Healthcare re-enters the highest 5

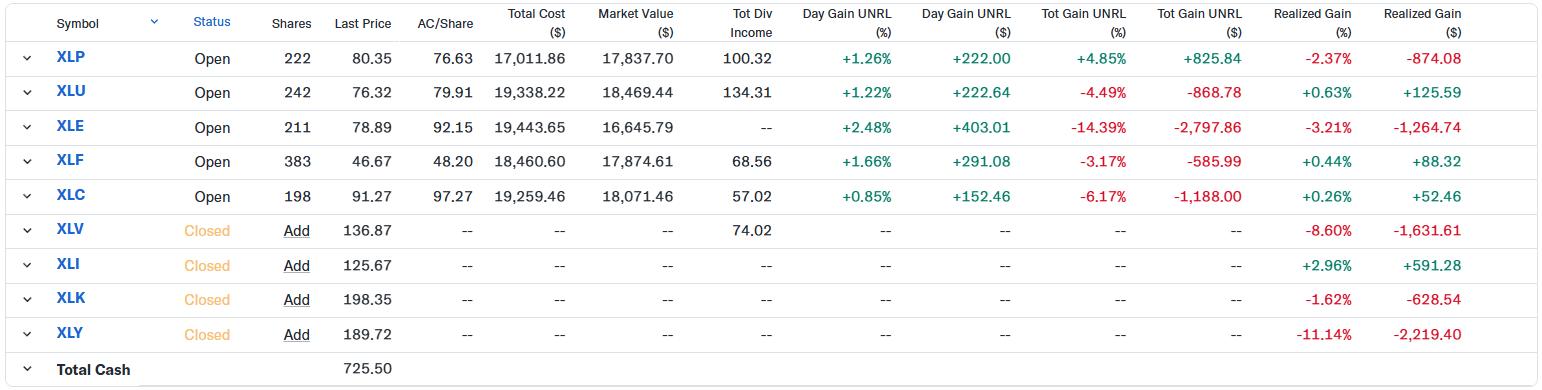

After a wild week within the markets, the sector rating obtained fairly a shake-up. Allthough just one sector modified within the high 5, all the high 5 modified positions. Within the backside half of the rating, solely two sectors remained stationary.

The Healthcare sector re-entered the highest 5 after dropping out two weeks earlier. This occurred on the expense of Power, which dropped to #7. Client Staples jumped from the #4 place and is now main, adopted by Utilities. Financials and Communication Providers dropped to #4 and #5, down from #1 and #2.

Within the backside half, Actual-Property jumped to #6 from #9. Power dropping from the highest 5 is now at #7 and pushed Induatrials and Client Discretionary right down to #8 and #9.

Supplies and Know-how stay on positions #10 and #11.

- (4) Client Staples – (XLP)*

- (5) Utilities – (XLU)*

- (1) Financials – (XLF)*

- (2) Communication Providers – (XLC)*

- (6) Healthcare – (XLV)*

- (9) Actual-Property – (XLRE)*

- (3) Power – (XLE)*

- (7) Industrials – (XLI)*

- (8) Client Discretionary – (XLY)*

- (10) Supplies – (XLB)

- (11) Know-how – (XLK)

