KEY

TAKEAWAYS

- The AAII survey demonstrates an absence of bullish optimism after the current bounce increased.

- The NAAIM Publicity Index suggests that cash managers stay skeptical of the current advance.

- Whereas Rydex fund flows present a rotation to defensive positions, earlier bearish cycles have seen a lot bigger rotations.

Once I take into account the fairness markets from a macro perspective, I start with the evaluation of the value of the S&P 500. Then I exploit breadth indicators to verify what I am seeing by analyzing value motion. Lastly, and nonetheless very importantly, I have a look at market sentiment indicators that talk to how buyers are feeling concerning the markets at any given second.

Whereas we have skilled a big rally off the early April lows, my overview of key sentiment indicators will present that there’s positively not rampant optimism today. On the contrary, most indicators look like just like early-stage bearish phases. Let’s overview the proof collectively.

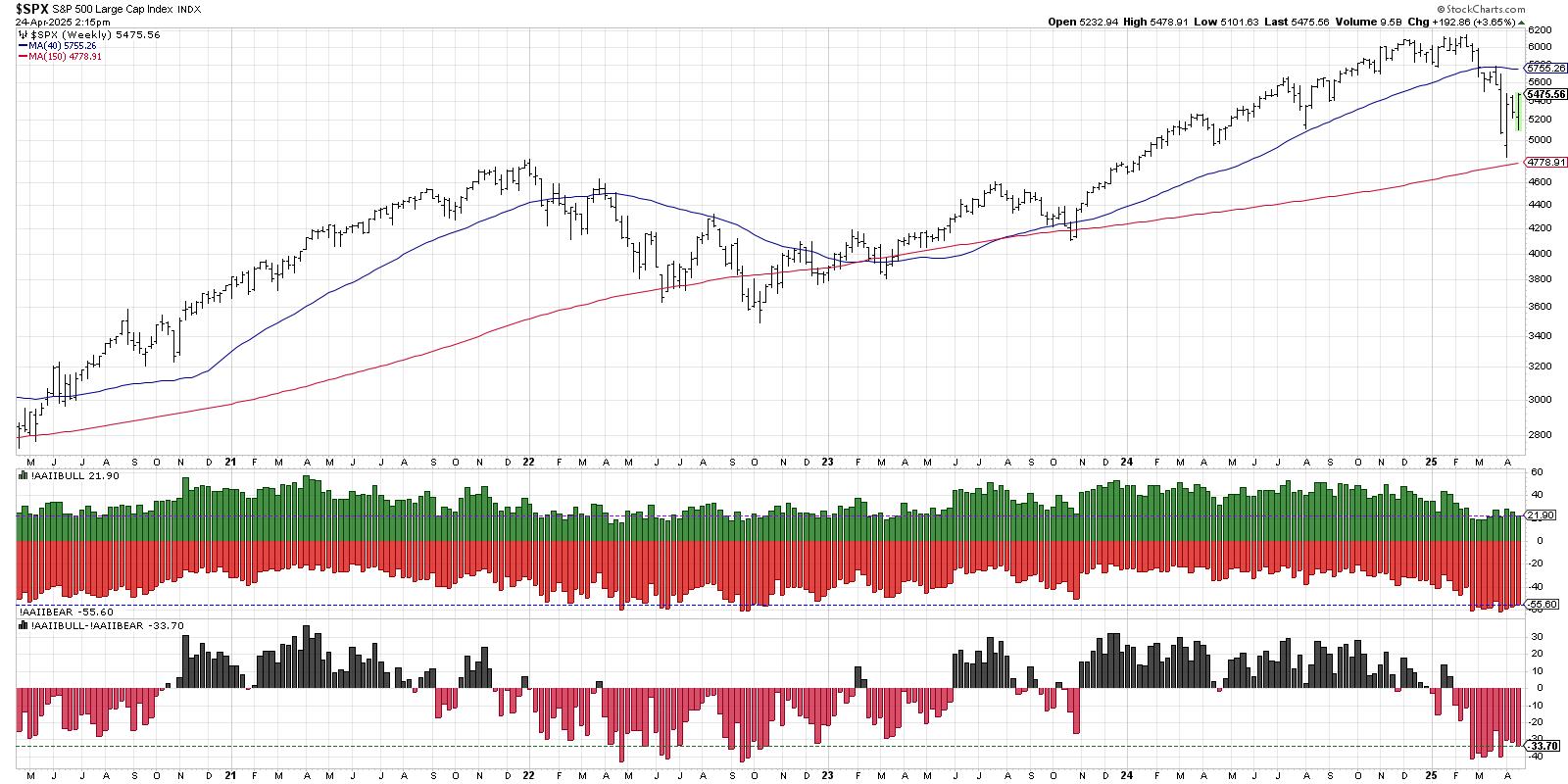

AAII Survey Exhibits Notable Lack of Bulls

The American Affiliation of Particular person Traders (AAII) conducts a weekly survey of members, asking if they’re bullish, bearish, or impartial about equities. The most recent weekly knowledge from this ballot exhibits 22% bullish and 56% bearish, with a 34% unfold between the 2 buckets.

Within the weeks following the February 2024 market peak, the AAII bullish studying plunged from about 45% to twenty% and has remained round that degree ever since. Bearish readings have been within the 55-60% vary over the last eight weeks, and the unfold between bulls and bears has been pretty constant.

Regardless of many requires optimism on the current bounce in our main fairness benchmarks, the AAII survey is suggesting that particular person buyers stay fairly skeptical about additional upside at this level. And should you look again to 2022, you may see that this survey can stay on this common vary for fairly a while throughout protracted bear phases.

