KEY

TAKEAWAYS

- Supplies sector climbs to #5 in rankings, displacing Utilities

- Expertise maintains management, however Communication Companies and Financials present weak spot

- Every day RRG reveals potential for Supplies, warning wanted for Comm Companies and Financials

- Portfolio drawdown continues, at present 8% behind S&P 500 YTD

After a comparatively quiet week for the S&P 500, we’re seeing some attention-grabbing shifts in sector dynamics. Let’s dive into the newest rankings, RRG evaluation, and what it means for our portfolio technique.

Sector Shifts and RRG Insights: Supplies on the Transfer

The large information this week is the ascent of the Supplies sector, which has muscled its method into the highest 5 on the expense of the Utilities sector.

The remainder of the highest 5 remained regular, however we’re seeing some motion within the decrease ranks as nicely. Shopper Discretionary made a notable soar from #9 to #7, pushing Shopper Staples and Actual Property down a notch every. Power and Well being Care proceed to deliver up the rear at #10 and #11, respectively.

- (1) Expertise – (XLK)

- (2) Industrials – (XLI)

- (3) Communication Companies – (XLC)

- (4) Financials – (XLF)

- (6) Supplies – (XLB)*

- (5) Utilities – (XLU)*

- (9) Shopper Discretionary – (XLY)*

- (7) Shopper Staples – (XLP)*

- (8) Actual-Property – (XLRE)*

- (10) Power – (XLE)

- (11) Healthcare – (XLV)