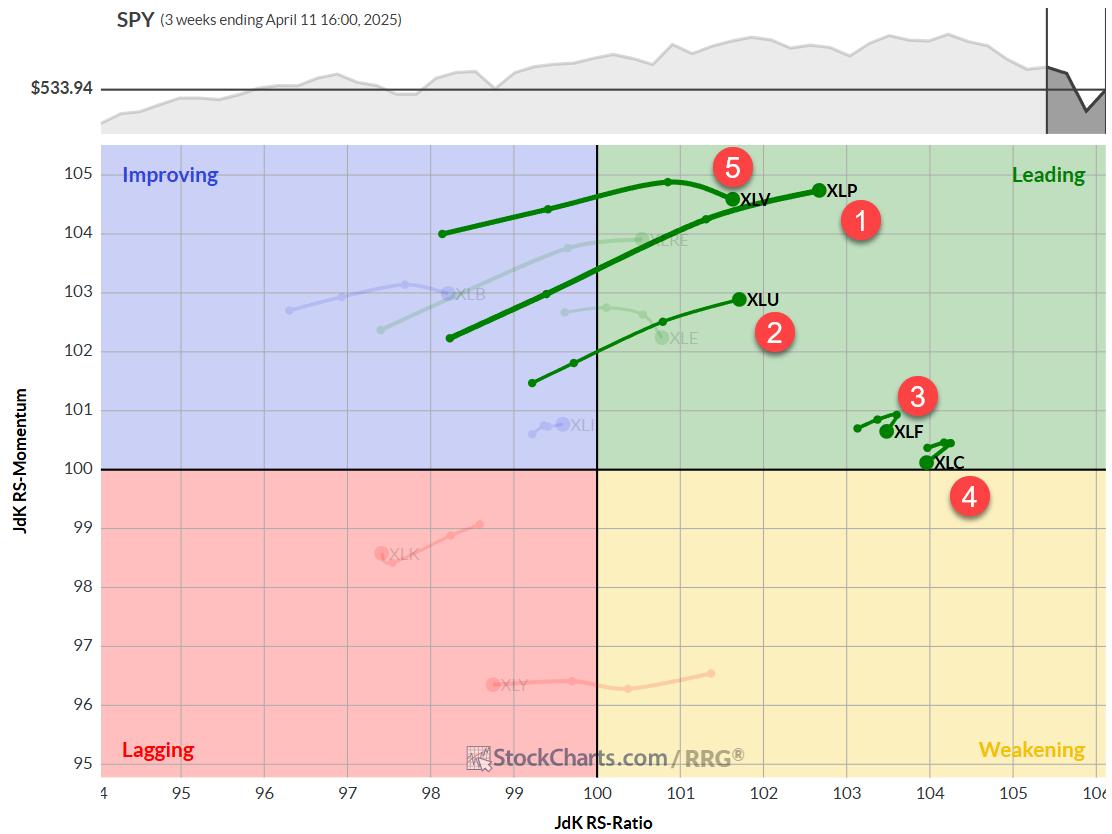

Weekly RRG: Robust Tails for XLU and XLP

On the weekly RRG, Financials and Communication companies stay at excessive JdK RS-Ratio ranges however have began to roll over whereas nonetheless contained in the main quadrant.

XLV dropped on the JdK RS-Momentum axis however nonetheless strikes increased on RS-Ratio. The 2 strongest tails are for XLP and XLU, that are pushing additional into main at constructive RRG-Headings.

