In response to crypto analyst Cas Abbé, Dogecoin’s present motion suggests it’s entering into a brand new growth part after an prolonged interval of accumulation. This improvement comes after months of comparatively muted sentiment with robust value help, which now seems to be forming the groundwork for an additional robust breakout. Notably, technical evaluation of assorted charts monitoring Dogecoin’s hash fee, CVDD ranges, alpha pricing, and community stress index offers context to this technical outlook, which could see Dogecoin surge to new value highs.

Indicators Of An Enlargement Section In Dogecoin

Taking to the social media platform X, crypto analyst Cas Abbé defined a number of causes as to why the Dogecoin value is about to enter into an growth part. The first being that Dogecoin has been buying and selling inside a large accumulation vary previously few months. This base has been on the $0.20 value stage because the starting of August.

This kind of extended base-building is generally all the time recognized to precede sharp upward strikes, because it displays the gradual buildup of robust demand. Moreover, the analyst famous that the present breakout makes an attempt are backed by rising buying and selling quantity, which he interpreted as institutional accumulation. That is not like previous Dogecoin bull cycles, which had been largely primarily based on retail hype.

Technical momentum indicators such because the Relative Power Index (RSI) are presently in a mid-range place, and which means Dogecoin nonetheless has important room to climb earlier than hitting overbought situations.

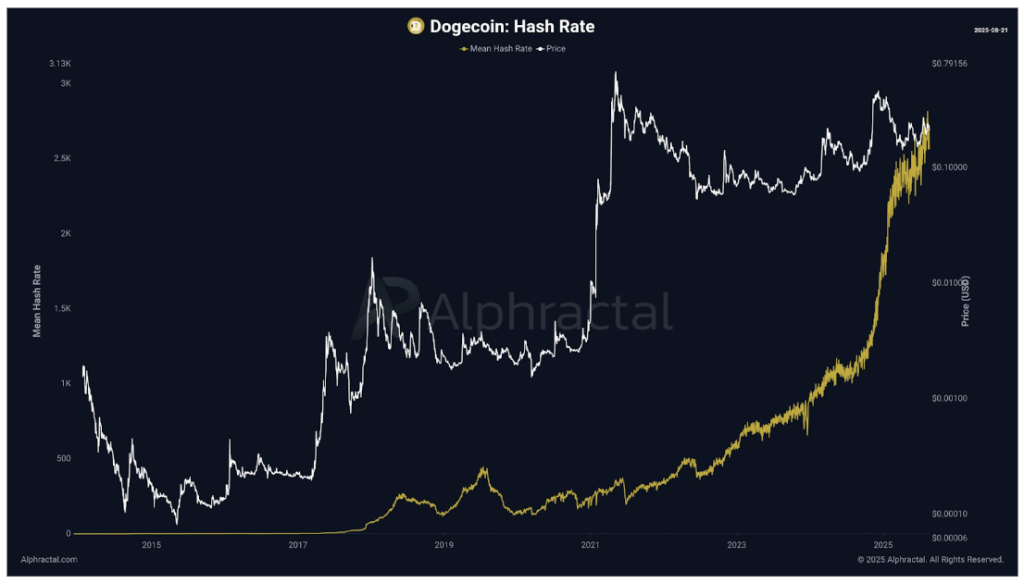

One other issue is the Dogecoin mining hash fee chart. As proven within the picture under, the hash fee has been rising massively because the starting of 2025, exhibiting that community power has been steadily climbing even throughout value consolidations and declines.

Historic Patterns Again Enlargement Outlook

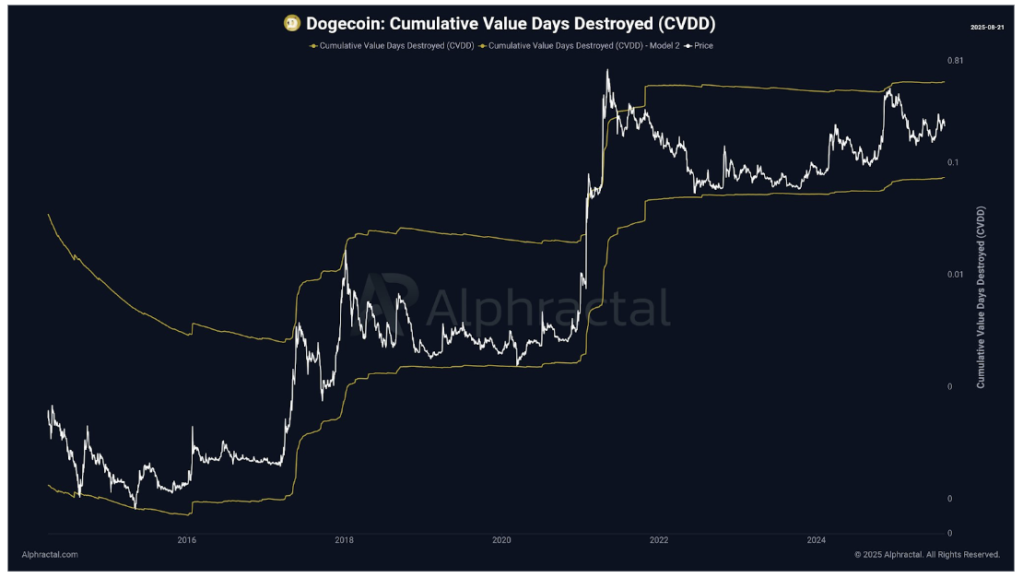

Considered one of Abbé’s key factors is that Dogecoin’s value cycles have persistently adopted the same sample of lengthy sideways stretches adopted by sudden vertical expansions. This cycle construction may be seen within the cumulative worth days destroyed (CVDD) chart. As proven within the chart under, Dogecoin’s value motion stayed nicely inside its accumulation zones earlier than breaking increased in 2018 after which in 2021.

Nonetheless, not like the peaks in 2018 and 2021 the place on-chain metrics had been overheated, present situations are calm, which reveals extra of real accumulation somewhat than profit-taking and distribution.

The growth part shouldn’t be about short-lived spikes however somewhat the beginning of a brand new directional pattern that would redefine Dogecoin’s value construction. Though the analyst didn’t outline a value goal, technical analyses from different analysts level to cost predictions that may take the Dogecoin value nicely above its 2021 peak of $0.7316 into the $1 threshold and past. A comparable evaluation by crypto analyst Javon Marks factors to a Dogecoin value goal of $1.25.

On the time of writing, Dogecoin is buying and selling at $0.237, up by 9.5% previously 24 hours.

Featured picture from Unsplash, chart from TradingView