EA Settings and Configuration Information

On this part, I’ll present an in depth overview of all of the parameters of the EA and methods to set them for optimum efficiency. In case you are new to utilizing the EA or need to fine-tune the settings, this information will help you.

EA Parameters:

- EA_Name – This title seems within the commerce notes.

- Show_Info_Panel – Allows or disables the data panels displaying account knowledge and key settings.

- Stop_Loss & Take_Profit – Set the cease loss (SL) and take revenue (TP) in pips.

- Trailing_Stop – Allows or disables the trailing cease.

- Trailing_Stop_Start – Set the pip worth at which the trailing cease will begin working.

- Trailing_Stop_Distance – Set the pip distance at which the trailing cease will comply with the value.

- Start_Time_Hour & Start_Time_Minute – The beginning time of the commerce, in hours and minutes.

- Spread_Filter – Allows or disables the unfold filter.

- Max_Spread – The utmost allowed unfold, past which no trades might be opened.

- Fixed_Lot – Set a set lot dimension (works provided that the auto lot operate is disabled).

- Use_Auto_Lot – Allows the auto lot operate, which calculates the danger as a proportion of the fairness.

- Risk_Percentage_Per_Trade – Set the danger per commerce as a proportion of the fairness.

- Recovery_Mode – Allows or disables the restoration mode.

- Lot_Multiplier_After_Loss – Multiplies the lot dimension by this worth after a loss.

- Reset_After_N_Losses – Resets the lot dimension after the required variety of consecutive losses.

- Reset_After_N_Profits – Resets the lot dimension after the required variety of consecutive wins.

- Trade_On_Monday – Allows or disables buying and selling on particular days of the week.

- Magic Quantity – The distinctive identifier for the EA. Helps make sure the EA solely manages its personal trades.

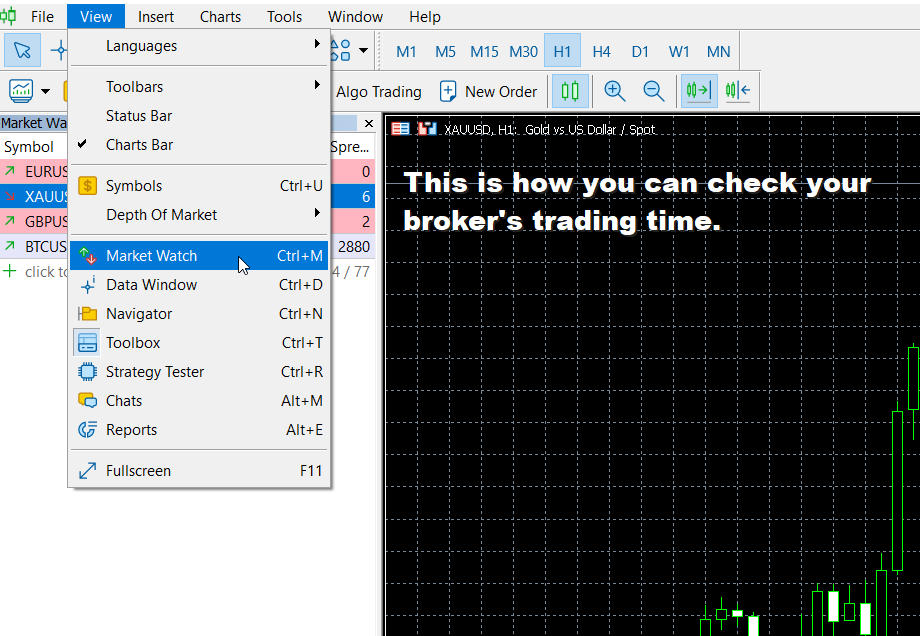

Learn how to Verify if the Dealer’s Server Time Matches the Default Settings:

