Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin worth continues to face headwinds, as the newest report on Digital Asset Fund Flows reveals a staggering $751 million in outflows from the digital asset. The sheer quantity of this withdrawal raises alarm bells about whether or not establishments could also be cashing out from the flagship cryptocurrency.

Bitcoin Value Faces Strain Amid Large Outflows

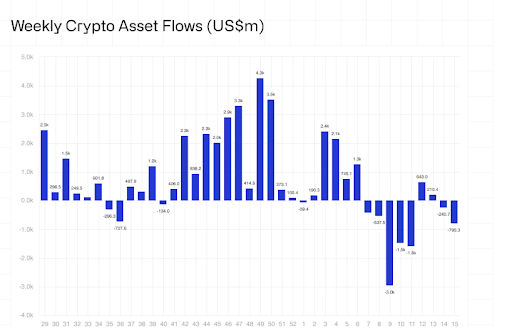

CoinShares’ weekly report on Digital Asset Fund Flows has disclosed a large $795 million in outflows from the crypto market—shockingly, $751 million of which got here from Bitcoin alone. This mass exodus marks one of many largest single-week outflows of the yr, and it comes at a time when the worth of Bitcoin has hit a wall.

Associated Studying

James Butterfill, the Head of Analysis at CoinShares, revealed that since early February 2025, digital asset funding merchandise have suffered cumulative outflows of roughly $7.2 billion, successfully erasing virtually all of the year-to-date inflows. Notably, this week marks the third consecutive week of declines, with Bitcoin main the downturn and recording essentially the most vital losses amongst main digital belongings.

As of this report, web flows for 2025 have dwindled to a modest $165 million, a pointy drop from a multi-billion greenback peak simply two months in the past. This steep decline underscores a cooling sentiment amongst institutional buyers and highlights a rising sense of warning amid ongoing market volatility.

At present, the Bitcoin worth is struggling to regain previous all-time highs, with latest outflows serving as one of many many limitations hindering the cryptocurrency’s breakout potential. Till these outflows reverse and the market stabilizes, Bitcoin’s path to setting new all-time highs stays challenged.

Regardless of shedding $751 million in outflows, Bitcoin nonetheless maintains a reasonably optimistic place with $545 million in web year-to-date inflows. Nevertheless, the sheer scale and velocity of the newest outflows elevate concern. The truth that Bitcoin suffered such a large withdrawal alerts a possible shift in sentiment amongst establishments. Whether or not it’s as a result of profit-taking or macroeconomic uncertainty, this transfer means that huge gamers are starting to drag out — no less than within the quick time period.

Along with Bitcoin, Ethereum noticed $37 million in outflows, whereas Solana, Aave, and SUI additionally posted losses of $5.1 million, $0.78 million, and $0.58 million, respectively. Surprisingly, even quick Bitcoin merchandise, designed to learn from market downturns, weren’t spared, recording $4.6 million in outflows.

Tariffs And Political Volatility Drive Outflows

One of many key drivers behind the pullback throughout digital belongings is the rising financial uncertainty sparked by tariff insurance policies which have adversely influenced investor sentiment. The wave of destructive sentiment started in February after United States (US) President Donald Trump introduced plans to impose tariffs on all imports coming into the nation from Canada, Mexico, and China.

Associated Studying

Nevertheless, a late-week rebound in crypto costs was seen after Trump’s momentary reversal of the controversial tariffs, offering a short respite for the market. This coverage shift helped increase whole Asset Underneath Administration (AUM) throughout digital belongings from a low of $120 billion on April 8 to $130 billion, marking an 8% restoration.

Featured picture from Adobe Inventory, chart from Tradingview.com