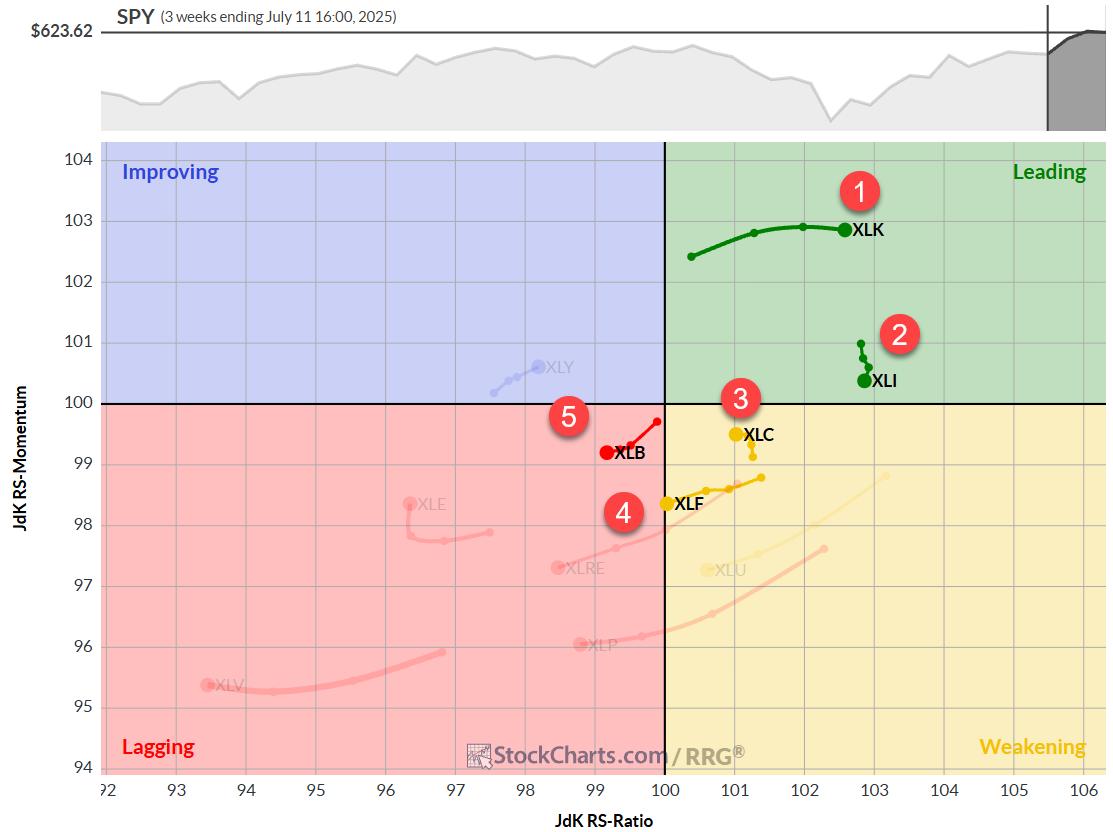

Weekly RRG

The weekly Relative Rotation Graph (RRG) provides us a broader perspective on sector traits. Expertise continues to dominate, firmly entrenched within the main quadrant, no surprises there.

Industrials is exhibiting stability with a brief tail within the main quadrant, indicating a constant relative uptrend.

Communication Companies, nevertheless, is elevating some eyebrows. It is lurking within the weakening quadrant with a brief tail, suggesting a steady relative uptrend however with unfavorable momentum.

Financials are teetering on the sting of the lagging quadrant, a transfer that calls for consideration.

Supplies, regardless of its rise within the rankings, is definitely within the lagging quadrant on the weekly RRG. You will note why it made its method into the highest 5 on the day by day RRG.

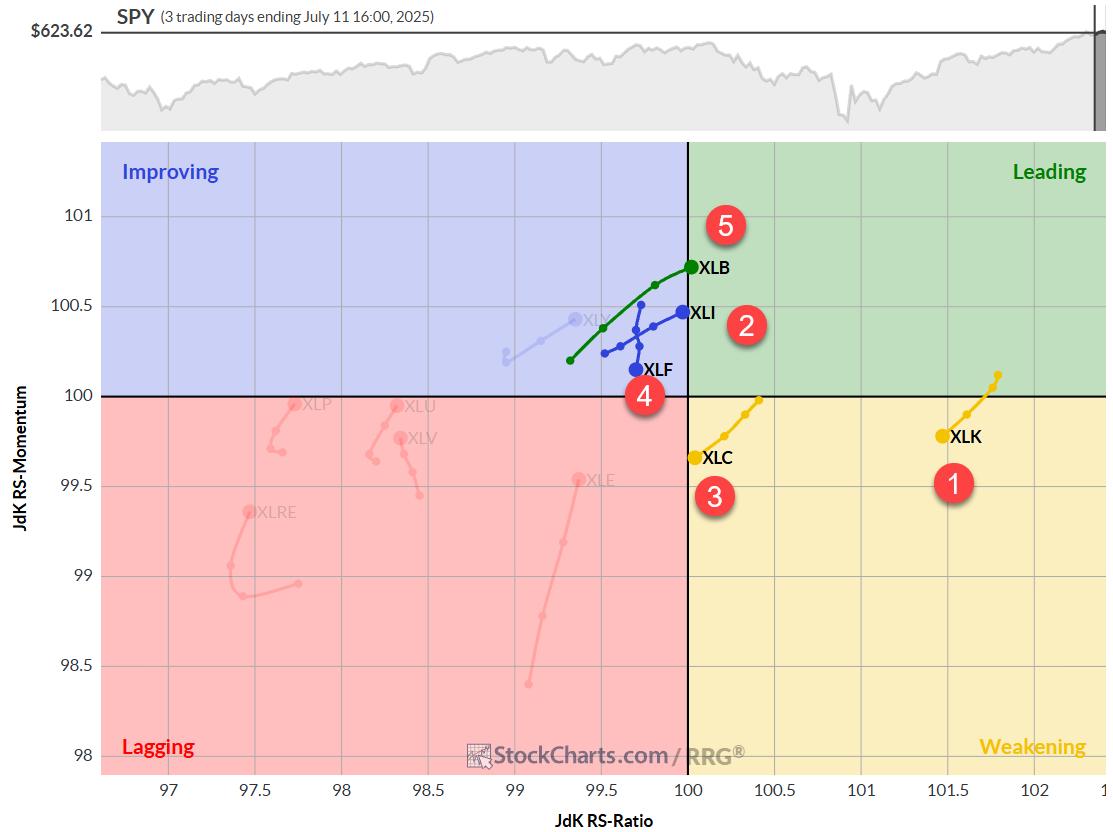

Every day RRG

On the day by day RRG, we get a extra nuanced image of short-term sector actions:

- Supplies (XLB) is the star of the present, crossing into the main quadrant and standing alone in that coveted area.

- Financials (XLF) is exhibiting weak spot, rolling over and heading again in direction of the lagging quadrant — confirming what we noticed on the weekly chart.

- Communication Companies is on the verge of crossing into the lagging quadrant, an indication that’s not nice for its present #3 rating.

- Industrials is flexing its muscle tissue, approaching the main quadrant with a optimistic heading.

- Expertise, whereas rotating into the weakening quadrant, nonetheless has ample room to bounce again into main territory.

Expertise

The tech practice continues to roll, breaking by resistance round 240 and sustaining its upward trajectory in each worth and relative energy. The RS line is pushing larger after a clear breakout from its falling development, a bullish signal for the sector chief.

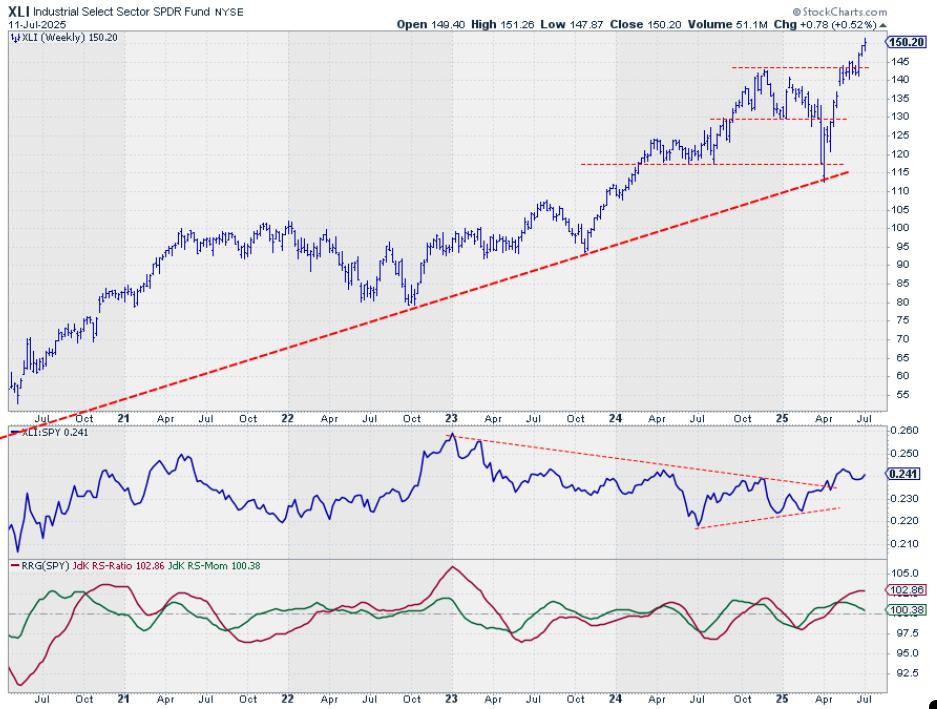

Industrials

XLI is following by properly on each worth and relative energy charts. The uncooked RS line has established a brand new larger low, dragging the RS ratio larger. In my view, this sector appears to be like rock-solid.

