Arthur Hayes has issued a stark market warning: he sees a rising cut up between his most well-liked danger gauge, Bitcoin, and the tech-heavy Nasdaq 100 as a sign that credit score stress could also be constructing underneath the floor.

Associated Studying

Hayes, a co-founder and former CEO of cryptocurrency trade BitMEX, calls Bitcoin a “fiat liquidity hearth alarm” — an asset that reacts shortly when credit score situations change.

A Warning From Market Indicators

When two property that always moved collectively begin to pull aside, merchants take discover. Hayes believes {that a} hole like this deserves investigation as a result of it might level to bother in financial institution stability sheets or within the circulate of lending.

He argues the transfer shouldn’t be about one inventory or one commerce; it’s in regards to the plumbing of credit score and how briskly liquidity can dry up when issues flip.

How AI Job Cuts May Ripple By way of Credit score

Experiences be aware that firms cited AI as a cause for 1000’s of layoffs lately, with an outplacement agency counting roughly 55,000 cuts in 2025 that had been tied to AI. A lot of that hit was inside tech.

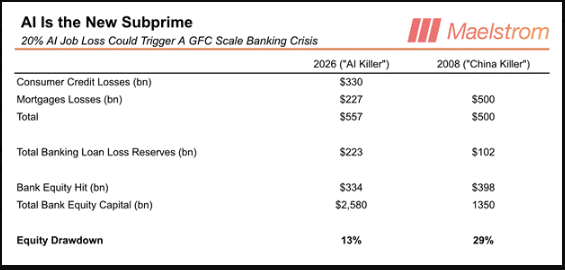

Hayes sketches a tough state of affairs: a large drop in knowledge-worker employment would weaken mortgage and client credit score compensation, which might then shave financial institution fairness and tighten lending.

The numbers he gives are approximate and constructed on a number of assumptions, however they’re supposed to point out how a shock to white-collar paychecks might cascade into the credit score system.

Expectations About Central Financial institution Motion

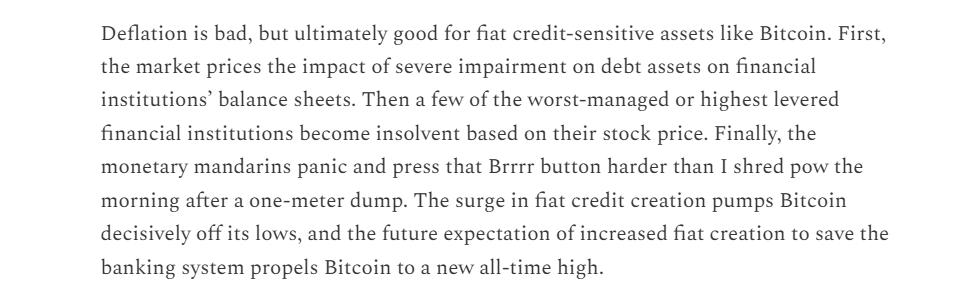

Hayes expects a coverage response if banks begin to fail and credit score freezes. He argues the Federal Reserve would step in with recent liquidity, and that extra money creation would observe — a transfer he says could be favorable for Bitcoin’s worth outlook.

That state of affairs has been a recurring theme in his commentary; previous essays and posts have linked anticipated Fed liquidity to sharp rallies in crypto markets.

Altcoin Bets And Fund Positioning

His fund, Maelstrom, is claimed to plan staking or stablecoin deployments into privacy-focused and exchange-native performs as soon as liquidity coverage shifts happen, naming Zcash and Hyperliquid as examples. That sort of tactical stance is supposed to revenue from a short-term surge in danger property after a coverage pivot.

Associated Studying

A Measured View

It is a dramatic chain of occasions: AI job losses result in credit score losses, which trigger financial institution stress, which forces the central financial institution to broaden cash provide, which lifts Bitcoin.

Every hyperlink is believable, however none is assured. A few of Hayes’ figures are tough estimates meant for example danger moderately than to behave as a exact forecast.

Market historical past reveals that central banks do typically step in, and that coverage strikes can energy asset rallies, however outcomes rely on timing, scale and public confidence — elements which might be arduous to foretell upfront.

Featured picture from Unsplash, chart from TradingView