Stories have disclosed that Polygon closed the ultimate quarter of 2025 with increased on-chain utilization, pushed by funds, stablecoin transfers, and tokenized property.

Associated Studying

Whereas merchants watched MATIC drift inside a slender vary, exercise on the chain instructed a special story, one centered on funds, stablecoins, and quiet institutional adoption relatively than value momentum.

Polygon Funds Use Grows Quicker Than Costs

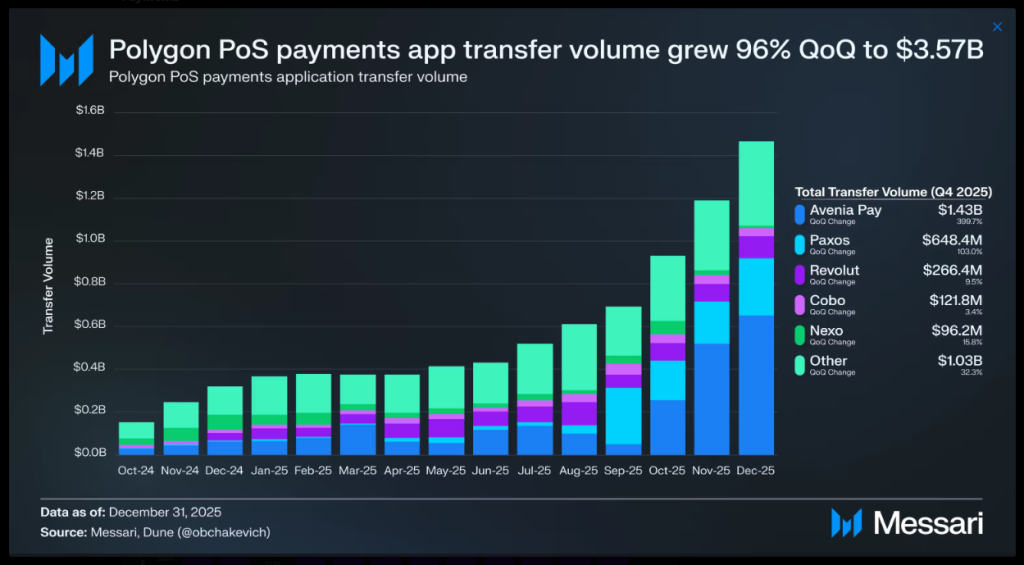

In keeping with Messari’s This fall community assessment launched on January 4, Polygon processed heavy fee visitors as charges stayed low and settlement occasions remained quick. Greater than 50 apps constructed for funds dealt with about $3.50 billion in transfers throughout the quarter.

That determine was 96% increased than the prior quarter and near 4 occasions the extent seen a 12 months earlier. Stablecoin-linked playing cards added one other layer of exercise.

Ten card packages collectively moved practically $363 million utilizing Mastercard and Visa rails, with Visa answerable for the bigger share. Stories say this progress got here from on a regular basis spending relatively than one-off occasions, an indication that Polygon is getting used for routine transfers as an alternative of short-term experiments.

Past card funds, a number of corporations expanded how they transfer cash on the chain. DeCard allowed customers to pay with USDC and USDT at a variety of retailers.

Flutterwave selected Polygon for cross-border enterprise funds in 30 African international locations. Revolut built-in low-cost stablecoin transfers inside its app, whereas Stripe continued constructing subscription instruments that depend on USDC.

None of these strikes grabbed market headlines, but collectively they pushed regular quantity by way of the community.

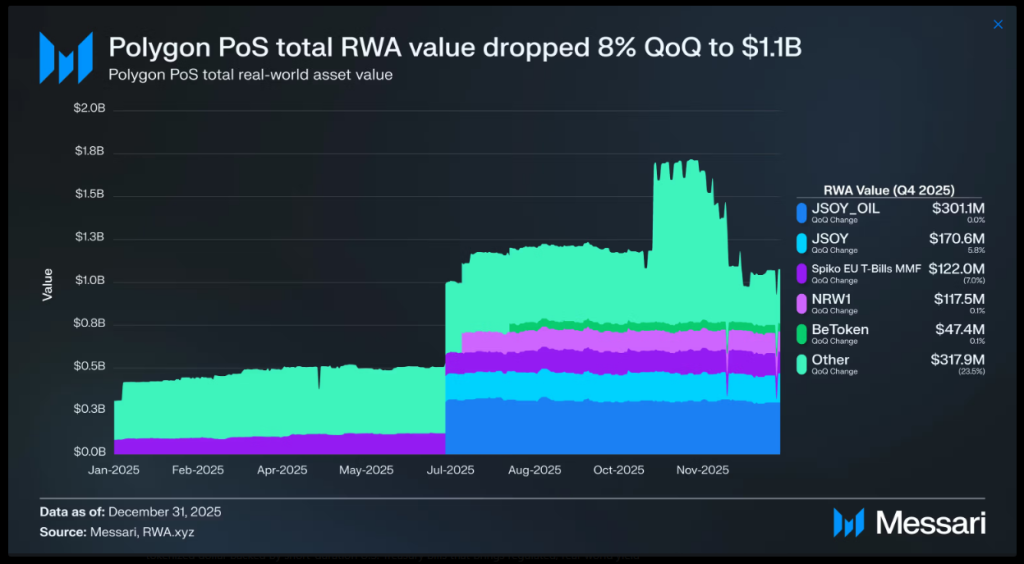

Tokenized Property Achieve Floor Quietly

Away from funds, tokenized real-world property continued to stack up. Stories notice Polygon ended This fall with practically $1.10 billion in RWAs, rating ninth worldwide. Progress was pushed much less by retail hype and extra by regulated buildings.

Stablecoin provide climbed to almost 3 billion, led by USDC at $1.34 billion and DAI close to $630 million. Latin America stood out as a key area, the place non-USD stablecoin quantity totaled $1.18 billion. Common day by day DEX quantity jumped 44% to slightly over $200 million.

MATICUSD buying and selling at $0.19 on the 24-hour chart: TradingView

MATIC Trades Sideways As Exercise Builds

MATIC’s value motion stayed restrained regardless of the on-chain progress. The token slipped again from short-term resistance throughout broader market weak point after which stabilized as patrons defended key assist zones.

Associated Studying

Deeper losses had been prevented, however sturdy upside strikes failed to look. Quantity has but to substantiate a shift in development. For now, Polygon reveals rising use throughout funds and tokenized property, whereas its token waits for a clearer sign from merchants.

Featured picture from Unsplash, chart from TradingView