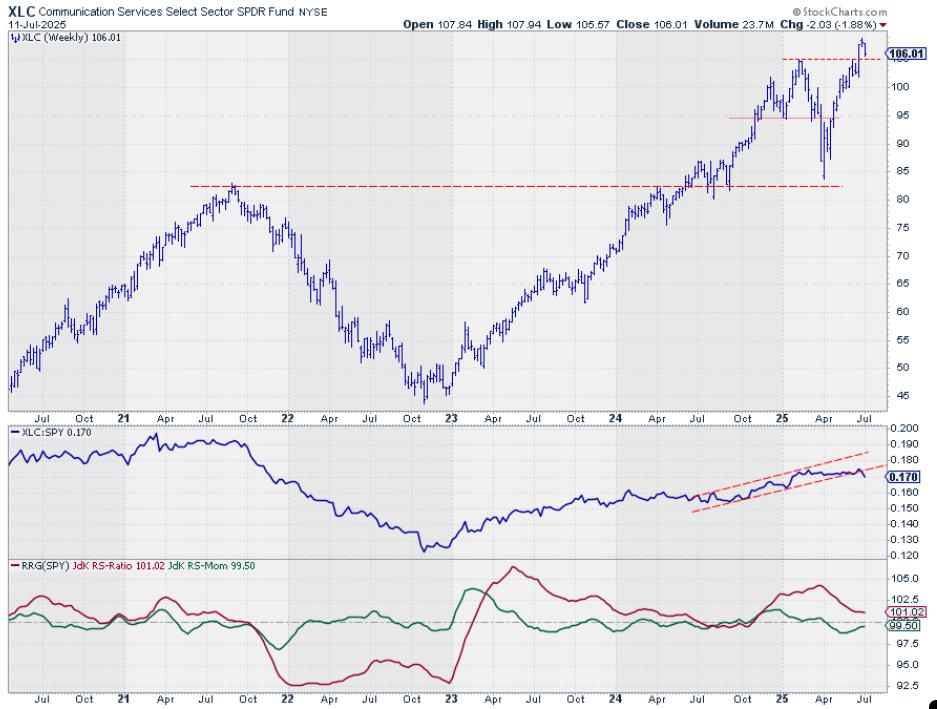

Communication Companies

Here is the place issues get dicey. XLC is clinging to its breakout above 105, however final week’s decline is testing that former resistance as new help. The uncooked RS line breaking beneath rising help is a warning signal, this sector might be in for a bumpy journey.

