Bitcoin continues to hover across the $112,500 stage, with volatility persisting throughout the market following final week’s historic crash. Based on on-chain information, short-term holders (STHs) stay beneath heavy strain, exhibiting clear indicators of panic. The STH realized worth, a metric that tracks the common price foundation of latest patrons, signifies that many merchants are nonetheless reacting emotionally to cost fluctuations. The most recent liquidation occasion appears to have deeply impacted market sentiment — even a small pullback yesterday was sufficient to set off one other wave of panic promoting.

Associated Studying

But, whereas some traders capitulate, others are seizing the chance. The well-known Bitcoin OG whale, who gained widespread consideration for shorting BTC and ETH proper earlier than the crash, has reportedly closed his place, locking in additional than $197 million in income. This transfer marks the top of some of the profitable brief trades of the 12 months.

As Bitcoin stabilizes inside a decent vary, the market stays divided between fear-driven sellers and opportunistic gamers positioning for the subsequent main transfer. The approaching days may decide whether or not BTC finds stability or faces renewed promoting strain from nervous short-term holders.

Bitcoin Whale Strikes Trigger Hypothesis

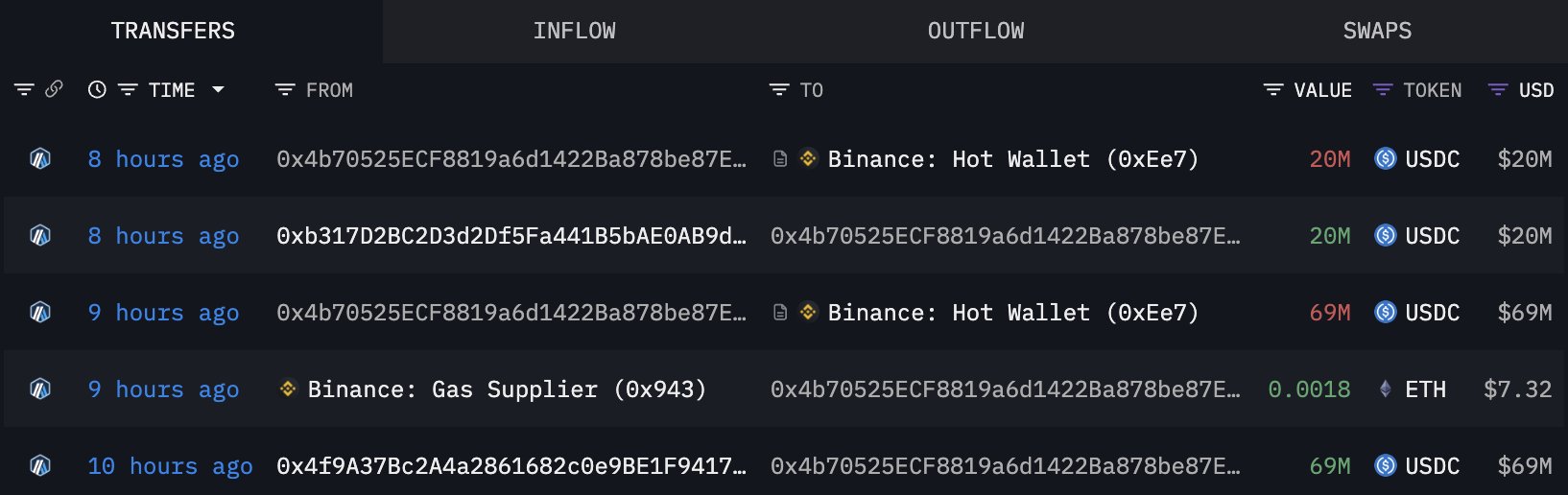

Lookonchain has tracked a sequence of high-stakes strikes from the dealer generally known as BitcoinOG (1011short) — some of the carefully watched whales out there proper now. The dealer reportedly closed all BTC brief positions on Hyperliquid, securing greater than $197 million in revenue throughout two wallets after final week’s crash.

Simply hours later, the identical pockets transferred $89 million USDC to Binance, instantly sparking hypothesis that the dealer might be making ready to reopen brief positions. Coincidentally, Bitcoin open curiosity on Binance surged by $510 million shortly after the deposit, including gasoline to theories that the whale could also be behind the transfer.

Whereas no direct hyperlink has been confirmed, analysts are break up on whether or not this alerts one other spherical of aggressive shorting or just capital repositioning. Some counsel the whale could also be betting on additional draw back after Bitcoin’s failure to carry above $115K, whereas others imagine the funds might be used for market-neutral methods like hedging or arbitrage.

Nonetheless, the timing has left merchants uneasy. The market stays fragile, and the whale’s actions — whether or not strategic or coincidental — may affect short-term sentiment as Bitcoin fights to defend help across the $110K area.

Associated Studying

BTC Consolidates Beneath Pivotal Stage

Bitcoin continues to face promoting strain because it trades round $112,500, hovering simply above its short-term help zone. The every day chart exhibits that BTC stays trapped between the 50-day shifting common (close to $115,000) and the 200-day shifting common (round $108,000), signaling an indecisive market. The repeated rejections close to $117,500 — a stage that acted as each help and resistance all year long — affirm it as a key provide zone.

The latest bounce makes an attempt have been weak, with quantity thinning and momentum indicators suggesting consolidation quite than a powerful reversal. Bulls are struggling to reclaim management after the sharp sell-off that briefly despatched BTC to $103K, and failure to carry above $110K may expose the subsequent decrease liquidity pockets round $107K and $105K.

Associated Studying

Then again, holding above this vary would stabilize market sentiment, permitting BTC to rebuild a base for a possible retest of the $115K–$118K space. For now, worth motion stays cautious — range-bound and reactive to broader danger sentiment. Merchants are looking forward to a breakout above $115K or a decisive drop under $110K to substantiate the subsequent main directional transfer within the aftermath of final week’s volatility.

Featured picture from ChatGPT, chart from TradingView.com