Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

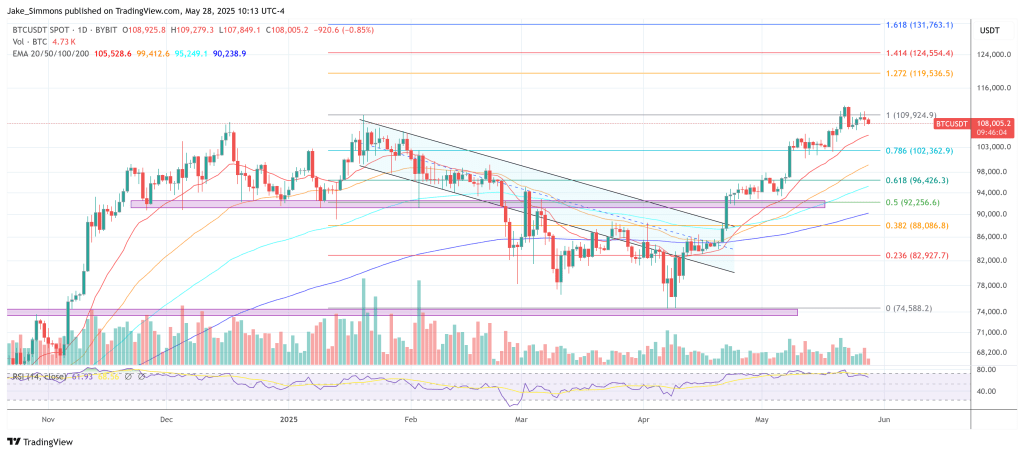

Bitcoin is at the moment altering fingers simply above $108,000, consolidating after Tuesday’s contemporary all-time excessive. Charles Edwards, founding father of the digital-asset hedge fund Capriole Investments, believes that value might be no less than 50% greater by November. In his newest market notice, “Saddle Up,” launched on 27 Might, the supervisor argues {that a} uncommon confluence of macro, technical and on-chain elements has created “probably the most bullish technical setup we may ask for for Bitcoin at all-time highs.”

Bitcoin 50% Rally Is “Conservative”

Edwards first set the stage for the decision in late April, when Bitcoin was buying and selling close to $93,000. “We famous the bullish Bitcoin setup and expectation to be ‘pushing new all-time highs […] fairly quickly’,” he recalled. One month later the market has risen 16%, validating that view and, in Edwards’s telling, clearing the decks for the subsequent leg greater.

Central to the thesis is what Edwards dubs the “Exhausting Asset Period.” A breakout within the Gold-to-S&P 500 ratio above its 200-week transferring common alerts that buyers are once more favouring scarce shops of worth over equities.

Traditionally, such regimes are “sticky,” he writes, including that the following outperformance of gold over shares has ranged from 150% to 650% in previous cycles. “If you happen to suppose gold has already rallied rather a lot, suppose once more,” Edwards mentioned. On that analogue, Bitcoin — which tends to lag gold by a number of months — might be poised for even steeper positive aspects.

Associated Studying

Latest coverage adjustments have underpinned the rotation. Basel III guidelines elevated gold to Tier-1 reserve standing in 2022, forcing banks to again paper positions with bodily metallic, whereas final yr’s approvals of spot-Bitcoin exchange-traded funds opened institutional flood-gates to the cryptocurrency.

Washington’s creation of a Strategic Bitcoin Reserve in early 2025 supplied a further layer of state-level legitimacy. In opposition to the identical backdrop, persistent inflation, tariff frictions and the precedent of freezing Russian foreign-exchange reserves have catalysed demand for politically impartial property.

Bitcoin Technicals And Basic

From a market-structure standpoint, Bitcoin’s April slide to $75,000 and sharp restoration above $90,000 is described as a text-book “fake-out” — a failed breakdown that usually precedes highly effective upside developments. The weekly shut reclaim above $90,000 “marked the beginning of a brand new pattern,” Edwards contends, making the $104,000 degree the primary line of defence. “So long as value is above $104K, that is probably the most bullish technical setup we may ask for,” he wrote, lowering near-term threat administration to a single quantity.

Associated Studying

Capriole’s machine-learning-driven Bitcoin Macro Index, which blends greater than 100 on-chain, macro and equity-market variables, continues to register in “bullish progress.” Obvious demand (manufacturing minus dormant provide) has turned constructive, US liquidity stays supportive, and Capriole’s new “Quantity Summer season” metric reveals trend-confirming growth in buying and selling exercise. Taken along with the historic three-to-five-month lag between gold breakouts and Bitcoin rallies, the agency argues that “a 50 %-plus rise over the subsequent six months is a conservative goal.”

Coverage Wild-Playing cards

The clearest threats to the projection lie on the coverage entrance. Edwards highlights a 30- to 60-day window for the USA to strike tariff compromises with China and the European Union; failure may dent threat urge for food. He additionally warns that the flourishing “Bitcoin-treasury arbitrage” — whereby corporates difficulty low-cost debt to build up BTC — may amplify draw back in a future deleveraging, although leverage ranges stay manageable for now.

For the second, nonetheless, the mixture of a hard-asset bull cycle, confirmed technical energy and enhancing fundamentals retains Capriole “very optimistic concerning the mid- to long-term potential for each gold and Bitcoin.” So long as the market holds above that $104,000 weekly pivot, Edwards suggests buyers ought to — in his personal closing phrases — “saddle up.”

At press time, BTC traded at $108,005.

Featured picture created with DALL.E, chart from TradingView.com