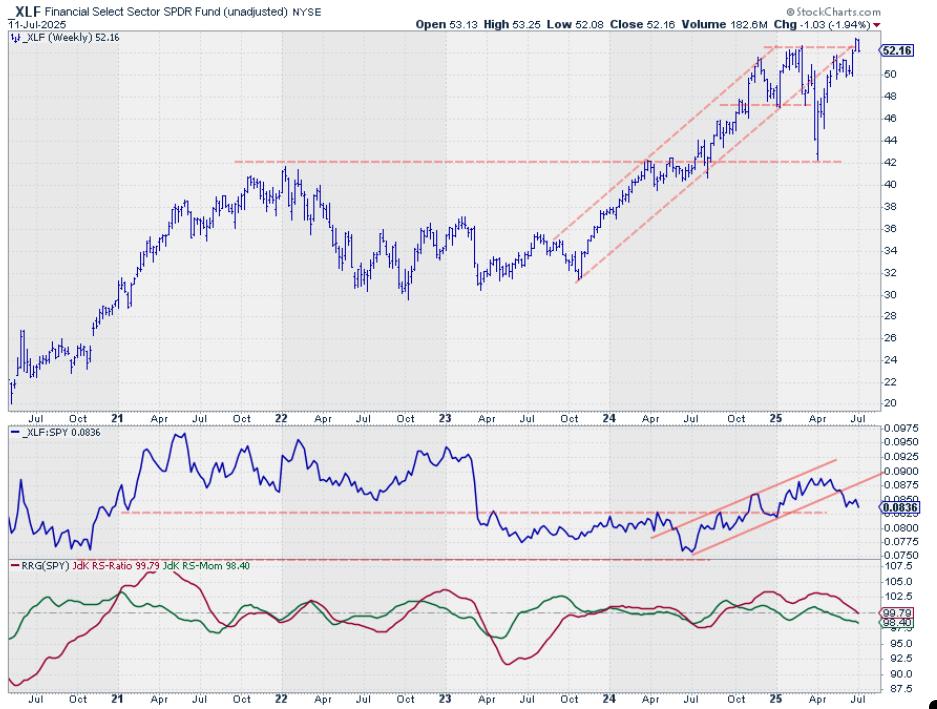

Financials

Much like Communications Companies, Financials has retreated to check previous resistance as help. The uncooked RS line appears to be like even worse right here, having damaged out of its rising channel weeks in the past. Each RRG traces are flirting with the 100 degree; an extra push into the lagging quadrant appears seemingly.

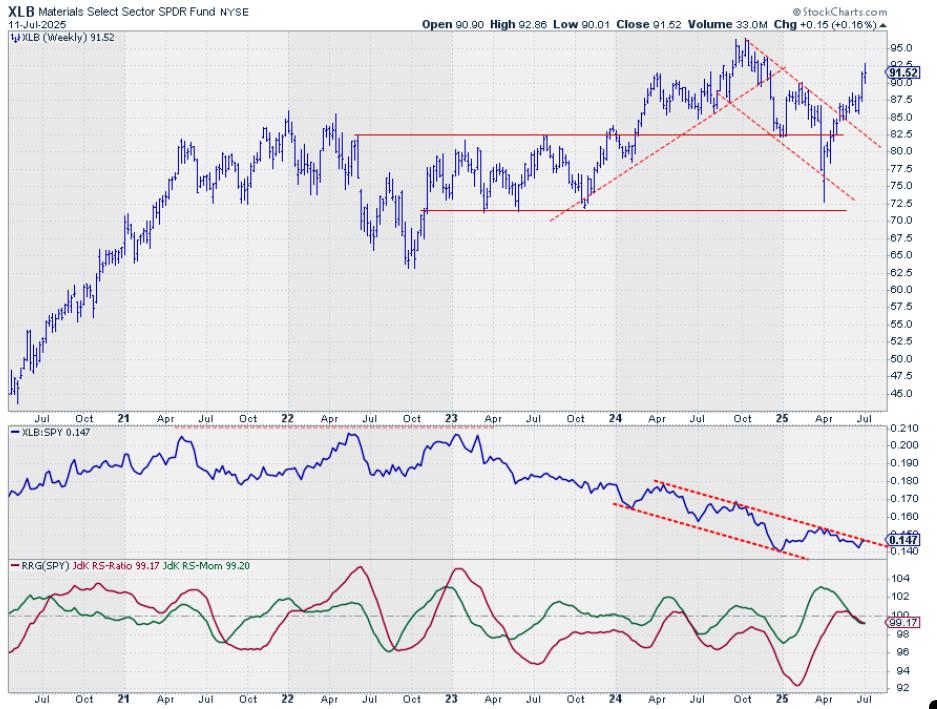

Supplies

XLB is exhibiting some muscle, breaking out of its falling channel and taking out current highs. The uncooked RS line is pushing in opposition to falling resistance — if it could possibly break by, we might see a major turnaround within the RRG traces, confirming the sector’s newfound energy.

