How A lot Do You Really Must Begin Hedging Prop Agency Challenges?

It is the primary query everybody asks.

Not “how does hedging work?” Not “is it secure?” Not “will I get detected?”

“How a lot cash do I want in my reside account to start out hedging?”

And it is smart that that is the primary query. As a result of if the reply is “you want $50,000 to hedge a $50,000 problem,” then hedging would not make sense for many merchants. The entire level of prop corporations is buying and selling with another person’s capital as a result of you do not have sufficient of your individual.

Here is the excellent news: you want far lower than you assume.

What Determines the Quantity

The capital you want in your reside hedge account relies on 4 issues:

1. Problem charge

That is an important issue. Your reside account capital is predicated on the problem charge — not the problem measurement.

2. Most drawdown proportion

The max drawdown in your problem (sometimes 6-12%) determines the worst-case loss state of affairs. This impacts how the hedge multiplier is calculated.

3. Restoration mode setting

That is the setting on Prop Agency Hedge Dwell that determines how a lot the hedge ought to get well:

- Break even mode: Get better simply the problem charge. Lowest capital requirement.

- Charge + 50% restoration: Get better the charge plus 50% additional revenue. Reasonable capital.

- Charge + 100% restoration: Get better the charge and double it. Highest capital requirement.

4. Dealer leverage in your reside account

With excessive leverage (1:1000), margin is negligible. The capital you want is not for margin — it is for masking the hedge’s floating loss when the problem is successful, plus a buffer to keep away from margin calls.

The Actual Numbers: What You Really Want

The capital calculation is easier than you assume. It is based mostly on the problem charge, not the problem measurement.

The formulation:

- Break Even mode: 2x the problem charge (1x for hedge value + 1x margin buffer)

- +100% Revenue mode: 3x the problem charge (2x for hedge value + 1x margin buffer)

The margin buffer (1x) is a reserve to forestall your dealer from auto-closing your hedge trades once they’re in a floating loss. When the problem is successful, the hedge is shedding — and also you want sufficient stability to maintain that place open till the commerce closes.

| Problem | Charge | Break Even (2x charge) | +100% Revenue (3x charge) |

|---|---|---|---|

| $10,000 | $100 | $200 | $300 |

| $25,000 | $200 | $400 | $600 |

| $50,000 | $300 | $600 | $900 |

| $100,000 | $500 | $1,000 | $1,500 |

| $200,000 | $800 | $1,600 | $2,400 |

That is it. A $50K problem wants $600 in your reside account for break even. Not $3,000. Not $5,000. $600.

Even a $200K problem — the biggest widespread measurement — solely wants $1,600 to $2,400. That is 0.8-1.2% of the problem worth.

