KEY

TAKEAWAYS

- The S&P 500 presently sits about 8% beneath its 200-day shifting common, even with a robust upswing on final week’s tariff information.

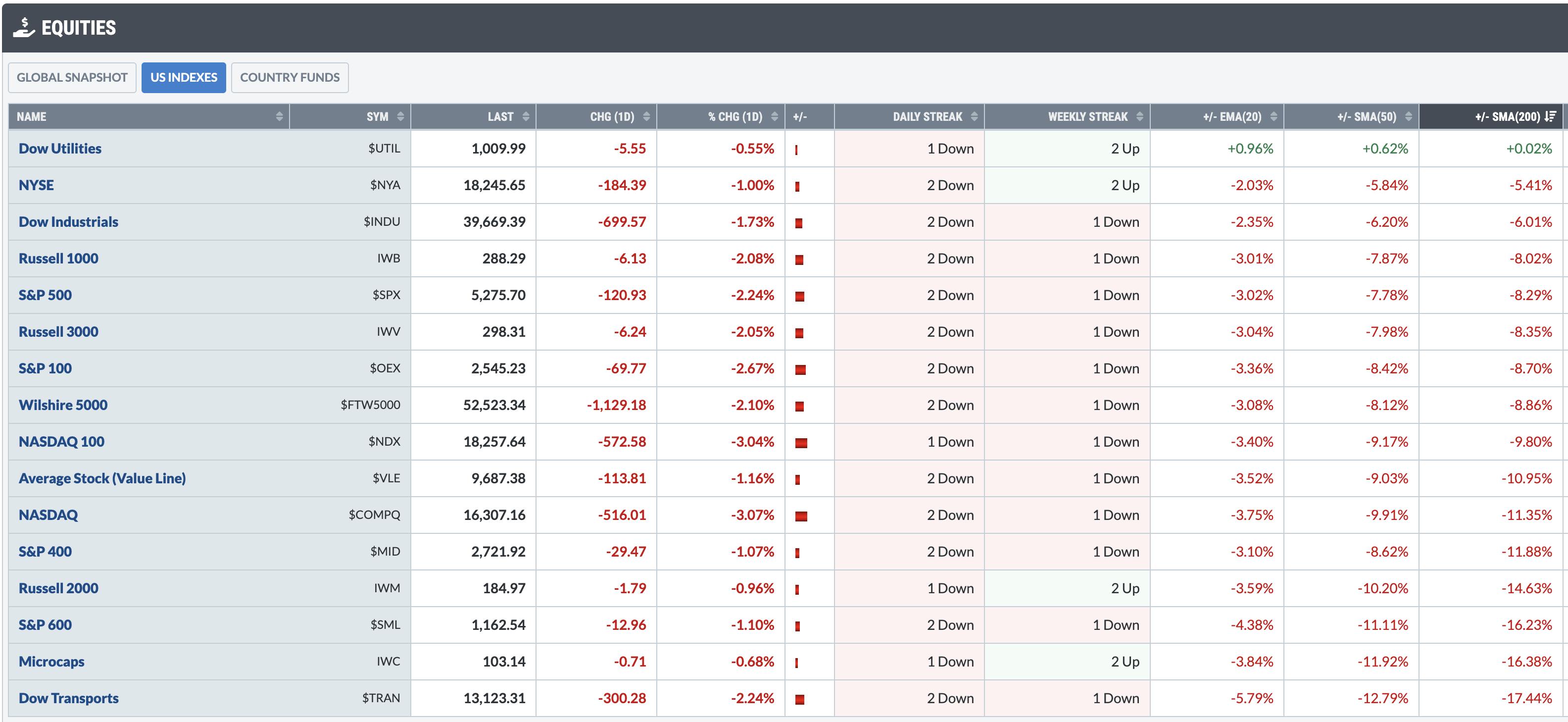

- The newly up to date Market Abstract web page on StockCharts.com permits traders to match key market indexes to their 200-day shifting averages.

- Three vital development stocks- META, AMZN, and TSLA- have struggled to reclaim their very own 200-day, suggesting a transparent distribution sample.

When markets get extra unstable and extra unstable, I get the urge to take a step again and mirror on easy assessments of development and momentum. Immediately we’ll use one of the crucial frequent technical indicators, the 200-day shifting common, and talk about what this easy trend-following instrument can inform us about situations for the S&P 500 index.

Nothing Good Occurs Under the 200-Day Transferring Common

I’ve obtained a variety of questions just lately as to why I am not far more bullish after the sudden rally off final Wednesday’s low. I really like to reply with Paul Tudor Jones’ well-known quote, “Nothing good occurs beneath the 200-day shifting common.”

To be clear, the 200-day shifting common is nearly 500 factors above present ranges, so it could take fairly a rally to realize that worth degree any time quickly. However with the VIX nonetheless nicely above the 30 degree, which means the market is anticipating extensive worth swings and large strikes may very well be very potential.

However usually talking, any time I see a chart the place the worth is beneath a downward-sloping 200-day shifting common, I really feel snug making the fundamental assumption that the first development is down. And till the SPX can regain this long-term development barometer, I am inclined to deal with the market as “responsible till confirmed harmless.”

Monitoring the 200-Day With the New Market Abstract Web page

The new and up to date model of the StockCharts Market Abstract web page contains a desk of main fairness indexes and features a comparability to the 200-day shifting common for every index. I’ve sorted at the moment’s desk in descending order primarily based on this metric, which permits us to match the relative place of various indexes and deal with which areas of the fairness market are exhibiting actual power.