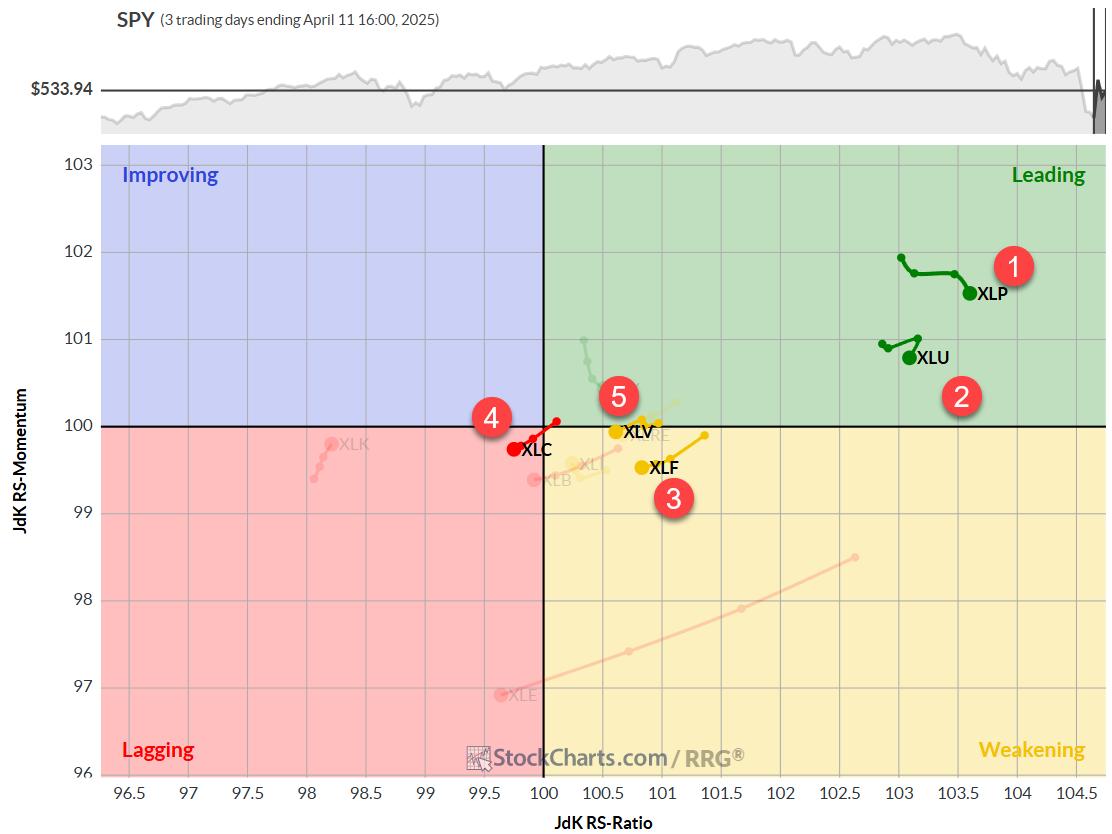

Day by day RRG: Communication Providers Drops into Lagging

On the every day RRG, XLP and XLU are beginning to lose relative momentum, however it’s taking place at excessive RS-Ratio ranges. That is mixed with the sturdy weekly tails, which maintain each sectors comfortably within the high 5.

XLV and XLF are rotating by way of the weekly quadrant, whereas XLC has crossed over into lagging.

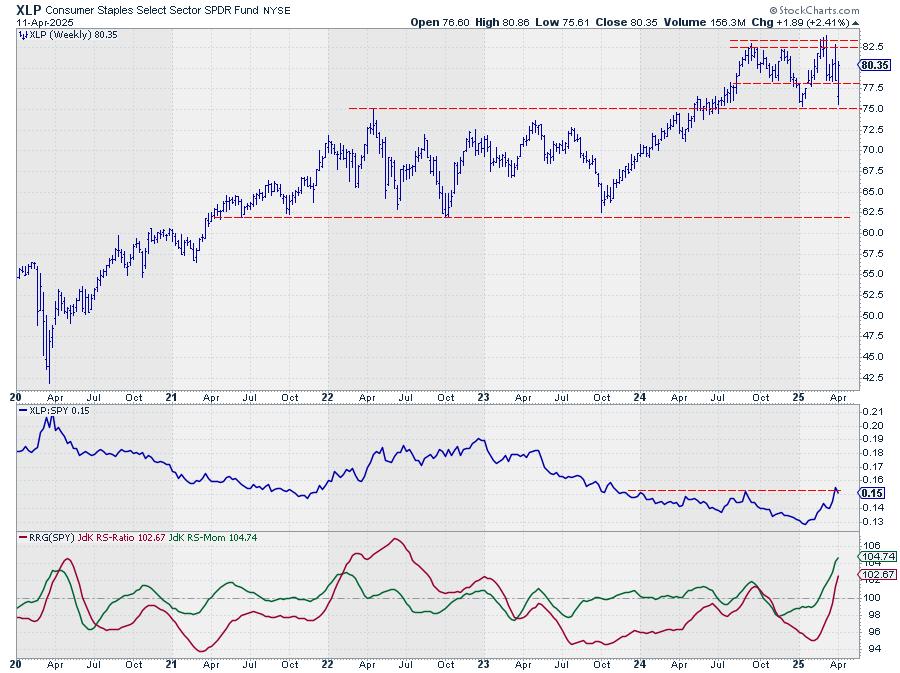

Client Staples

XLP dipped again to assist close to 75 however recovered strongly again into its earlier vary.

In consequence, the uncooked RS-Line is difficult its overhead resistance, dragging each RRG-Traces sharply increased. That is now clearly the strongest sector.

Utilities

In the course of the week, XLU dropped beneath assist however managed to come back again throughout the vary at Friday’s shut. Identical to Staples, uncooked RS is about to interrupt its higher boundary, away from its vary.

Each RRG-Traces are accelerating increased, pushing the tail deeper into main.

