Bitcoin’s

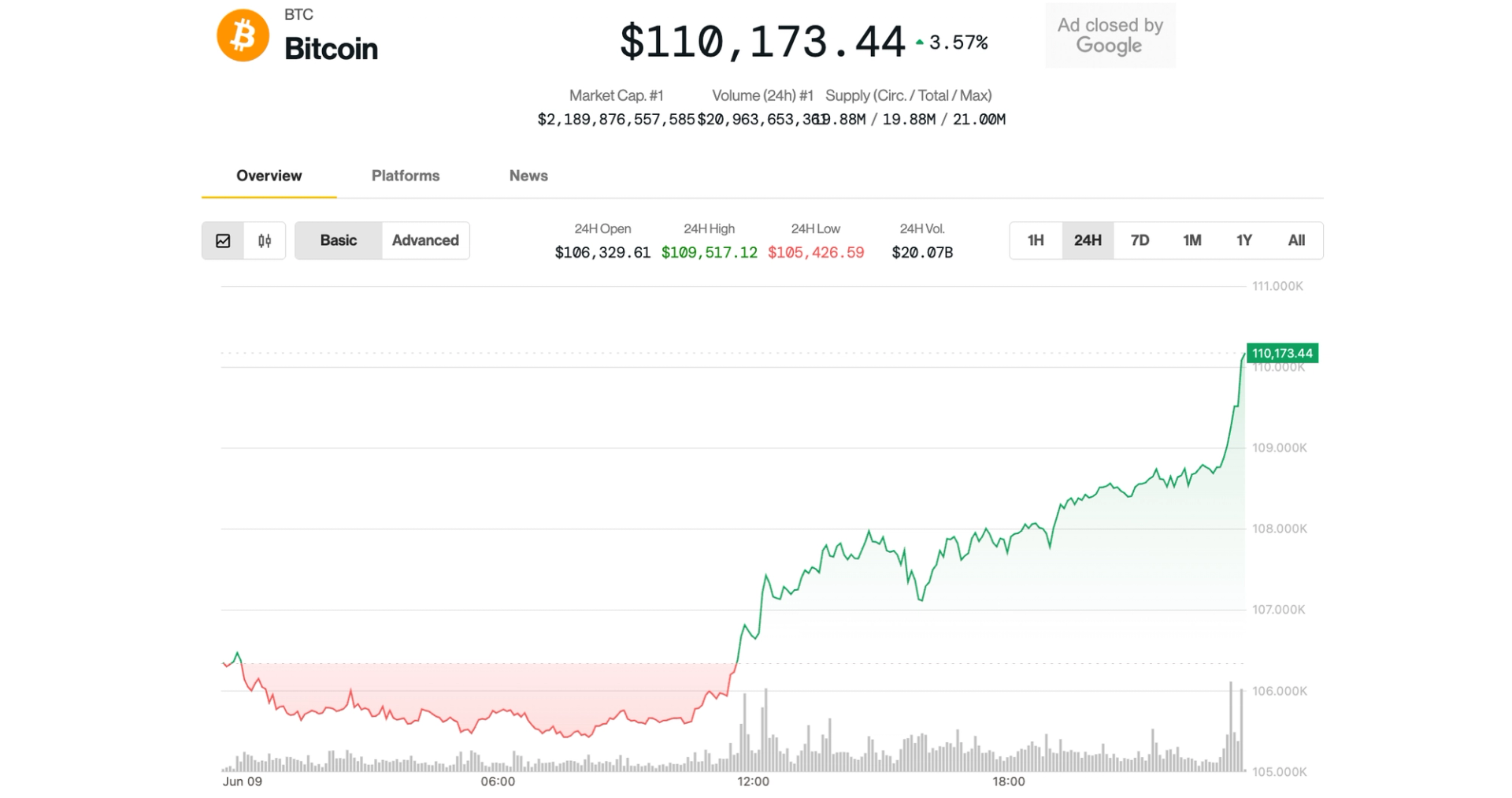

quiet climb on Monday accelerated to its strongest value in June, rebounding from final week’s decline to close all-time excessive ranges.

The biggest crypto superior by 3.7% over the previous 24 hours, topping $110,000, and it is altering fingers by solely 2% from its report costs noticed in Could. Ethereum’s ether

stored tempo with a 3.8% acquire throughout the identical interval, bouncing above $2,620. Native tokens of Hyperliquid and SUI outperformed most large-cap cryptocurrencies, rising 7% and 4.5%, respectively.

Bitcoin’s transfer greater caught leveraged merchants off-guard, liquidating over $110 million price of brief positions inside an hour, CoinGlass knowledge exhibits. Throughout all crypto belongings, some $330 million of shorts had been liquidated through the day, probably the most in a month. Shorts are in search of to revenue from declining asset costs.

The transfer occurred whereas conventional markets confirmed muted motion, with the S&P 500 and Nasdaq indexes flat on the day. Crypto-related shares bounced through the session to meet up with BTC’s restoration over the weekend.

“A ‘peaceable rally’ is an ideal solution to describe this value motion,” stated well-followed analyst Caleb Franzen, founding father of Cubic Analytics. “Only a constant improvement of upper highs and better lows. Any indicators of weak spot? Patrons step in and defend the pattern.”

The crypto market is now on steadier footing for a possible subsequent leg greater after bitcoin’s 10% decline to close $100,000 and with greater than $1.9 billion in liquidations throughout crypto derivatives over the previous week, having flushed extreme leverage, Bitfinex analysts famous in a Monday report.

Nonetheless, on-chain knowledge signifies rising promote stress from long-term holders that might overwhelm demand, the analysts added.

“Bitcoin is now at a crossroads—balanced between structural help and waning bullish momentum, ready for its subsequent macro cue,” the Bitfinex observe added.

These macro catalysts might come later this week, famous Jake O, OTC dealer at crypto buying and selling agency Wintermute.

“U.S. and Chinese language commerce representatives are scheduled to fulfill immediately, with markets seemingly delicate to any headlines following final week’s optimistic momentum, and the information calendar stays gentle till Wednesday, when CPI will provide recent perception into U.S. inflation,” he stated.

UPDATE (June 9, 21:51 UTC): Provides brief liquidation knowledge from CoinGlass.