KEY

TAKEAWAYS

- When inventory markets decline, you possibly can defend your positions with choices.

- Shopping for places on shares you personal can assist defend your place if the inventory falls additional.

- A put vertical unfold is one other technique to guard your portfolio holdings.

When the inventory market is turbulent, it is sensible to hedge a few of your beneficial fairness positions. One solution to do it’s via choices.

When the inventory market is turbulent, it is sensible to hedge a few of your beneficial fairness positions. One solution to do it’s via choices.

The adage “Do not maintain all of your eggs in a single basket” is well-known amongst buyers. Whereas a diversified portfolio reduces your danger, you most likely have a handful of favourite shares that you do not need to promote. However watching these shares lose worth could be painful.

The excellent news: There’s a solution to cut back your losses on these positions.

Hedging With Choices

Earlier than diving into the methods, you must decide what you need to do with the shares you need to maintain on to. When a market is trending decrease, choices assist defend your investments within the following methods:

- Defending your shares towards losses.

- Producing revenue from declining inventory values.

- Realizing earnings from declining shares if the inventory strikes in your favor.

Earlier than continuing additional, take a look at all of your portfolio holdings and decide which shares you need to maintain on to, then decide your hedging aims.

This text will concentrate on the methods you possibly can implement to defend your shares towards losses. You are able to do this by shopping for places, that are much like an insurance coverage coverage. You pay for draw back safety to realize limitless upside potential.

Here is the way it works.

- You purchase one put contract for 100 shares of an underlying inventory. For instance, should you personal 100 shares of Apple, Inc. (AAPL), you purchase one AAPL put contract; should you personal 200 shares of AAPL, you could possibly purchase 2 put contracts.

- You purchase a put with a strike worth that would generate a revenue that you just’re snug with in your fairness place, and a premium (the worth of the contract) that you just’re prepared to pay to guard your place.

- If the inventory’s worth falls under the strike worth, you could possibly promote your put contract for a revenue. You can additionally select to train your put contract, i.e., promoting the underlying shares on the contract’s strike worth.

For instance, say you obtain 100 shares of AAPL for $110 per share. AAPL inventory is buying and selling barely under $205 however hit a excessive of $259.81. You need to defend your unrealized beneficial properties in case the worth falls additional. Trying on the day by day chart of AAPL under, additional draw back seems extremely possible.

The 50-day easy shifting common (SMA) has crossed under the 200-day, the StockCharts Technical Rank (SCTR) rating is at 32.50, which is comparatively low, and the relative power index (RSI) just under 50, indicating impartial momentum.

FIGURE 1. DAILY CHART OF AAPL STOCK. A declining development, a technically weak chart, and lukewarm momentum point out the next likelihood of additional decline.Chart supply: StockCharts.com. For academic functions.

