Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has been resting on the $2 stage, however indications of motion are rising. One crypto analyst by the identify of “J4b1” lately said that buying XRP at $2.20 isn’t too late. The truth is, he thinks that it might be the proper time, simply earlier than issues change dramatically. His assertions are based on historic worth motion, Ripple’s present technique, and what establishments could do subsequent.

Associated Studying

XRP Worth Saved Secure By Ripple’s Month-to-month Exercise

Ripple’s dominance over XRP’s provide is a vital facet of J4b1’s argument. Each month, the agency releases 1 billion XRP from escrow however sells solely a fraction of it. The remaining quantity is put again into escrow. These gross sales are likely to happen by way of over-the-counter (OTC) channels slightly than open markets. Within the analyst’s view, this apply prevents Ripple from experiencing sharp worth fluctuations.

Is XRP about to blow up or already overpriced?

Is shopping for at $2.20 good or is it too late? Let’s break it down with information, historic context, and Ripple’s worth management technique. 🧵👇 pic.twitter.com/UHvbYD4GJl

— J4b1 (@XRPJ4b1) Might 4, 2025

He used an instance: if Ripple needs to switch $200 million utilizing 100 million XRP, each coin should be value $2. If the value rises too quickly, Ripple can promote extra. If it falls too far, they might purchase some again. This technique could possibly be one of many the explanation why XRP has not damaged by means of the $2.20 barrier.

Institutional Demand Might Change All the things

J4b1 talked about just a few issues that would drive XRP up. He cited doable regulatory readability from a brand new US administration that could possibly be extra crypto-friendly. He additionally talked about the opportunity of an XRP spot ETF and the expansion of tokenized property on the XRP Ledger.

The analyst believes that if establishments start accumulating in massive portions, Ripple’s present strategy might not be adequate to comprise the value. If demand outstrips the availability Ripple has, the value could surge.

XRP market cap at the moment at $125 billion. Chart: TradingView.com

XRP’s Historical past Holds Clues

XRP’s journey started in 2012, when it was value lower than a penny. It picked up tempo through the years as Ripple offered it to banks as a method of creating cross-border funds sooner and cheaper. That momentum took XRP to a excessive of $3.80 within the 2017 bull run.

Associated Studying

However every part modified when regulators stepped in. In 2015, Ripple was fined by FinCEN. Then, in 2020, the SEC lawsuit struck, slowing down XRP’s adoption and protecting the value underneath management. However, Ripple continued to construct, buying corporations like Metaco and acquiring licenses throughout the globe.

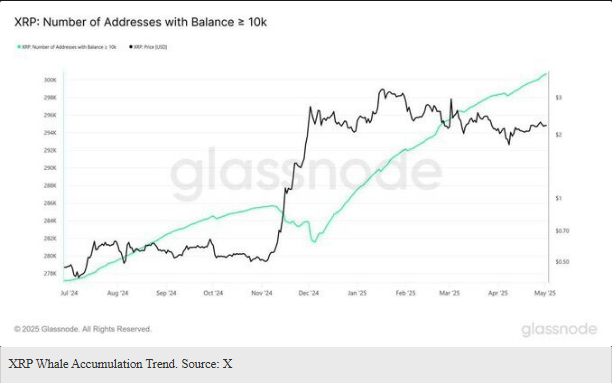

Whale Wallets Are Rising Quickly

In the meantime, as XRP’s worth stays stagnant, the massive holders are filling up. In accordance with latest statistics, there at the moment are greater than 300,000 addresses holding a minimal of 10,000 XRP. That’s a rise from round 281,000 as of December 2024. Whale wallets proceed to rise although the value stays largely flat round $2.20.

That kind of buildup tends to point a way that costs could rise additional sooner or later. It’s occurring as international uncertainty will increase, which can be encouraging traders to prepare for the subsequent main transfer.

In the intervening time, XRP merchants are paying shut consideration. A fast transfer on the upside might not be distant.

Featured picture from Gemini Imagen, chart from TradingView