How Restoration Mode Impacts Capital Necessities

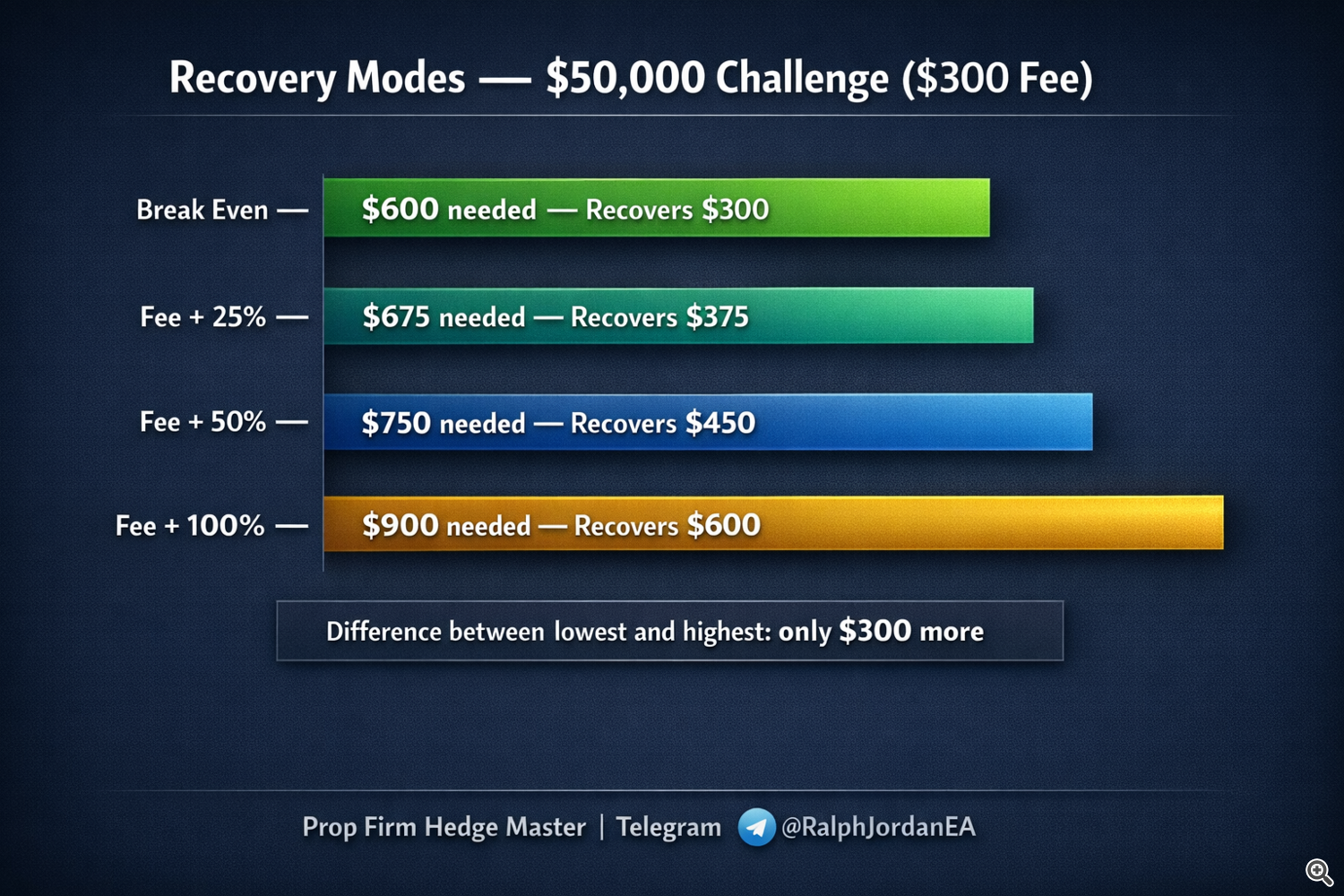

The numbers above present break even and +100%. Here is the total breakdown for a $50,000 problem:

| Restoration Mode | What It Recovers | Charge Multiplier | Dwell Account Wanted |

|---|---|---|---|

| Break Even | Charge solely ($300) | 2x | $600 |

| Charge + 25% | $300 + $75 = $375 | ~2.25x | $675 |

| Charge + 50% | $300 + $150 = $450 | ~2.5x | $750 |

| Charge + 100% | $300 + $300 = $600 | 3x | $900 |

The distinction between break even and +100% revenue is simply $300 extra in your reside account. For many merchants, beginning with break even is smart — defend the charge first, then improve restoration as you get snug.

A Notice on Dealer Leverage

With 1:1000 leverage, margin per commerce is nearly nothing. The capital you want is for masking floating losses, not margin. This is the reason the formulation is predicated on the charge, not lot sizes or margin calculations.

In case your dealer provides decrease leverage (1:100 or 1:30), you may want extra capital as a result of the margin per commerce eats into your buffer. However with 1:1000, the numbers above are correct.

Suggestion: Use a dealer with no less than 1:500 leverage in your reside hedge account. This retains your margin necessities low and lets your capital work as a floating loss buffer — which is what it is truly for.

The EA Does the Math for You

One of many options I constructed into Prop Agency Hedge Dwell is an computerized capital advice.

Whenever you arrange the EA in your reside account, the dashboard exhibits you:

- Really helpful minimal stability based mostly in your problem measurement, restoration mode, and dealer leverage

- Present margin utilization so you’ll be able to see how a lot buffer you may have

- Fee allowance routinely calculated so your hedge earnings aren’t eaten by buying and selling prices

- Actual-time hedge standing exhibiting whether or not your present stability can assist the energetic hedge

You need not do these calculations manually. The EA reads your account situations and tells you precisely what you want. In case your stability drops beneath the advisable stage, you may see a warning earlier than the system takes on trades it may well’t correctly assist.

You Do not Want as A lot as You Suppose

Let me put this in perspective.

In case you’re working a $50,000 problem with a $300 charge, you want $600 in your reside account to hedge with break even restoration.

$600. That is it.

For $600, you get:

- Zero threat on the problem charge — if you happen to fail, the hedge covers the $300

- A funded account if you happen to move — the problem revenue far exceeds the small hedge value

- The power to take limitless makes an attempt — as a result of failure by no means prices you something

Examine that to what most merchants do: spend $300 per try, fail 7-8 out of 10 instances, and burn via $2,100-$2,400 per 12 months with nothing to indicate for it.

With $600 in a reside account, you’d by no means lose a problem charge once more. And that $600 stays in your account — it isn’t spent, it is working for you.

Begin Small, Scale Up

In case you’re new to hedging, here is the strategy I like to recommend:

Step 1: $10K challenges — Testing & Studying

Capital wanted: $200-$300. Find out how the system works. See the hedge open, shut, and get well charges in actual time.

Step 2: $30K-$50K challenges — Mastery

Capital wanted: $600-$900. You perceive the system. Now construct consistency and confidence with mid-size challenges.

Step 3: $100K challenges — Most Optimum

Capital wanted: $1,000-$1,500. The candy spot. Finest cost-to-capital ratio. That is the place the system pays for itself.

Step 4: $200K challenges — Scaling Up

Capital wanted: $1,600-$2,400. As soon as you have mastered the system, scale to most problem sizes.

The Backside Line

The capital requirement for hedging prop challenges is much decrease than most merchants count on.

- A $10K problem wants $200-$300

- A $50K problem wants $600-$900

- A $100K problem wants $1,000-$1,500

- A $200K problem wants $1,600-$2,400

The formulation is straightforward: 2x the problem charge for break even, 3x for +100% revenue. Half goes to hedge value, the opposite portion is your margin buffer.

You need not match the problem measurement. You do not want hundreds of {dollars}. You want 2-3x the problem charge — and that is a fraction of what most individuals assume.

Cease guessing. Begin with the numbers. Choose a problem measurement you’ll be able to hedge comfortably, show the system works, and scale from there.

The capital calculations above are based mostly on actual numbers from 300+ challenges with over $500K in verified payouts. Prop Agency Hedge Grasp runs in your problem account, and Prop Agency Hedge Dwell runs in your private account to deal with the hedge — together with computerized stability suggestions and fee calculations.

Each EAs can be found on MQL5 Market. If you’d like assist calculating the correct setup on your state of affairs, test the product web page or ship me a message.