Crypto markets noticed a modest elevate after the US Federal Reserve made one other transfer on charges, and merchants are looking forward to a clearer follow-through. In keeping with experiences, the Fed has carried out three consecutive rate of interest cuts totaling 0.75% from September to December. The transfer was extensively anticipated. Nonetheless, market responses have been combined and considerably uneven.

Associated Studying

Fed Strikes And Market Takeaway

In keeping with CoinEx chief analyst Jeff Ko, a lot of the Fed’s motion was already priced in, and the up to date dot plot leaned a bit extra hawkish than some had hoped.

Ko pointed to $40 billion in short-term Treasury purchases as a technical step to ease liquidity and decrease short-term charges, not as a broad stimulus program.

Markets took the measures as mildly optimistic. US shares rose, and that helped Bitcoin discover some footing after an early dip.

Santiment And The Brief-Time period Response

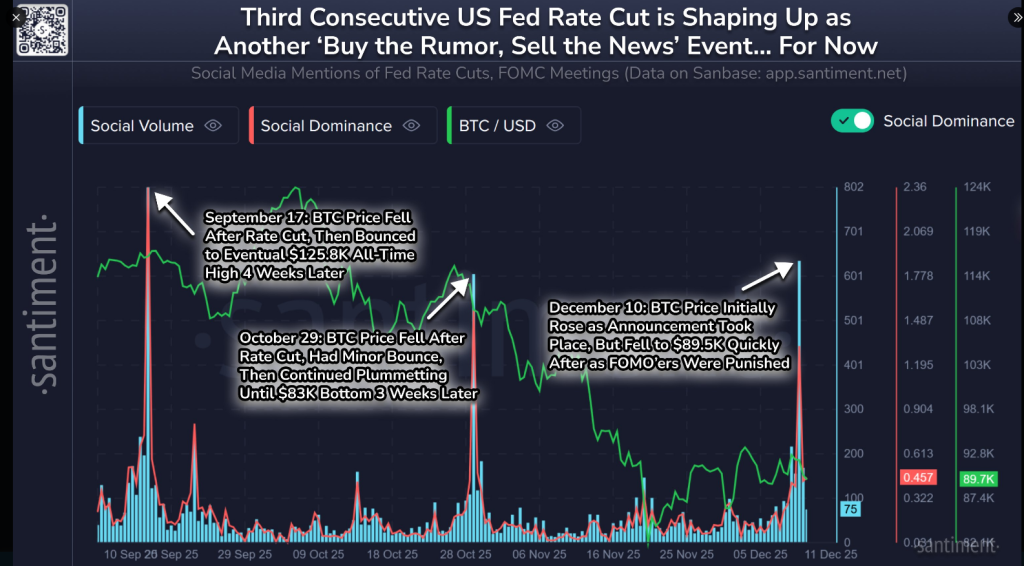

Based mostly on experiences from onchain analytics agency Santiment, every minimize has prompted a basic “purchase the rumor, promote the information” transfer the place preliminary optimism is adopted by quick promoting.

🇺🇸 The US Fed made three strategic cuts over the previous 3 months, leading to a complete of an 0.75% discount to rates of interest.

1⃣ September 17, 2025: Fed lowered the goal vary to 4.00 %–4.25 % (from 4.25 %+) on the 16–17 Sep assembly.

2⃣ October 29, 2025: Fed minimize the speed to… pic.twitter.com/X6DWypvq5t

— Santiment (@santimentfeed) December 11, 2025

Cuts are seen as bullish for crypto over the lengthy haul, but they’ve triggered transient pullbacks in follow. Santiment provides {that a} small wave of FUD or retail promoting typically indicators that the gentle post-cut downswing is completed and a bounce could comply with as soon as issues relax.

Technical Ranges Merchants Are Watching

Bitcoin was unstable within the aftermath. It fell below $90,000 then popped to $93,500 on Coinbase earlier than settling close to $92,300 on the time of reporting. Key resistance sits between $97,000 and $108,000.

On the day by day chart, BTC stays inside a small rising channel that sits inside a bigger downtrend, and technical merchants be aware {that a} MACD histogram is approaching a optimistic crossover — an indication some see as potential renewed momentum.

ETF exercise has been tepid, with solely $219 million in internet inflows since late November, which retains some buyers cautious.

Associated Studying

Greenback Weak spot And Fairness Alerts

A weaker greenback has been a part of the backdrop; the DXY index fell to 98.36 and is displaying bearish momentum by itself MACD.

Nasdaq’s transfer again above its 50-, 100- and 200-day easy transferring averages helped elevate danger property briefly, and that has supported Bitcoin’s rebound makes an attempt.

But correlation with equities stays uneven — losses in shares are inclined to hit Bitcoin tougher than positive factors assist it, creating an uneven danger profile for merchants.

Featured picture from Unattainable Pictures, chart from TradingView