Information reveals the Bitcoin Web Taker Quantity has been extremely constructive on Binance lately, an indication that the bulls are placing up aggressive bets.

Bitcoin Binance Web Taker Quantity Is At present At A Notable Optimistic Stage

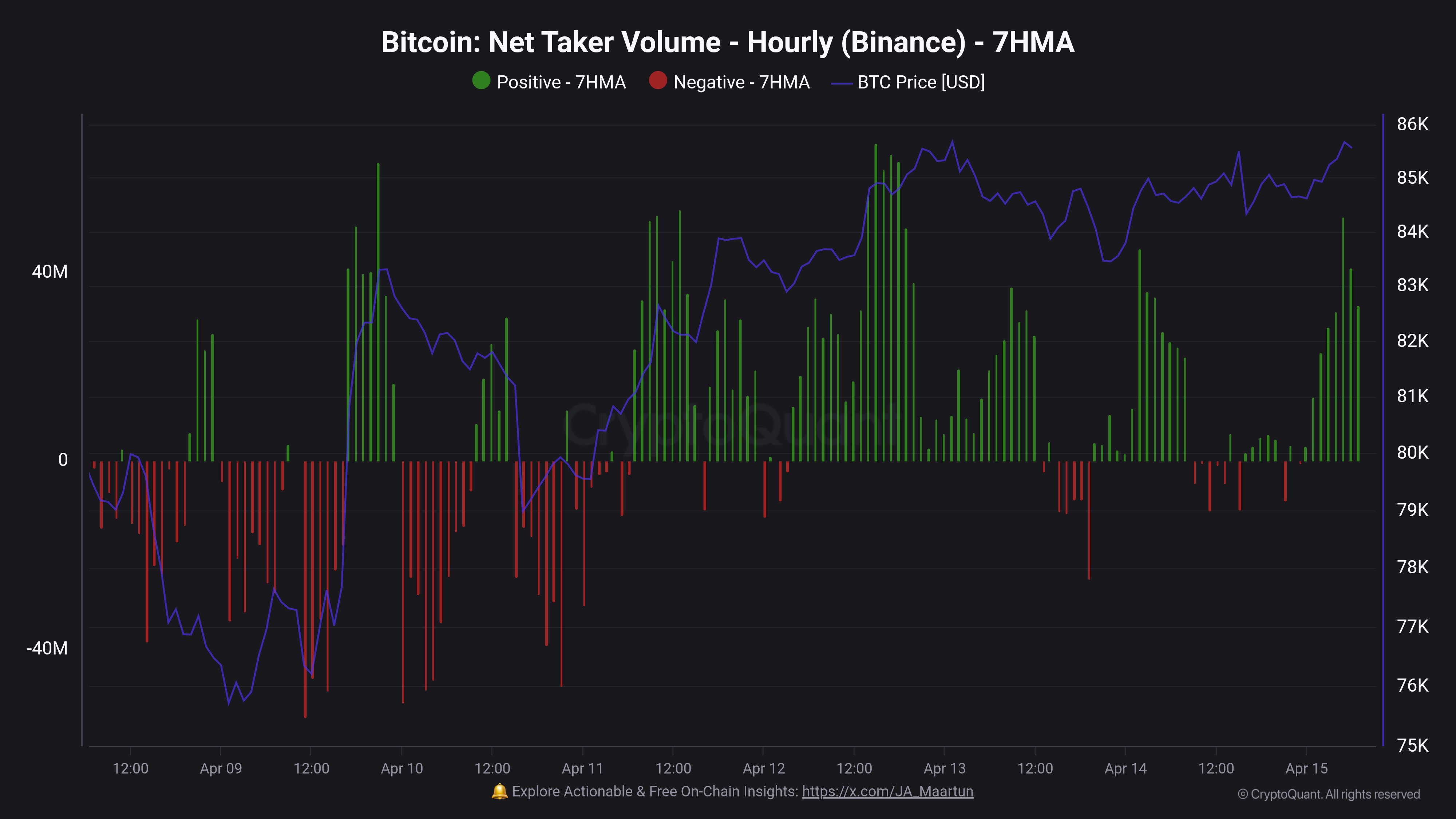

As defined by CryptoQuant group analyst Maartunn in a brand new publish on X, Bitcoin taker consumers have dominated the Binance platform throughout the previous few days. The indicator of relevance right here is the “Web Taker Quantity,” which measures the distinction between the taker purchaser and taker vendor quantity on any given centralized alternate.

When the indicator has a constructive worth, it means the taker consumers are outweighing the taker sellers on the platform. This sort of development implies a bullish sentiment is shared by the vast majority of the customers.

Then again, the metric being underneath the zero mark suggests a bearish mentality is dominant on the alternate because the brief quantity is bigger than the lengthy quantity.

Now, under is the chart shared by the analyst that reveals the development within the 7-hour shifting common (MA) Bitcoin Web Taker Quantity for the most important alternate within the cryptocurrency sector: Binance.

As displayed within the above graph, the Bitcoin Web Taker Quantity has largely remained contained in the constructive territory since April eleventh. The metric’s inexperienced values haven’t been small, both, which suggests the futures customers have been putting some aggressive bullish bets on the platform.

The shift towards the constructive sentiment on the alternate has come as BTC has been making restoration following the information of the 90-day pause on the tariffs for many international locations.

Traditionally, Bitcoin has tended to maneuver within the course that the gang least expects, so this bullish temper may very well show to be a foul signal for the restoration rally. It solely stays to be seen, although, whether or not a prime would now be hit or if the guess of those traders would repay.

In another information, the 30-day of the Bitcoin Market Worth to Realized Worth (MVRV) Ratio has hit the bottom degree in six months, as an analyst has identified in a CryptoQuant Quicktake publish.

The MVRV Ratio is an indicator that principally tells us in regards to the profit-loss standing of the Bitcoin traders. From the chart, it’s obvious that the 30-day worth of this metric has plunged lately, suggesting holder profitability has declined.

The identical degree as now was additionally reached at a few factors final yr and BTC fashioned a backside throughout each of these situations. As such, it’s potential that this development may as soon as once more show to be bullish for the cryptocurrency.

BTC Value

On the time of writing, Bitcoin is floating round $85,800, up greater than 8% within the final seven days.