Solana (SOL)

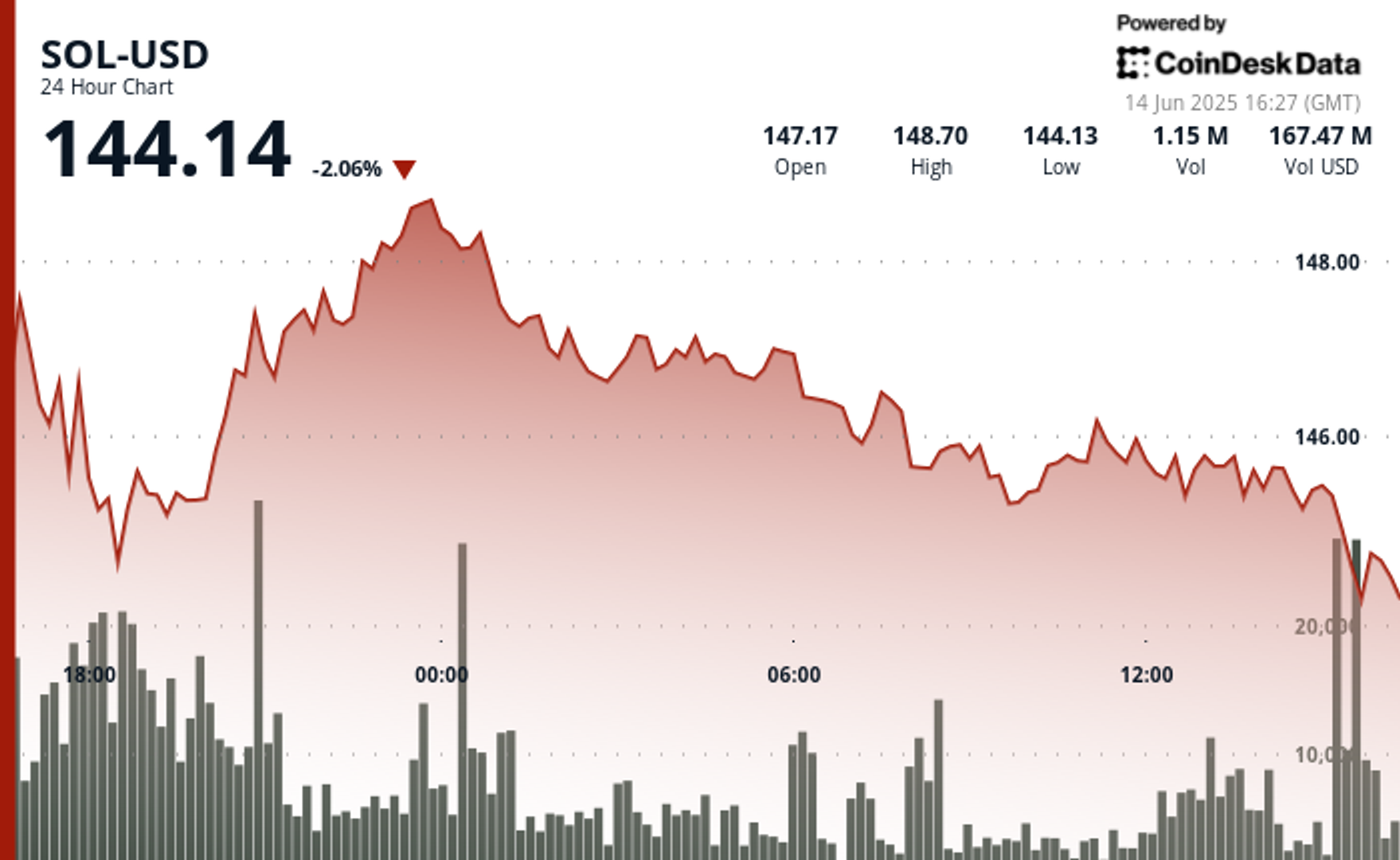

traded at $144.14 on June 14, down 2.06% over the previous 24 hours, however confirmed resilience as long-term institutional exercise offset retail-driven weak spot. Worth motion stays pinned close to the decrease finish of its current $145–$149 consolidation zone, following a broader multi-day correction throughout crypto markets tied to rising geopolitical rigidity.

Regardless of current weak spot, two main institutional developments recommend deepening engagement with the Solana ecosystem.

First, Bloomberg’s James Seyffart confirmed on Friday that this week that every one seven spot Solana ETF issuers — i.e. together with Constancy, Grayscale, VanEck, 21Shares, Franklin, Bitwise and Canary Marinade —submitted up to date S-1 filings with the SEC. Every submitting now consists of staking provisions, making them structurally aligned with solana’s on-chain economics.

Second, DeFi Growth Corp, a Nasdaq-listed Solana treasury agency, introduced on Thursday that it entered right into a $5 billion fairness line of credit score (ELOC) settlement with RK Capital. The power permits DeFi Dev Corp to situation shares step by step to fund extra SOL accumulation, moderately than counting on a single, fixed-price providing.

This follows a minor regulatory setback: on Wednesday, the corporate utilized to the SEC for the withdrawal of registration assertion on Type S-3. It mentioned it needed to withdraw a previous S-3 submitting attributable to technical eligibility points flagged by the SEC. The agency mentioned it might file a resale registration assertion sooner or later to boost the capital it wants.

Regardless of the submitting hiccup, the corporate emphasised its continued dedication to rising its SOL treasury, which at present holds over 609,190 tokens — valued at greater than $97 million. CEO Joseph Onorati mentioned in Thursday’s press launch that the brand new capital construction gives a “clear, strategic path” to scale publicity whereas compounding validator yield.

SOL’s value seems to be stabilizing as these institutional tailwinds strengthen, whilst retail exercise stays subdued.

Technical Evaluation Highlights

- SOL traded in a 24-hour vary of $4.57 (3.08%), from $144.13 to $148.70.

- Preliminary power light, with value drifting towards the $144 assist stage.

- Resistance stays agency close to $149, whereas short-term rejection hit $145.78.

- Excessive-volume promoting occurred between 13:41–13:47 UTC, with a pointy drop from $145.95.

- A quantity spike at 13:23 UTC aligned with the failed breakout.

- Whale accumulation continues under $146, although follow-through stays restricted.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.