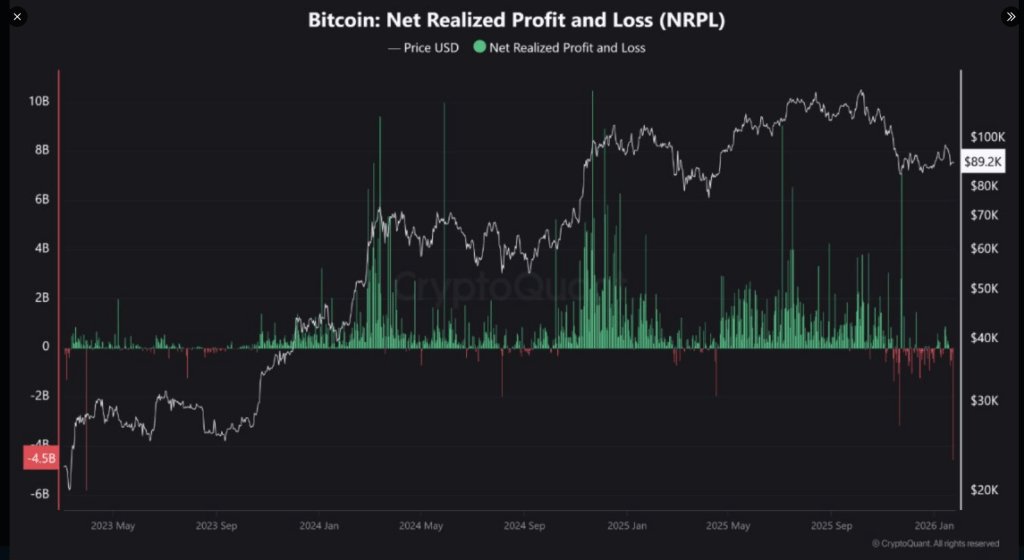

Studies word that Bitcoin holders realized massive losses as costs slid, and the headline quantity is difficult to disregard. Based on on-chain tracker CryptoQuant, about $4.5 billion in web losses was recorded on January 23.

Associated Studying

That quantity displays moved cash offered at costs decrease than once they had been purchased. It’s a large switch of paper ache into actual losses.

Realized Losses Spike

Whereas the greenback determine grabs consideration, the which means is what issues. Many who purchased late within the run larger are selecting to promote somewhat than maintain by means of extra decline. That habits reveals frustration.

Studies say the Internet Realized Revenue and Loss metric tallies this by evaluating promote costs to buy costs, and a unfavorable studying this huge indicators a wave of capitulation.

Some bigger, long-term holders have been quieter. Their exercise seems muted whereas smaller and mid-term individuals make the day-to-day strikes.

Based on analyst posts on CryptoQuant, this combine — quiet large holders and lively smaller sellers — is widespread throughout corrective stretches. It doesn’t routinely imply the market is damaged; it means sentiment has shifted towards warning.

$4.5 Billion in Realized Loss on Bitcoin

“Highest quantity of realized losses in three years. The final time this occurred in Bitcoin, the value was buying and selling at $28,000 after a quick correction interval that lasted a few yr.” – By @gaah_im pic.twitter.com/OJ7bbL3RSC

— CryptoQuant.com (@cryptoquant_com) January 26, 2026

Bitcoin Worth Motion

Halfway by means of the week, Bitcoin traded across the mid-$80,000s, properly beneath the $90,000 mark that some buyers had eyed as a key degree.

Market chatter reveals merchants watching macro cues just like the US Federal Reserve and inflation knowledge for steerage.

Volatility has not disappeared; it has merely grow to be extra tied to broader financial indicators than to remoted crypto headlines.

Whale addresses appeared to step in at occasions, serving to to carry native value flooring. However many merchants stay cautious.

Studies word that geopolitical headlines may cause fast swings, but the present motion appears extra like sluggish digestion of revenue and repositioning than explosive panic promoting.

Exercise on spot exchanges and ETF flows has been variable, reflecting the blended temper throughout the market.

Associated Studying

Capitulation Has Come Earlier than

Comparable loss spikes had been seen in March 2023, when realized losses reached near $6 billion, and in November 2022, when losses hit roughly $4.3 billion.

These occasions had been adopted by consolidation after which eventual restoration. Primarily based on experiences from analytics companies and market observers, spikes in realized losses can mark the late levels of promoting stress, after which the market generally finds a base.

Featured picture from Pexel, chart from TradingView