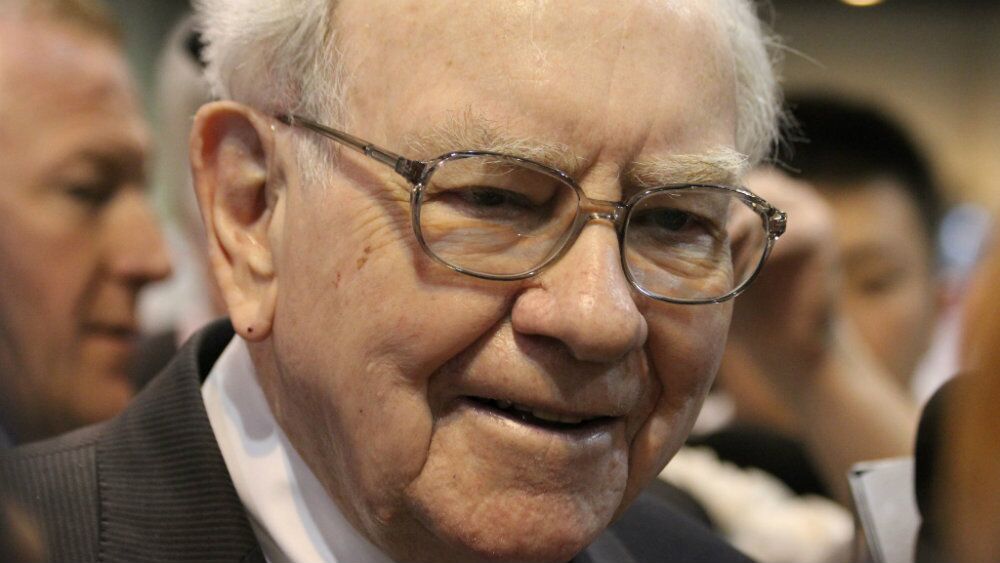

Picture supply: The Motley Idiot

There’s a altering of the guard on the earth of investing, and buyers are paying consideration. After greater than six many years on the helm, Warren Buffett is stepping down from Berkshire Hathaway (NYSE:BRK.B)(NYSE:BRK.A). Whereas the information isn’t solely stunning, Buffett is 94 years outdated, it nonetheless marks the top of an period. He’s lengthy been the poster youngster for buy-and-hold investing, worth self-discipline, and calm throughout market storms. However now, it’s time for somebody new to steer the US$900 billion ship. That somebody is Greg Abel, a Canadian government who’s been quietly managing a lot of Berkshire’s non-insurance enterprise for years.

The brand new sheriff on the town

Born and raised in Edmonton, Abel is a low-key chief with deep expertise in power and utilities. He joined Berkshire in 2000 and labored his means as much as vice chair of non-insurance operations. He oversees corporations like BNSF Railway, Berkshire Hathaway Vitality, and Dairy Queen, and has been broadly considered Buffett’s successor for just a few years now. The transition will grow to be official by the top of 2025, with Buffett stepping right into a extra advisory function, based on sources near the corporate.

Whereas many buyers are nonetheless assured in the way forward for Berkshire Hathaway below Abel, others are beginning to trim their positions. There’s a pure tendency to reassess when a legendary chief retires. Some high-net-worth buyers and fund managers at the moment are searching for recent alternatives outdoors of Berkshire. Apparently, some are even turning their focus again to Canada, particularly to the TSX, the place corporations like CES Vitality Options (TSX: CEU) are beginning to catch their eye.

Why CES

CES Vitality Options isn’t a family identify, but it surely’s making waves within the oil and gasoline companies sector. Primarily based in Calgary, the TSX inventory offers consumable chemical options for drilling and manufacturing throughout North America. That may sound dry, but it surely’s really a high-margin enterprise with regular demand. Oil producers depend on chemical options to maintain drilling environment friendly, secure, and worthwhile, and CES has carved out a robust place in that area of interest.

In its most up-to-date earnings report for the fourth quarter of 2024, CES delivered income of $605.4 million, up 9.5% from the identical interval final 12 months. That’s strong progress in an trade that has confronted its share of volatility. The TSX inventory additionally posted report earnings earlier than curiosity, taxes, depreciation and amortization (EBITDA) of $103.2 million, representing a 22% improve and a margin of 17.1%. These aren’t simply good numbers. They sign energy, particularly in a sector the place value management and effectivity matter greater than ever.

Earnings per share (EPS) got here in at $0.18, which was barely beneath analysts’ expectations of $0.22, however the TSX inventory’s income and EBITDA progress greater than made up for the miss. CES is displaying that it is aware of find out how to develop in a disciplined means, whereas additionally rewarding shareholders by way of a ahead dividend yield of two.7%. Past the numbers, CES has just a few intangibles that make it stand out. Its operations are diversified throughout Canada and the U.S., and it continues to put money into know-how and innovation. The administration group has a robust monitor report of execution, and its steadiness sheet is in strong form. The power producer additionally advantages from the continued rebound in drilling exercise, notably in Western Canada.

Backside line

For Canadian buyers occupied with rebalancing their portfolios, CES presents an fascinating alternative. It’s obtained progress potential, pays a dividend, and operates in a sector that also has room to run, even because the world transitions to renewables. And with some big-name buyers transferring cash out of Berkshire and into under-the-radar names, CES is likely to be on the verge of broader recognition.

Buffett’s retirement would possibly mark the top of an period, but it surely additionally opens the door to a brand new wave of considering – and investing. If you happen to’re searching for a made-in-Canada inventory to carry, CES Vitality Options is one to look at. It’s not making an attempt to be the following Berkshire. However it would possibly simply be the proper of firm for what comes subsequent.