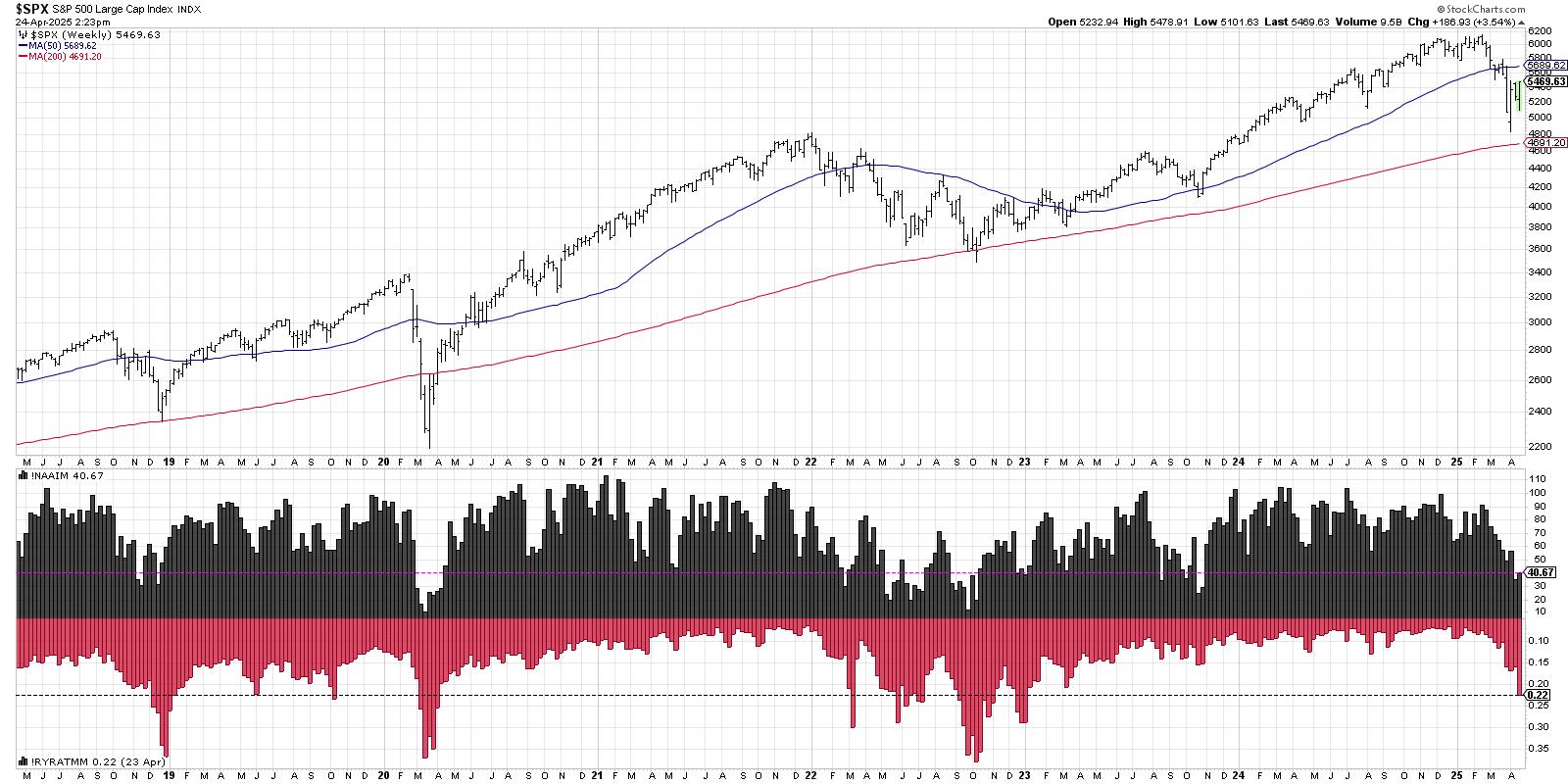

NAAIM Publicity Index Signifies Defensive Positioning

Now let’s take a look at two extra sentiment indicators, beginning with the NAAIM Publicity Index. As I mentioned in a current podcast interview with the President of NAAIM, the Nationwide Affiliation of Lively Funding Managers, this is a corporation of cash managers who’re requested about their publicity to the fairness markets each week.

The most recent outcomes of that survey present a mean allocation round 41%, down from simply over 90% on the February market peak. So whereas I’ve heard rumblings of institutional buyers piling into threat property off the April low, this survey would recommend that there’s nonetheless loads of capital patiently ready on the sidelines. And whereas the present studying at 41% is nicely beneath common, we have seen the indicator attain right down to single digits throughout earlier bear market cycles.

Rydex Flows Not But at Excessive Ranges

The underside panel in that earlier chart exhibits the Rydex fund flows, displaying how buyers within the Rydex fund household are rotating between offensive and defensive positioning. This week, we noticed a brand new log for 2025, displaying the Rydex fund buyers have continued to rotate to extra defensive positions off the February market excessive. Look additional to the left and you will see that in 2022, 2020, and late 2018, this indicator reached a lot deeper ranges earlier than a significant market backside was lastly achieved. So whereas the current rotation confirms a extra cautious outlook for buyers, it has not but reached excessive sufficient readings to be giving a transparent sign of draw back capitulation.

Within the order of significance, I might put value on the high of the record. Ought to the S&P 500 regains its 200-day shifting common, I’ll discover it rather more tough to stay bearish about market situations. However based mostly on my newest evaluation of key market sentiment indicators, the bears could have extra time within the solar earlier than this pullback part is over.

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any method signify the views or opinions of some other particular person or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps energetic buyers make higher selections utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main specialists on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can also be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Be taught Extra