Quantum Pattern Scanner

Multi-Foreign money · Multi-Timeframe · AI Pattern Dashboard for MetaTrader 5

Model: 1.0 | Platform: MetaTrader 5 | Class: Pattern Indicators

Overview

The Quantum Pattern Scanner is a professional-grade multi-currency, multi-timeframe development dashboard indicator constructed for MetaTrader 5. It consolidates the development state of 30 main, minor, and treasured steel pairs throughout 9 timeframes into three interactive on-chart panels — supplying you with an immediate, 360-degree view of your complete foreign exchange market with out switching charts.

In contrast to easy transferring common crossovers, this indicator makes use of a three-factor confluence engine: EMA alignment, worth momentum, and market construction (increased highs / decrease lows) — making certain solely high-probability development alerts are displayed. An AI Insights panel then synthesises all information into actionable suggestions.

💡 Good for merchants who must shortly determine the strongest trending pairs and timeframes earlier than putting trades — eliminating hours of guide chart evaluation.

Get this Indicator right here https://www.mql5.com/en/market/product/165656

What’s Inside — Three Highly effective Panels

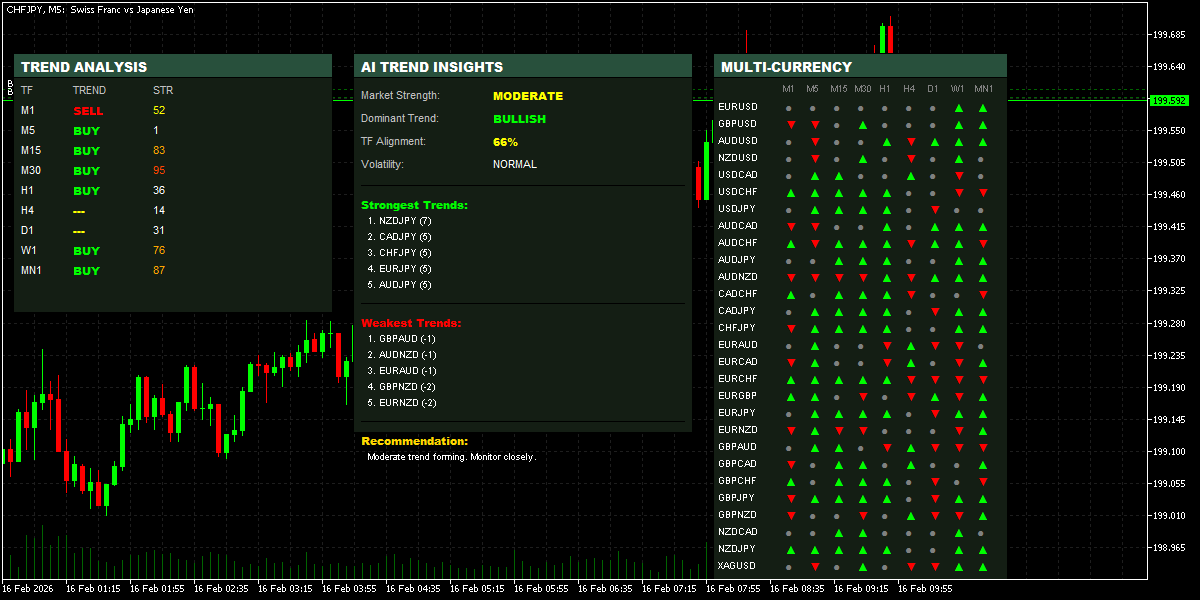

1. Pattern Evaluation Panel (Left)

Hooked up to the present chart image, this panel exhibits development path and sign energy throughout all 9 commonplace timeframes from M1 by MN1.

• Course labels: BUY (lime inexperienced), SELL (pink), or — (impartial/ranging)

• Power rating from 0–100 directional depth calculation

• Colour-coded energy: orange-red (≥90), orange (≥70), yellow (≥50)

• Updates on each new bar and each 30-second timer tick

2. Multi-Foreign money Matrix Panel (Proper)

A compact dot matrix displaying development bias for 30 pairs throughout all 9 timeframes — supplying you with 270 development information factors in a single look.

• 30 pairs: all main/minor FX pairs plus XAGUSD, XAUEUR, and XAUUSD

• ▲ inexperienced arrow = bullish development | ▼ pink arrow = bearish | ● gray dot = impartial

• Good caching: solely recalculates when a brand new bar opens on that timeframe — very low CPU load

3. AI Pattern Insights Panel (Centre)

The intelligence layer. This panel aggregates all development information and presents distilled insights for the present chart image.