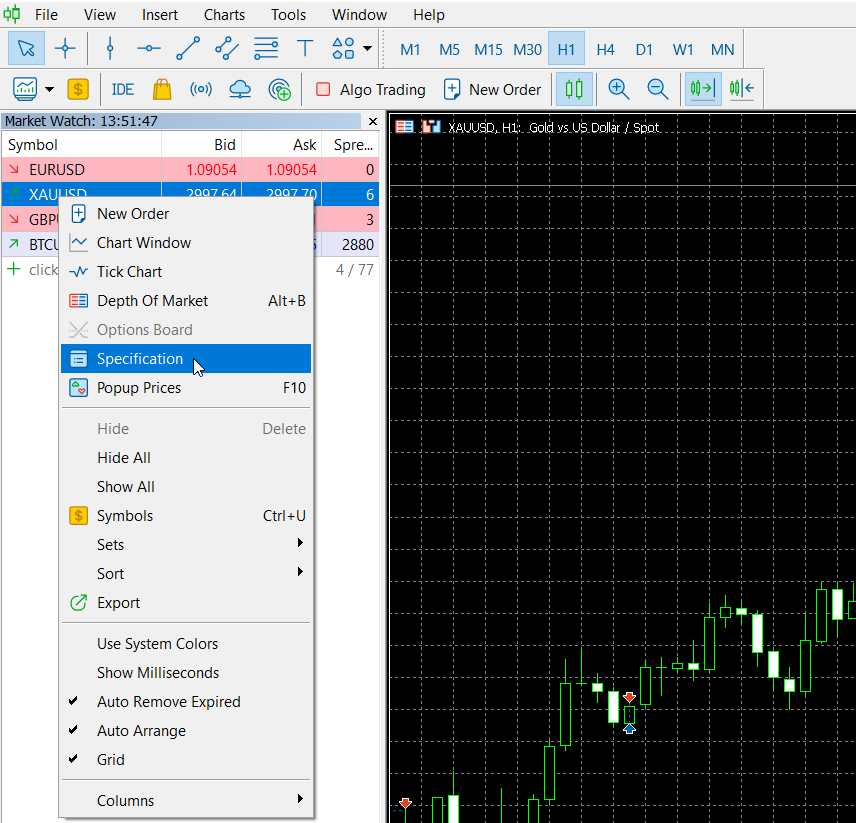

- Proper-click on the Gold image within the Watchlist.

- Choose Specs.

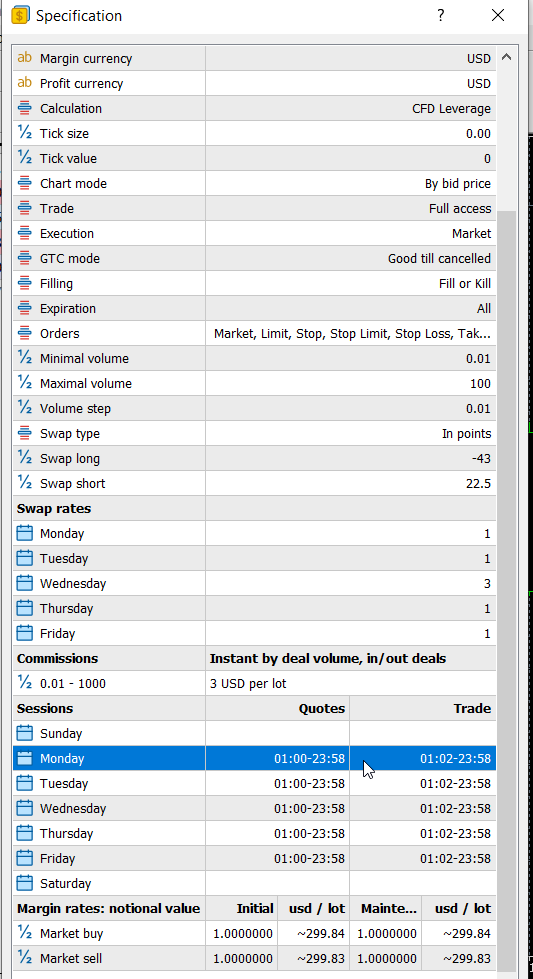

- Scroll all the way down to the Buying and selling Hours part.

- Verify the market shut time. Whether it is 23:59, no adjustment is required.

- If, for instance, the market shut time is 20:59, set the Begin Time to twenty:00.

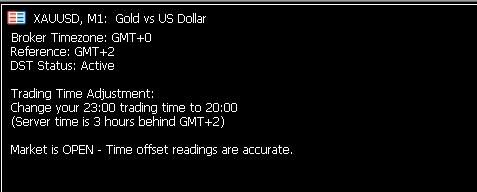

I’ve created an indicator that mechanically determines the advisable buying and selling time, and I’ve hooked up it right here:

Really helpful Danger Settings:

- Conservative: 2-3% danger per commerce.

- Aggressive: Max 10% danger per commerce (with out Restoration Mode).

My Settings:

- Excessive-Danger Account: 15% danger per commerce, all different settings are default.

