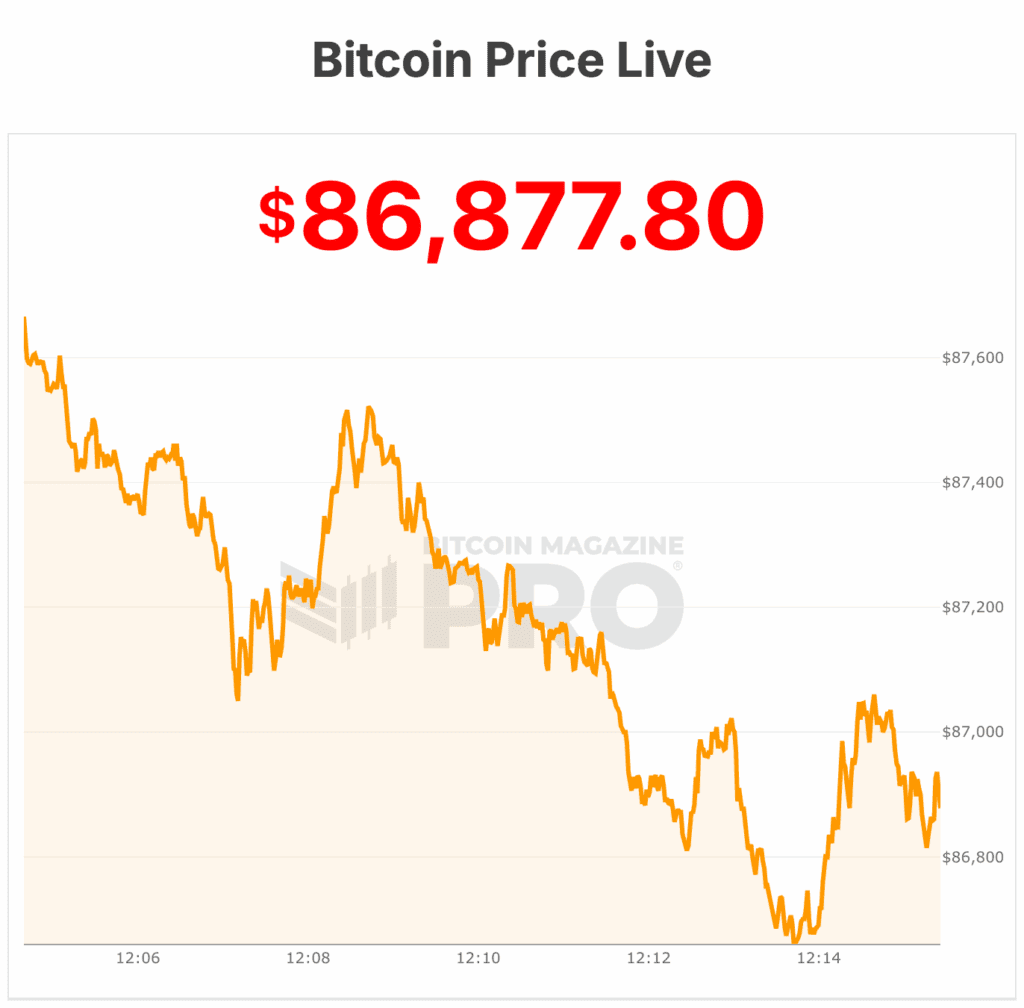

Bitcoin value is buying and selling at lows of $86,610, down over 1% over the previous 24 hours, with a 24-hour buying and selling quantity of $87 billion.

The highest cryptocurrency is at the moment 5% beneath its seven-day excessive of $92,944 however is at the moment making new seven-day and seven-month lows. With a circulating provide of 19,950,600 BTC out of a most of 21 million, the worldwide Bitcoin market cap is $1.78 trillion, reflecting a 1% decline over the previous day.

The bitcoin value traded above $92,000 in a single day however sharply dumped in early eastern-time zone buying and selling to lows within the $86,000s vary.

The Bitcoin Worry and Greed Index at the moment sits in “Excessive Worry.”

The U.S. labor market confirmed sudden power in September, based on knowledge launched by the Bureau of Labor Statistics after a six-week delay because of the authorities shutdown.

Nonfarm payrolls elevated by 119,000, greater than double economists’ forecast of fifty,000, though the unemployment price ticked as much as 4.4% from 4.3%.

August’s studying was revised to a 4,000-job loss. This report, usually launched in early October, marks the resumption of official financial knowledge and shall be adopted by additional updates in mid-December.

The labor knowledge added to a broader backdrop of optimism in U.S. markets. Bitcoin value gained modestly in a single day to the $92,000 vary following Nvidia’s stronger-than-expected third-quarter earnings report. The chipmaker posted $57 billion in income, defying issues of an AI-driven market bubble.

The Nvidia report buoyed threat property globally. Nasdaq futures rose 1.9%, Asian indices climbed, and S&P 500 futures gained 1%. The ten-year Treasury yield held at 4.11%, whereas the U.S. greenback posted small positive aspects.

For crypto markets, tech-driven liquidity stays a key driver, and Nvidia’s efficiency reassured traders that AI investments by main companies—Amazon, Microsoft, Meta—will proceed for the foreseeable future.

Bitcoin’s value dump is a standard incidence after a difficult month, throughout which the bitcoin value dipped towards $87,000 amid a $3 billion withdrawal from U.S. spot Bitcoin ETFs.

Nonetheless, inflows returned on Wednesday, with ETFs attracting $75 million, based on DefiLlama.

Bitcoin value outlook

Final week, the Bitcoin value closed the week at $94,290, plunging beneath the important thing $96,000 help stage and erasing positive aspects made earlier in 2025.

The break of this main help indicated a pointy shift in market sentiment, with bears taking clear management of value motion. Bitcoin’s lack of ability to carry above $96,000 meant that the chance of a sustained bull market had diminished considerably.

Following the lack of the $96,000 help, Bitcoin’s subsequent vital help was recognized close to the 0.382 Fibonacci retracement from the 2022 backside to the October 2025 excessive.

Bitcoin Journal analysts additionally highlighted a high-volume node between $83,000 and $84,000 as one other potential flooring. Beneath these ranges, the following main help zone was traced to the 2024 consolidation vary, between $69,000 and $72,000, suggesting substantial room for additional declines if Bitcoin continued to weaken.

Resistance above Bitcoin’s $94,000 stage had change into substantial. Any minor bounce from present lows confronted fast obstacles at $98,000, with a possible quick squeeze pushing the value to $101,000.

Nonetheless, robust resistance remained within the $106,000 to $109,000 vary, with further ranges at $114,000 and $116,000 forming a near-impenetrable barrier for bulls. Analysts concluded that solely an in depth above $116,000 would require a re-evaluation of market construction and will point out a shift towards bullish momentum.

Market sentiment remained extraordinarily bearish as Bitcoin had fallen over 25% from its October highs. Analysts recommended that the broadening wedge sample, although not but definitively damaged to the draw back, provided minimal hope for bulls.

The most effective-case state of affairs for Bitcoin was a short-lived rally to $106,000 earlier than rolling over to new lows. Bears appeared firmly in management, and any upside was more likely to encounter heavy resistance.

Bitcoin value is at the moment at $86,877.