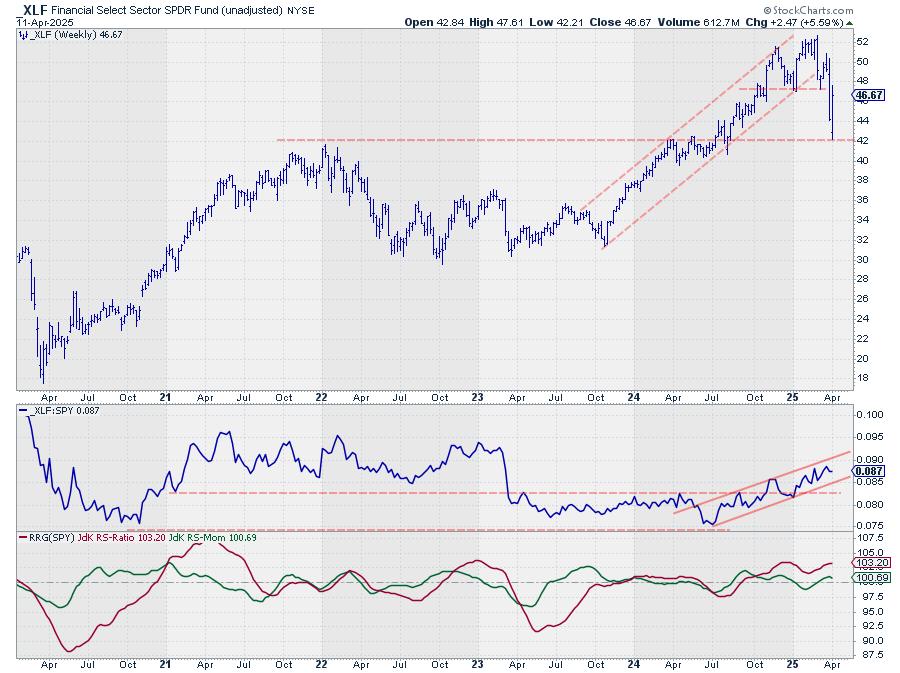

Financials

XLF examined assist round 42, however the bounce stopped close to its outdated assist stage of round 47.50.

RS steadily strikes increased throughout the boundaries of its rising channel.

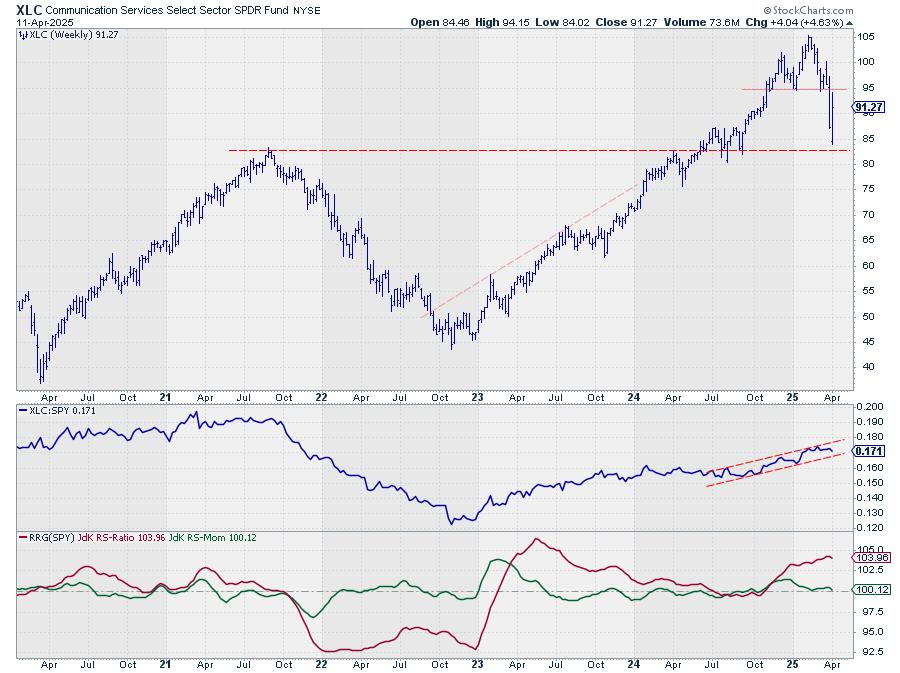

Communication Providers

An enormous worth drop was caught simply above horizontal assist close to 83. The restoration, to this point, has not reached overhead resistance at 95, the outdated assist stage. This makes XLC essentially the most susceptible sector inside the highest 5.

Relative power stays secure at excessive RS-Ratio readings and flat RS-Momentum.

