Deep out-of-the-money (OTM) bitcoin put choices are lighting up in longer-dated expiries, as merchants decide up low cost lottery tickets for potential moonshot payoffs if BTC swings wild.

On main crypto choices alternate Deribit, the $20,000 strike put is the second hottest among the many June 2026 expiry choices, boasting a notional open curiosity of over $191 million.

Notional open curiosity is the greenback worth of the variety of lively contracts. Put choices at strikes under the going market fee of BTC are stated to be OTM. These OTM places are usually cheaper than these close to or above the spot worth of BTC.

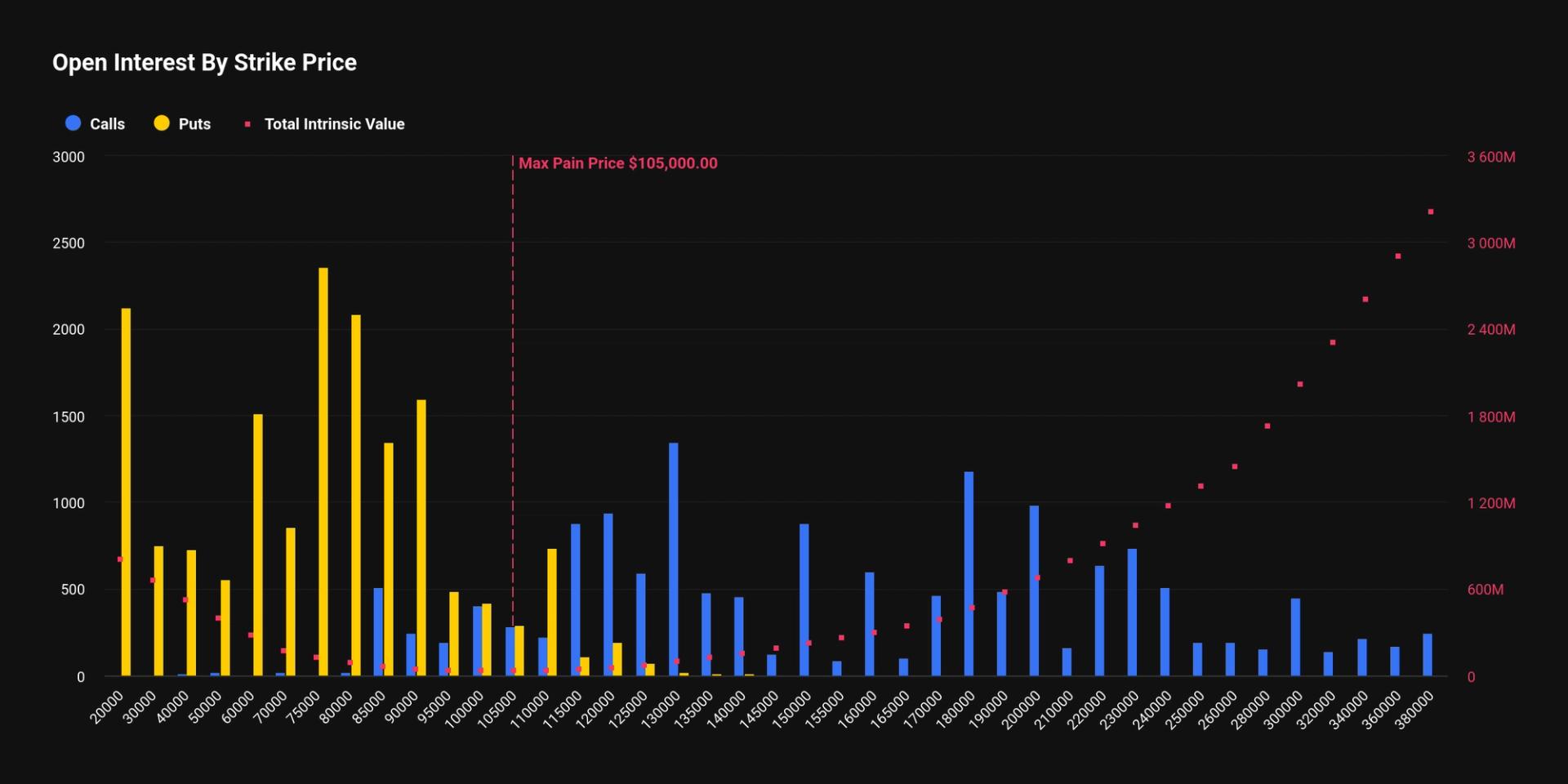

The June expiry additionally sees vital exercise in different OTM places at $30,000, $40,000, $60,000, and $75,000 strikes.

Exercise in deep OTM places is usually learn as merchants bracing for a worth crash. However that is not essentially the case right here, because the alternate has additionally seen exercise on higher-strike calls above $200,000.

Taken collectively, these flows symbolize a bullish view on long-dated volatility at low value somewhat than a guess on worth path, in response to Deribit’s International Head of Retail Sidrah Fariq. Consider it as low cost lottery tickets on a possible volatility explosion over the subsequent six months.

“There may be about 2,117 open curiosity on the $20K bitcoin put for the June expiry. We additionally noticed some huge trades within the $30,000 put and $230,000 name strikes. The mixture of those far out of the cash choices doesn’t counsel directional buying and selling, however somewhat deep wing trades that professionals use to commerce long-dated volatility cheaply and modify tail threat of their books,” Fariq advised CoinDesk.

She defined that it is basically volatility positioning, not worth positioning, as a result of the $20,000 put or the $230,000 name are just too removed from the spot worth to be a purely protecting hedge. As of writing, BTC modified palms close to $90,500, in response to CoinDesk information.

These holding each OTM calls and places may rating uneven payoffs from excessive volatility or wild worth swings in both path. But when markets keep flat, these choices shortly lose worth.

Choices are spinoff contracts that give the purchaser the best to purchase or promote the underlying asset at a predetermined worth at a later date. A put possibility offers the best to promote and represents a bearish guess in the marketplace. A name presents the best to purchase.

The crypto choices market, together with the one tied to BlackRock’s IBIT ETF, has developed into a classy enviornment the place establishments and whales interact in three-dimensional chess, managing threat and making the most of worth path, time decay, and volatility swings.

Broadly talking, the choices market temper seems bearish, as BTC places proceed to commerce at a premium to calls throughout all tenors, in response to Amberdata’s choices threat reversals. That is no less than partly as a consequence of persistent name overwriting, a method aimed toward boosting yield on high of spot market holdings.