Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

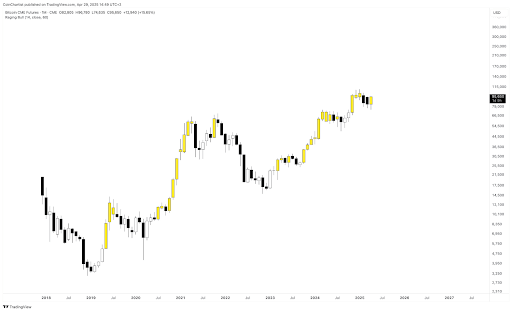

Bitcoin continues to present indicators of resilience on the $95,000 area, pushing larger from latest lows and making an attempt to reclaim its bullish construction after a unstable April. The month-to-month candlestick for April on the CME Futures chart presently presents a robust bullish engulfing formation, which, if sustained into the weekly shut, might present the market with bullish momentum to shut Could with one other bullish candle.

The potential of this bullish shut is sufficient to sway the sentiment amongst bearish proponents, in accordance with crypto analyst Tony “The Bull” Severino.

Raging Bull Instrument Flashes Sign On CME Futures

Bitcoin’s value motion over the previous two weeks has been constructive and has seen an in any other case waning bullish sentiment slowly creeping again amongst crypto merchants. Curiously, this value motion has even seen Bitcoin’s web taker quantity flip constructive for the primary time shortly. Though the development remains to be in its early phases, the renewed power is already starting to melt a few of the extra bearish outlooks, particularly as key indicators begin to flip.

Associated Studying

Tony “The Bull” Severino, a well-followed crypto analyst, not too long ago revealed on social media platform X that his proprietary “Raging Bull” indicator has turned again on. Nevertheless, this indicator has turned again on solely on the Bitcoin CME Futures chart, not the spot BTC/USD chart.

The divergence between CME Futures and the spot chart, with solely the previous flashing this bullish sign, has added complexity to Bitcoin’s present outlook. The Raging Bull device, which makes use of weekly value knowledge, is designed to determine early phases of highly effective upward actions. In response to Severino, the looks of this sign, regardless of his bearish stance, suggests a significant shift in market construction could also be creating. Nevertheless, he was fast so as to add {that a} confirmed weekly shut remains to be mandatory earlier than any agency conclusions will be drawn.

Breaking Above This Degree Is Key

Inspecting the month-to-month chart shared by the analyst, the bullish engulfing candlestick is clearly seen following a pointy rebound from April’s lows beneath $83,000. Bitcoin started the month of April at round $83,000, however a swift downturn within the first few days pushed the value downward till it bottomed out at round $75,000. Nevertheless, the present April candle not solely erases March’s losses but in addition signifies elevated curiosity in Bitcoin from institutional merchants on the CME platform.

Associated Studying

Nonetheless, regardless of the encouraging candlestick formation, Bitcoin should decisively break above the $96,000 to $100,000 area, the place earlier uptrends have stalled. This stage is appearing as a ceiling that might decide whether or not the latest bullish momentum continues or stalls. A failure to shut above this vary, both on the weekly or month-to-month timeframe, might invalidate the Raging Bull sign.

Moreover, the Raging Bull indicator wants to show again on the spot BTCUSD chart to substantiate a robust bullish outlook. This will solely be achieved if Bitcoin manages to interrupt considerably above $96,000.

On the time of writing, Bitcoin is buying and selling at $94,934.

Featured picture from Pixabay, chart from Tradingview.com