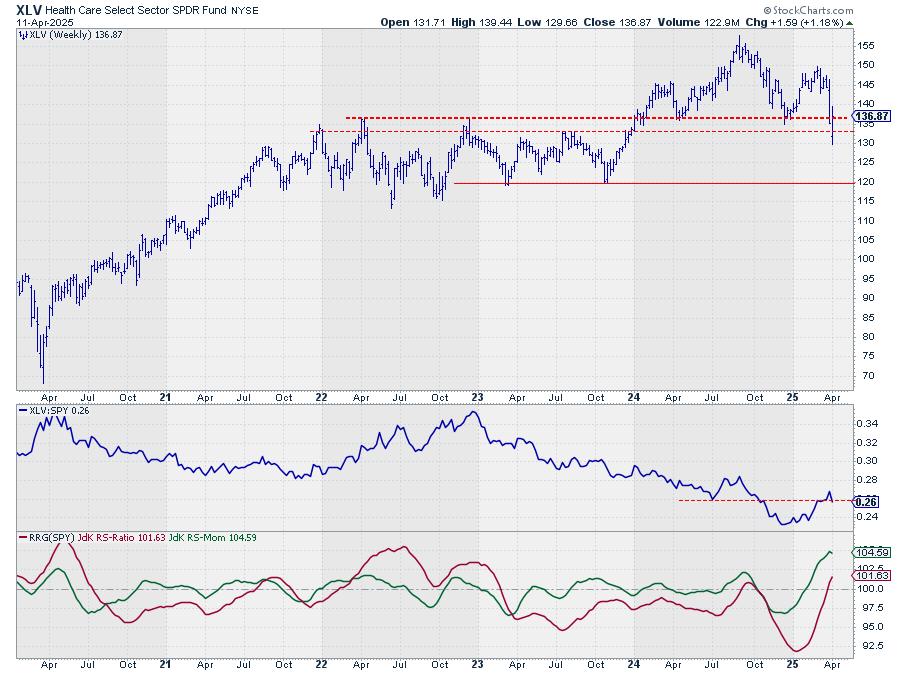

Healthcare

The Healthcare sector re-entered the highest 5 after one week of absence. This brings all three defensive sectors again into the RRG portfolio.

On the worth chart, XLV is battling with the previous horizontal assist space, now resistance, round 136.

Relative power continues to rise, placing the XLV tail effectively contained in the main quadrant.

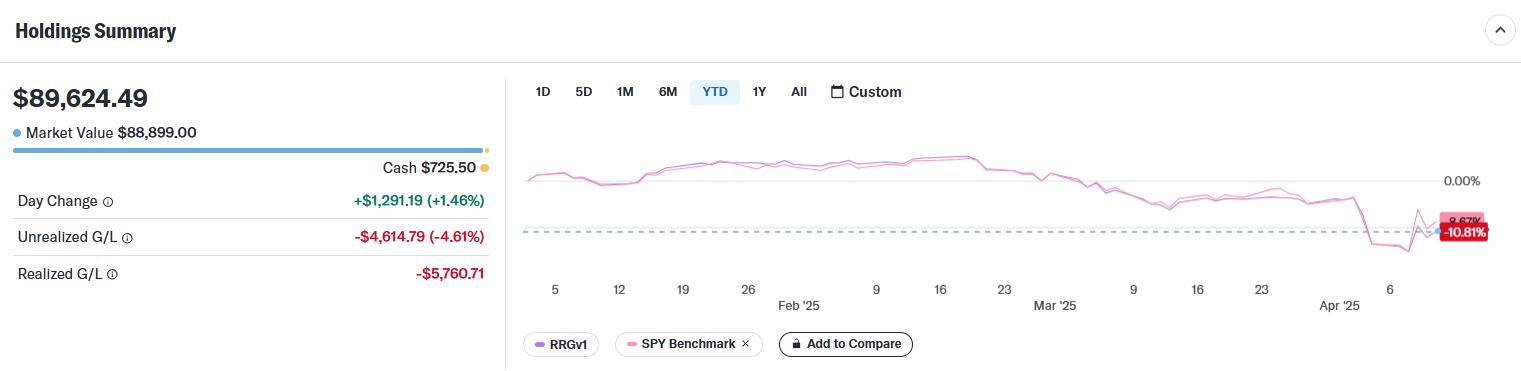

Portfolio Efficiency Replace

Final week’s volatility was a bit an excessive amount of for the portfolio to maintain up with, and it’s now lagging the S&P 500 by virtually 2%.

#StayAlert –Julius