In one other main transfer, right now a proposal has been raised for the acquisition of Derive, a number one decentralised choices platform and former Synthetix ecosystem challenge. The transaction, outlined in SIP-415, marks a serious step in consolidating product, expertise and token economic system right into a single, unified derivatives protocol on Ethereum mainnet.

Pending approval by the Spartan Council and Derive governance, the deal might be structured as a token change at a 27:1 DRV-to-SNX ratio, valuing the deal at roughly $27 million USD. To facilitate this, Synthetix will situation as much as 29.3 million SNX tokens (3-month lock-up and 9-month linear vesting) in an effort to merge the Derive token provide and market cap with that of SNX.

Strategic Rationale: One Protocol, Unified Path

This acquisition accelerates Synthetix’s push in the direction of a number one Ethereum mainnet perps engine, by integrating Derive’s capabilities and group into the core protocol. Key advantages embrace:

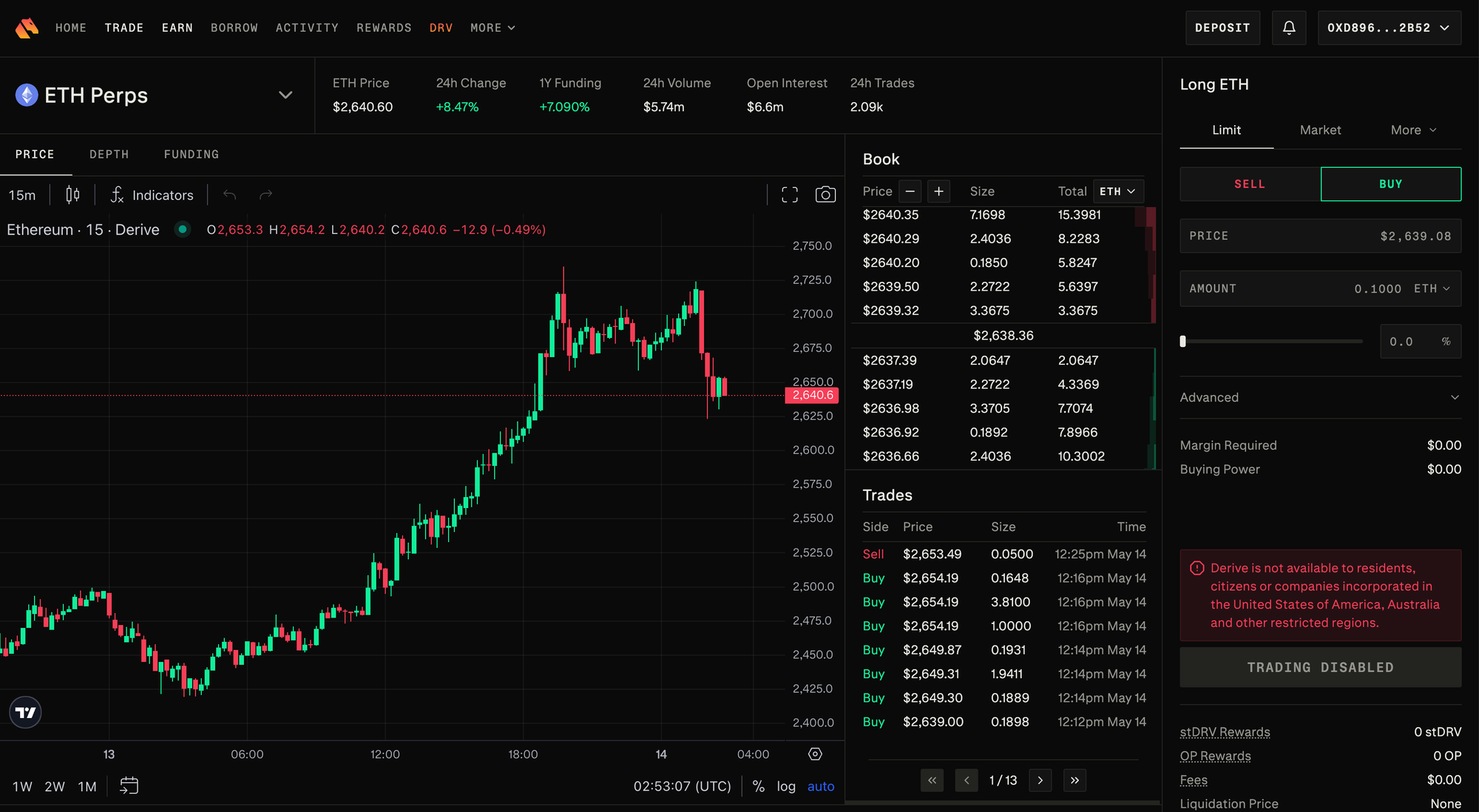

- Product Suite Growth: Derive’s CLOB-based perpetuals change, delivering a hybrid decentralised derivatives stack with superior Choices Buying and selling infrastructure on the desk which will be merged with Synthetix to rival Hyperliquid, Binance, Deribit, and dYdX.

- Tech & Workforce Integration: The Derive group, (a few of whom are Synthetix OGs already) deliver vital expertise in modular CLOB design, L1/L2 methods, and choices mechanics: all straight complementing Synthetix DNA and roadmap.

- Accelerated Deployment: With Derive’s app-chain primarily based stack production-ready, the mainnet deployment of the CLOB change can start instantly after acquisition shut.

- Group and Governance Consolidation: Derive and Synthetix communities share frequent roots and values. This transfer unites us below a single token, governance construction, and go-to-market technique, enhancing each community results and operational readability.

- Worth Creation: With all protocol merchandise and income now flowing by way of a single token, the funding thesis turns into stronger and less complicated. What could possibly be higher as we deal with bringing extra worth to Ethereum mainnet through the SNX token.

Reuniting the Tribe

Launched initially as Lyra, Derive emerged from Synthetix throughout a interval when the protocol deprioritised direct product improvement in favour of supporting exterior integrators. That mannequin led to fragmentation and misaligned incentives throughout the ecosystem.

The previous six months have reversed that trajectory. With a renewed deal with product velocity, protocol-level capital effectivity, and ecosystem consolidation, Synthetix has returned to constructing primitives straight—beginning with the re-acquisitions of Kwenta and TLX, and now, Derive.

“Derive was born from the identical DNA,” stated Kain Warwick, founding father of Synthetix. “Reuniting below one banner simplifies our structure and governance and unlocks the subsequent section. That is the children going out to construct their very own profitable start-ups, and coming again to hitch the household enterprise ”

Again to First Ideas

This acquisition displays our return to what made Synthetix highly effective within the first place: vertical integration, token-aligned incentives, and world-class on-chain merchandise. Constructed and owned by the protocol itself.

Choices, perps, app-chains, and vaults; deployed natively, ruled on-chain, and executed with urgency.

“By returning to Ethereum for its credible neutrality, composable settlement, and trusted self-custody, Synthetix’s redemption path is about to return to being a market-leading decentralised derivatives platform.” – Ben “Fenway” Celermajer

What’s Subsequent

The proposal is topic to approval by each governance our bodies: the Spartan Council and Derive token holders, by way of the Synthetix SIP and Derive DIP governance processes, respectively. Upon approval, Derive’s treasury, mental property, repos, UI stack, and governance methods might be merged into the Synthetix protocol. DRV holders will obtain SNX below the agreed vesting phrases, aligning long-term incentives throughout the unified community.