• Market Power: Very Weak → Average → Robust → Very Robust classification

• Dominant Pattern: BULLISH / BEARISH / RANGING with confidence alignment share

• Timeframe Alignment %: exhibits how aligned all 9 timeframes are in the identical path

• Volatility State: LOW / NORMAL / HIGH primarily based on depth averages

• Prime 5 Strongest pairs — sorted by cross-timeframe development rating

• Prime 5 Weakest pairs — perfect candidates for counter-trend or avoidance

• Contextual Advice: plain-English commerce bias suggestion

Function Abstract

|

Panel |

Function |

Description |

|

Left Panel |

Pattern Course |

BUY / SELL / Impartial for 9 timeframes (M1 to MN1) |

|

Left Panel |

Sign Power |

0–100 depth rating primarily based on ADX-style calculation |

|

Proper Panel |

30 Foreign money Pairs |

All main, minor, and XAU pairs lined |

|

Proper Panel |

9 Timeframes |

▲ Bullish / ▼ Bearish / ● Impartial dot matrix view |

|

AI Insights |

Market Power |

Very Weak → Very Robust classification |

|

AI Insights |

Dominant Pattern |

Bullish / Bearish / Ranging with % alignment |

|

AI Insights |

Strongest Pairs |

Prime 5 trending pairs ranked in actual time |

|

AI Insights |

Weakest Pairs |

Backside 5 counter-trend pairs recognized |

|

AI Insights |

Advice |

Context-aware buying and selling suggestion |

How the Pattern Engine Works

Most development indicators depend on a single situation. Quantum Pattern Scanner makes use of a three-factor confluence mannequin — all components are independently scored after which mixed:

Issue 1 — EMA Alignment

Issue 2 — Worth Momentum

Issue 3 — Market Construction

This three-factor strategy means the indicator is considerably extra immune to false alerts throughout ranging or low-volatility markets in comparison with easy MA crossover indicators.

Enter Parameters

All panels, colours, and positions are absolutely customisable:

|

Parameter |

Default |

Description |

|

TrendPeriod |

14 |

Lookback interval for construction evaluation |

|

IntensityPeriod |

20 |

Interval for ADX-based energy calculation |

|

ShowLeftPanel |

true |

Toggle the single-symbol development evaluation panel |

|

ShowRightPanel |

true |

Toggle the multi-currency matrix panel |

|

ShowAIPanel |

true |

Toggle the AI insights and suggestions panel |

|

UpColor |

Lime |

Colour for bullish development alerts |

|

DownColor |

Pink |

Colour for bearish development alerts |

|

NeutralColor |

Yellow |

Colour for impartial / no development alerts |

|

BaseFontSize |

8 |

Base font measurement for all panel textual content |

|

LeftPanelX/Y |

10 / 50 |

Pixel place of the development evaluation panel |

|

RightPanelX/Y |

710 / 50 |

Pixel place of the multi-currency panel |

|

AIPanelX/Y |

350 / 50 |

Pixel place of the AI insights panel |

Computerized Chart Theme

When the indicator is loaded, it mechanically applies a clear darkish buying and selling theme to the host chart:

• Black background, darkish grey grid — straightforward on the eyes throughout lengthy periods

• Lime inexperienced bullish candles, pink bearish candles — immediate visible readability

• Inexperienced bid line, orange ask line, yellow final worth

• Tick quantity bars displayed by default

You possibly can override these colours through the usual MetaTrader chart settings at any time.

Efficiency & CPU Optimisation

Operating 30 pairs × 9 timeframes in actual time on a single indicator could possibly be very resource-intensive. The Quantum Pattern Scanner makes use of a number of methods to maintain CPU utilization minimal:

• Bar-level caching — development information for every pair/timeframe mixture is just recalculated when a brand new bar opens on that timeframe

• Final bar timestamp monitoring — the cache index tracks whether or not the bar has modified earlier than triggering a brand new calculation

• 30-second timer — panel updates are batched through EventSetTimer(30) slightly than on each tick

• Replace-on-change logic — OnCalculate() solely triggers a full refresh when the present bar has really modified

Methods to Use — Buying and selling Workflow

1. Begin with the Multi-Foreign money Matrix. Scan the proper panel for pairs displaying sturdy ▲ or ▼ alignment throughout a number of timeframes — these are your greatest development candidates.

2. Test the AI Insights Panel. Search for TF Alignment ≥ 75% and Market Power of STRONG or VERY STRONG. This confirms institutional-level conviction within the transfer.

3. Navigate to the chosen pair. The Left Panel will replace mechanically, displaying detailed development and energy information for that image throughout all timeframes.

4. Verify your entry timeframe. Guarantee your chosen buying and selling timeframe exhibits BUY/SELL with a energy rating ≥ 50 earlier than coming into. Larger scores = cleaner tendencies.

5. Keep away from pairs displaying the Ranging label. The AI panel flags when the market is in a mixed-signal state — an excellent time to step apart or cut back place measurement.

Devices Coated

The suitable panel displays the next 30 devices out of the field:

EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCAD, USDCHF, USDJPY, AUDCAD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, NZDCAD, NZDJPY, XAGUSD, XAUEUR, XAUUSD

Advisable Use Instances

• Swing merchants in search of high-alignment, multi-timeframe confirmed tendencies

• Day merchants scanning for the strongest intraday momentum pairs every session

• Place merchants confirming that D1 and W1 construction helps their bias

• Gold and silver merchants utilizing XAUUSD and XAGUSD development context

• Prop agency merchants who must commerce solely the cleanest, highest-probability setups

About VolatilityPlus Buying and selling

VolatilityPlus Buying and selling specialises in creating skilled algorithmic buying and selling instruments for MetaTrader 5. Our indicators and Professional Advisors are constructed from actual buying and selling expertise — not simply theoretical fashions. We commerce what we construct.

For buying and selling alerts, updates, and group dialogue, comply with our Telegram channel: Volatility Plus.

|

⚠️ Threat Disclaimer: Buying and selling international trade and CFDs entails important threat. Previous efficiency of any indicator will not be indicative of future outcomes. At all times use correct threat administration when buying and selling with actual capital. |