For a few months now Bitcoin has been displaying document low volatility and the shortage of momentum leaves crypto merchants in rigidity, ready for indicators of a brand new speedy motion of the primary cryptocurrency. The general hype round Bitcoin has gone down, however what if the present uncertainty ends in a robust upward development? Or will the crypto value fall? At the moment Bitcoin is traded at $9 300, however ultimately a flat dynamic may flip right into a development or the other. Learn the total article for a technical evaluation of Bitcoin and make up your thoughts about it.

Since its low of $3 800 ultimately of March, Bitcoin made it to $10 000 in two months (across the 1st of June) and has been fluctuating between $8 500 and $10 000 ever since. June and July had been months of uncertainty and there are a number of forecasts with merchants ready for Bitcoin to interrupt the help or resistance ranges.

The earlier development was constructive and Bitcoin doubled in value, may the present consolidation end result within the progress of the asset? The general constructive tone of the inventory market may create the idea for it, however it’s not set in stone.

The current progress of Bitcoin created many buying and selling alternatives for crypto merchants and the present occasions might lead to much more potential probabilities. Let’s flip to technical indicators and see what they’ve to supply. For all indicators, examples of a value chart for 30 days with candles of 12h interval are getting used.

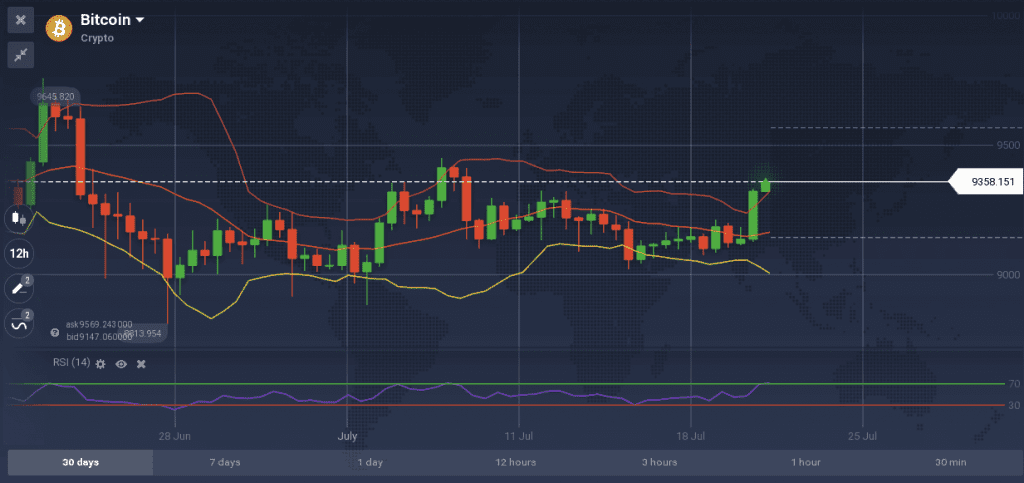

RSI + Bollinger Bands

First on the listing: a well-liked mixture of RSI and Bollinger Bands. Bollinger Bands present that the asset has crossed the higher band and at the moment strikes upwards, whereas RSI offers a sign that the asset is overbought. This might imply that the beginning constructive development might reverse and switch right into a diminishing one, as asset costs don’t usually keep lengthy within the overbought or oversold areas.

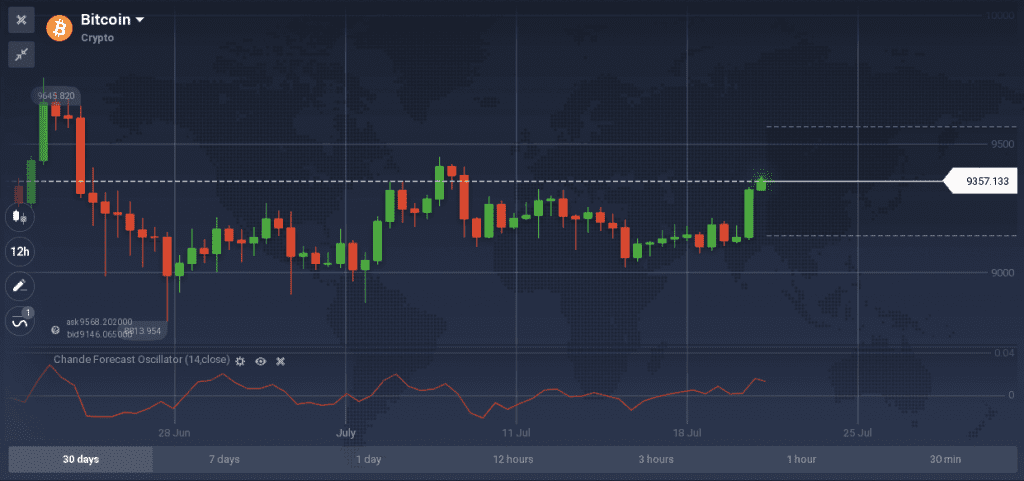

Chande Forecast Oscillator

This momentum indicator could also be used by itself to doubtlessly predict the longer term value path. As it’s apparent from the chart, the indicator was displaying value progress for a while, however now it may probably reverse and drop beneath the 0 worth of the indicator. Solely time can inform what is going to really occur.

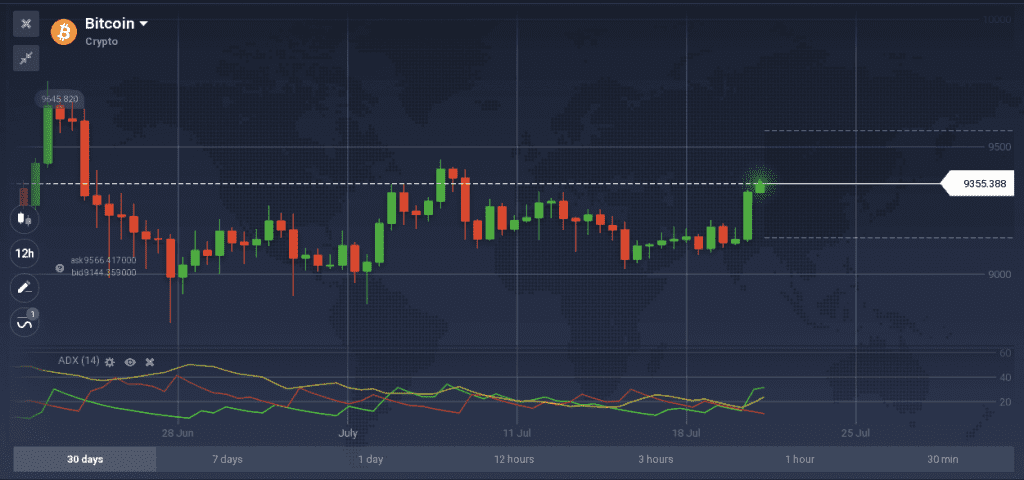

ADX

ADX exhibits a bullish crossover with the development energy slowly rising (the ADX line crossed the 20 worth and tends up). Does this imply that Bitcoin may doubtlessly achieve momentum and break via the resistance stage at $10 000 – $10 300?

Although ADX exhibits a constructive development, different indicators level out the potential drop in value. Even with the present drop in volatility, BTC stays one of the vital traded belongings and there’s no doubt that quickly the asset will shock everybody with new information. After all, it is very important examine the market nicely earlier than coming into it and checking the indicators with different indicators could be a superb observe.

Lastly, it’s all the time necessary to notice that previous efficiency isn’t an indicator of future efficiency. You will need to keep in mind that no indicator exhibits 100% correct indicators and that divergences might occur.