- Medium-Danger Account: 3% danger per commerce with Restoration Mode enabled. On this mode, if a commerce leads to a loss, the following commerce will use loads dimension multiplied by 5 (solely as soon as) to recuperate the loss. This considerably will increase the danger: two consecutive dropping trades would lead to a lack of roughly 3% + (3% × 5) = 18%. Nonetheless, the likelihood of two losses in a row may be very low primarily based on historic efficiency.

Prop Agency Settings:

Since every prop agency has its personal guidelines, make certain the EA complies with these. If many customers use the identical technique, the account could also be banned, so some settings must be minimally adjusted:

- EA Identify (as seen within the feedback).

- Magic Quantity.

- Set the danger per commerce between 0.5% and three% to adjust to the prop agency’s day by day drawdown restrict.

- SL and TP slight adjustment: In case you are utilizing a trailing cease, you possibly can regulate the TP freely so long as it’s bigger than the trailing cease worth. It’s also possible to modify the trailing cease values by half or 1 pip.

- Commerce Time adjustment (±1-2 minutes). Be cautious, as these adjustments can have an effect on the outcomes.

- Some prop companies prohibit conserving trades open over the weekend. In such circumstances, buying and selling on Friday have to be disabled.

Particular Dealer Suggestion (for brokers that increase spreads at night time, e.g., XM):

If the unfold will increase at night time, disable the trailing cease as it could negatively impression efficiency. Set the TP to 26 pips, which has given good outcomes for me.

Often Requested Questions (FAQ)

Under you will discover a abstract of probably the most continuously requested questions concerning the Golden Nights EA. This checklist is up to date usually.

Which period body ought to I exploit?

The EA works identically throughout all timeframes. It’s not time frame dependent.

Does it work on indices or different devices?

No. The EA is particularly optimized for gold. Should you want to attempt it on one thing else, you should backtest and optimize settings your self, and solely use it if outcomes are promising.

Can I commerce at totally different instances or open a number of trades per day?

No. Buying and selling at different instances might cut back profitability or lead to losses. The EA is designed to open just one commerce per day, and solely one place at a time — to take care of danger management.

Why does it solely place Purchase orders?

The technique exploits typical worth patterns earlier than the gold market closes, which normally present an uptrend or consolidation. In recent times, gold has been in a powerful bullish development, supported by financial and geopolitical elements, and continues to be.

Is the swap hurting outcomes?

Sure, it has some impact, however most trades shut earlier than the market closes.

Suggestions:

– Use a swap-free account

– Disable buying and selling on Wednesdays to keep away from 3x swap prices.

What about excessive nighttime spreads?

Some brokers enhance unfold at market shut/open. Really helpful settings:

– Trailing Cease: OFF

– TP: 26 factors

This works properly on brokers like XM.

Does the EA use martingale or grid?

No. Neither technique is used.

Nonetheless, there’s an elective “Restoration Mode” that will increase lot dimension after a loss. It’s totally customizable and could be disabled.

Why is the risk-reward ratio low?

True, the RR is low, however that is compensated by the excessive win fee (~96%) in keeping with backtests. Lengthy-term outcomes stay worthwhile.

Can I alter SL/TP to enhance RR?

Not advisable, as it might probably hurt efficiency and even trigger losses. Should you insist, make certain to backtest completely earlier than going stay.

Can I exploit this EA for prop agency challenges?

Theoretically sure, however every agency has totally different guidelines. No ensures in opposition to bans, particularly if many customers make use of the identical EA. At all times verify the agency’s circumstances first.

Really helpful Brokers and VPS for Utilizing the EA

I’d wish to share my private expertise with the brokers I’ve been utilizing, which have been performing excellently with the EA. Each brokers supply swap-free accounts and have low charges, making them an awesome alternative for working the EA successfully.

XMGlobal for European Purchasers with buying and selling leverage 1:500

Moreover, for the perfect EA efficiency, a dependable VPS is essential. Whereas you should use MetaTrader’s VPS service, I additionally suggest ForexVPS as a wonderful different. Listed below are some benefits of utilizing ForexVPS:

- Low Latency: Ensures quick execution instances, vital for automated buying and selling.

- 24/7 Uptime: Your EA runs continuous with out interruptions.

- Quick Assist: Fast response instances for troubleshooting or setup help.

- Specialised for Buying and selling: Optimized for working MetaTrader and different buying and selling platforms.

That mentioned, this EA ought to work properly with different brokers too.

Remember that low spreads, good buyer assist, and swap-free accounts are important for maximizing the efficiency of your EA.