Breakout Field Sentinel

System Logic

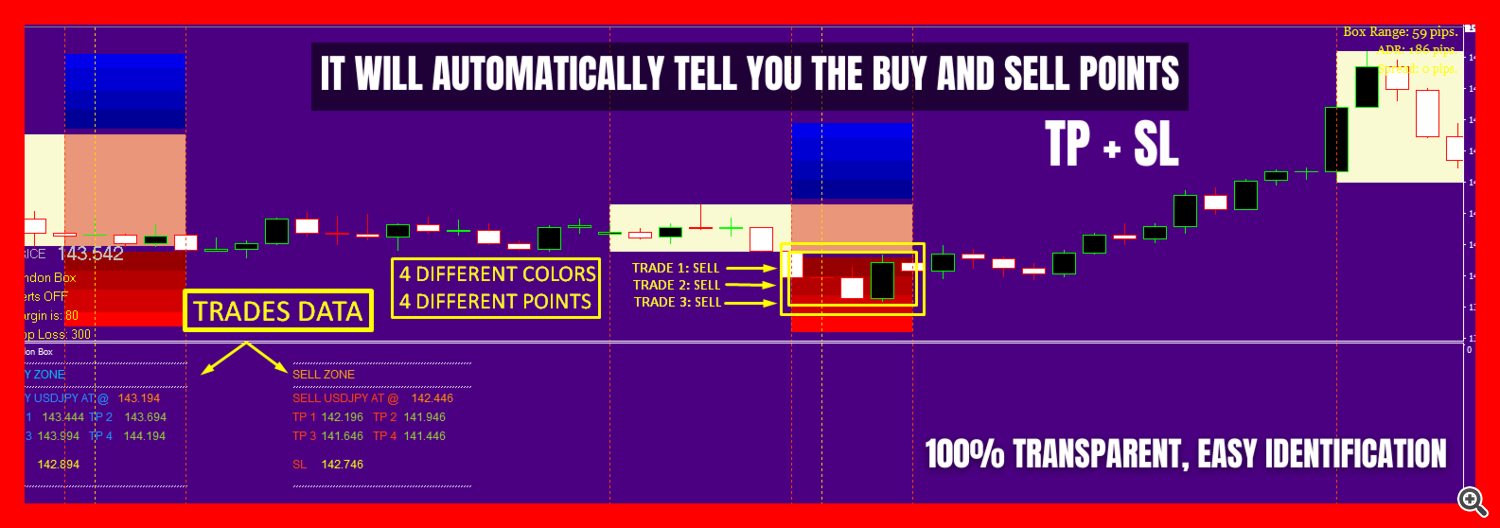

Breakout Field Sentinel will not be a easy overlay. It’s a structural instrument that detects directional dedication by way of breakout zones generated by worth compression. Not like conventional indicators that clean or generate visible noise, this method identifies volatility-driven conduct inside a clear, session-aware framework.

How It Works

As a substitute of following lagging alerts, Breakout Field Sentinel observes imbalances in worth construction fashioned by repetitive patterns. These zones act as preconditions for enlargement, permitting merchants to visualise entry eventualities with out anticipation. Its logic relies on volatility impulses and worth response to key zones.

Session-Based mostly Adaptation

Market conduct adjustments with liquidity circumstances. This indicator adjusts routinely to international periods—Asia, London, and New York—highlighting zones based mostly on every session’s typical dynamics. What you see is all the time time-contextualized.

Constructed for Actual Merchants

In case you commerce with worth motion, candle construction, or clear setups, this method will really feel pure. It provides readability with out noise, and enhances your discretion with out overriding it.

FAQ

Does it repaint?

No. As soon as alerts are confirmed, they’re fastened and don’t change after the candle closes.

Can it’s used on any timeframe?

Sure. It really works significantly nicely on M15–H1 charts however is adaptable to any timeframe.

Which belongings are advisable?

It performs finest on unstable pairs like XAUUSD, GBPJPY, and indices, particularly throughout session overlaps.

Is it appropriate for rookies?

It’s designed for merchants with a primary understanding of breakout construction and session dynamics. It doesn’t train a technique however strengthens one.

Can I backtest it visually?

Completely. Alerts don’t repaint, so historic analysis is dependable.