Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin continues to be buying and selling across the $103,000 mark, though the upward momentum it began in Might has exhibited a slowdown prior to now seven days. Though a short-term volatility is at present taking part in out, the long-term outlook is undoubtedly bullish.

Associated Studying

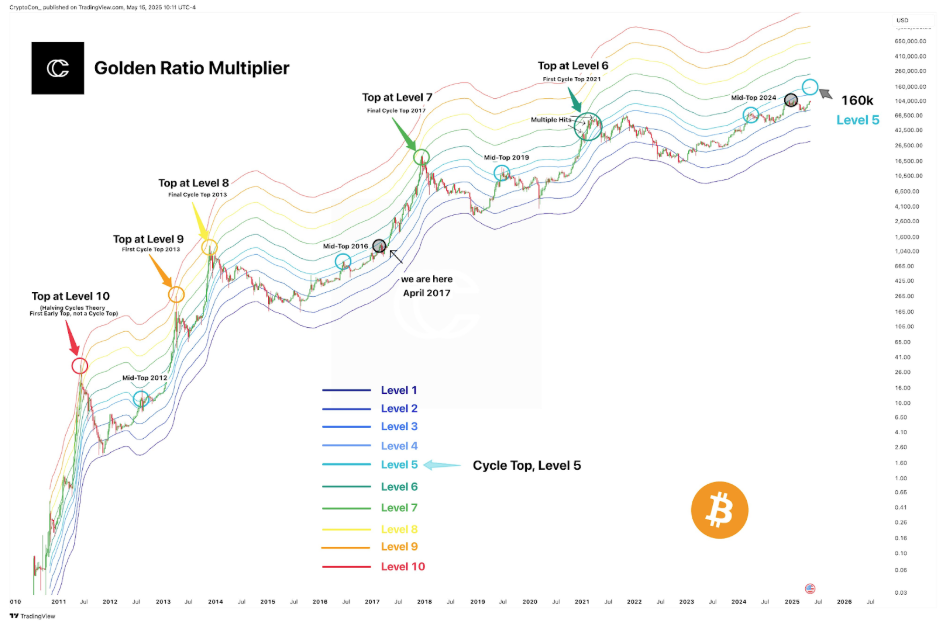

Some analysts want to long-term cycle indicators for path. One such device, the Golden Ratio Multiplier, which referred to as the Bitcoin high in 2021, has resurfaced with one other fascinating high for the present Bitcoin cycle.

Golden Ratio Multiplier Recognized 2021 Prime, Now Factors To New Peak

Taking to a submit on social media platform X, widespread crypto analyst CryptoCon highlighted the reliability of the Golden Ratio Multiplier in predicting Bitcoin’s value high in every cycle. The Golden Ratio Multiplier is a logarithmic mannequin that comes with Fibonacci-derived multipliers to anticipate Bitcoin’s macro developments.

Notably, this metric was among the many few to precisely name the April 2021 cycle high in actual time, the identical because the 2017 and 2013 value tops. This cycle, the mannequin has already flagged a major peak in March 2024, though the crypto analyst interpreted this not as the ultimate excessive however as a mid-top.

CryptoCon defined that Bitcoin’s value motion has already hit Stage 4 of the multiplier chart this cycle, however this isn’t the ultimate peak. “We’ve already hit our cycle high stage this cycle as soon as, however this was for the cycle mid-top in March 2024, which implies we’re certain to do it once more,” he wrote.

The Stage 5 band now sits round $160,000 and continues to development upward. Drawing a parallel to previous cycles, CryptoCon famous that the construction of the present cycle exhibits sturdy similarities to the 2015 to 2017 interval, when Bitcoin noticed a gradual build-up adopted by an explosive breakout.

Based mostly on this comparability, the present market section is seen as equal to April 2017, proper earlier than Bitcoin went on a rally within the months that adopted.

Golden Multiplier Ratio Suggests $160k Is Subsequent Main Goal

The chart accompanying CryptoCon’s submit paints a well-known image with the Golden Multiplier Ratio. Every band, starting from Stage 1 to Stage 10, is predicated on a multiplier stage derived from the 350-day transferring common. Bitcoin has topped at varied ranges: Stage 10 in 2011, Stage 9 and eight in 2013, Stage 7 in 2017, and Stage 6 in 2021. The present cycle’s peak ought to almost certainly be Stage 5, however the Bitcoin value is but to get there.

Associated Studying

Ought to the market proceed to respect this construction, Bitcoin could possibly be making ready for a rally towards the Stage 5 mark of $160,000 someday later within the yr, which may mark the ultimate excessive of this cycle. The present vary round $103,000 might be the calm earlier than the ultimate breakout. “Slower buildup, then all of sudden,” the analyst stated.

On the time of writing, Bitcoin was buying and selling at $102,971.

Featured picture from Unsplash, chart from TradingView