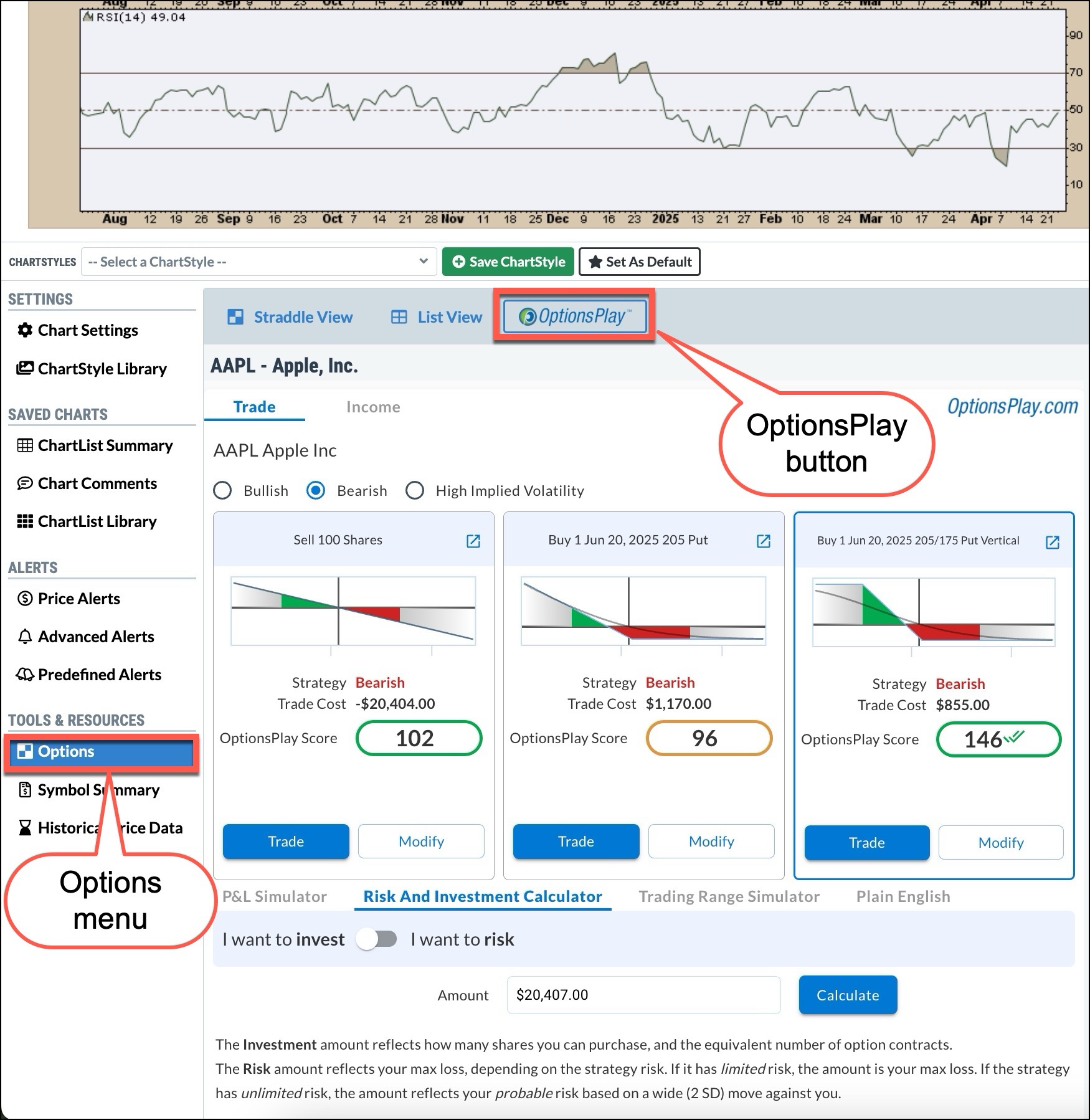

When you had been to purchase a put, what strike worth and expiration would you select? That may be a time-consuming train, however the OptionsPlay Add-on in StockCharts does it for you shortly. Here is how.

- Beneath the chart, click on the Choices menu, discovered below Instruments & Sources. You may see the Choices Chain by default (Choices Abstract).

- Click on the OptionsPlay button above the Choices Chain to entry the OptionsPlay Explorer. You may see the three optimum methods listed.

FIGURE 2. OPTIMAL OPTIONS STRATEGIES FOR AAPL STOCK. You can promote 100 shares of AAPL, purchase a put, or purchase a put vertical unfold. You may analyze the three eventualities and decide which one will assist defend your fairness place.Picture supply: StockCharts.com. For academic functions.

The really helpful lengthy put (displayed within the center) is the June 20 $205 put, which can value $1,170. It’s a must to resolve if it is price paying this a lot premium to guard your place within the inventory. If the inventory worth rises above $205 by expiration, your contract will expire nugatory. You’ll have misplaced $1,170. Are you prepared to take that danger?

You may modify the technique by altering the expiration and strike worth of the contract. This may assist decide if there are extra favorable risk-to-reward eventualities. The next eventualities may play out:

State of affairs 1: The inventory worth falls under $205.

- You can promote the put choice for a revenue, which can offset among the unrealized losses from the decline within the inventory’s worth.

- You can additionally select to train the choice and promote the shares for $205. You’ll stroll away with a revenue of $8,330 ($9,500 – 1,170).

State of affairs 2: The inventory worth is above $205 by expiration.

- Your put contract will expire nugatory.

- When you suppose the inventory worth will drop as contract expiration will get shut, you could possibly roll it to a further-out expiration. You’d promote your $205 June put and buy one other put choice with a later expiration.

When shopping for places, your most danger is restricted to what you pay for the premium.

There’s Extra You Can Do

The technique on the precise reveals a put vertical technique, which has a a lot decrease value, the next OptionsPlay rating, and a possible reward of $2,145, which is far decrease than shopping for a put.

The put vertical includes including a decrease strike worth put with the identical expiration. This could be a two-leg choices commerce—you purchase the June 20 205 put and promote the June 20 $175 put.

The advantage of the put vertical is that you just restrict your danger to $855 (the debit). This may occur if AAPL is above $205 and each places expire nugatory.

Your potential reward is restricted to $2,145 (strike worth – debit), which you’ll understand if AAPL’s inventory worth falls under $175. The likelihood of revenue of the put vertical is 41.79%, versus 37.48% for the lengthy put.

The Backside Line

Shopping for places and put vertical spreads can defend your choices positions in a declining market. You continue to want to judge the price of safety versus your revenue potential, simply as you’d while you’re searching for insurance coverage.

The advantage of utilizing the OptionsPlay Add-on is that the legwork is completed for you. All you need to do is consider the completely different methods, that are spelled out for you in easy phrases. To study extra in regards to the options accessible within the OptionsPlay Add-on, go to the StockCharts TV OptionsPlay with Tony Zhang YouTube channel.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your private and monetary scenario or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra