KEY

TAKEAWAYS

- The inventory market is consolidating, leaving traders unsure about its subsequent transfer.

- The Know-how sector has regained management, however is not exhibiting sufficient momentum to observe by way of.

- The upcoming non-farm payrolls may decide whether or not the market breaks greater or pulls again.

Lots has occurred within the inventory market since Liberation Day, holding us on our toes. Volatility has declined considerably, shares have bounced again from their April 7 low, and the financial system has remained resilient.

Lots has occurred within the inventory market since Liberation Day, holding us on our toes. Volatility has declined considerably, shares have bounced again from their April 7 low, and the financial system has remained resilient.

Should you’re nonetheless feeling unsure, although, you are not alone. The inventory market’s in a little bit of a “wait and see” mode, going by way of a interval of consolidation because it figures out its subsequent transfer.

The S&P 500 ($SPX) is hesitating to hit 6000 regardless of reclaiming its 200-day easy shifting common (SMA). This indecision can go away traders feeling caught in “no man’s land.” And it isn’t simply the S&P 500, both; most main indexes are in an analogous situation, apart from small caps, which have been left behind. This may very well be as a result of the market has priced in a delay in rate of interest reduce expectations.

Tech Is Taking the Lead

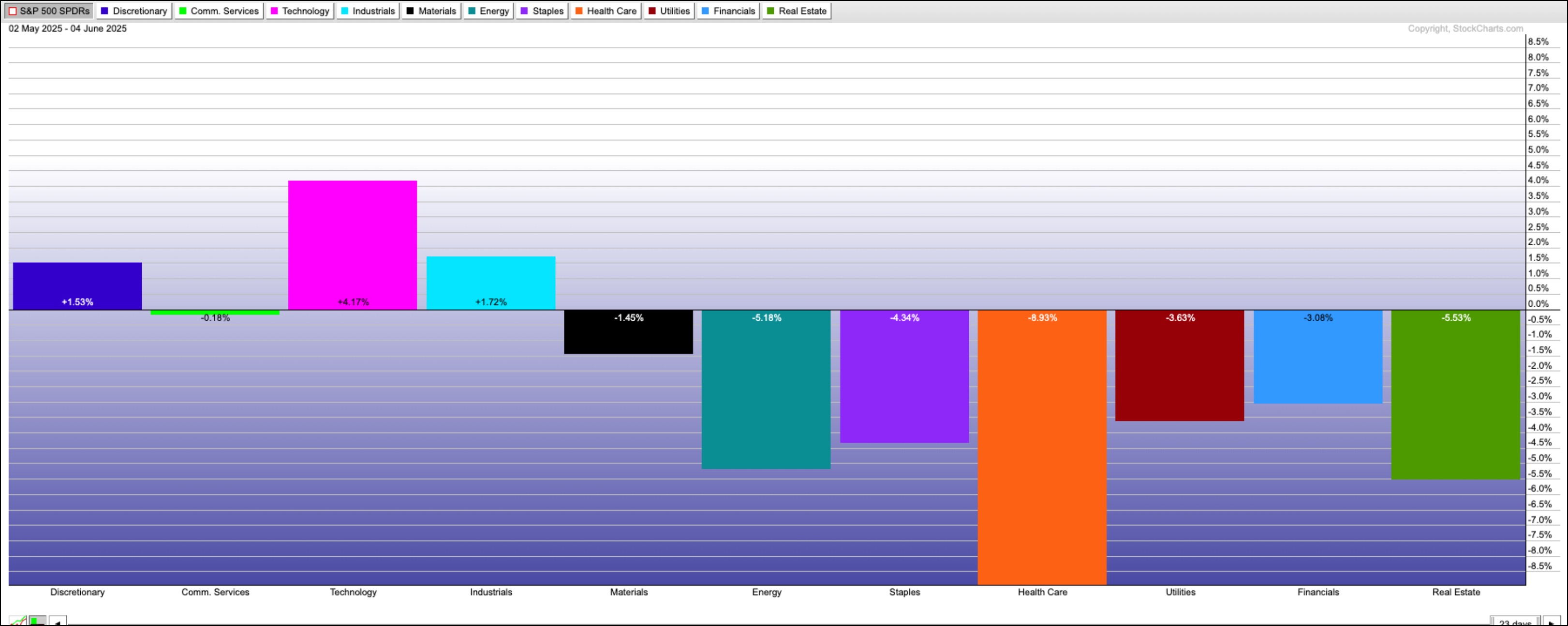

Should you drill down into the main indexes, there may be some motion you should not ignore. Tech shares have began to take the lead once more, though momentum has been missing. Over the previous month, the Know-how sector has been up over 4%.

FIGURE 1. S&P SECTOR ETF PERFORMANCE OVER THE LAST 30 DAYS. Know-how is the clear chief with a acquire of over 4%.Picture supply: StockCharts.com. For academic functions. It is encouraging to see tech shares regain their management place. Tech is a significant power behind the S&P 500 and Nasdaq Composite ($COMPQ). The every day chart of the Know-how Choose Sector SPDR Fund (XLK) reveals the ETF has been attempting to interrupt above a consolidation vary it has been caught in since mid-Might.

FIGURE 2. DAILY CHART OF XLK. Though the ETF has barely damaged above its consolidation vary, we have to see larger momentum to verify a observe by way of to the upside.Chart supply: StockCharts.com. For academic functions.Nothing is standing in the best way of XLK reaching its all-time excessive, however the momentum is not fairly there but. The 14-period relative energy index (RSI) is under 70 and appears to be stalling, just about in step with the general inventory market’s value motion.

So, what is the market ready for? Possibly a catalyst, like Friday’s non-farm payrolls report. This week’s JOLTS, ADP, and ISM Providers knowledge did not transfer the needle a lot, however the NFP report may very well be the sport changer.

S&P 500 Technical Forecast

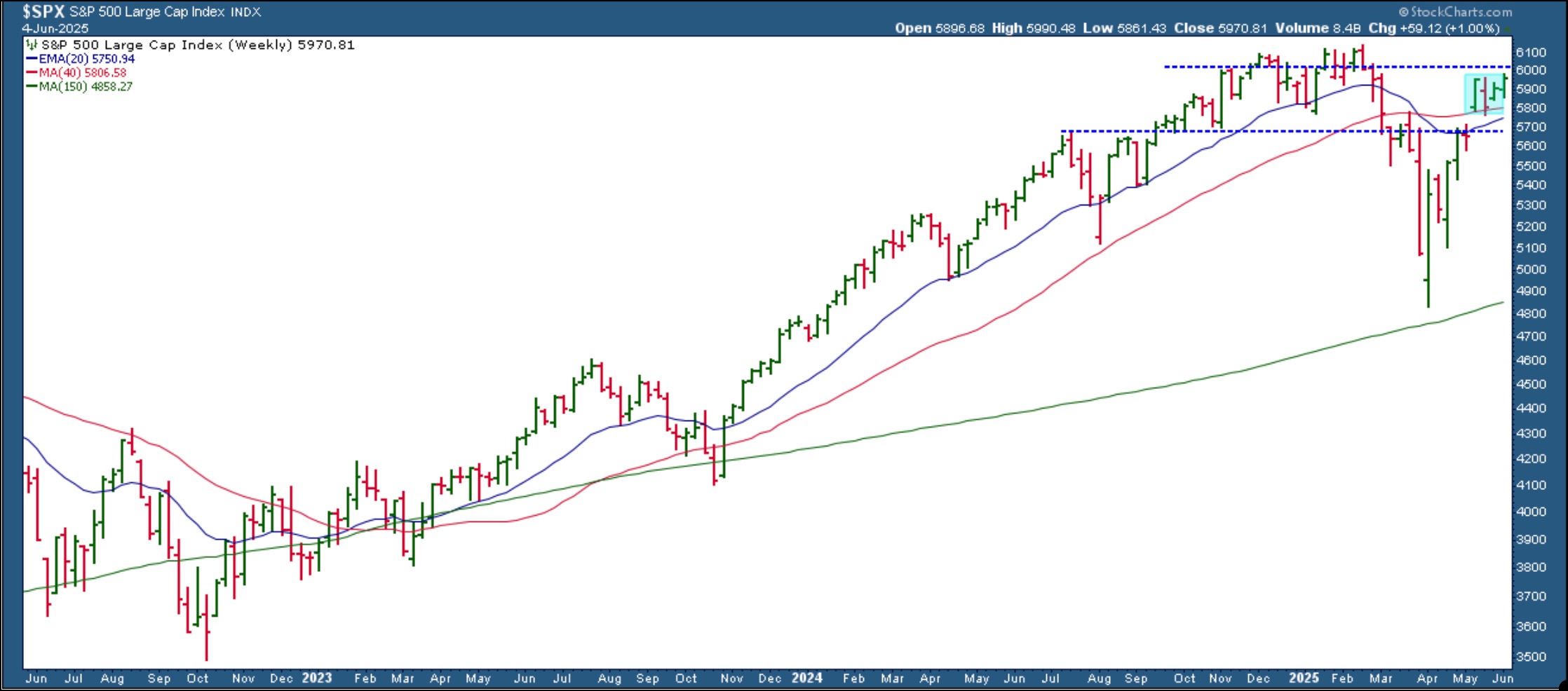

The place may the S&P 500 go from right here? Let’s dive into the weekly chart.

FIGURE 3. WEEKLY CHART OF THE S&P 500. The index is spitting distance to its all-time excessive. A break above the November excessive would clear the trail to new highs.Chart supply: StockCharts.com. For academic functions.

The S&P 500 broke above its 40-week SMA on the week of Might 12 and has held above it. Nonetheless, it has been in a consolidation for the final month, much like that of XLK.

The S&P 500 is approaching its November excessive of 6017. A break above it may push it towards new highs. On the flip aspect, if it slides under the 40-week SMA, it could be a trigger for concern and will imply the Might 12 gap-up may get stuffed. Regulate the 5688 degree. If the S&P 500 pulls again near that degree and turns round, it could be a wholesome correction — a chance to purchase the dip. An additional draw back transfer would imply exercising persistence or unloading a few of your positions.

What’s Going On With Gold and Bonds?

Whereas shares are grinding sideways, gold costs are rising, and bond costs are exhibiting inexperienced shoots. This value motion tells us that traders may very well be bracing for slower progress forward. It isn’t one thing to panic about — simply one thing to observe.

You will get a fast take a look at what gold, bonds, and all the main indexes are doing by testing the StockCharts Market Abstract web page and Your Dashboard.

So, what must you do?

Maintain, add, or fold? That is the massive query. The market wants time to digest rather a lot, from financial knowledge to geopolitical dangers and coverage headlines. Preserve checking in and monitor the sectors, observe index efficiency, and be aware how different areas of the market, similar to treasured metals and bonds, are reacting.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra