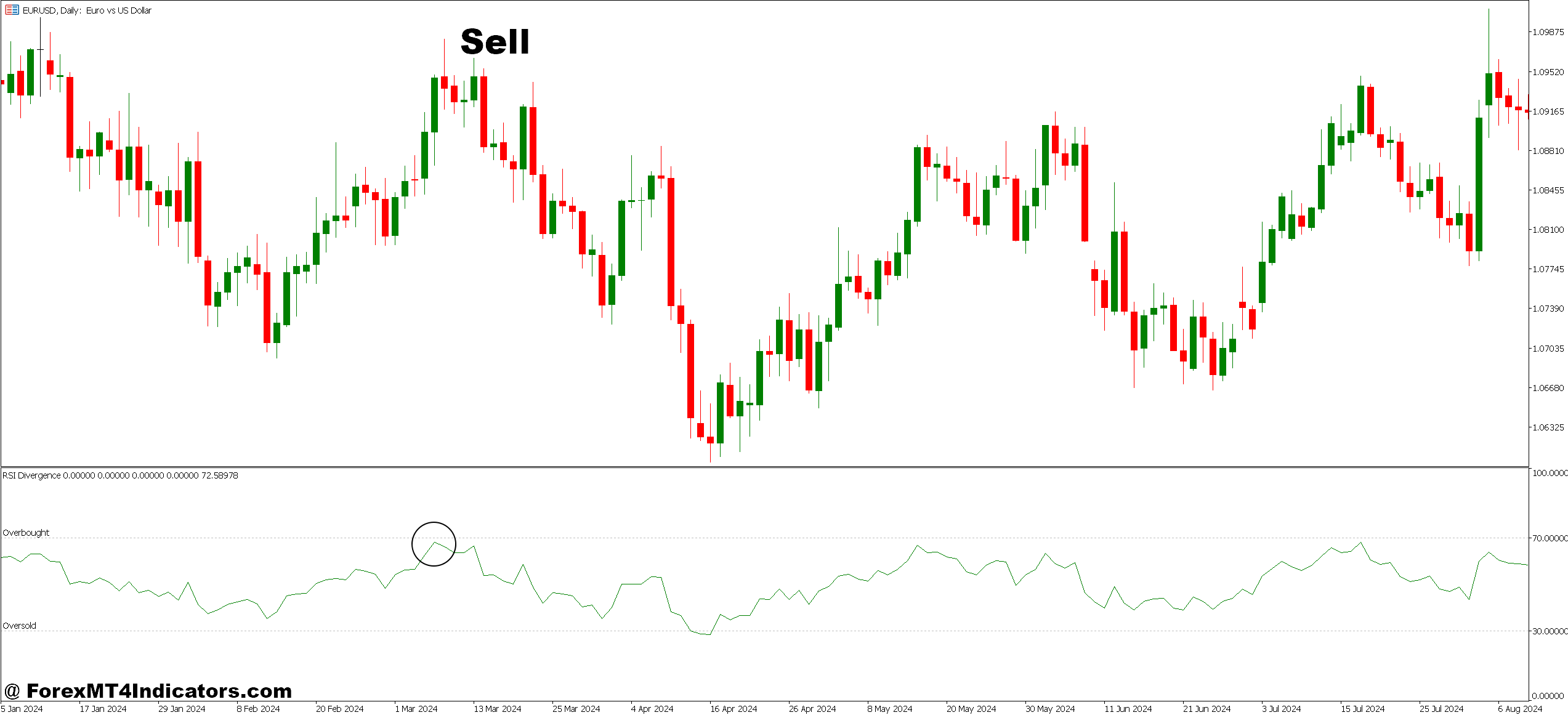

Promote Entry

- Spot bearish divergence at resistance – Search for worth making the next excessive at a key resistance zone (like GBP/USD at 1.2800) whereas RSI or MACD prints a decrease excessive on 4-hour charts or greater.

- Anticipate affirmation candle – Enter quick solely after a bearish engulfing, capturing star, or robust rejection candle types following the divergence sign in your chosen timeframe.

- Place stops above the swing excessive – Set your cease loss 10-20 pips above the worth excessive that created the divergence to keep away from getting stopped out by minor fluctuations earlier than the reversal.

- Scale out at key ranges – Take 50% revenue on the first help stage (sometimes 30-50 pips on majors), then path your cease to breakeven on the remaining place.

- Skip in robust uptrends – Ignore bearish divergence when worth is making greater highs above the 200 EMA on every day charts; development energy typically overpowers divergence alerts.

- Require a number of timeframe affirmation – When you see bearish divergence on the 1-hour chart, confirm that the 4-hour chart isn’t exhibiting bullish momentum or opposing divergence patterns.

- Keep away from throughout main information occasions – Don’t take divergence alerts half-hour earlier than or after high-impact information releases like NFP or central financial institution choices; volatility invalidates technical alerts.

- Exit if divergence invalidates – Shut your quick place instantly if worth makes a brand new greater excessive with the oscillator additionally making the next excessive, because the divergence sample has failed.

Making the Indicator Work for You

The MT5 divergence indicator shines when merchants perceive its function: A filter and timing software, not a whole buying and selling system. It identifies the place reversals would possibly happen. Affirmation from worth motion, help/resistance, or development evaluation determines which alerts to take.

Begin by backtesting on main pairs throughout totally different market circumstances. Discover which timeframes produce one of the best risk-reward setups in your buying and selling model. Scalpers would possibly discover the 5-minute chart workable with strict filters, whereas place merchants follow every day divergences solely.

Mix it with danger administration that accounts for the false sign charge. If divergence alerts win 60% of the time, place sizing and cease placement must replicate that. Don’t danger greater than 1-2% per commerce no matter how “excellent” the divergence seems to be.

In follow, the indicator serves merchants greatest as a heads-up system. When it flags divergence on EUR/GBP, that’s a cue to look at worth motion intently for reversal affirmation. The divergence creates the thesis; worth motion gives the entry set off. That two-step strategy filters out many dropping trades whereas retaining the winners.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90