We are able to see that solely the Dow Utilities stay above the 200-day shifting common, even with the sturdy bounce we have noticed over the past week. The S&P 500 is about 8% beneath its 200-day shifting common, and for the Nasdaq Composite it is over 11%. So this principally implies that the S&P might see one other 8% rally, drawing in all types of traders, but nonetheless stay in a bearish part primarily based on its place relative to the 200-day.

Three Shares Dealing with a Essential Take a look at This Week

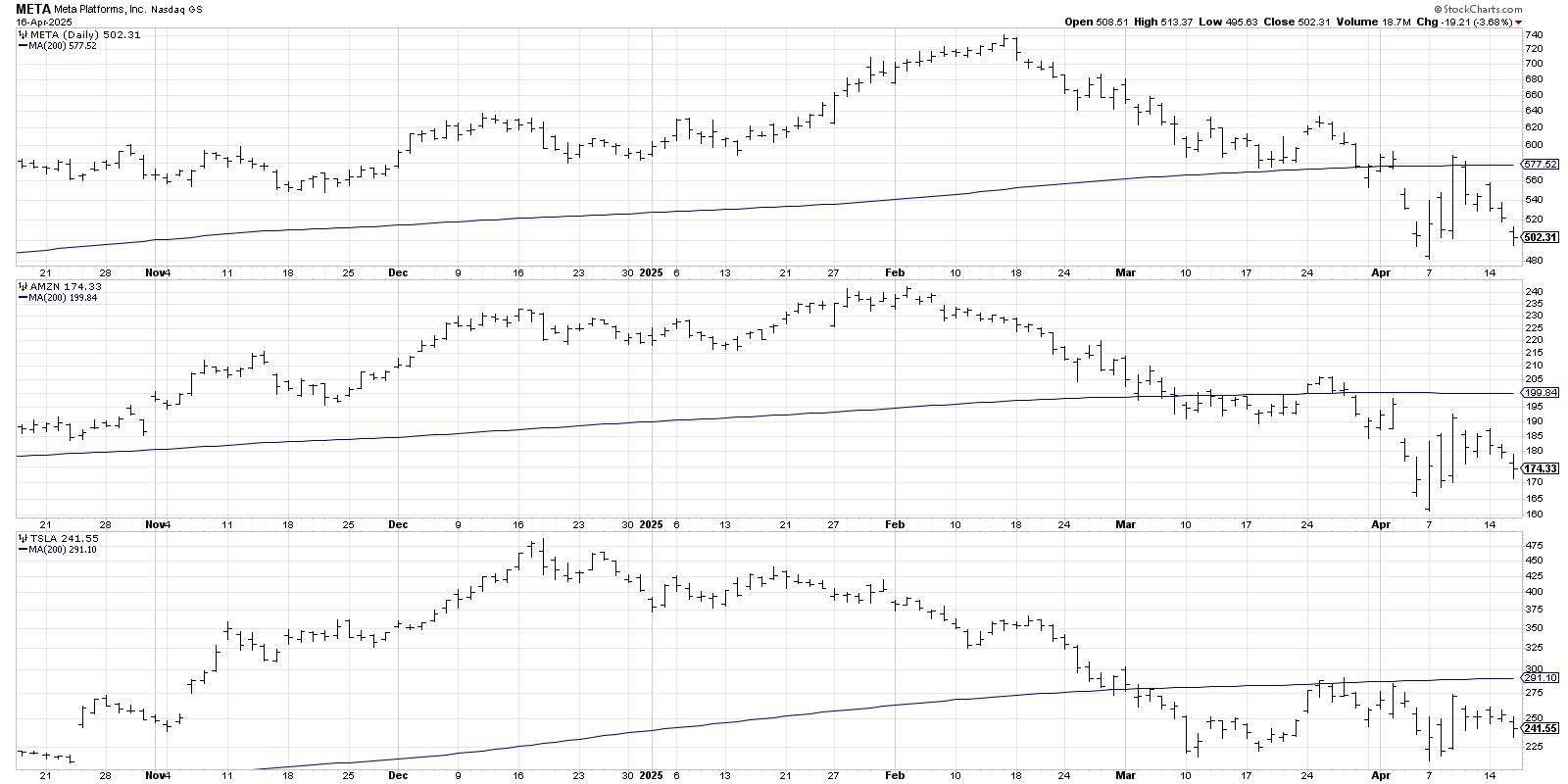

One chart I am watching intently this week entails three key development shares which are truly very close to their very own 200-day shifting common. If these Magnificent 7 shares have sufficient upside momentum to energy by the 200-day, then there might undoubtedly be hope for the S&P 500 and Nasdaq to observe go well with within the coming weeks.

Be aware within the prime panel how Meta Platforms (META) powered above the 200-day final Wednesday after the announcement of a 90-day pause in tariffs. However after closing above the 200-day for that someday, META broke proper again beneath the subsequent day. META has closed decrease each buying and selling day since that breakout.

Neither Amazon.com (AMZN) nor Tesla (TSLA) reached their very own 200-day on final Wednesday’s rally, and each are actually quickly approaching their lows for 2025. And if mega cap development shares like META, AMZN, and TSLA are unable to energy above their 200-day shifting averages, why ought to we anticipate our growth-dominated benchmarks to do the identical?

With a flurry of reports headlines each buying and selling day, and an earnings season that might paint a disturbing image of lowered expectations for financial development and shopper sentiment, I really feel that there’s extra draw back available earlier than the good bear market of 2025 is accomplished. However as an alternative of making an attempt to foretell the longer term, I select to easily observe the traits. And primarily based on the form of the 200-day shifting common for these vital charts, the first development seems to nonetheless be down.

RR#6,

Dave

PS- Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any method signify the views or opinions of another individual or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps lively traders make higher choices utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main consultants on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can also be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Be taught Extra