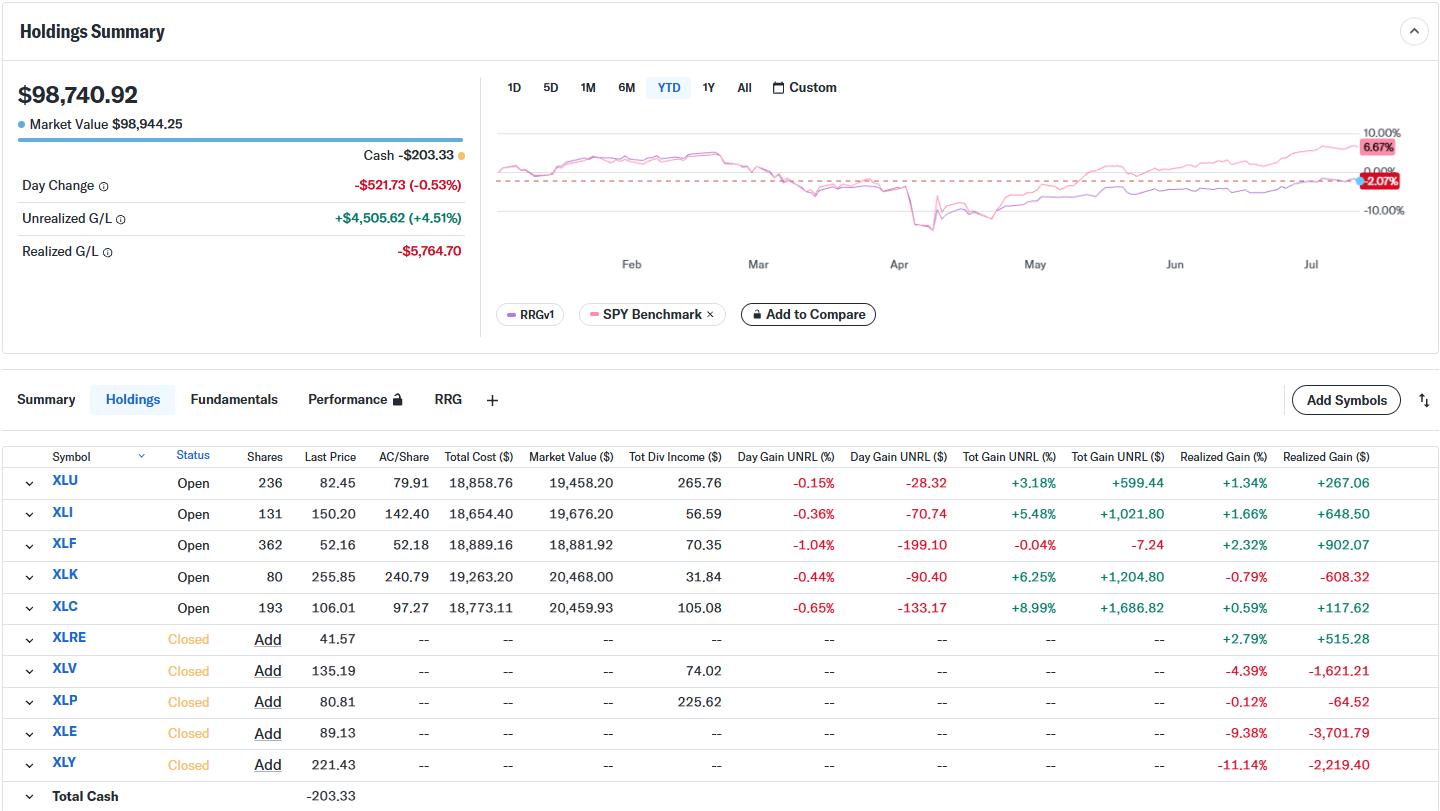

Portfolio Efficiency

Now, for the half which may sting a bit, the portfolio drawdown is ongoing. It is one thing development followers must study to dwell with. At present, the portfolio is down about 2% for the 12 months, whereas the S&P 500 is up over 6%. That places us roughly 8% behind the benchmark YTD.

It is not a snug place, nevertheless it’s a part of the sport. Development-following methods usually lag in uneven or quickly altering markets. The secret is to remain disciplined and belief within the long-term efficacy of our method.

#StayAlert and have an ideal week, Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels below the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to every message, however I’ll definitely learn them and, the place fairly attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra