KEY

TAKEAWAYS

- Market declined 2-2.5% final week, however nonetheless modifications chart dynamics

- Know-how sector enters prime 5, pushing out Client Staples

- Industrials stays top-ranked, pushing in opposition to all-time highs

Know-how Again in High-5

Final week’s market decline of 2-2.5% (relying on the index) has led to some notable shifts in sector efficiency and rankings.

This pullback, coming after a powerful rally, is altering the order of highs and lows on the weekly chart — a very important improvement, at the least for me.

Let’s dive into the main points and see what’s flying round available in the market.

The composition of the highest 5 sectors has seen some notable modifications. Here is the way it stands now:

The large shock right here is Know-how making its means into the highest 5, displacing Client Staples (now at #6). This shift suggests a gradual transfer from a extra defensive positioning to sectors which might be extra cyclical and economically delicate.

One other eye-catching transfer comes from Client Discretionary, leaping from #10 to #7 — a major leap, albeit nonetheless within the backside half of the rating. Actual Property and Supplies noticed minor shifts, whereas Vitality dropped to #10 and Well being Care stays at #11.

- (1) Industrials – (XLI)

- (4) Communication Providers – (XLC)*

- (3) Utilities – (XLU)

- (2) Financials – (XLF)*

- (6) Know-how – (XLK)*

- (5) Client Staples – (XLP)*

- (10) Client Discretionary – (XLY)*

- (7) Actual-Property – (XLRE)*

- (8) Supplies – (XLB)*

- (9) Vitality – (XLE)*

- (11) Healthcare – (XLV)

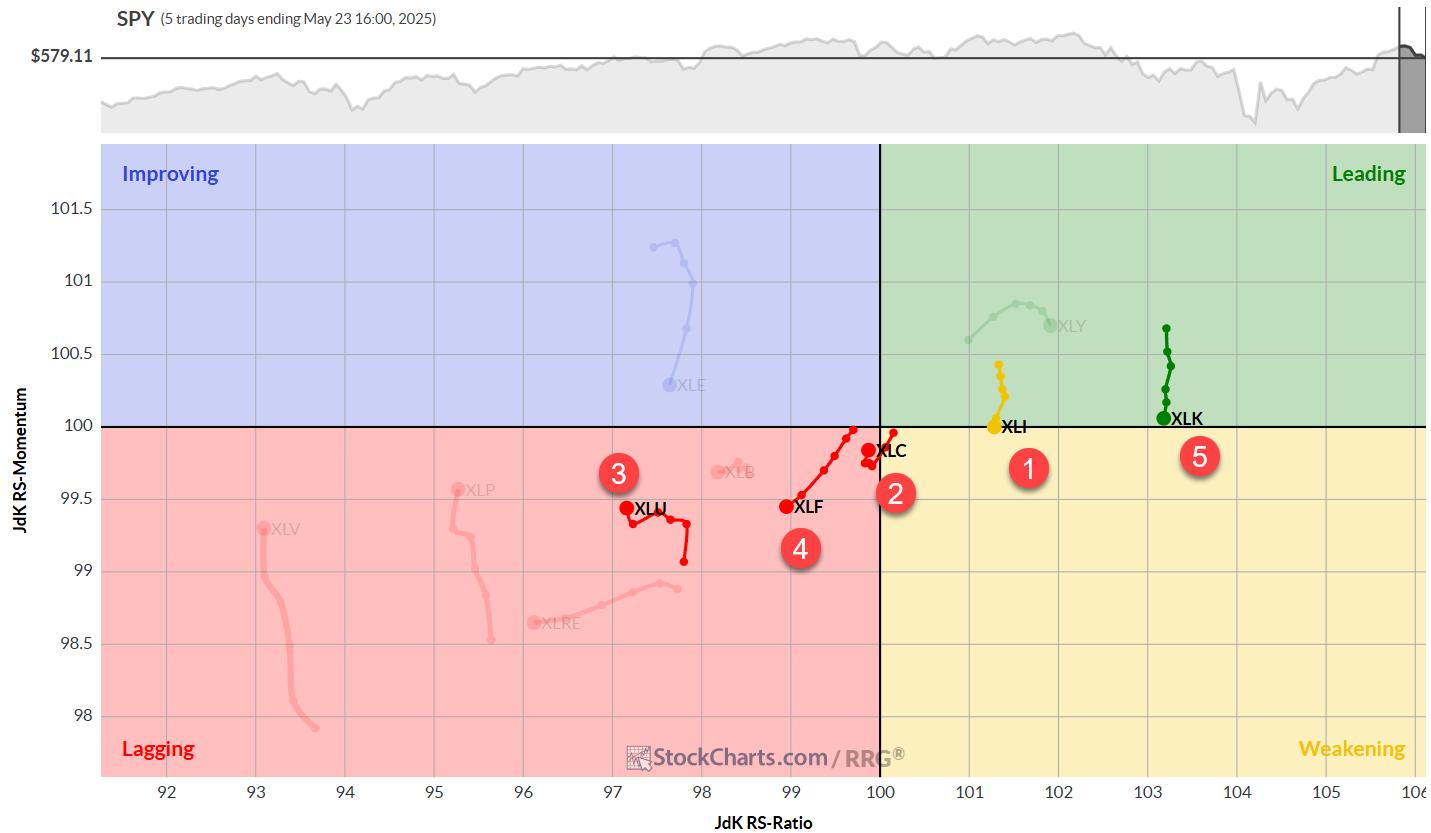

Weekly/Every day RRG Evaluation

The weekly Relative Rotation Graph (RRG) offers some attention-grabbing insights:

- Utilities maintains very excessive readings, however Client Staples (highest on RS-Ratio rating) is more likely to be pushed down by weak every day chart readings.

- Industrials continues to push additional into the main quadrant with steady momentum.

- Financials and Communication Providers are contained in the weakening quadrant however have room to twist again in the direction of main.

- Know-how, regardless of having the second-lowest RS-Ratio studying, is quickly bettering with a powerful RS-Momentum heading over current weeks.

Keep in mind, the rating combines every day and weekly readings.

Know-how’s excessive every day chart studying is propelling it into the highest 5, whereas Client Staples’ weak every day studying is pushing it out.

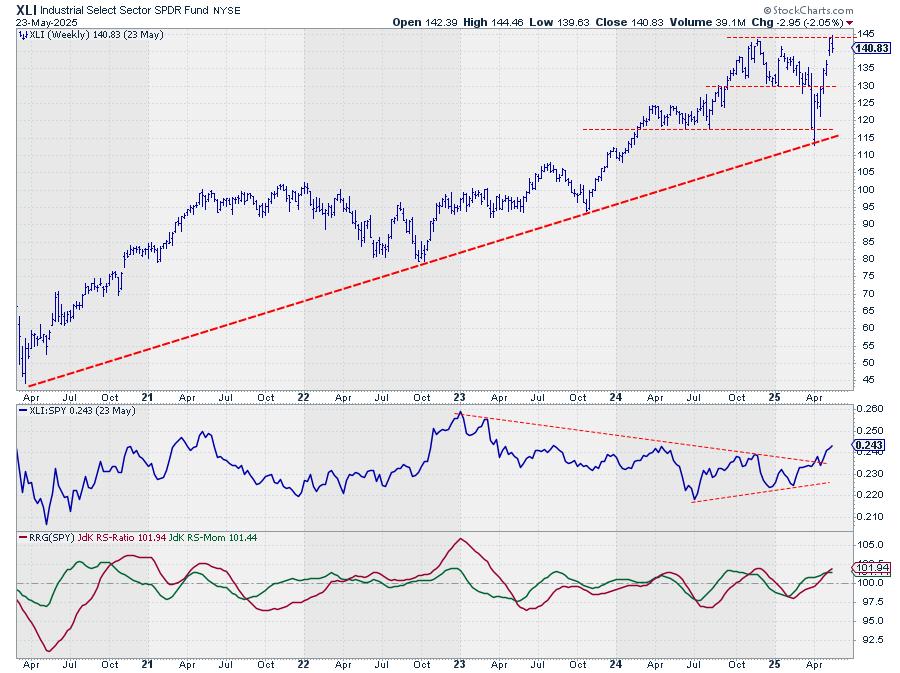

Industrials: The Chief Holding Sturdy

XLI is now pushing in opposition to its all-time excessive, slightly below 145. After two weeks of makes an attempt, final week’s slight market decline confirms that this resistance degree has labored.

We’re now on the lookout for the place any potential decline would possibly cease and type a brand new low. The hole space from two weeks in the past appears to be a very good help space to look at.

The relative energy line breaking out of its consolidation formation continues to pull the RRG traces greater. XLI, for good motive, stays the strongest sector in the meanwhile.

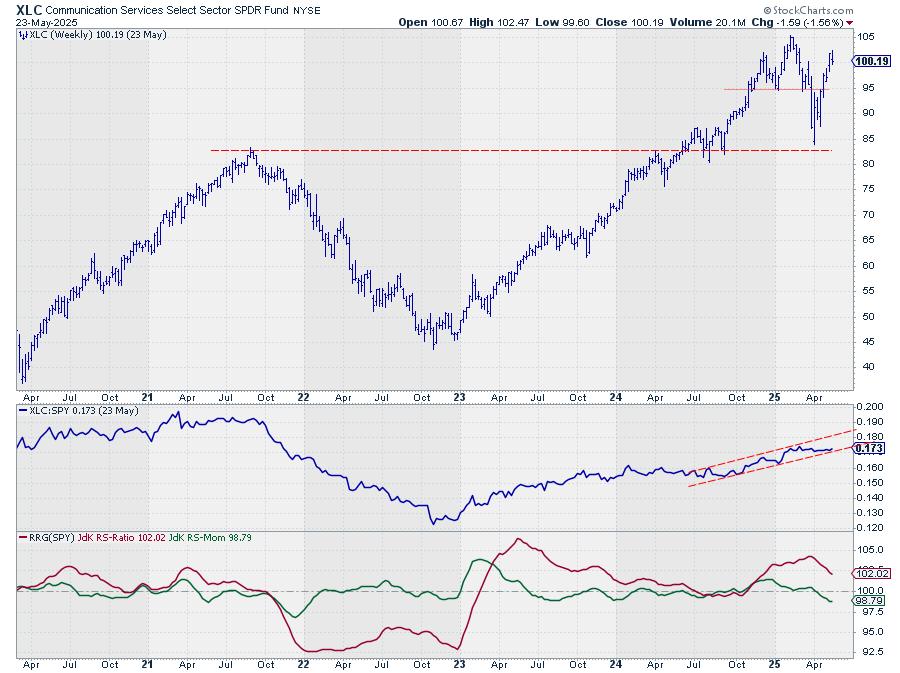

Communication Providers: Steady Relative Uptrend

XLC is continuous its transfer greater with exceptional stability. The uptrend within the RS line continues to be legitimate, presently testing the decrease boundary of the rising channel.

As a result of lack of upward relative momentum in current weeks, each RRG traces are actually pointing decrease.

Nonetheless, the RS-Ratio line stays effectively above 100, maintaining the XLC tail on the right-hand facet of the RRG.

Utilities: Testing Resistance

XLU is pushing in opposition to overhead resistance however has but to handle a decisive break greater.

With defensive sectors beneath strain, it is questionable whether or not this breakout will occur within the brief time period.

The RS line versus SPY is dropping again into its buying and selling vary, unable to interrupt away decisively. This drop is inflicting the RS-Momentum line to roll over and begin pointing decrease.

It is the current energy in relative energy that is maintaining Utilities contained in the main quadrant for now.

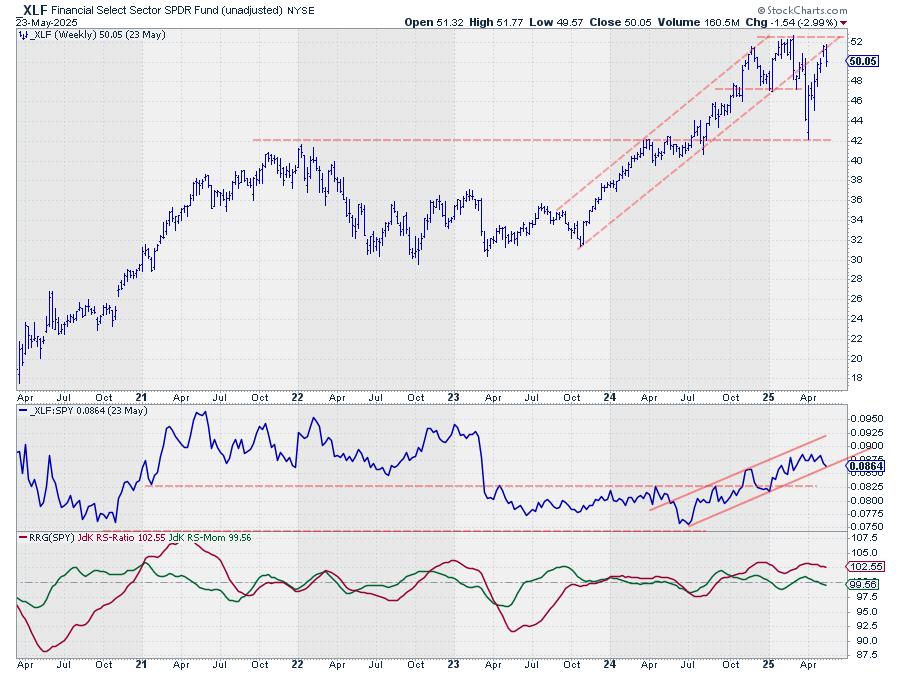

Financials: At a Crossroads

The Monetary sector appears to be respecting the outdated rising help line as resistance, with the market dropping off that line final week and now buying and selling round $50.

This transfer is affecting the relative energy line, which has returned to the decrease boundary of the rising channel — a degree that should maintain to keep up a optimistic outlook for XLF.

The RS-Ratio line is steady round 102.50, excessive sufficient to maintain Financials on the right-hand facet of the graph.

The RS-Momentum line has simply dropped under 100, positioning the XLF tail contained in the weakening quadrant, however with sufficient room to twist again up earlier than hitting lagging.

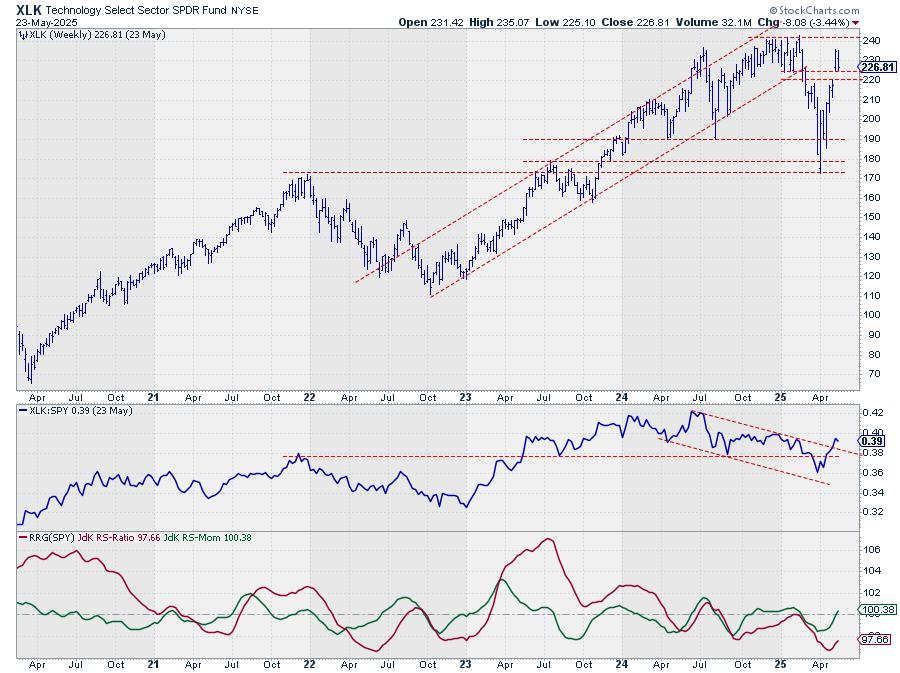

Know-how: The Week’s Winner

XLK noticed a major leap two weeks in the past and has since returned to check the outdated resistance space as help. If final week’s decline continues, there is a bit extra room to the draw back — $220 appears to be a very good degree to look at for help, marking the underside of the hole vary from two weeks in the past.

The leap has pushed the relative energy line above its falling resistance line, a very good signal that appears to be breaking the relative downtrend in place since mid-last yr.

That is altering the traits of the relative energy transfer for the Know-how sector.

For now, it has solely pushed the RS-Momentum line above 100, transferring XLK into the bettering quadrant on the weekly RRG, nevertheless it’s already beginning to drag the RS-Ratio line greater.

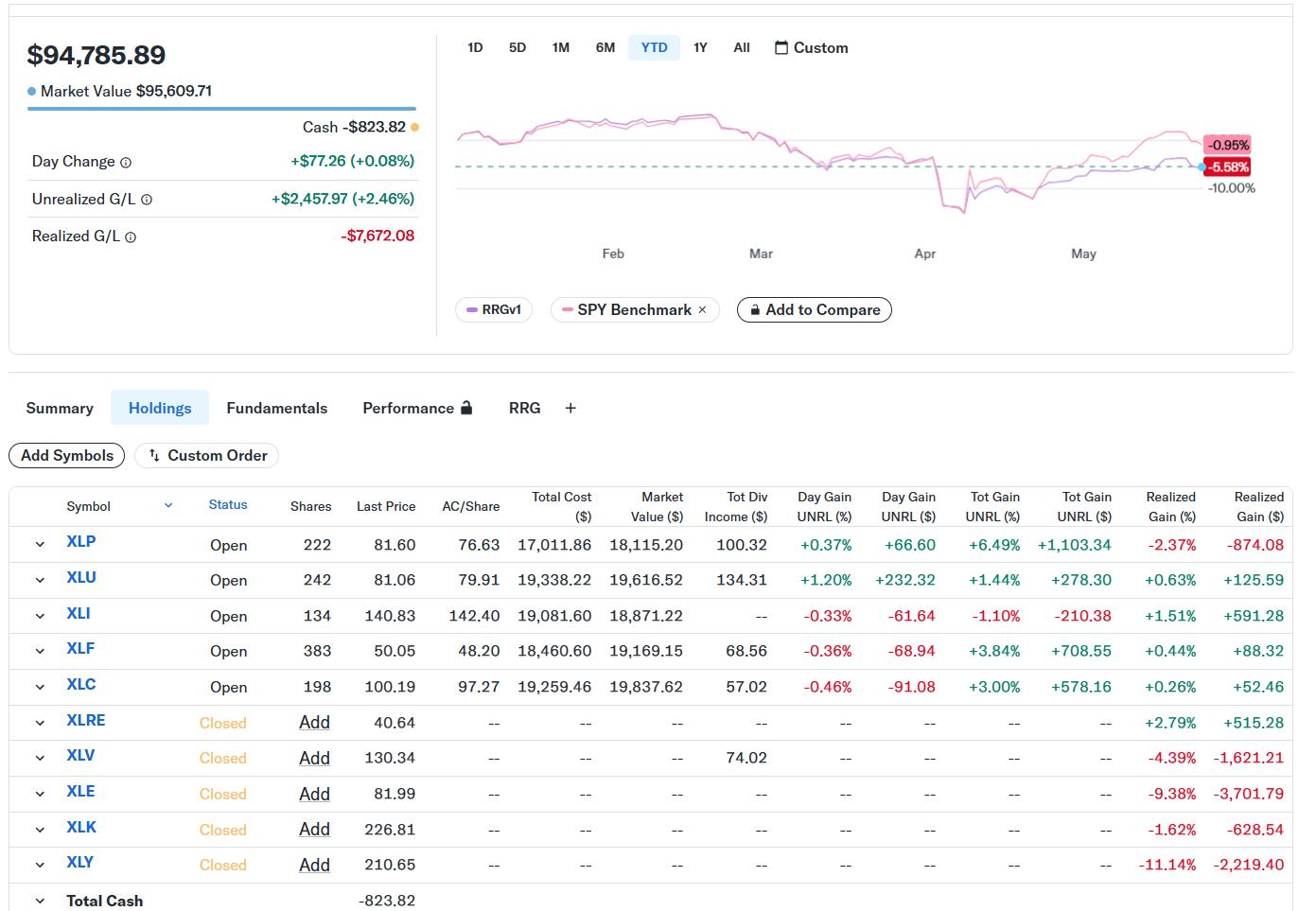

Portfolio Efficiency

We’re clawing again a few of the losses from current weeks. The underperformance of just about 6% final week has now shrunk to 4.6%. Nonetheless behind the benchmark, however closing in once more and narrowing the hole.

It is a long-term recreation, so we preserve pushing ahead. To date, nothing out of the bizarre. Let’s wait and see whether or not we have seen the low in underperformance and the way lengthy it’s going to take to return to SPY’s efficiency since inception.

#StayAlert –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to each message, however I’ll definitely learn them and, the place moderately potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Study Extra